ON Semiconductor: Leveraging Fab-Light Model To Achieve High Growth

April 20, 2023

Trending News ☀️

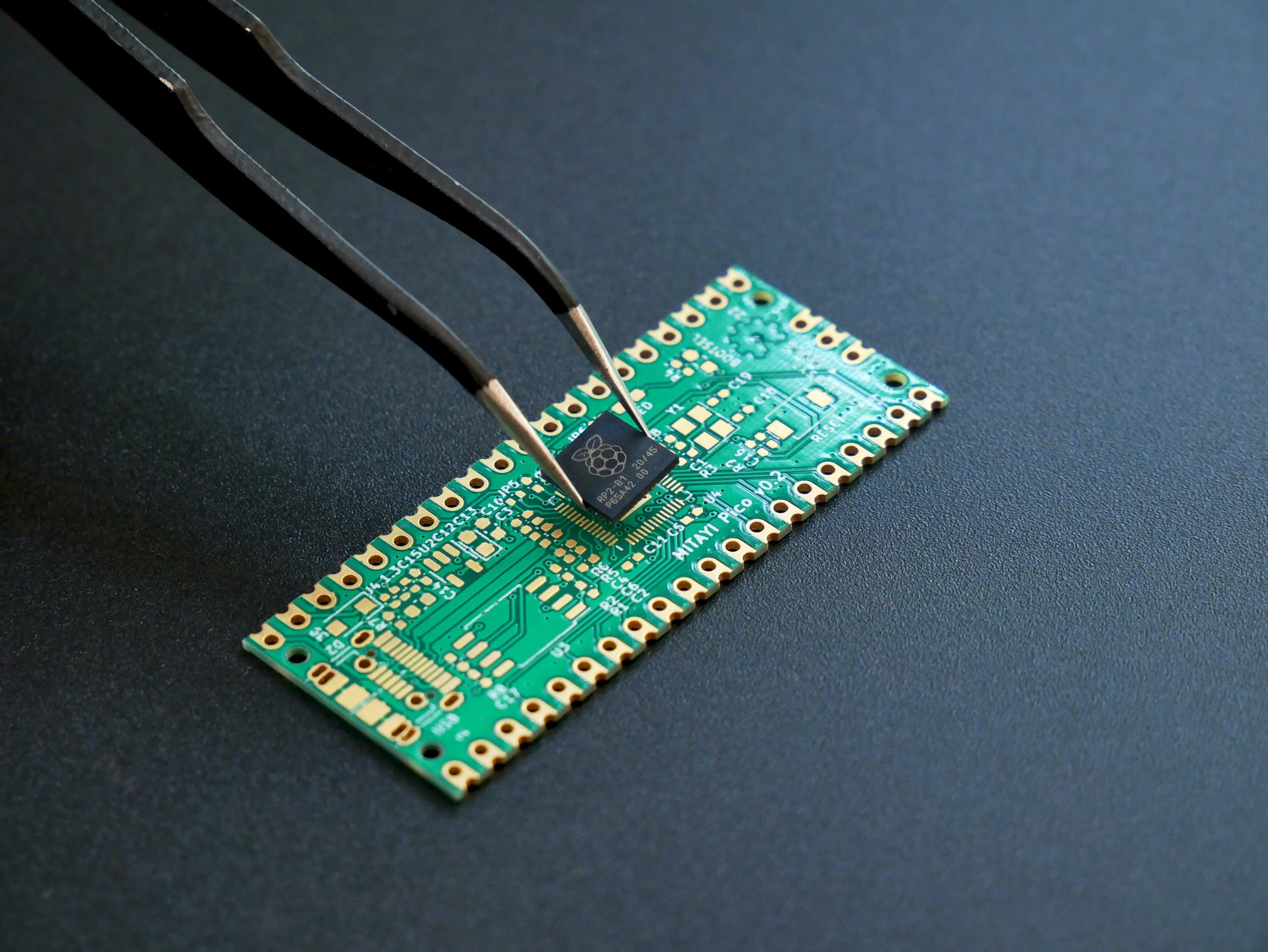

ON ($NASDAQ:ON) Semiconductor is a global provider of semiconductor-based solutions, offering a comprehensive portfolio of products and services that address the needs of a wide variety of markets. Over the years, the company has achieved considerable success in the semiconductor industry and continues to be a leader in the industry. Recently, ON Semiconductor has adopted a new Fab-Light Model that is expected to further accelerate their growth. The Fab-Light Model enables ON Semiconductor to reduce their production costs while improving their quality and time-to-market. This model relies on external foundries to produce chip designs from ON Semiconductor. This allows the company to increase its production capacity without increasing their fixed costs.

As a result, ON Semiconductor can reduce their production costs, improve their product quality, and reduce their time-to-market. By leveraging the Fab-Light Model, ON Semiconductor can achieve high growth. This model will help them build a competitive advantage in the semiconductor industry and will help them expand their market share. It is expected that this model will enable ON Semiconductor to achieve sustainable growth in the long run. Moreover, this model could help the company achieve greater profitability and returns for shareholders.

Share Price

ON Semiconductor has seen a steady rise in stock prices since Tuesday, when it opened at $79.2 and closed at the same price, an increase of 1.0% from the previous closing price of 78.4. The company has leveraged its Fab-Light model to drive growth and maintain competitive advantages in the semiconductor industry. This model involves minimizing capital expenses and shortening the production cycle by relying on external manufacturing suppliers to produce smaller quantities of semiconductor products. Through this strategy, ON Semiconductor is able to achieve high growth and maintain a competitive edge in a rapidly changing industry.

Additionally, its broad portfolio of products helps it to remain competitive in a diverse set of markets, allowing it to capitalize on a variety of opportunities. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for On Semiconductor. More…

| Total Revenues | Net Income | Net Margin |

| 8.33k | 1.9k | 26.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for On Semiconductor. More…

| Operations | Investing | Financing |

| 2.63k | -705.4 | -370 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for On Semiconductor. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 11.98k | 5.77k | 14.33 |

Key Ratios Snapshot

Some of the financial key ratios for On Semiconductor are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.7% | 63.5% | 29.5% |

| FCF Margin | ROE | ROA |

| 19.2% | 25.9% | 12.8% |

Analysis

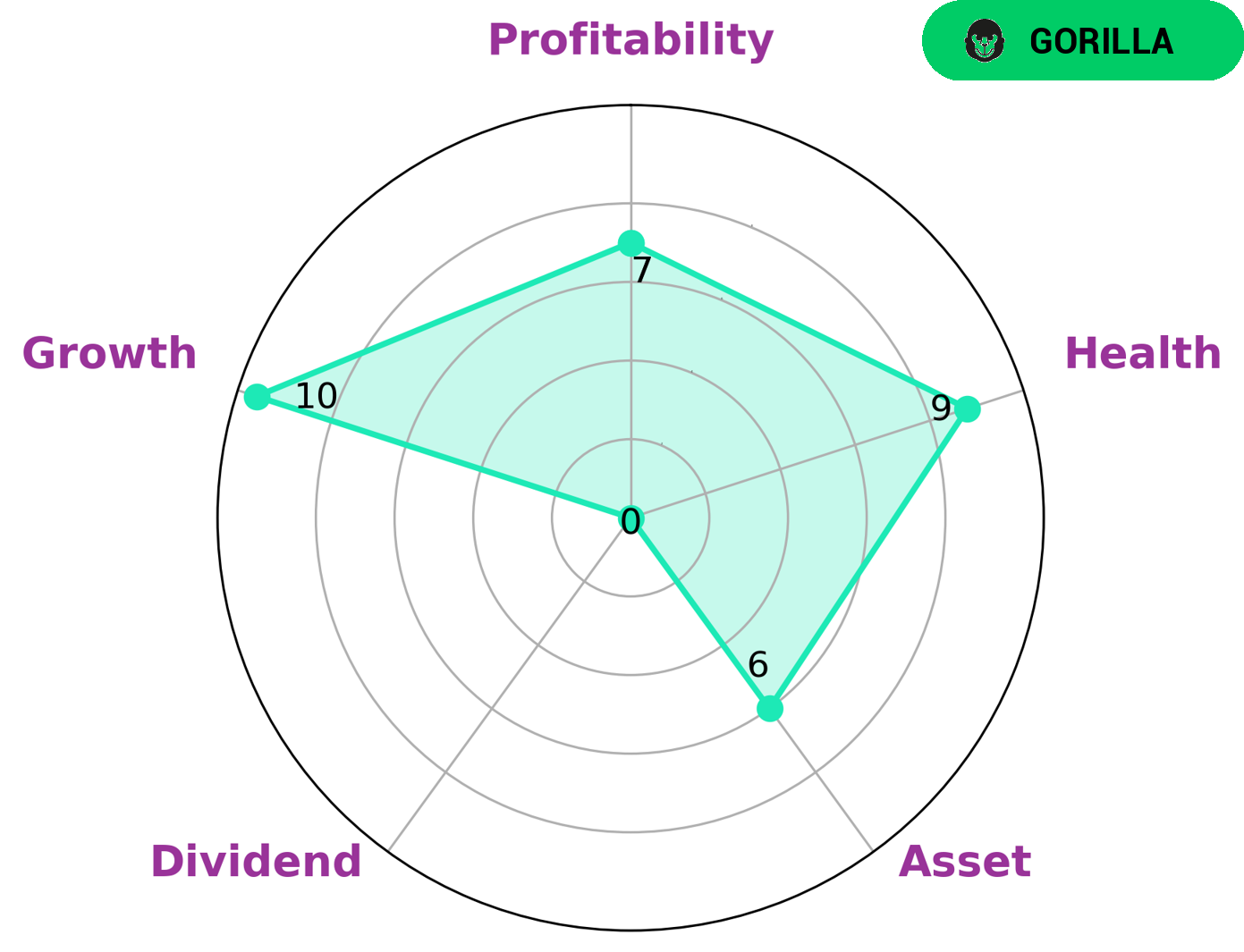

We at GoodWhale recently performed an analysis of ON SEMICONDUCTOR‘s wellbeing, and concluded that it is classified as a ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Investors interested in such companies are likely to be those looking for growth, as ON SEMICONDUCTOR is strong in growth, profitability, and medium in asset, while being somewhat weak in dividend. That said, ON SEMICONDUCTOR still has a high health score of 9/10 with regard to its cashflows and debt, meaning it is more than capable of sustaining future operations in times of crisis. This makes ON SEMICONDUCTOR a strong choice for investors looking for a reliable and profitable investment. More…

Peers

The semiconductor industry is highly competitive, with a large number of companies vying for market share. ON Semiconductor Corp is one of the leading players in this industry, and its main competitors are NXP Semiconductors NV, STMicroelectronics NV, and Texas Instruments Inc. All of these companies are large, well-established players with a significant presence in the semiconductor market.

– NXP Semiconductors NV ($NASDAQ:NXPI)

NXP Semiconductors NV is a global semiconductor company with a market cap of 37.11B as of 2022. The company’s return on equity (ROE) is 41.87%. NXP Semiconductors NV designs, manufactures and supplies semiconductor and system solutions for automotive, identification, wireless infrastructure, lighting, industrial, mobile, consumer and computing markets.

– STMicroelectronics NV ($LTS:0INB)

STMicroelectronics is a global semiconductor company that designs, develops, manufactures and markets a broad range of semiconductor products, including integrated circuits, discrete and analog devices. Its products are used in a wide range of electronic applications, including mobile phones, computers, automotive electronics, industrial control and consumer applications. The company has a market cap of $29.74 billion and a return on equity of 20.91%.

– Texas Instruments Inc ($NASDAQ:TXN)

As of 2022, Texas Instruments Inc has a market cap of 139.48B and a Return on Equity of 62.22%. Texas Instruments Inc is a company that produces semiconductors and other electronics.

Summary

ON Semiconductor provides investors with an attractive opportunity for high growth potential due to its Fab-Light Model. This model enables the company to reduce costs and increase efficiency by producing components in limited quantities, while leveraging its existing infrastructure.

Additionally, ON Semiconductor has a strong portfolio of products that are essential in a variety of industrial and consumer applications. The company’s focus on innovation and product development has led to significant progress in areas such as power management, digital power conversion and advanced sensor solutions. With strong customer relationships and a global reach, ON Semiconductor is well-positioned to capitalize on the many advantages of its Fab-Light Model and deliver excellent returns for investors.

Recent Posts