Albany International Stock Fair Value – ALBANY INTERNATIONAL Reports Record Q4 Earnings, Exceeding Expectations

April 26, 2023

Trending News 🌥️

ALBANY INTERNATIONAL ($NYSE:AIN) Corporation, a leading global advanced textiles and materials processing company, recently reported record fourth quarter earnings, exceeding expectations.

In addition, total revenue came in at $269.1M, $13.96M above expectations. The company also provided FY23 revenue guidance in line with analysts’ estimates. The company is focused on innovative solutions for a wide range of industries, including aerospace, energy, and medical. ALBANY INTERNATIONAL is committed to research and development, which has enabled it to stay ahead of the competition and deliver innovative, high-quality products to the marketplace. The company’s commitment to innovation has been a key factor in its success over the past several years.

Market Price

On Tuesday, ALBANY INTERNATIONAL opened at $90.0 and closed at $89.5, down 1.7% from the last closing price of 91.0. The company’s strong performance was driven by growth in both its paper machine clothing and engineered composites segments. ALBANY INTERNATIONAL’s chairman and CEO, William Stiehl, commented on the earnings report, stating that “the solid fourth quarter results are a testament to the hard work of our team, who has done a great job executing on our strategy and creating value for our shareholders”. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Albany International. More…

| Total Revenues | Net Income | Net Margin |

| 1.03k | 95.76 | 8.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Albany International. More…

| Operations | Investing | Financing |

| 128.21 | -96.35 | -23.65 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Albany International. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.64k | 774.71 | 27.74 |

Key Ratios Snapshot

Some of the financial key ratios for Albany International are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.6% | -2.6% | 14.5% |

| FCF Margin | ROE | ROA |

| 3.1% | 11.2% | 5.7% |

Analysis – Albany International Stock Fair Value

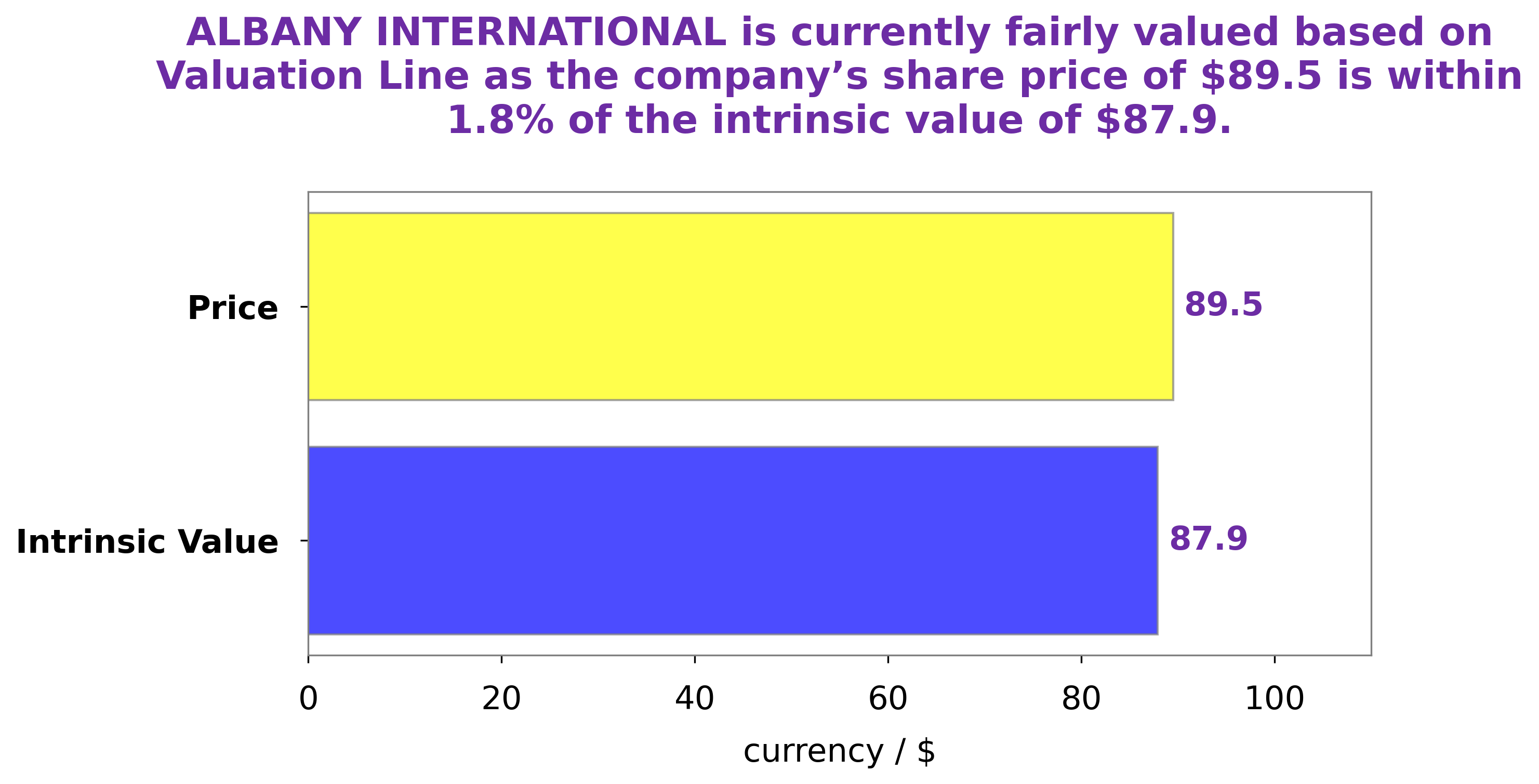

At GoodWhale, we’ve taken a deep dive into ALBANY INTERNATIONAL’s financials. After our analysis, we believe their fair value is around $87.9, based on our proprietary Valuation Line. Right now, the stock is trading at $89.5, which is a fair price, but is slightly overvalued by 1.8%. More…

Peers

Their competitors include Trident Ltd, Jasch Industries Ltd, and Ruentex Industries Ltd, all of whom are dedicated to providing innovative solutions to meet the dynamic needs of their customers.

– Trident Ltd ($BSE:521064)

Trident Ltd is an Indian yarn and fabric manufacturer, producing a wide range of products for the home textiles, apparel, and industrial markets. As of 2023, the company has a market capitalization of 171.99B, indicating a strong financial performance. Additionally, the company has a Return on Equity of 13.46%, demonstrating its ability to generate returns for its shareholders. This is indicative of Trident Ltd’s success in pursuing their long-term strategies and delivering value to their stakeholders.

– Jasch Industries Ltd ($BSE:500220)

Jasch Industries Ltd is a multinational conglomerate headquartered in Hong Kong. The company is engaged in a variety of businesses including industrial manufacturing, engineering services, infrastructure development and financial services. As of 2023, the company has a market capitalization of 1.92 billion and a Return on Equity of 20.32%. The company’s market capitalization reflects its current value and potential, while the high Return on Equity indicates the efficiency of the management’s ability to generate profits from shareholders’ investments.

– Ruentex Industries Ltd ($TWSE:2915)

Ruentex Industries Ltd is a Taiwanese conglomerate with a market cap of 68.33B as of 2023. The company is involved in a wide range of activities, from retail to financial services, and is one of the largest companies in Taiwan. The company has a remarkable Return on Equity of 105.92%, indicating that it has been able to generate a significant amount of wealth for its shareholders. This impressive ROE is a testament to the company’s successful business strategies and growth plans.

Summary

The company reported non-GAAP earnings per share of $0.91, beating the consensus estimate by $0.07. Revenue came in at $269.1 million, surpassing analyst forecasts by $13.96 million. Additionally, the company provided revenue guidance for FY2023 which was in line with analyst estimates. Investors should keep a close eye on Albany International‘s performance in the coming quarters as the company continues to make progress towards its long-term growth goals.

Recent Posts