Napco Security Technologies to Release Quarterly Earnings Data Ahead of Market Open on Monday

May 11, 2023

Trending News ☀️

Napco Security Technologies ($NASDAQ:NSSC), a leading manufacturer of innovative security solutions, will be releasing its quarterly earnings figures before the start of trading on Monday, May 8th. With their dedication to innovation and customer service, Napco has grown to become a leading provider of access control, intrusion and fire alarm systems, video surveillance and more. The upcoming quarterly earnings release is expected to shed light on the financial performance of the company over the past quarter and provide insight into its future prospects. Investors will be looking to see how the company has performed and how this reflects on the current value of their stock.

Analysts will be keeping a close eye on the numbers to see if there are any signs of growth or stagnation in the company’s results. With the impending release, investors and analysts alike will be eagerly awaiting the results to see what they mean for the future of Napco.

Price History

Napco Security Technologies announced that they will release their quarterly earnings data on Monday before the market opens. This news caused a significant boost to the company’s stock, as it opened on Monday at $31.4 and closed at $33.8, soaring 23.6% from the previous closing price of 27.4. The increase in the market value of Napco Security Technologies provides an indication that the company is doing well and is expecting strong results in their financial data. Investors have reacted positively to this news, with many expecting the company to deliver an impressive performance this quarter. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for NSSC. More…

| Total Revenues | Net Income | Net Margin |

| 160.94 | 25.66 | 15.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for NSSC. More…

| Operations | Investing | Financing |

| 1.62 | -11.61 | 0.04 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for NSSC. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 154.36 | 24.87 | 3.52 |

Key Ratios Snapshot

Some of the financial key ratios for NSSC are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.6% | 22.5% | 20.7% |

| FCF Margin | ROE | ROA |

| 0.1% | 16.7% | 13.5% |

Analysis

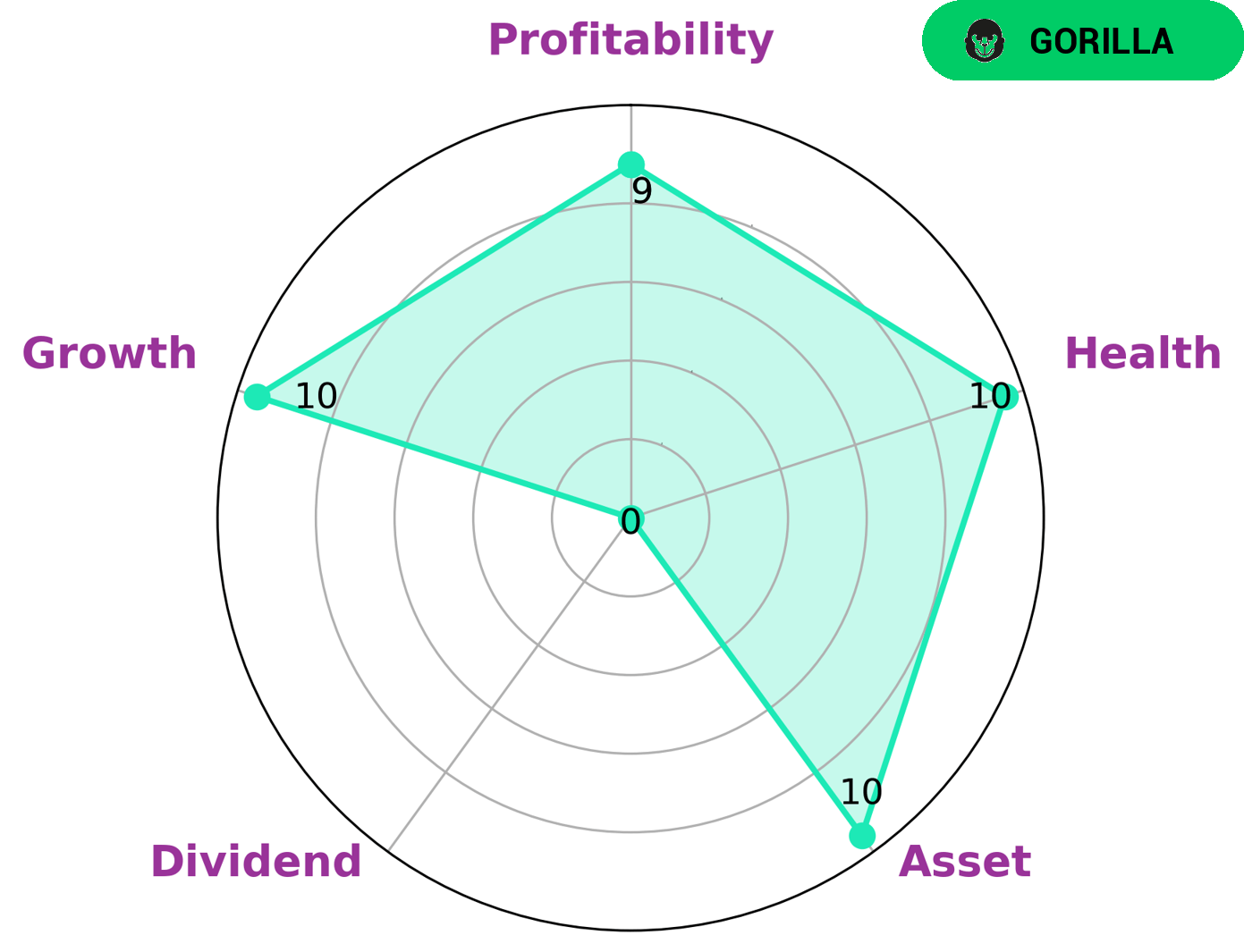

At GoodWhale, we have conducted a thorough analysis of NAPCO SECURITY TECHNOLOGIES’s fundamentals. According to our Star Chart analysis, NAPCO SECURITY TECHNOLOGIES is strong in assets, growth, and profitability, and weak in dividends. Additionally, the company has a high health score of 10/10 with regards to its cashflows and debt, meaning that it is capable of sustaining future operations in times of crisis. We further classified NAPCO SECURITY TECHNOLOGIES as ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Given these positive fundamentals, we believe that value investors, growth investors, and income investors alike may be interested in investing in NAPCO SECURITY TECHNOLOGIES. Value investors may be attracted by the company’s strong balance sheet and capacity to weather economic downturns; growth investors may be attracted by its strong asset growth and competitive advantage; and income investors may be attracted by the potential for dividend growth in the future. More…

Peers

Headquartered in Amityville, New York, NAPCO manufactures and sells a comprehensive line of security products, including intruder and fire alarm systems, video surveillance products, access control systems, and door locking products. The company has three main subsidiaries: Alarm Lock, Continental Instrument, and Marks USA. NAPCO serves residential, commercial, and institutional customers through a network of professional security dealers and integrators, as well as distributors and retailers worldwide. NAPCO’s primary competitors are Viscount Systems Inc, Costar Technologies Inc, and Taiwan Shin Kong Security Co Ltd.

– Viscount Systems Inc ($OTCPK:VSYS)

Viscount Systems Inc. is a provider of physical security solutions that enable organizations to secure their facilities, assets, and critical information. The company’s solutions include access control, video surveillance, and intrusion detection. Viscount Systems Inc. was founded in 2004 and is headquartered in Burnaby, Canada.

– Costar Technologies Inc ($OTCPK:CSTI)

Costar Technologies Inc is a technology company that provides solutions for the semiconductor and electronics industries. The company has a market cap of 9.74M and a ROE of 9.71%. Costar’s products and services include wafer cleaning and drying equipment, automated optical inspection equipment, and wafer level packaging equipment. The company’s customers include semiconductor manufacturers, foundries, and fabless companies.

– Taiwan Shin Kong Security Co Ltd ($TWSE:9925)

Taiwan Shin Kong Security Co Ltd is a security company that provides security services to businesses and individuals. The company has a market cap of 14.83B as of 2022 and a return on equity of 8.6%. The company operates in Taiwan, China, and Hong Kong.

Summary

Napco Security Technologies is a leading provider of security solutions, with a focus on innovative products such as access control systems, digital video surveillance, and home security. Investors are anticipating the company’s upcoming earnings report, which is expected to be released before the market opens on Monday, May 8th. Investors will be watching to see how Napco Security Technologies performs financially, as their stock price has been steadily climbing since the beginning of the year.

Analysts are expecting to see positive results, driven by strong demand for the company’s products and services. Potential investors should take this opportunity to further research the company and its financial stability, in order to make an informed decision before investing.

Recent Posts