Toray Industries Sees 206.8% Increase in Short Interest in December

January 31, 2023

Trending News ☀️

Toray Industries ($TSE:3402), Inc. is a leading company in the production of synthetic fibers and textiles, with operations in Japan and other countries around the world. The company has a strong presence in the global market and is known for its high-quality products. Recently, Toray Industries has seen a significant increase in short interest, rising 206.8% in December. With operations spanning Asia and Europe, Toray Industries is exposed to a variety of geopolitical and economic risks. The company also faces potential challenges from competitors, such as China-based textile companies. The increase in short interest may also be an indication of investors taking a cautious approach to the stock. Many investors may be wary of investing in a stock that is so heavily exposed to global market volatility. As such, they may prefer to take a wait-and-see approach before investing in the stock. This could explain why the short interest has risen so significantly. The company has a strong track record of delivering consistent performance and is well-positioned to benefit from any potential improvements in the global economy. In addition, the company’s strong presence in the global markets gives it a competitive advantage over many of its rivals. Overall, the rise in short interest of Toray Industries shows that investors are taking a cautious approach to the stock.

However, the company is still seen as a reliable investment option and could potentially benefit from any improvements in the global economy going forward.

Share Price

At the time of writing, news sentiment surrounding Toray Industries was mostly positive. On Thursday, the company’s stock opened at JP¥754.0 and closed at JP¥749.5, down by 0.6% from its last closing price of 753.9. The surge in short interest may indicate that investors are bearish on Toray Industries’ prospects. Short interest is a measure of how many investors are betting against a stock, and an increase in short interest can signal potential trouble for a company. It is possible that investors are expecting the company’s stock price to decline in the near future.

However, some investors may see the surge in short interest as a buying opportunity. If the company’s stock price does decline, these investors may be able to purchase shares at a discounted price and benefit from any potential upside in the future. It will be interesting to see what impact the increased short interest has on Toray Industries’ stock price in the coming months. While the sentiment surrounding the company appears to be mostly positive, it is possible that the surge in short interest could have a negative effect on its share price. Investors should keep an eye on Toray Industries’ stock price and news developments to gauge the impact of the increased short interest. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Toray Industries. More…

| Total Revenues | Net Income | Net Margin |

| 2.43M | 82.42k | 3.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Toray Industries. More…

| Operations | Investing | Financing |

| 98.73k | -94.95k | -10.21k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Toray Industries. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.32M | 1.66M | 948.05 |

Key Ratios Snapshot

Some of the financial key ratios for Toray Industries are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.5% | -8.0% | 5.4% |

| FCF Margin | ROE | ROA |

| 0.2% | 5.4% | 2.5% |

VI Analysis

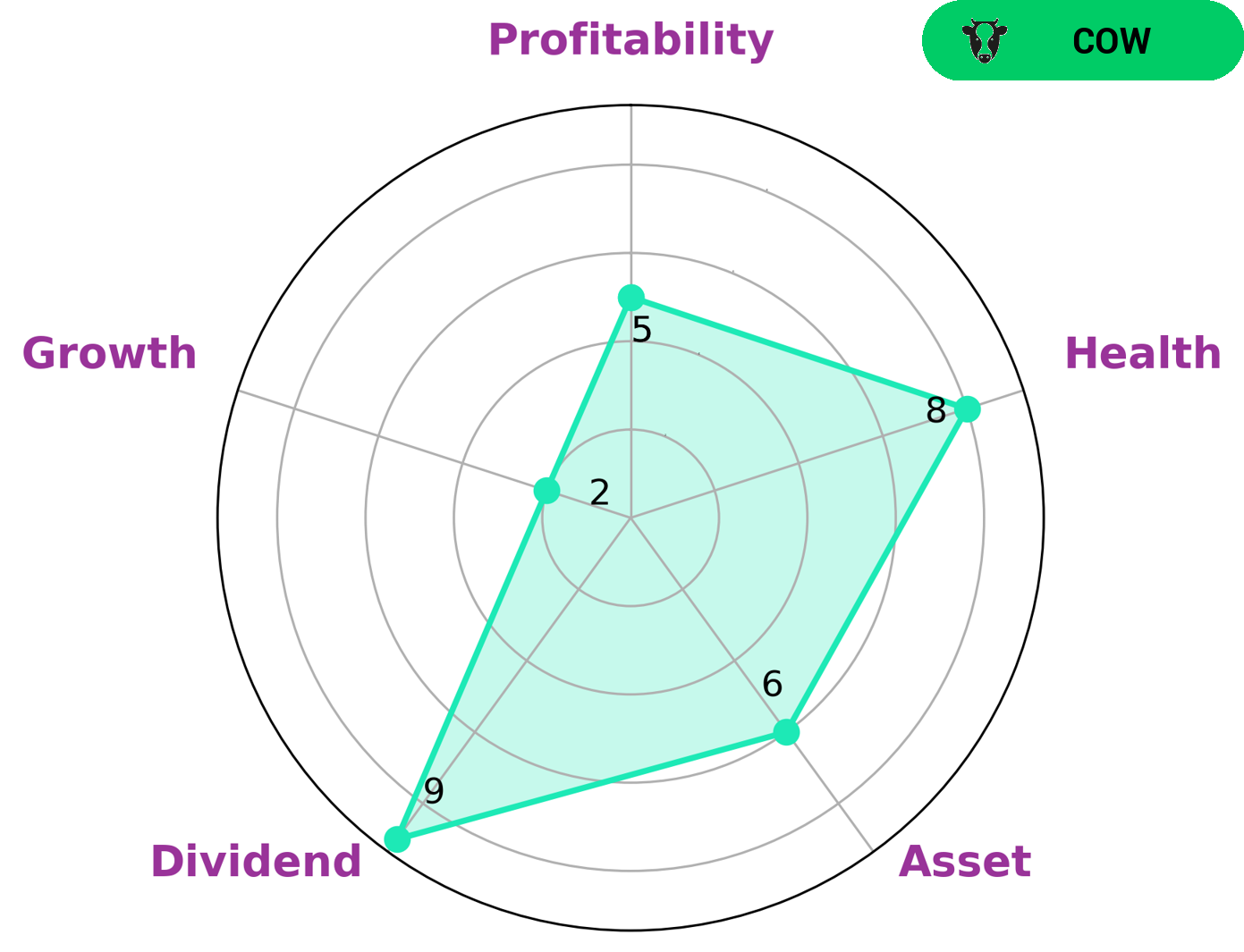

TORAY INDUSTRIES is an ideal pick for investors looking for long-term potential, as its fundamentals are strong and reliable. The VI Star Chart classifies TORAY INDUSTRIES as a ‘cow’, a type of company that pays out consistent and sustainable dividends. It has a high health score of 8 out of 10, indicating that it is capable of paying off debt and funding future operations. TORAY INDUSTRIES is strong in dividend, medium in asset, profitability and weak in growth. TORAY INDUSTRIES is a great choice for many types of investors. Those looking for steady income over the long-term can benefit from its consistent dividends, while those looking to increase their portfolio value can benefit from the company’s strong fundamentals. In addition, investors looking for stability and a low-risk investment can find this company appealing, as its health score indicates that it is able to pay off debt and fund future operations. In short, TORAY INDUSTRIES is an ideal pick for long-term investors looking for steady income, stability and low-risk. Its strong fundamentals and high health score make it an attractive option for many types of investors. More…

VI Peers

The competition among Toray Industries Inc and its competitors San Fang Chemical Industry Co Ltd, Fujibo Holdings Inc, and Suminoe Textile Co Ltd has been fierce in the global market. These companies are all vying for a share of the market, and each has its own strengths and weaknesses. As increasingly sophisticated technologies and innovative products become available in the market, the competition between these four companies continues to intensify.

– San Fang Chemical Industry Co Ltd ($TWSE:1307)

San Fang Chemical Industry Co Ltd is a Chinese chemical company that specializes in the production of industrial chemicals and related products. The company has a market cap of 8.27B as of 2023, which indicates that the company is highly valued by investors. Additionally, San Fang Chemical Industry Co Ltd has a Return on Equity (ROE) of 4.69%, which is an impressive figure and indicates that the company is generating substantial returns for its shareholders.

– Fujibo Holdings Inc ($TSE:3104)

Fujibo Holdings Inc is a Japanese multinational corporation that operates businesses in the consumer electronics, home appliance, and automotive industries. As of 2023, it has a market cap of 36.21 billion and a Return on Equity of 9.15%. The company’s market capitalization reflects the fact that its stock is highly valued compared to its competitors, given its size and position in the industry. It’s high ROE ratio indicates that it is generating a greater return on its equity investments than the industry average. The company’s success is due to its commitment to innovation and excellent customer service.

– Suminoe Textile Co Ltd ($TSE:3501)

Suminoe Textile Co. Ltd is a Japanese textile company that specializes in producing a wide range of textiles, including kimonos and other traditional garments. As of 2023, the company has a market cap of 11.43 billion, which indicates a strong financial performance. The company has also achieved an impressive 4.39% Return on Equity, indicating efficient use of its resources to generate income and profits. Suminoe Textile Co. Ltd is well-positioned to continue its success in the textile industry.

Summary

Toray Industries has seen a significant increase in short interest in December, indicating that investors may be expecting the company’s performance to improve. Analysts suggest that this could be due to a number of factors, such as strong performance in its core businesses, increased demand for its products, or expectations of a potential dividend increase. Given the positive news sentiment, investors should keep an eye on Toray Industries and consider investing if the company meets or exceeds their expectations. Investors should also research the company further to get a better understanding of its operations and financial health before making any decisions.

Recent Posts