WD-40 sees significant growth as Creative Planning boosts shares by 17.7%

November 6, 2024

☀️Trending News

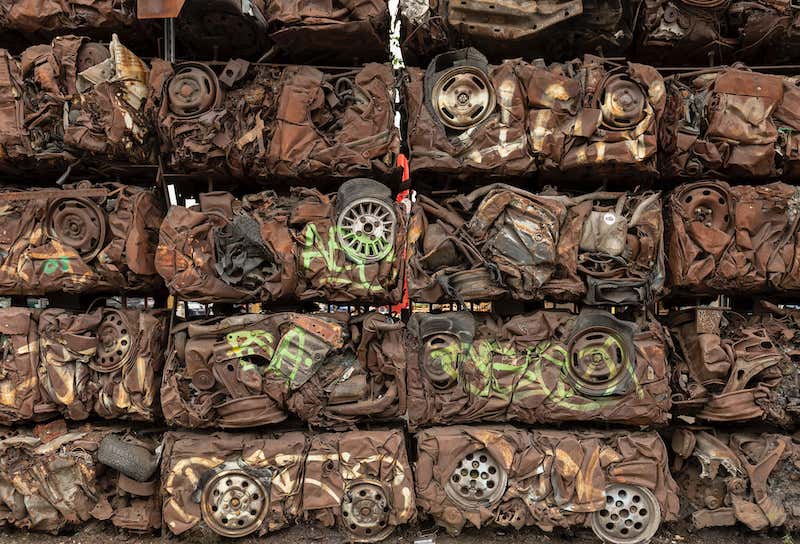

WD-40 COMPANY ($NASDAQ:WDFC) is a well-known global manufacturer of lubricants, household cleaners, and other maintenance products. The company’s most popular product is the WD-40 multi-use spray, which has become a household name for its ability to lubricate, protect, and remove stubborn rust and dirt from various surfaces. Recently, the company’s stock has been making headlines due to a significant increase in shares. This sudden surge can be attributed to Creative Planning’s 13F filing, which revealed a 17.7% increase in its shares of WD-40 during the third quarter. This news has caught the attention of investors and analysts alike, as it indicates positive growth and potential for the company. Creative Planning is a renowned wealth management firm that provides financial planning and investment management services to clients. The firm manages a significant amount of assets and often invests in well-performing stocks. This recent increase in their shares of WD-40 COMPANY shows their confidence in the company’s future prospects and potential for growth.

It is an essential tool for investors and analysts to track the buying and selling activities of large institutional investors. This significant growth in WD-40 COMPANY’s shares can also be attributed to its consistent financial performance over the years. The company has reported steady revenue growth and strong earnings, even during the pandemic. In conclusion, the recent 17.7% increase in WD-40 COMPANY’s shares by Creative Planning has sparked positive sentiment and optimism among investors. The company’s strong financial performance and consistent growth have solidified its position in the market and continue to attract the attention of institutional investors. As the company continues to expand its product offerings and global presence, it is poised for further success and potential growth in the future.

Analysis

After conducting a thorough analysis of WD-40 COMPANY‘s fundamentals, I have found that the company is strong in areas such as dividend and profitability, and has a medium performance in terms of asset and growth. These conclusions have been further supported by the Star Chart, which ranks WD-40 COMPANY highly in terms of its dividend and profitability, and labels it as a ‘rhino’ company in regards to its revenue and earnings growth. A ‘rhino’ company, as we define it, is one that has achieved moderate growth in terms of revenue and earnings. This means that while WD-40 COMPANY may not be experiencing rapid growth, it is still performing well in these areas. This type of company may be attractive to investors who are looking for a stable and consistent return on their investments, rather than high-risk, high-growth opportunities. Additionally, WD-40 COMPANY has a high health score of 9/10 when it comes to its cashflows and debt. This indicates that the company is in a strong financial position and is capable of paying off its debt and funding future operations. This may appeal to long-term investors who are looking for a stable and financially healthy company to invest in. In summary, WD-40 COMPANY appears to be a solid choice for investors who value stability, consistency, and financial health. The company’s strong fundamentals and ‘rhino’ status make it an attractive option for those seeking moderate growth and a reliable return on their investments. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Wd-40 Company. More…

| Total Revenues | Net Income | Net Margin |

| 552.78 | 69.19 | 12.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Wd-40 Company. More…

| Operations | Investing | Financing |

| 114.87 | -5.59 | -97.21 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Wd-40 Company. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 430.61 | 214.67 | 15.93 |

Key Ratios Snapshot

Some of the financial key ratios for Wd-40 Company are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.4% | 1.6% | 17.4% |

| FCF Margin | ROE | ROA |

| 19.7% | 28.2% | 14.0% |

Peers

WD-40 Co is a leading global provider of lubricants, cleaners and rust-prevention products. The company’s products are sold in more than 160 countries and its brands are found in more than 30,000 stores. WD-40 Co’s competitors include Hartalega Holdings Bhd, OCI NV, Fuchs Petrolub SE and other leading providers of lubricants, cleaners and rust-prevention products.

– Hartalega Holdings Bhd ($KLSE:5168)

Hartalega Holdings Bhd is a Malaysia-based company that manufactures and supplies nitrile gloves. The company has a market capitalization of 6.29 billion as of 2022 and a return on equity of 23.22%. Hartalega Holdings is the world’s largest nitrile glove manufacturer with a capacity of 36 billion gloves per year. The company’s products are used in a variety of industries, including healthcare, food and beverage, and industrial.

– OCI NV ($LTS:0QGH)

Alibaba Group Holding Limited is a Chinese multinational conglomerate holding company specializing in e-commerce, retail, Internet, and technology. Founded in 1999 by Jack Ma, Alibaba is one of the world’s largest online and mobile commerce companies. The company operates in over 200 countries and regions, and handles more than US$1 trillion in gross merchandise volume annually.

– Fuchs Petrolub SE ($OTCPK:FUPBY)

Fuchs Petrolub SE is a German oil and lubricant company with a market cap of 3.54B as of 2022. The company has a return on equity of 11.99%. Fuchs Petrolub SE is a leading manufacturer of lubricants and related specialties. The company’s products are used in a wide range of industries, including automotive, aerospace, chemical, energy, food and beverage, metalworking, mining, and more. Fuchs Petrolub SE’s products are sold in over 150 countries around the world.

Summary

Creative Planning, an investment management firm, has recently increased its position in shares of WD-40, a consumer products company. This increase of 17.7% occurred during the third quarter of the year. This suggests that Creative Planning sees potential in WD-40 and has confidence in its future performance. Investors should take note of this move and consider further analysis of WD-40 as a potential investment opportunity.

Other factors to consider in investing analysis for this company would include its financial health, market trends, and potential for growth. By closely monitoring these factors, investors can make informed decisions about whether or not to invest in WD-40.

Recent Posts