Semrush Holdings, on Track to Reach Record Profits in 2020

April 23, 2023

Trending News ☀️

The company is well-known for providing services to help businesses improve their online presence and maximize their marketing efforts. Their suite of tools, analytics, and data optimization services give companies access to the insights they need to make informed decisions. The company has seen steady growth since its founding, and lately it has seen a surge in demand as businesses strive to keep up with digital trends. This dedication has allowed Semrush Holdings ($NYSE:SEMR), Inc. to remain competitive in a rapidly changing digital landscape while also delivering exceptional results for its clients.

Share Price

On Monday, the stock opened at $9.8 and closed at $9.7, marking a 1.1% decrease from the previous closing price of $9.8, although this did not hinder the company’s prospects. The company continues to invest heavily in itself and is looking to expand its reach into new markets, which should help them achieve these lofty goals. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Semrush Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 254.32 | -33.85 | -10.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Semrush Holdings. More…

| Operations | Investing | Financing |

| -9.62 | -179.83 | -0.34 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Semrush Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 298.69 | 98.79 | 1.41 |

Key Ratios Snapshot

Some of the financial key ratios for Semrush Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 40.3% | – | -9.9% |

| FCF Margin | ROE | ROA |

| -6.1% | -7.6% | -5.3% |

Analysis

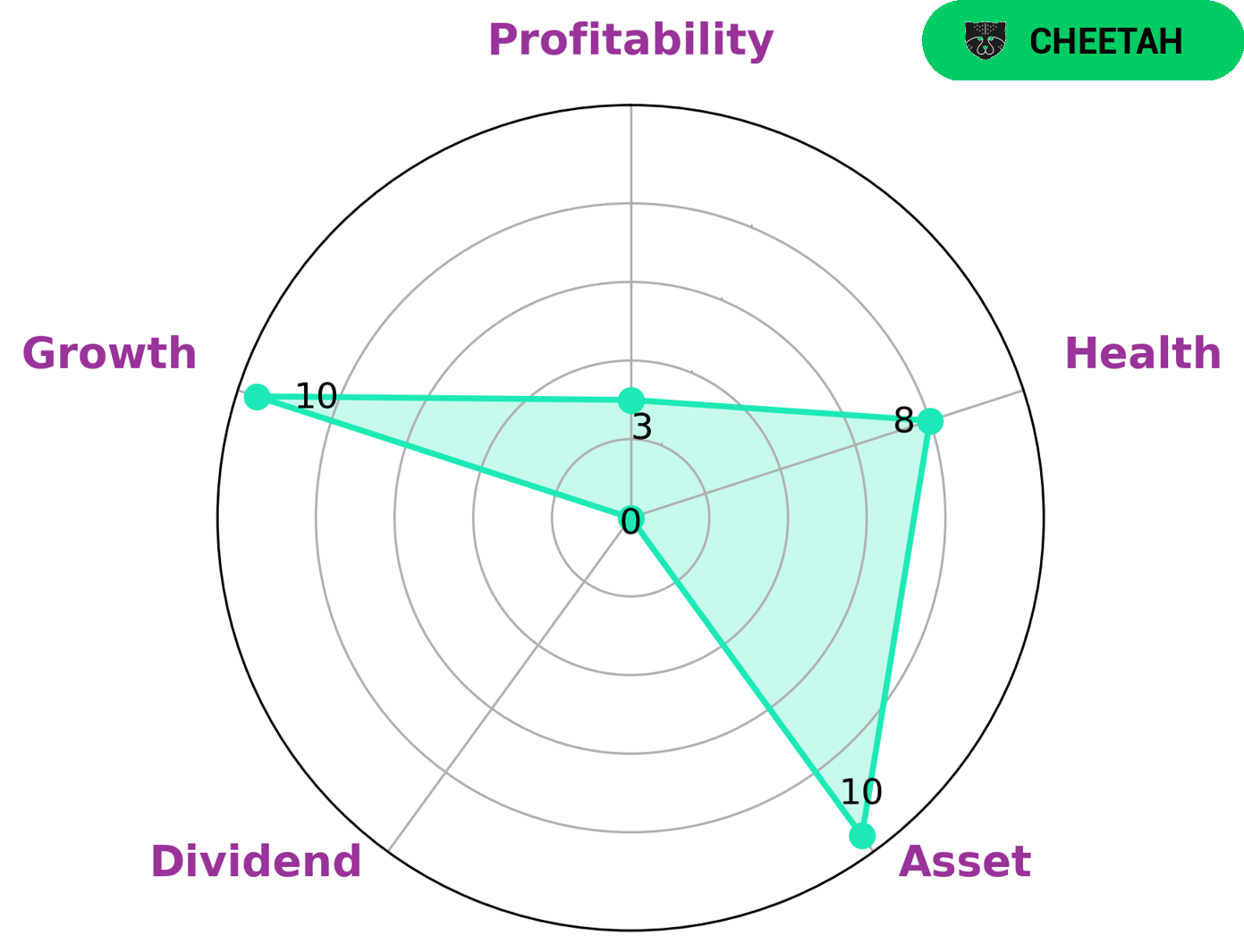

GoodWhale has thoroughly examined the financials of SEMRUSH HOLDINGS, and based on our Star Chart analysis, SEMRUSH HOLDINGS has a high health score of 8/10. This is evidence that the company is capable of paying off debt and funding future operations. According to our classification system, SEMRUSH HOLDINGS is considered a ‘cheetah’ company. This means that it has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors who are interested in the growth potential of such companies may be interested in investing in SEMRUSH HOLDINGS. This company is strong in assets and growth, but relatively weak in dividends and profitability. Therefore, investors should take this into consideration before committing to investing in this company. More…

Peers

SEMrush Holdings Inc is an online visibility management and content marketing platform that provides businesses with powerful insights and analytics related to their website performance.

– Thecoo Inc ($TSE:4255)

Thecoo Inc is a technology-driven digital media company that operates in the fields of digital media and advertising. The company has a market capitalization of 1.97 billion as of 2022 and a Return on Equity of -8.93%. This indicates that the company’s stock has not performed well in the market, and investors have not seen much return on their investment. The company is looking to improve its financial performance and increase its stock value by improving its operations and expanding its services.

– Vtex ($NYSE:VTEX)

Vtex is a cloud-based commerce and business platform that enables businesses to create and manage their online stores, catalogs, payments, logistics, and more. With a market capitalization of 655.44 million dollars as of 2022, Vtex is a leader in the e-commerce space. The company’s negative Return on Equity of -11.41% reflects its recent struggles to increase profitability. However, Vtex has seen great success in increasing its user base and expanding its services due to its innovative platform. The company is well positioned to further capitalize on the growth of e-commerce.

– Adaptive Medias Inc ($OTCPK:ADTM)

Adaptive Medias Inc is a digital media platform that provides monetization solutions for publishers and advertisers. The company serves over 4 billion ad impressions per month to its clients, including leading brands and marketers. As of 2022, Adaptive Medias Inc has a market cap of 52.83k and a Return on Equity of 146.99%. This indicates that the company has been able to generate higher returns on its equity than its peers, suggesting that investors are optimistic about the company’s prospects.

Summary

Semrush Holdings, Inc. offers a promising investment opportunity for investors. Its strong financials, demonstrated growth, and experienced management team make it an attractive option. Recent acquisitions have provided an influx of new technology, customers, and revenue streams. Analysts note that the company has a history of consistently increasing profits and expanding its market share.

Additionally, its technologies, services, and products have achieved positive customer reviews, indicating customer loyalty. Through careful evaluation, investors may uncover a strong portfolio addition with Semrush Holdings, Inc.

Recent Posts