Black Peony Raises 650 Million Yuan Through Bond Issuance

February 16, 2023

Trending News 🌥️

Black Peony ($SHSE:600510), a subsidiary of the Beijing-based conglomerate, has recently announced the issuance of a 650 million yuan bond. This marks the largest bond issuance of a Chinese company in the past two years. Black Peony is a publicly listed company that specializes in the production and sale of high-end apparel and accessories. It has recently opened flagship stores in major cities across China and has expanded its global reach to include Europe, North America and Southeast Asia. The new bond issuance is an important step for Black Peony. The proceeds from the bond will be used to finance the company’s expansion plans and to help strengthen its balance sheet. This suggests that investors have strong confidence in the company’s prospects and ability to repay the bonds.

This additional capital will help the company to accelerate its growth plans and open new stores across China. This also demonstrates strong investor confidence in the company, as investors are willing to back the business financially. The successful bond issuance reflects the strong financial position of Black Peony. This news is expected to provide a boost to the company’s stock price and increase investor confidence even further. With its strong balance sheet and ambitious expansion plans, Black Peony looks set to capitalize on the growing demand in the luxury fashion market.

Price History

On Thursday, Chinese retail company Black Peony made news when it announced its successful bond issuance, raising 650 million yuan. This news was welcomed positively by investors, as the stock opened at CNY7.2 and closed at CNY7.4, up by 0.5% from its last closing price of 7.3. The bond issuance was completed as part of Black Peony’s plan to raise its capital and finance further growth. It has also been reported that the company plans to use the proceeds of the bond issuance to pay for new projects and for general corporate purposes. The company has had a good track record in recent years and has seen a steady growth in its market share. The bond issuance is expected to further strengthen its financial position and enable it to take advantage of new opportunities in the market.

The news of the bond issuance has been well received by analysts who view it as a sign of the company’s financial strength and stability. They believe that this move is likely to benefit Black Peony in the long run as it expands its operations and takes on new projects. Overall, Black Peony’s successful bond issuance is good news for both the company and its shareholders. The move is expected to help the company grow, while also providing investors with a good return on their investments. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Black Peony. More…

| Total Revenues | Net Income | Net Margin |

| 8k | 257.05 | 6.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Black Peony. More…

| Operations | Investing | Financing |

| -3.53k | -832.06 | 2.81k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Black Peony. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 35.98k | 25.63k | 9.16 |

Key Ratios Snapshot

Some of the financial key ratios for Black Peony are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -7.0% | -31.7% | 8.3% |

| FCF Margin | ROE | ROA |

| -29.6% | 4.4% | 1.2% |

Analysis

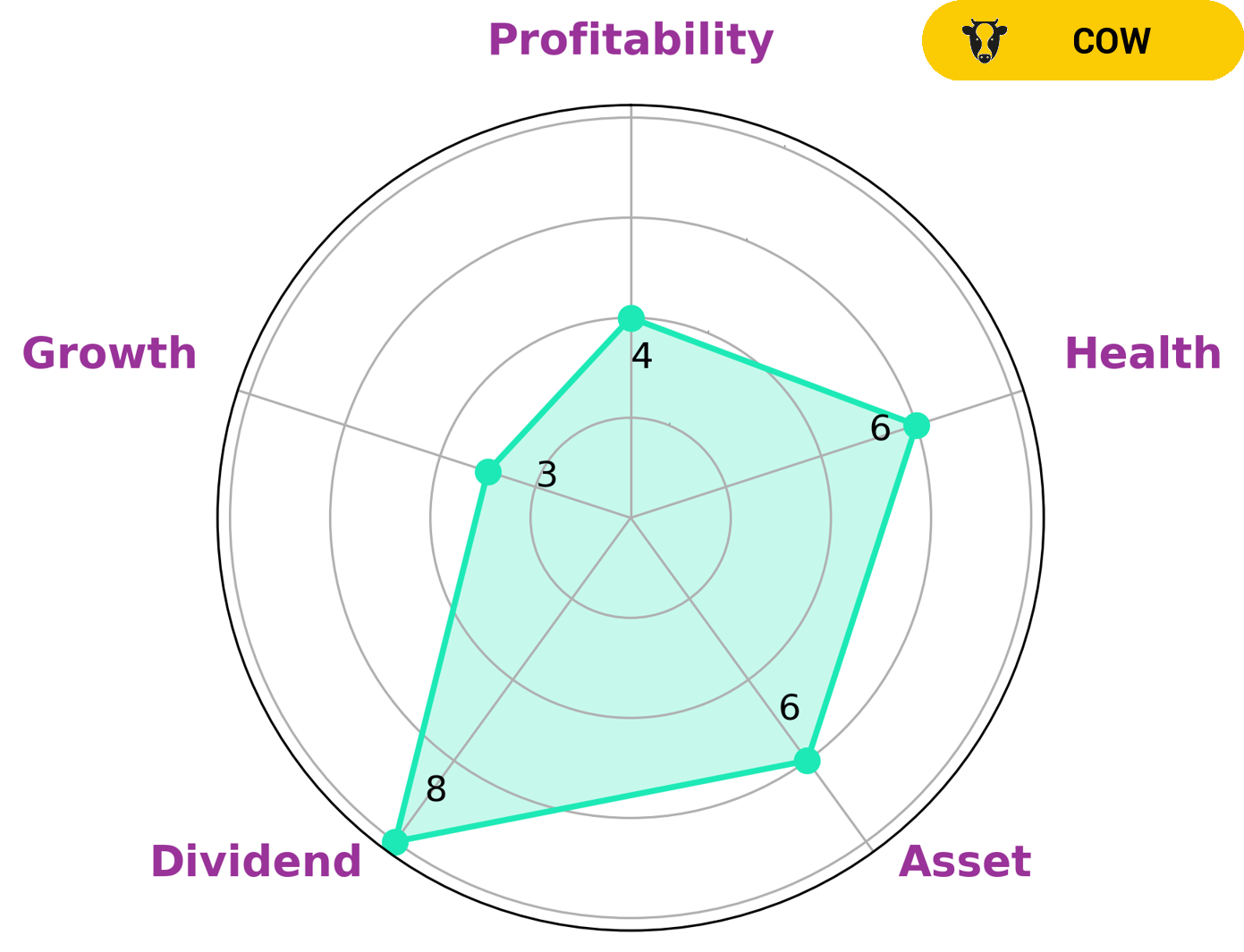

GoodWhale’s analysis of BLACK PEONY’s financials suggests that the company has an intermediate health score of 6/10. This is mainly due to its cash flows and debt, which suggest that it may be able to pay off its debt and fund future operations. These characteristics make BLACK PEONY very attractive to different types of investors. Investors looking for steady income and a low-risk investment option can benefit from the consistent dividend payments associated with this type of company. Those looking for medium-term growth may find BLACK PEONY’s assets and profitability appealing; however, its growth potential may not be as high as other companies. Overall, BLACK PEONY appears to offer a good balance between value, stability, and growth potential. Investors looking for an income source and less risk may be particularly interested in this company, although it may not be suitable for those seeking high returns in a short period of time. It is important to note that the success of an investment in BLACK PEONY will depend heavily on the market conditions and the investor’s individual circumstances. More…

Peers

It competes with other large companies such as Zhewen Pictures Group Co Ltd, Ningxia Zhongyin Cashmere Co Ltd and DCM Nouvelle Ltd, all of which are also active in the Chinese media industry.

– Zhewen Pictures Group Co Ltd ($SHSE:601599)

Zhewen Pictures Group Co Ltd is a Chinese media company that focuses on film and television production, distribution, and marketing. The company has a market cap of 3.74 billion US dollars as of 2023, indicating its strong financial position. Its Return on Equity (ROE) of 15.61% indicates that the company is able to generate high profits compared to its equity. The company is well positioned to expand its operations and gain market share in the coming years.

– Ningxia Zhongyin Cashmere Co Ltd ($SZSE:000982)

Ningxia Zhongyin Cashmere Co Ltd is a Chinese-based company that specializes in the production of cashmere products. It is one of the leading companies in the global cashmere industry and has a market cap of 8.01B as of 2023. The Return on Equity for the company is 0.81%, which is a good indicator of the company’s financial performance. The company is well-known for its high quality products and has established itself as one of the leading producers of cashmere in the world.

– DCM Nouvelle Ltd ($BSE:542729)

DCM Nouvelle Ltd is a leading company in the global automotive industry, specializing in the manufacturing and distribution of automobile components. With a market cap of 2.61B as of 2023 and a Return on Equity (ROE) of 8.7%, DCM Nouvelle Ltd is well-positioned to maintain its current share of the automotive market. The company’s strong ROE indicates that it is making effective use of its equity, generating more profits than what is being invested in the company. DCM Nouvelle Ltd’s high market cap demonstrates that it is a strong player in the industry and that investors are confident in its ability to generate returns.

Summary

Black Peony, a major Chinese investment firm, has issued 650 million Yuan (Chinese yuan) worth of bonds for potential investors. These bonds offer a return on investment and present an attractive opportunity for investors looking for higher returns on their investments. The bonds are being issued with varying levels of credit ratings, so investors should research the risks associated with each before investing. Black Peony is seen as a reliable and sound company to invest in, and these bonds will likely have strong demand among investors.

Recent Posts