Heinsite Capital Bets on Remitly Global to Generate Strong Growth

March 7, 2023

Trending News ☀️

Heinsite Capital, one of the leading venture capital firms backing innovation, has placed its bets on Remitly Global ($NASDAQ:RELY) as the company to generate strong growth. The investments funds from Heinsite will go towards further development of the technology used by Remitly’s mobile-first payment platform. Remitly has become the go-to choice for those sending money abroad, with their remittance services being used by millions of people globally. The company has experienced consistent year-over-year growth and expects to be able to reach new markets and users with the new investment. The funding from Heinsite Capital is also an endorsement of the reliability and scalability of Remitly’s technology, which provides individuals and businesses with a secure and safe way to send money.

It allows the company to further invest in its international expansion initiatives, targeting countries in the Middle East, South East Asia and Africa. The partnership with Heinsite Capital is a major step forward that will allow Remitly to further increase its global footprint and reach more customers. With the new funds, Remitly expects to be able to increase its user base and provide even more cost-effective and reliable services for those sending money abroad.

Stock Price

Heinsite Capital recently bet on Remitly Global, and the news coverage so far has been nothing but positive. On Tuesday, the REMITLY GLOBAL stock opened at $14.1 and closed at $14.6 – a jump of 4.6% from its previous closing price of 14.0. This has been viewed positively by the market, as investors and analysts see significant potential for growth and opportunities with Remitly Global. With this increased investment from Heinsite Capital, the company is expected to take off in a big way, with potentially huge returns for all stakeholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Remitly Global. More…

| Total Revenues | Net Income | Net Margin |

| 653.56 | -114.02 | -17.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Remitly Global. More…

| Operations | Investing | Financing |

| -105.14 | -7.31 | 11.07 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Remitly Global. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 695.95 | 215.87 | 2.74 |

Key Ratios Snapshot

Some of the financial key ratios for Remitly Global are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 72.8% | – | -17.1% |

| FCF Margin | ROE | ROA |

| -17.2% | -14.7% | -10.0% |

Analysis

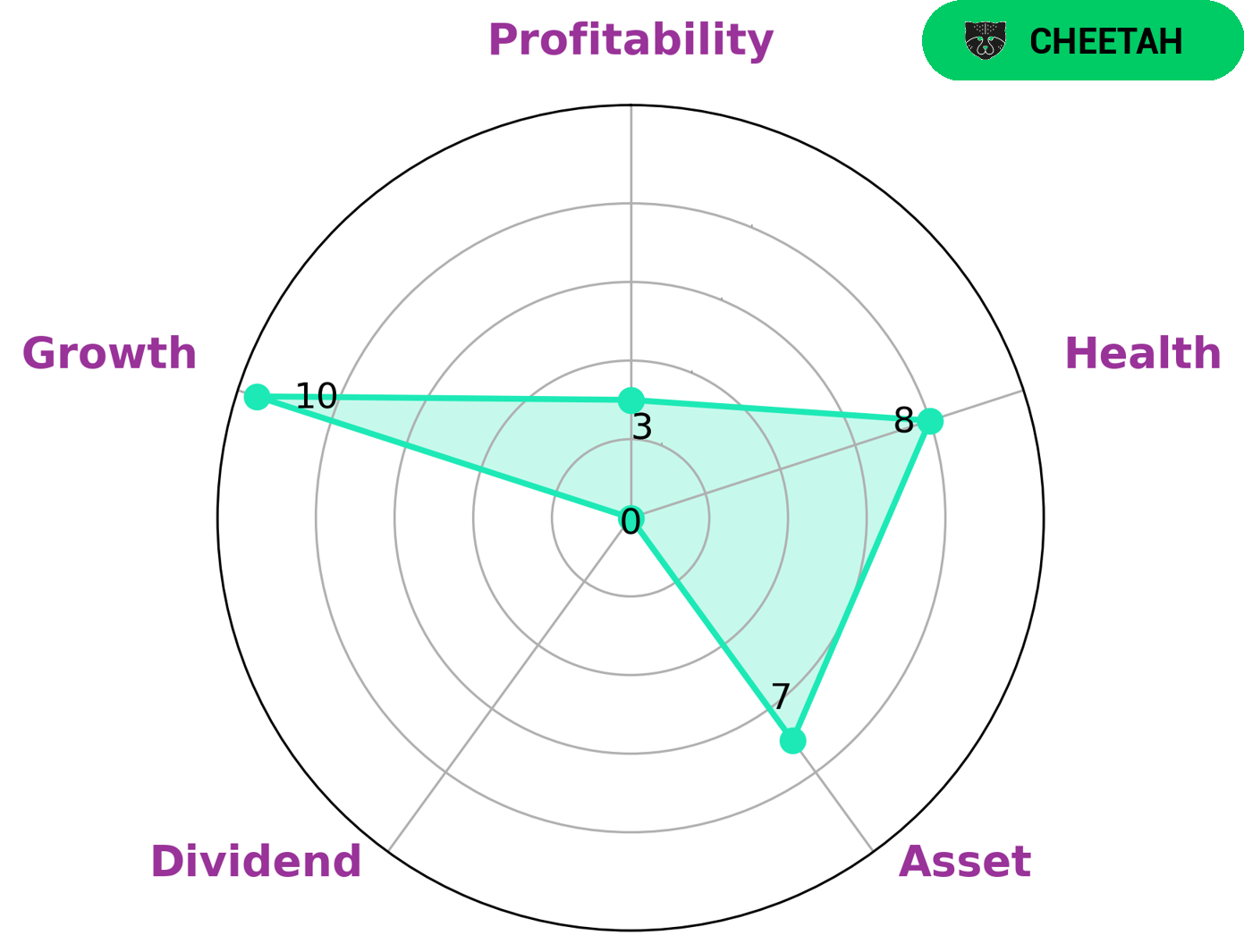

At GoodWhale, we recently conducted an analysis of REMITLY GLOBAL’s wellbeing. According to our Star Chart, REMITLY GLOBAL has a health score of 8/10 indicating that it is well-positioned to sustain operations in times of market downturns. We found that the company is strong in asset and growth, but relatively weak in dividend and profitability. We classified REMITLY GLOBAL as a ‘cheetah’, a type of company that achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors interested in high-growth companies with less risk might find this type of company to be an attractive option. They may be drawn by REMITLY GLOBAL’s potential for earnings and revenue growth, while being able to exercise caution due to the lower profits. Risk-averse investors may be more hesitant to invest in such companies but may still find it worth considering if other metrics, such as asset and growth strength, provide indications that it is a sound investment. More…

Peers

The company was founded in 2011 and is headquartered in Seattle, Washington. Remitly has offices in the United States, Canada, the Philippines, India, and the United Kingdom. The company offers money transfer services to more than 50 countries. Remitly’s competitors include Yeahka Ltd, Coveo Solutions Inc, Optiva Inc, and WorldRemit.

– Yeahka Ltd ($SEHK:09923)

The company’s market cap is 9.29B as of 2022. The company’s ROE is 3.37%. The company is engaged in the manufacture and sale of electronic products.

– Coveo Solutions Inc ($TSX:CVO)

Coveo Solutions Inc has a market cap of 561.87M as of 2022, a Return on Equity of 59.41%. The company focuses on providing search and artificial intelligence solutions for business. Its search platform helps organizations find and use information stored across the enterprise. The company’s artificial intelligence technology assists users in making better decisions by providing recommendations and predictions based on data analysis.

– Optiva Inc ($TSX:OPT)

Optiva Inc is a Canadian company that provides software solutions for the telecommunications industry. Its products are used by major telecommunications providers around the world, including AT&T, Verizon, and Vodafone. The company has a market capitalization of 108.11 million as of 2022 and a return on equity of -52.55%.

Summary

Heinsite Capital has recently placed a large bet on Remitly Global, a financial services company. So far, news coverage of the investment is largely positive, with the stock price increasing significantly on the same day of the announcement. Analysts believe that Remitly Global is an attractive investment opportunity due to its strong potential for growth. The company’s services are designed to provide an easy and affordable way to send money cross-border and within the United States.

Furthermore, its user-friendly mobile app and various payment options make it a convenient choice for those who need to send money abroad. The company has also partnered with several major banks and financial intuitions, boosting its reputation and customer base. In conclusion, Remitly Global appears to be a solid investment for those looking for growth potential.

Recent Posts