LGI Homes Reports Strong Revenue Growth Despite Falling Short of EPS Estimates

May 4, 2023

Trending News ☀️

LGI ($NASDAQ:LGIH) Homes is a US-based residential home builder that specializes in entry-level and first-time move-up buyers. This exceeded the estimate of $467.54 million. However, the company reported GAAP EPS of $1.14, which was lower than the expected $1.25. Despite the lower-than-expected EPS, investors were encouraged by the strong revenue growth, which was likely due to a robust housing market that experienced an increase in demand during the pandemic. LGI Homes is well positioned to capitalize on this trend as they are one of the leading companies in the housing industry.

Share Price

On Tuesday, the company’s stock opened at 116.6, but finished the day down 2.9% at 115.2, a closing price lower than its previous day’s closing price of 118.6. Despite the strong top-line growth, the company’s bottom-line results were impacted by higher operating expenses and a weaker-than-anticipated housing market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Lgi Homes. More…

| Total Revenues | Net Income | Net Margin |

| 2.25k | 274.84 | 12.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Lgi Homes. More…

| Operations | Investing | Financing |

| -155.06 | -9.45 | 154.16 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Lgi Homes. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.1k | 1.43k | 71.19 |

Key Ratios Snapshot

Some of the financial key ratios for Lgi Homes are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.8% | 7.2% | 15.6% |

| FCF Margin | ROE | ROA |

| -6.9% | 13.2% | 7.1% |

Analysis

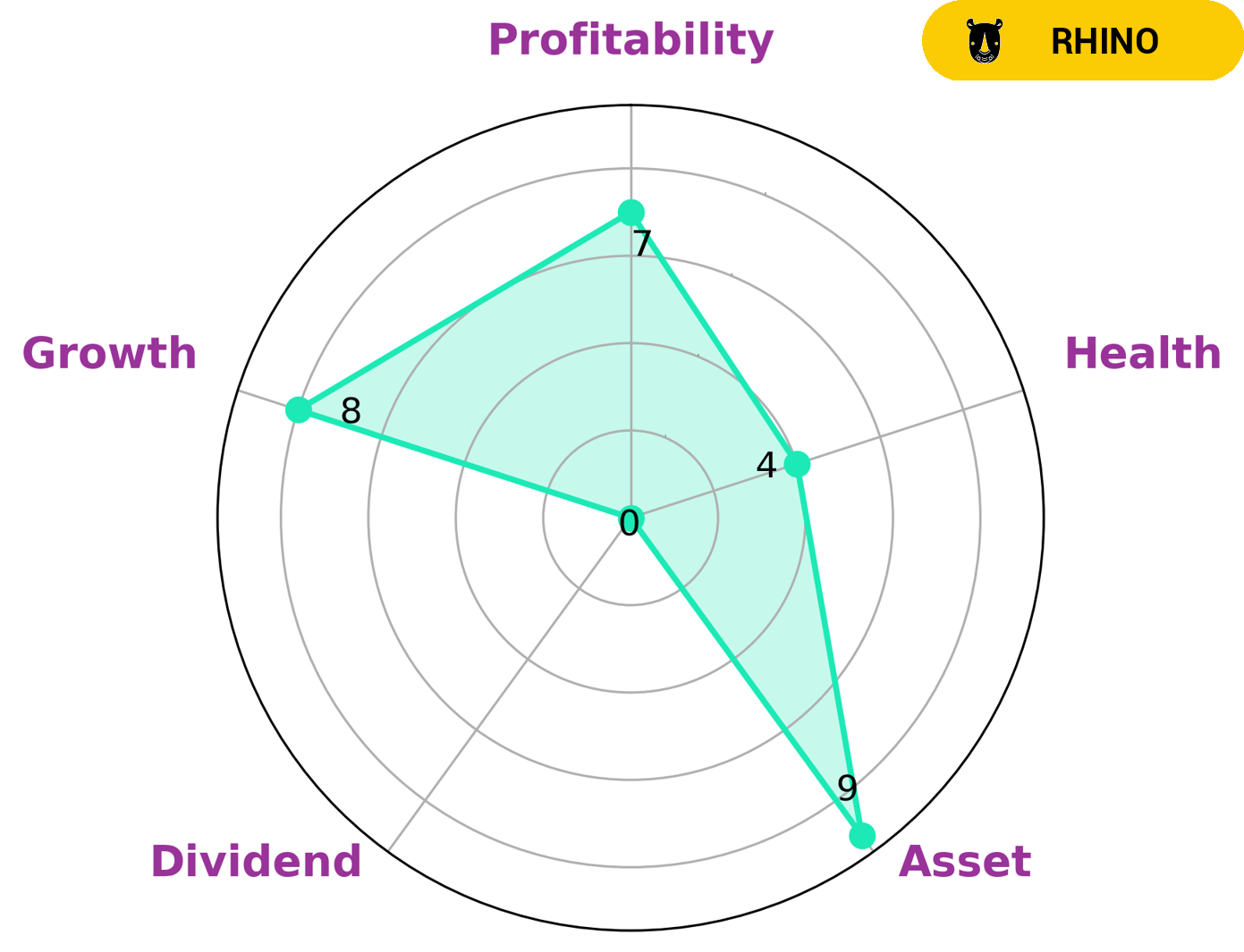

GoodWhale has conducted an analysis of LGI Homes‘ financials, and based on our star chart, we have classified LGI Homes as a ‘rhino’. This is a type of company that has achieved moderate revenue or earnings growth. As such, LGI Homes may be of interest to investors who are looking for a moderate risk with the potential for moderate returns. LGI Homes has shown strong performance in terms of asset, growth and profitability, but is weak in terms of dividend payments. It also has an intermediate health score of 4/10, which suggests that it is likely to sustain future operations even in times of crisis. This combination of moderate growth potential and intermediate financial health may make LGI Homes attractive to investors looking for a relatively low-risk, moderate return investment. More…

Peers

Its main competitors are Tri Pointe Homes Inc, Taylor Wimpey PLC, and Skyline Champion Corp. All three companies are large homebuilders that operate in the United States.

– Tri Pointe Homes Inc ($NYSE:TPH)

Tri Pointe Homes Inc is a homebuilding company that focuses on the construction and sale of single-family homes in the United States. As of 2022, the company had a market capitalization of 1.64 billion dollars and a return on equity of 16.87%. The company builds homes in a variety of locations across the country, including California, Colorado, Arizona, and Washington. In addition to new home construction, the company also provides homebuyers with a variety of services, such as home financing, home insurance, and home warranty services.

– Taylor Wimpey PLC ($LSE:TW.)

Taylor Wimpey PLC is a leading homebuilder in the United Kingdom with a strong focus on creating sustainable communities. The company has a market cap of 3.3 billion as of 2022 and a return on equity of 10.94%. Taylor Wimpey PLC is committed to creating value for all of its stakeholders and is dedicated to building high-quality homes and communities that people can be proud of.

– Skyline Champion Corp ($NYSE:SKY)

Skyline Champion Corp is a leading manufacturer and seller of modular and manufactured homes in North America. With a market cap of 2.69B and a ROE of 34.19%, the company is well-positioned to continue its growth trajectory in the coming years. Skyline’s homes are known for their quality construction and attention to detail, and the company has a strong reputation in the industry. In addition to its manufacturing and sales operations, Skyline also provides financing and insurance services to its customers.

Summary

LGI Homes is a homebuilding company that recently released its financial results for the quarter. The company reported adjusted earnings per share of $1.14, missing the analyst consensus estimate of $1.25. Investors will likely be watching the company’s performance over the coming quarters to determine whether the revenue beat was an anomaly or a sign of growth potential.

Analysts will also be watching to see if the company is able to return to profitability and reach its targets for the year. Long term investors will likely be paying close attention to the company’s balance sheet, management strategy, and competitive landscape, while short term traders will be looking for opportunities to capitalize on any potential swings in the stock price.

Recent Posts