Enphase Energy to Leverage Global Expansion for Unprecedented Growth

April 14, 2023

Trending News ☀️

Enphase Energy ($NASDAQ:ENPH) is a leading global provider of cutting-edge solar energy solutions. As the world’s largest producer of microinverters, Enphase has revolutionized the way solar power is generated and distributed. With a focus on innovation and customer service, Enphase is poised to become one of the most important players in the global renewable energy industry. To reach this goal, international expansion is key for Enphase Energy. In recent years, Enphase has made significant investments in its international operations. The company has recently opened a new manufacturing facility in India to serve the Asian market, and it has also opened offices in Europe, South America, and Australia. With these new facilities, Enphase is positioned to capitalize on the rapidly growing demand for renewable energy solutions in emerging markets.

Additionally, Enphase has developed strategic partnerships with local energy providers and industry experts in these regions to ensure a smooth transition into their respective markets. As the demand for renewable energy continues to rise, Enphase will be uniquely positioned to supply a growing market with reliable, efficient solutions. With an expansive portfolio of products and services, Enphase is well-positioned to continue its rise to the top of the global energy landscape.

Price History

On Thursday, ENPHASE ENERGY stock opened at $200.0 and closed at $209.7, rising by 7.0% from its prior closing price of 196.0. This is evidence that the company is leveraging global expansion initiatives to facilitate unprecedented growth. ENPHASE ENERGY has been working hard to expand their operations into new regions, making their products and services available to a wider market. This new momentum in the company’s stock price demonstrates a clear sign that their efforts are paying off, as they continue to benefit from increased demand in their international markets. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Enphase Energy. More…

| Total Revenues | Net Income | Net Margin |

| 2.33k | 397.36 | 17.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Enphase Energy. More…

| Operations | Investing | Financing |

| 744.82 | -371.91 | -17.13 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Enphase Energy. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.08k | 2.26k | 6.05 |

Key Ratios Snapshot

Some of the financial key ratios for Enphase Energy are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 55.1% | 62.3% | 19.8% |

| FCF Margin | ROE | ROA |

| 30.0% | 40.2% | 9.4% |

Analysis

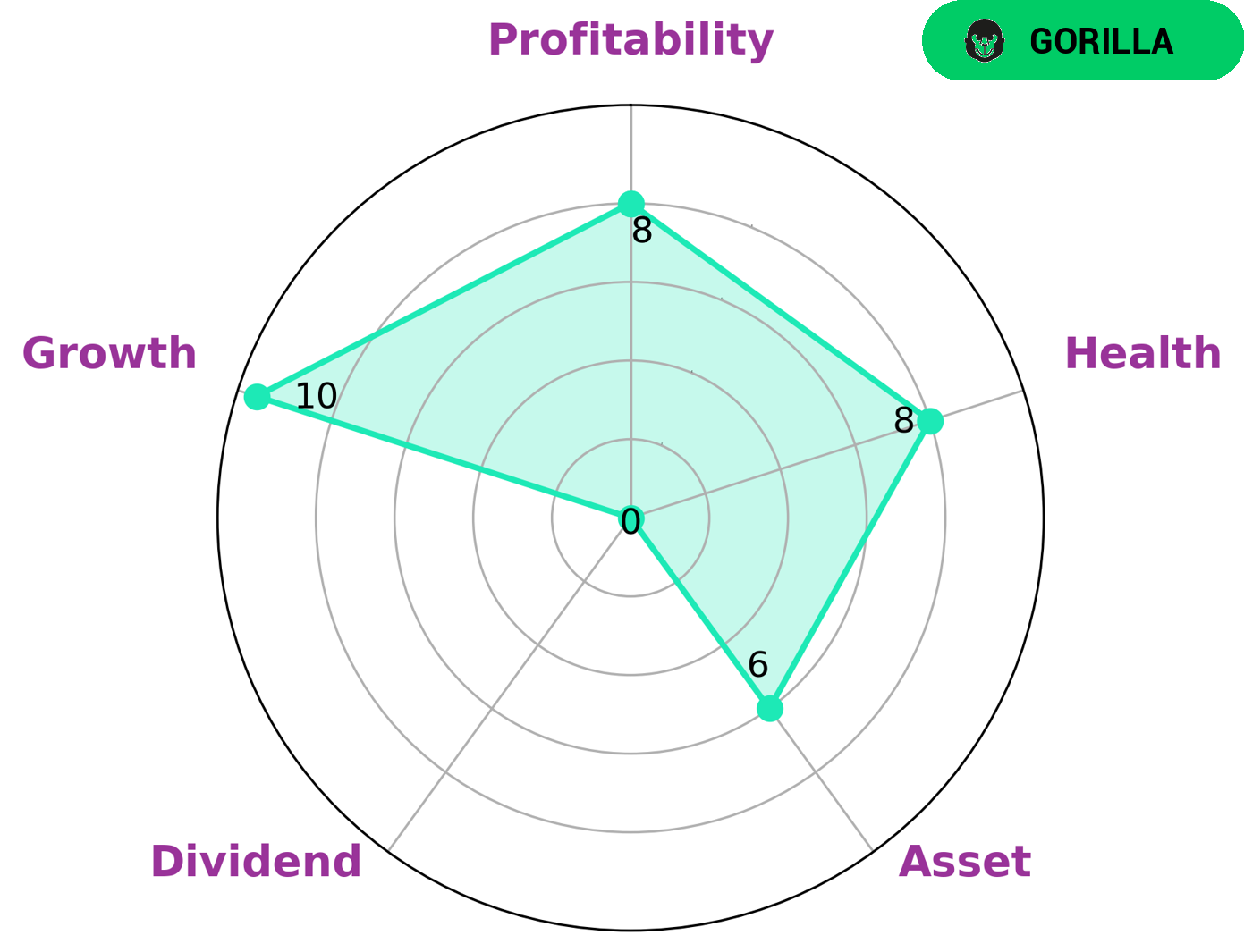

GoodWhale has conducted an analysis of ENPHASE ENERGY‘s wellbeing in order to understand what type of investors may be interested. Our analysis revealed that ENPHASE ENERGY is classified as a ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Furthermore, ENPHASE ENERGY is highly healthy with a score of 8/10 when considering their cashflows and debt structure, meaning they are capable of paying off debt and funding future operations. When examining the company’s performance criteria, it is clear that ENPHASE ENERGY is strong in growth and profitability, but moderately weak when it comes to asset deployment. Additionally, the company falls short in dividend payments. More…

Peers

Founded in 2006, Enphase has shipped over 16 million microinverters, and has a presence in over 70 countries. Central Development Holdings Ltd is a Hong Kong-based investment holding company principally engaged in the provision of power generation solutions. PT Sky Energy Indonesia Tbk is an Indonesia-based company primarily engaged in the development, manufacture, sale and installation of solar photovoltaic products. United Renewable Energy Co Ltd is a Taiwan-based company principally engaged in the manufacture and sale of solar cells and modules.

– Central Development Holdings Ltd ($SEHK:00475)

As of 2022, Central Development Holdings Ltd has a market cap of 244.17M and a Return on Equity of -16.31%. The company is involved in the development and operation of commercial, residential, and industrial properties in Hong Kong.

– PT Sky Energy Indonesia Tbk ($IDX:JSKY)

Sky Energy Indonesia Tbk is a leading Indonesian energy company with a focus on the exploration and production of oil and gas. The company has a market capitalization of $105.69 billion as of 2022 and a return on equity of -22.56%. Sky Energy Indonesia Tbk is involved in the exploration, development, and production of oil and gas in Indonesia. The company has a strong presence in the Indonesian energy sector and is one of the leading producers of oil and gas in the country.

– United Renewable Energy Co Ltd ($TWSE:3576)

As of 2022, United Renewable Energy Co Ltd has a market cap of 34.16B and a Return on Equity of 2.02%. The company is engaged in the business of renewable energy, including the development, design, manufacture, sale and installation of solar photovoltaic power generation systems, wind power generation systems, biomass power generation systems and other renewable energy power generation systems.

Summary

Enphase Energy (ENPH) is an attractive investment opportunity for investors looking for returns in the renewable energy industry. The stock price has recently moved up, signaling investor confidence in the business prospects of the company. Looking ahead, international expansion is key for Enphase Energy to achieve greater success. The company has already made strides with its presence in key markets like Australia and Europe, and plans to continue expanding its global reach into more countries.

With a wide range of products and services, including microinverters, energy storage solutions, and cloud-based software, Enphase is well-positioned to take advantage of the growth opportunities in the renewable energy market. With a strong balance sheet and a focus on innovation, Enphase Energy could be an attractive long-term investment for investors who are bullish on the renewable energy industry.

Recent Posts