Lyft Ends 2023 with $1 Billion in Revenue Despite $588 Million Net Loss in Q4

February 11, 2023

Trending News 🌧️

Lyft ($NASDAQ:LYFT) is a transportation network company based in San Francisco, California, which provides ride-hailing services worldwide. The company has grown rapidly over the last few years and is now the second-largest ride-hailing service in the United States. Despite this, Lyft still remained on track to achieve its goal of generating $1 billion in revenue by the end of 2023. While it is still uncertain whether the company will be able to reach its milestone, it is encouraging to see that revenue is continuing to grow.

This suggests that Lyft’s strategy of expanding into new markets and offering services such as scooter rental is paying off. Overall, while Lyft continues to report hefty losses in the short term, investors can be confident that their long-term strategy will help them reach their goal of generating $1 billion in revenue by the end of 2023. With the continued growth in revenue, Lyft is poised to become an even more powerful force in the ride-hailing industry, and investors should remain optimistic about the company’s prospects.

Market Price

At the time of writing, the media’s exposure to Lyft has been mostly negative. On Thursday, the stock opened at $17.1 and closed at $16.2, a decrease of 3.2% from the last closing price of 16.8. This comes as the company recently reported their fourth quarter results, which showed a staggering $588 million net loss. Despite this, the company was able to end fiscal year 2023 with a revenue of $1 billion. Lyft’s financial report highlighted a number of key points and milestones.

In addition, the company noted that they are continuing to make progress in increasing efficiency and reducing expenses. Overall, despite the heavy losses incurred in the fourth quarter, Lyft has managed to end the 2023 fiscal year with $1 billion in revenue and strong growth in ridership and stock performance. With continued investment and focus on increasing efficiency, the future looks promising for this ride-hailing giant. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Lyft. More…

| Total Revenues | Net Income | Net Margin |

| 4.1k | -1.58k | -38.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Lyft. More…

| Operations | Investing | Financing |

| -237.28 | 186.04 | -87.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Lyft. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.56k | 4.17k | 1.05 |

Key Ratios Snapshot

Some of the financial key ratios for Lyft are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.2% | – | -38.1% |

| FCF Margin | ROE | ROA |

| -8.6% | -168.8% | -21.4% |

Analysis

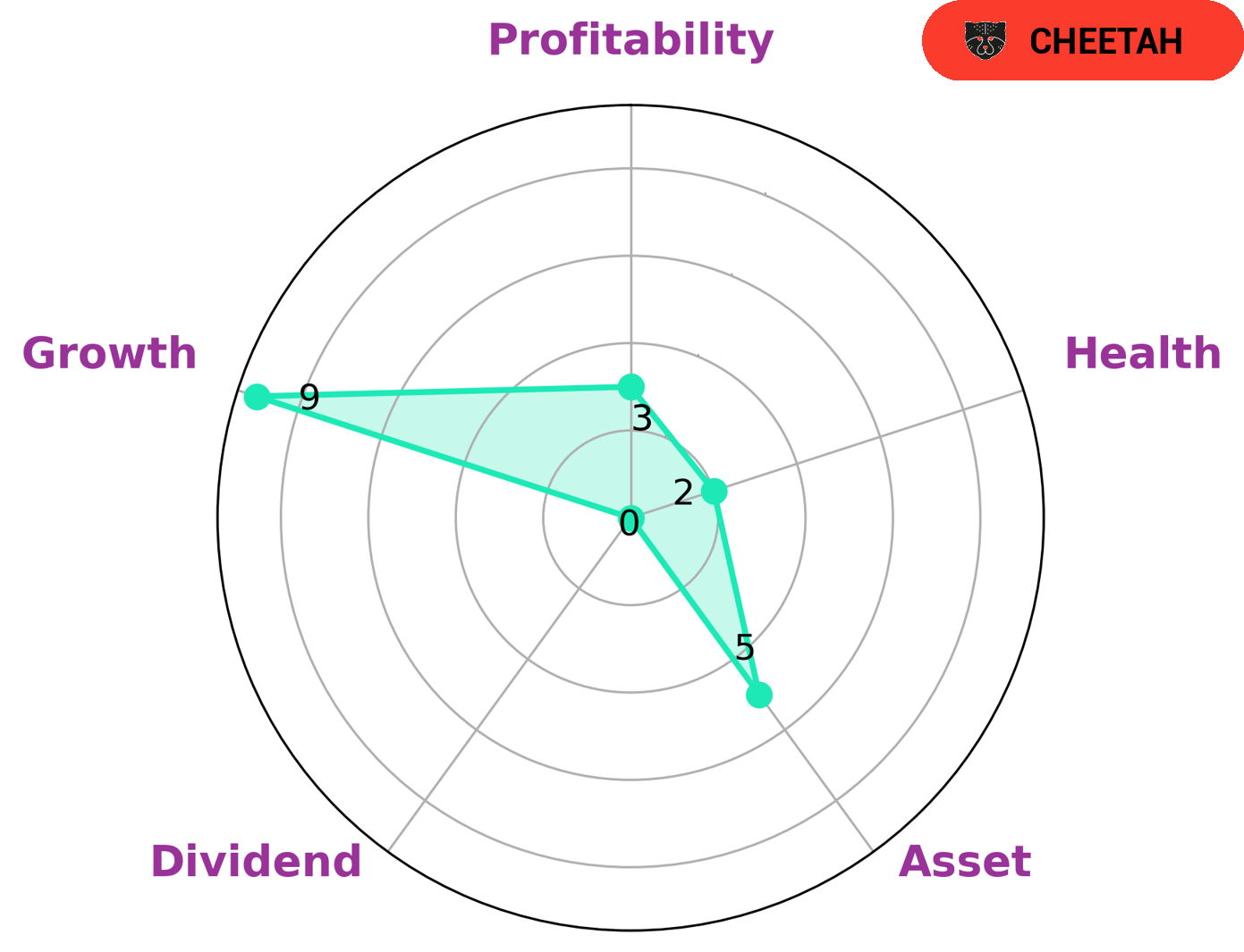

GoodWhale conducted an analysis of LYFT‘s wellbeing, using their Star Chart to give a picture of the company’s performance. It was found that LYFT is strong in growth, medium in assets and weak in dividend and profitability. As a result, LYFT is classified as a ‘cheetah’ – a type of company with high revenue or earnings growth but considered less stable due to lower profitability. Given this, it is likely that investors who are looking for aggressive growth potential and are willing to take on higher risks will be interested in LYFT’s stock. Those who are more risk-averse may not be attracted to LYFT as it has a low health score of 2/10 regarding its cashflows and debt, making it less likely to pay off debt and fund future operations. Such investors may prefer other companies with higher ratings in these areas. Overall, the analysis of LYFT’s wellbeing by GoodWhale highlights its strengths and weaknesses, allowing investors to get an idea of what to expect from the company. Although it is classified as a ‘cheetah’, investors who are willing to take on higher risks may find it attractive due to its strong growth potential. However, the low health score may be a deterrent for those who prefer more stability. More…

Peers

The competition among Lyft Inc, Forge Global Holdings Inc, SK Hynix Inc, and CE Info Systems Ltd is fierce. All four companies are vying for a share of the market, and each has its own strengths and weaknesses. Lyft Inc is a relative newcomer to the market, but it has quickly established itself as a major player. Forge Global Holdings Inc is a large company with a long history in the industry. SK Hynix Inc is a smaller company, but it has a strong reputation for quality. CE Info Systems Ltd is a small company, but it has a very innovative product.

– Forge Global Holdings Inc ($NYSE:FRGE)

Founded in 2001, Forge Global Holdings Inc is a provider of investment banking and capital markets services. The company has a market cap of 301.72M as of 2022 and a Return on Equity of -4.23%. The company offers a range of services, including mergers and acquisitions, public and private placement of debt and equity securities, and advising on restructurings and other corporate finance matters.

– SK Hynix Inc ($KOSE:000660)

SK Hynix is a South Korean semiconductor company that produces dynamic random-access memory (DRAM) chips and flash memory chips. SK Hynix is the world’s second-largest memory chipmaker after Samsung Electronics. The company has a market capitalization of US$65.46 billion as of March 2021.

SK Hynix was founded in 1983 as a joint venture between Hyundai Electronics and Samsung Electronics. The company’s main manufacturing facility is located in Icheon, South Korea. SK Hynix also has fabrication plants in China, the United States, and Taiwan.

The company’s products are used in a variety of electronic devices, including personal computers, servers, mobile devices, and digital cameras. SK Hynix is a major supplier of DRAM chips to companies such as Apple, Samsung, and Dell.

SK Hynix reported a 15.68% return on equity for the year ended December 31, 2020.

– CE Info Systems Ltd ($BSE:543425)

HCL Technologies Ltd, a leading global technology company, has a market cap of $70.19 billion as of March 2022. The company’s return on equity (ROE) is 18.0%. HCL Technologies is a provider of IT services, including digital, technology, consulting, and operations services. The company has a strong presence in India, the United States, Europe, and Asia Pacific.

Summary

Investing in Lyft has become increasingly risky with the company recording a net loss of $588 million in the fourth quarter of 2023 and its revenue forecast of $1 billion that year. The stock price responded in kind, with a drop on the same day the earnings were released. Media coverage of the company has been mostly negative, making it a risky bet for investors. However, should the company be able to reach its revenue forecast, it could return some value to its investors.

Recent Posts