Taylor Frigon Capital Management LLC Sells Shares of Napco Security Technologies,

January 30, 2023

Trending News ☀️

Taylor Frigon Capital Management LLC recently sold off shares of Napco Security Technologies ($NASDAQ:NSSC), Inc. (NAPCO), a leading provider of security products and technologies for the residential, commercial, institutional, and industrial markets. The company offers a wide range of security solutions, including access control, intrusion protection, and fire systems. NAPCO Security Technologies, Inc. is a publicly traded company listed on the NASDAQ stock exchange. The company has been successful in developing innovative security technologies and products that provide customers with reliable, secure, and cost-effective solutions. The company’s products are used in a variety of applications, including residential security systems, commercial alarm systems, and industrial automation systems. NAPCO also provides a variety of managed services, such as alarm monitoring and video surveillance. In addition, the company offers a wide array of services that provide customers with customized security solutions tailored to their specific needs. It remains to be seen how this move will affect the company’s stock performance in the future.

However, with its strong presence in the security industry and its impressive array of products and services, NAPCO Security Technologies, Inc. is likely to remain a leader in the industry for years to come.

Market Price

The stock opened at $30.7 and closed at $29.5, down by 2.7% from the last closing price of $30.3. Despite the dip, the news sentiment surrounding Napco Security Technologies remains overall positive. Napco Security Technologies specializes in developing and manufacturing security solutions for residential and commercial markets worldwide. Their products include intrusion and fire alarm systems, access control systems, remote home management solutions, video surveillance systems, and related accessories.

The company has a strong global presence, with operations in North America, Latin America, Europe, and the Middle East. Napco Security Technologies is well-positioned to capitalize on the increasing demand for security solutions as safety concerns grow around the world. With a strong portfolio of products and an international presence, Napco Security Technologies is poised to make waves in the industry for years to come. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for NSSC. More…

| Total Revenues | Net Income | Net Margin |

| 152.03 | 18.25 | 12.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for NSSC. More…

| Operations | Investing | Financing |

| 2.9 | -11.38 | 0.18 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for NSSC. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 151.6 | 30.88 | 3.29 |

Key Ratios Snapshot

Some of the financial key ratios for NSSC are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 12.8% | 11.6% | 16.6% |

| FCF Margin | ROE | ROA |

| 1.0% | 13.4% | 10.4% |

VI Analysis

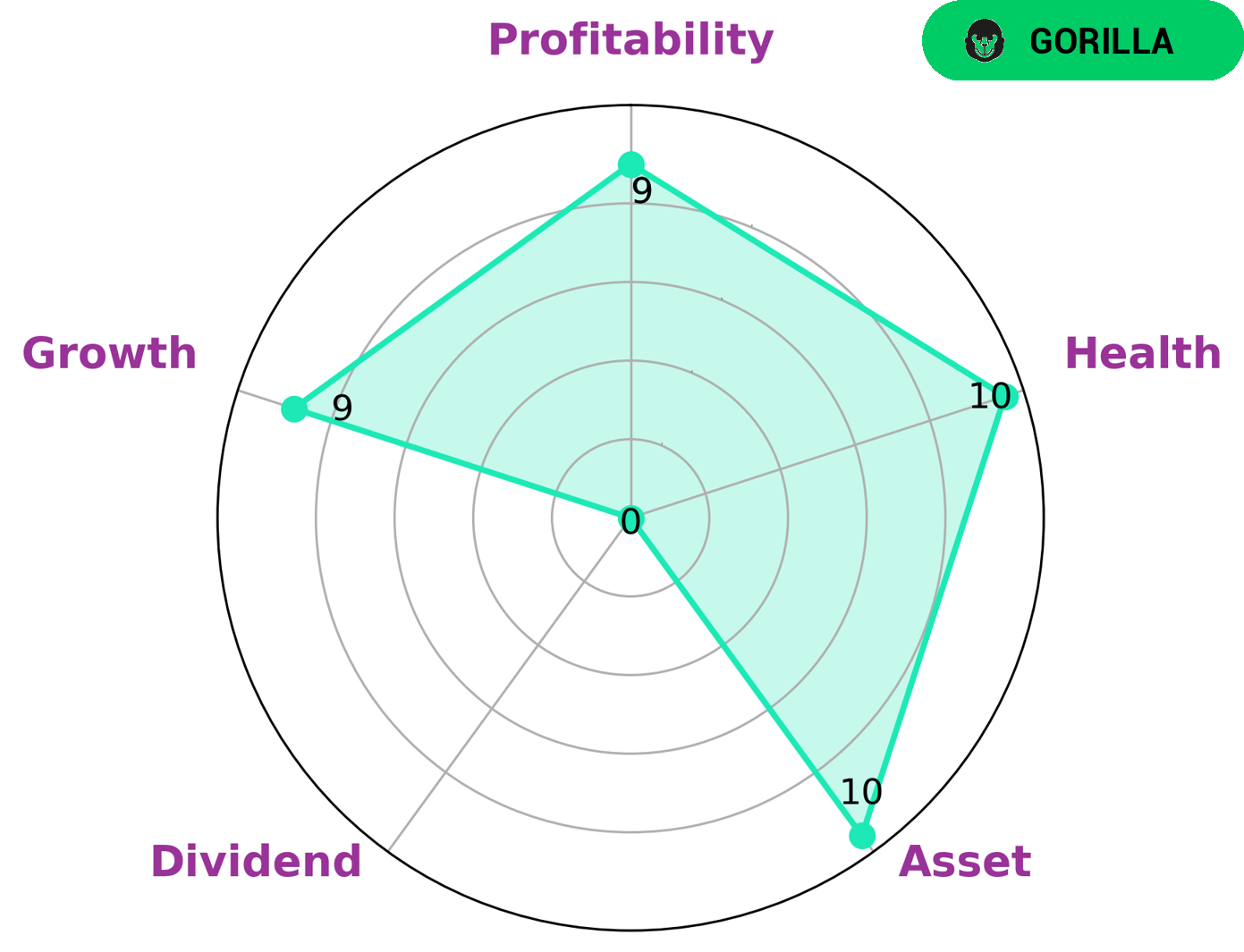

The VI app is a great tool for investors who want to analyze the fundamentals and long term potential of NAPCO SECURITY TECHNOLOGIES. The VI Star Chart classifies the company as a “gorilla”, indicating that it has achieved stable and high revenue or earning growth due to its strong competitive advantage. Investors with a long-term outlook and who are comfortable with holding a company for many years may find this company attractive. Furthermore, its health score of 10/10 indicates that NAPCO SECURITY TECHNOLOGIES is financially sound and is capable of riding out any crisis without the risk of bankruptcy. While the company is strong in terms of assets, growth and profitability, it is weak in terms of dividends. This could be an area of potential improvement for the company in the future, as dividends can provide additional income to shareholders. All in all, NAPCO SECURITY TECHNOLOGIES appears to be an attractive option for investors who are looking for a steady and reliable investment opportunity. More…

VI Peers

Headquartered in Amityville, New York, NAPCO manufactures and sells a comprehensive line of security products, including intruder and fire alarm systems, video surveillance products, access control systems, and door locking products. The company has three main subsidiaries: Alarm Lock, Continental Instrument, and Marks USA. NAPCO serves residential, commercial, and institutional customers through a network of professional security dealers and integrators, as well as distributors and retailers worldwide. NAPCO’s primary competitors are Viscount Systems Inc, Costar Technologies Inc, and Taiwan Shin Kong Security Co Ltd.

– Viscount Systems Inc ($OTCPK:VSYS)

Viscount Systems Inc. is a provider of physical security solutions that enable organizations to secure their facilities, assets, and critical information. The company’s solutions include access control, video surveillance, and intrusion detection. Viscount Systems Inc. was founded in 2004 and is headquartered in Burnaby, Canada.

– Costar Technologies Inc ($OTCPK:CSTI)

Costar Technologies Inc is a technology company that provides solutions for the semiconductor and electronics industries. The company has a market cap of 9.74M and a ROE of 9.71%. Costar’s products and services include wafer cleaning and drying equipment, automated optical inspection equipment, and wafer level packaging equipment. The company’s customers include semiconductor manufacturers, foundries, and fabless companies.

– Taiwan Shin Kong Security Co Ltd ($TWSE:9925)

Taiwan Shin Kong Security Co Ltd is a security company that provides security services to businesses and individuals. The company has a market cap of 14.83B as of 2022 and a return on equity of 8.6%. The company operates in Taiwan, China, and Hong Kong.

Summary

Taylor Frigon Capital Management LLC recently sold shares of Napco Security Technologies, Inc., a provider of security products and technologies. As of now, the sentiment around the company is mostly positive. Investors looking to gain exposure to Napco Security Technologies may consider analyzing the company’s financials, competitive landscape, and potential catalysts that may drive future growth.

Additionally, it is important to consider the company’s management team, strategic direction, and risk profile when making an investment decision. With an understanding of the fundamentals, investors can make an informed decision about whether or not Napco Security Technologies is a good fit for their portfolio.

Recent Posts