Okta Sees Impressive Increase in Revenues Despite Long Journey Towards Profitability

April 6, 2023

Trending News ☀️

Okta ($NASDAQ:OKTA) is a cloud-based identity and access management company that provides secure connections between people and technology. Despite a long journey towards profitability, Okta has seen impressive increases in their revenues. This marks the eleventh consecutive quarter of double-digit year-over-year growth for the company.

However, this strong performance has not yet translated into profitability. Despite this, executives remain optimistic about the future and are confident that the company’s current investments will lead to long-term profitability. This optimism is echoed by analysts who suggest that Okta’s position as a leader in the identity and access management market will only continue to grow in the coming years.

Price History

On Wednesday, OKTA stock experienced a downturn, opening at $81.5 and closing at $78.6, down by 4.4% from prior closing price of 82.2. Despite this minor dip, the company has seen a significant increase in revenues over the past few months as they continue their journey towards profitability. OKTA’s impressive performance is largely attributed to their expanding customer base and their increasing ability to capture the business market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Okta. More…

| Total Revenues | Net Income | Net Margin |

| 1.86k | -815 | -42.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Okta. More…

| Operations | Investing | Financing |

| 86 | -130 | 48 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Okta. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.31k | 3.84k | 33.89 |

Key Ratios Snapshot

Some of the financial key ratios for Okta are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 46.9% | – | -42.5% |

| FCF Margin | ROE | ROA |

| 3.4% | -9.1% | -5.3% |

Analysis

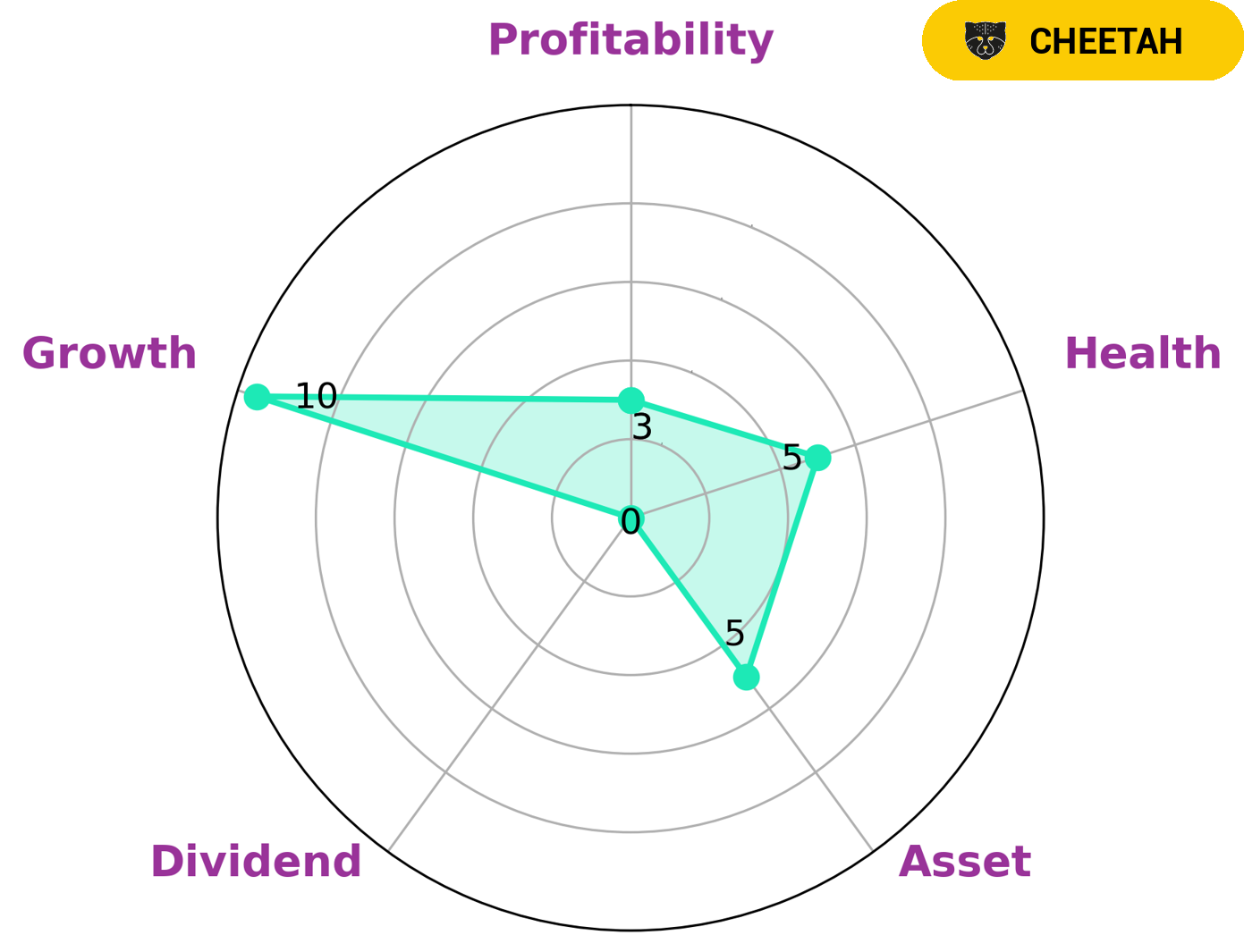

GoodWhale conducted an analysis of OKTA‘s wellbeing. This type of company may be of interest to active investors looking for short-term capital gains, as well as investors looking to diversify their portfolios into high-growth companies. When assessing OKTA’s performance, it is clear that the company is strong in growth and medium in asset, but weak in dividend and profitability. Its intermediate health score of 5/10 indicates that OKTA is likely to be able to pay off debt and fund future operations. This makes it an attractive prospect for those looking for growth opportunities. More…

Peers

Its competitors include Ping Identity Holding Corp, Zscaler Inc, and CrowdStrike Holdings Inc.

– Ping Identity Holding Corp ($NASDAQ:ZS)

Zscaler Inc is a cloud-based information security company that provides internet security, web security, next-generation firewalls, sandboxing, and zero-day protection. It has a market cap of 22.04B as of 2022 and a ROE of -37.32%. The company was founded in 2007 and is headquartered in San Jose, California.

– Zscaler Inc ($NASDAQ:CRWD)

CrowdStrike Holdings Inc is a cybersecurity technology company. The company provides software and services to protect against cyber threats. CrowdStrike Holdings Inc has a market cap of 37.62B as of 2022, a Return on Equity of -6.41%. The company’s products and services are used by organizations worldwide, including Fortune 500 companies, government agencies, and small businesses.

Summary

Okta is an identity and access management company that has seen unprecedented growth in revenue over the last few years. Their revenue growth has been bolstered by a sharp rise in demand for their services as organizations increasingly rely on cloud-based security solutions. Despite their impressive revenue growth, Okta has yet to reach profitability. As such, investors may be wary of investing in this stock. On the day of their strong revenue announcement, the stock price moved slightly downward, suggesting that investors are still reluctant to invest in Okta until it reaches profitability. It is clear that Okta’s future looks bright and that investments in the company could be a worthwhile asset.

However, investors should be aware of the company’s lack of profitability and make sure they are comfortable with the risks before investing.

Recent Posts