Guggenheim Boosts Fluence Energy Rating to Buy on Impressive Growth Outlook

April 6, 2023

Trending News ☀️

Guggenheim has recently given Fluence Energy ($NASDAQ:FLNC) a “Buy” rating, citing the company’s impressive growth potential. Fluence Energy is a publicly traded company that provides innovative solutions for the global energy sector. The company specializes in the design, deployment, and optimization of energy storage, microgrids and other distributed energy resources. Their products are aimed at making energy more affordable, efficient, and reliable in both urban and rural areas. The company has seen significant growth in recent years, driven by their increasing presence in the energy storage and microgrid markets.

Additionally, Fluence Energy has invested heavily in research and development to remain competitive in the ever-evolving energy industry. As a result, Guggenheim believes that Fluence Energy is well positioned to continue its success in the future.

Stock Price

This news came as FLUENCE ENERGY opened slightly lower at $20.8, but closed down by 3.4% from the previous closing price of 19.9, ending at $19.2. This suggests that investors remain cautious about the company’s growth prospects, despite Guggenheim’s bullish rating. Nonetheless, analysts remain optimistic that FLUENCE ENERGY has a bright future ahead, as evidenced by its strong outlook and the upgrade to Buy. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Fluence Energy. More…

| Total Revenues | Net Income | Net Margin |

| 1.33k | -100.32 | -7.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Fluence Energy. More…

| Operations | Investing | Financing |

| -179.73 | -153.88 | 6.82 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Fluence Energy. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.15k | 1.55k | 3.63 |

Key Ratios Snapshot

Some of the financial key ratios for Fluence Energy are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 135.2% | – | -15.9% |

| FCF Margin | ROE | ROA |

| -14.2% | -31.0% | -6.2% |

Analysis

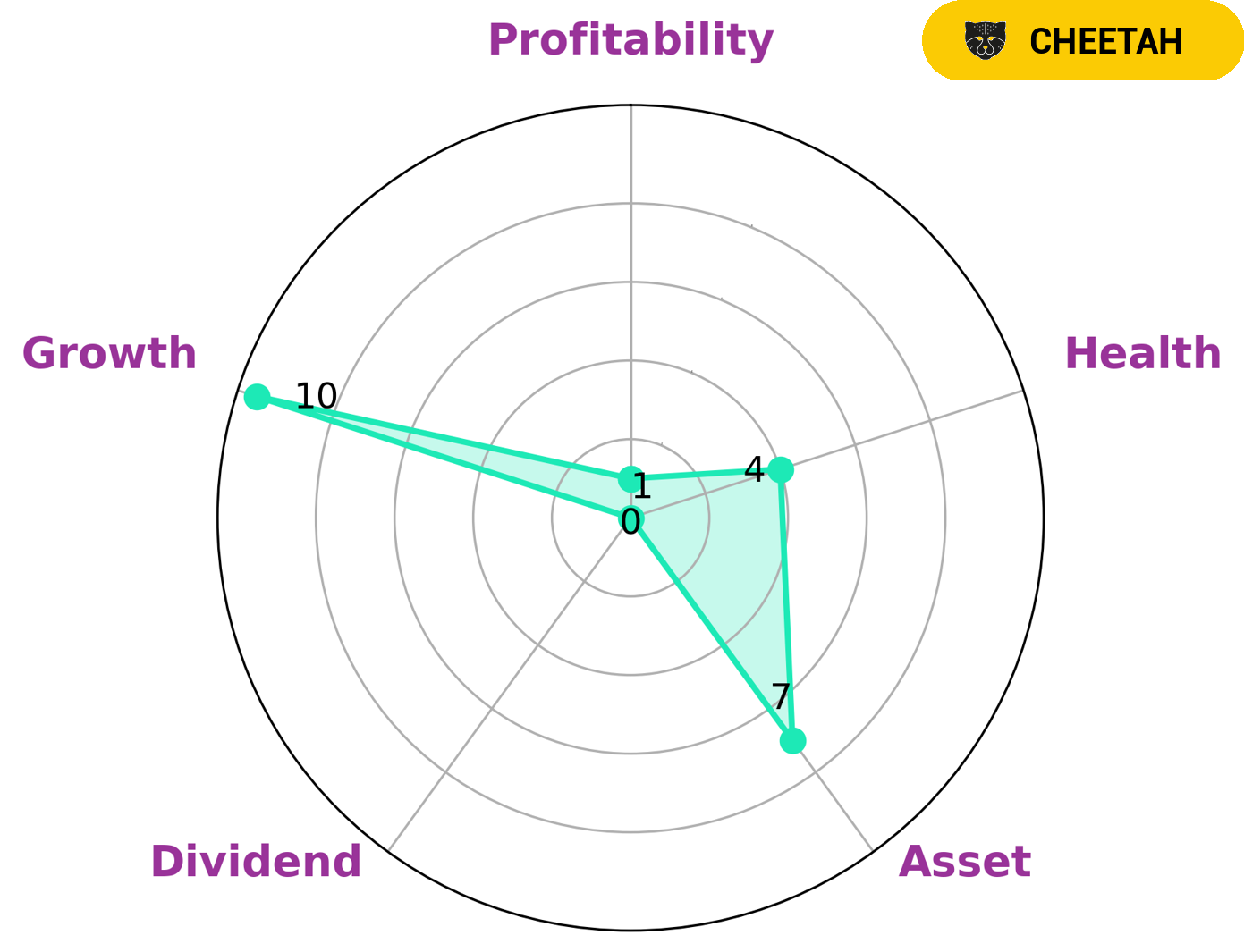

At GoodWhale, we analyzed FLUENCE ENERGY‘s financials and found that according to Star Chart FLUENCE ENERGY is strong in asset and growth but weak in dividend and profitability. Based on these findings, we classify FLUENCE ENERGY as a ‘cheetah’, a type of company that has high revenue or earnings growth but is considered less stable due to lower profitability. Our analysis suggests that investors who are risk-tolerant and looking for above-market returns may be interested in investing in FLUENCE ENERGY. We also found that FLUENCE ENERGY has an intermediate health score of 4/10 considering its cashflows and debt, making it likely to sustain future operations in times of crisis. More…

Peers

Its competitors are Energy Vault Holdings Inc, China Southern Power Grid Energy Efficiency & Clean Energy Co Ltd, and Nevo Energy Inc.

– Energy Vault Holdings Inc ($NYSE:NRGV)

As of 2022, Energy Vault Holdings Inc has a market cap of 496.1M and a Return on Equity of 43.81%. The company is a provider of energy storage solutions. Energy Vault’s technology enables the storage of renewable energy in the form of gravitational potential energy. The company’s storage solutions are designed to provide grid-scale energy storage that is cost-effective, efficient, and scalable.

– China Southern Power Grid Energy Efficiency & Clean Energy Co Ltd ($SZSE:003035)

As of 2022, Southern Power Grid Energy Efficiency & Clean Energy Co Ltd has a market capitalization of 22.27 billion and a return on equity of 9.23%. The company is engaged in the transmission and distribution of electricity in China.

– Nevo Energy Inc ($OTCPK:NEVE)

Nevo Energy Inc is a Canadian oil and gas company with a market capitalization of $746.77 million as of March 2021. The company has a return on equity of 19.78%. Nevo Energy Inc is engaged in the exploration, development, production, and marketing of crude oil and natural gas in Canada.

Summary

Guggenheim recently upgraded their rating of Fluence Energy from Neutral to Buy, citing the company’s strong growth potential. On the same day, the stock price dropped, however this could be attributed to a broader correction in the market. To make an informed decision, investors should evaluate Fluence Energy’s current financials, competitive position and potential for future growth. Specifically, investors should consider the company’s revenue growth, profitability margins, debt levels, cash flows and competitive advantages.

Furthermore, investors should pay attention to the industry outlook and Fluence Energy’s positioning to capitalize on potential growth opportunities. With careful analysis, investors can decide if Fluence Energy is a good fit for their portfolio.

Recent Posts