L.B. Foster Reports Negative EPS Despite Record Revenues

May 11, 2023

Trending News 🌧️

L.B. ($NASDAQ:FSTR) Foster, a leading rail technology provider, recently released its quarterly financials, revealing a mixed performance. The company reported record revenues of $115.49M which exceeded expectations by $2.58M; however, the company reported a GAAP earnings per share of -$0.20, which was lower than the expected $-0.19. L.B. Foster is a publicly traded company listed on the Nasdaq Global Select Market under the ticker symbol FSTR. Its products and services help to enhance the rail infrastructure and transport industry, offering customized solutions for its clients. The company is a global leader in the design, manufacture and distribution of innovative railway products, services and systems which provide durable, reliable and cost-effective rail infrastructure solutions. Despite strong revenues, L.B. Foster’s disappointing EPS could be attributed to higher operational costs associated with its new product launches and increased investments in research and development.

In addition, the company also faces pricing pressure in its core markets as competition intensifies. Going forward, L.B. Foster will need to focus on driving operational efficiency and optimizing its cost structures in order to remain competitive and profitable in the long term.

Earnings

In its earning report of FY2022 Q4 ending December 31 2022, L.B. FOSTER reported record-breaking total revenues of 137.17M USD, a 21.4% increase from the 115.58M USD reported in the same period last year. Despite this seemingly impressive growth, the company reported a net income loss of 43.93M USD. The earning report showed that in the last 3 years, L.B. FOSTER’s total revenues have steadily increased from 115.58M USD to 137.17M USD.

This is a testament to the company’s ability to generate new business and grow its operations. Unfortunately, this growth was not enough to offset the operating costs and ultimately, the company reported a negative earnings per share (EPS) result for the quarter.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for L.b. Foster. More…

| Total Revenues | Net Income | Net Margin |

| 497.5 | -45.56 | -8.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for L.b. Foster. More…

| Operations | Investing | Financing |

| -10.58 | -56.42 | 60.24 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for L.b. Foster. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 365.31 | 227.71 | 12.73 |

Key Ratios Snapshot

Some of the financial key ratios for L.b. Foster are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -8.8% | -68.9% | -1.1% |

| FCF Margin | ROE | ROA |

| -3.7% | -2.3% | -1.0% |

Share Price

The stock opened at $11.1 and closed at $10.7, down by 2.6% from the previous closing price of $11.0. Despite the negative EPS, the company’s management is optimistic about the future. They also noted that their backlog of orders for infrastructure products was strong and that they are seeing strong momentum in their business going forward.

Overall, L.B. Foster had an impressive first quarter despite the negative EPS. Investors are hopeful that the strong backlog and increasing pre-tax margin will help the company grow in the coming quarters and return to profitability soon. Live Quote…

Analysis

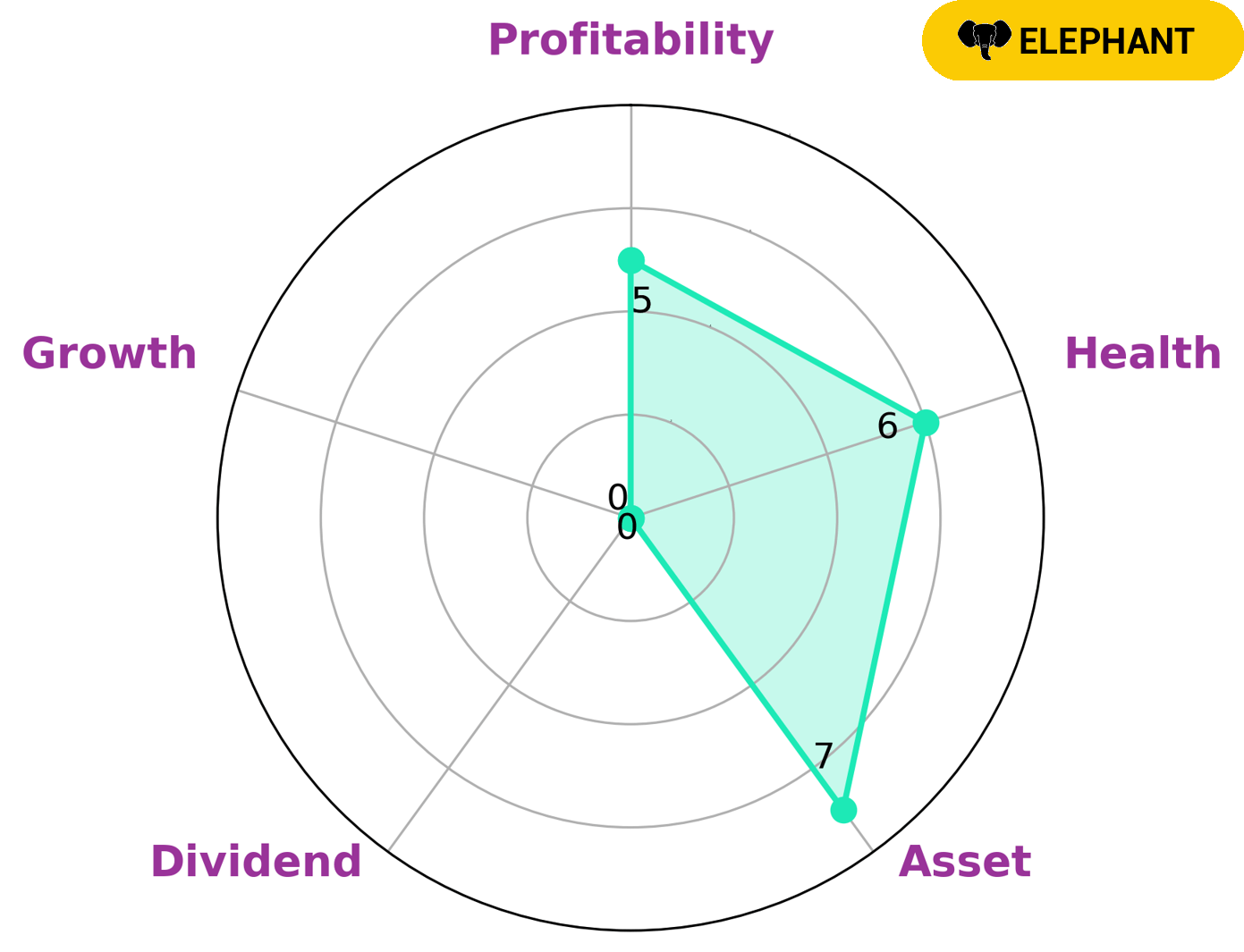

As part of our analysis of L.B. FOSTER‘s overall wellbeing, we took a look at their Star Chart. This chart showed us that L.B. FOSTER is classified as an ‘elephant’ type of company, meaning that it is rich in assets after deducting off liabilities. This suggests that investors who are looking to benefit from the company’s asset base will be interested in this company. In addition to its assets, we looked at L.B. FOSTER’s profitability, growth, and dividend strength. We found that the company is strong in assets, medium in profitability and weak in dividend and growth. This means that investors seeking capital gains may be attracted to this company. Finally, we took a look at L.B. FOSTER’s overall health score of 6/10, which considers their cashflows and debt. This suggests that the company is likely to be able to pay off their debt and fund future operations. Therefore, investors looking for a company that can provide both current and future returns may be interested in L.B. FOSTER. More…

Peers

The Company’s primary competitors are Beijing Tieke Shougang Railway-Tech Co Ltd, Komatsu Wall Industry Co Ltd, and Cos Targoviste SA.

– Beijing Tieke Shougang Railway-Tech Co Ltd ($SHSE:688569)

Beijing Tieke Shougang Railway-Tech Co Ltd is a railway transportation company that provides services including railway passenger and freight transportation, railway infrastructure construction, and railway equipment manufacturing. The company has a market cap of 4.04B as of 2022 and a return on equity of 8.73%. The company’s railway passenger and freight transportation services include the transportation of passengers and freight by rail. The company’s railway infrastructure construction services include the construction of railway tracks, tunnels, bridges, and other infrastructure. The company’s railway equipment manufacturing services include the manufacture of locomotives, rolling stock, and other railway equipment.

– Komatsu Wall Industry Co Ltd ($TSE:7949)

Komatsu Wall Industry Co Ltd is a Japanese company that manufactures and sells construction equipment, air conditioners, and other products. The company has a market cap of 17.04B as of 2022 and a Return on Equity of 3.05%. Komatsu Wall Industry Co Ltd is a publicly traded company listed on the Tokyo Stock Exchange.

– Cos Targoviste SA ($LTS:0FJ5)

Targoviste SA is a Romanian company that produces and sells construction materials. The company has a market cap of 254.75M as of 2022 and a Return on Equity of -13.87%. The company’s products include cement, concrete, bricks, and tiles. Targoviste SA is a publicly traded company listed on the Bucharest Stock Exchange.

Summary

L.B. Foster, an infrastructure and energy-oriented manufacturer and distributor, reported quarterly earnings and revenue that fell short of Wall Street analysts’ expectations. Revenue for the quarter was $115.49M, coming in above the analysts’ estimate by $2.58M. While the earnings and revenue numbers were not ideal, investors may find value in L.B. Foster as the company has shown strength in its core business and has seen improvement in its backlog numbers over the past few quarters. Overall, this news may lead to some short-term volatility in the stock price, however, investors should focus on the company’s long-term prospects.

Recent Posts