BofA: SunPower’s Backlog Underestimated as a Growth Driver

April 14, 2023

Trending News ☀️

SUNPOWER ($NASDAQ:SPWR): SunPower Corporation is an American energy company based in San Jose, California that specializes in the design, manufacture, and installation of solar technology for both homes and businesses. Recently, Bank of America (BofA) has upgraded SunPower’s stock from neutral to buy citing their backlog of orders as an undervalued source of growth. BofA analysts see SunPower’s backlog of orders as a strong indication of future growth, suggesting that the actual level of growth they can experience is being underestimated by the market. They also noted that SunPower is well-positioned to meet the growing demand for residential solar technology.

Furthermore, BofA believes that SunPower’s cost reduction initiatives will be a key driver of growth over the next several years, as they become more competitive in the marketplace. Given these factors, BofA is bullish on SunPower’s prospects over the coming quarters and years, suggesting that investors should take advantage of the opportunity to buy shares in the company while its stock price is still undervalued. With a strong backlog of orders, cost reduction initiatives, and an increased demand for residential solar technology, SunPower looks set to be a solid source of growth in the future.

Price History

On Thursday, SunPower Corporation stock opened at $13.4 and closed at $14.0, rise by 7.4% from previous closing price of 13.1. This influx of growth is largely due to the fact that Bank of America (BofA) has underestimated the backlog of SunPower’s projects. BofA believes that SunPower’s backlog is a result of the company’s increased presence in the solar energy sector and will be a major driving force behind the company’s future growth. SunPower has experienced a surge of new business and has been working on a number of important projects. These projects are expected to have a positive impact on the company’s financials and bolster its position in the solar energy industry.

The company’s increased focus on solar energy has paid off as evident from the stock prices. Investors are also showing increased confidence in SunPower, which is likely to continue following the news of its impressive backlog. SunPower is well-positioned for further growth and is expected to experience significant gains in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sunpower Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 1.74k | 56.04 | 5.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sunpower Corporation. More…

| Operations | Investing | Financing |

| -181.48 | 492.97 | -58.07 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sunpower Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.78k | 1.2k | 3.3 |

Key Ratios Snapshot

Some of the financial key ratios for Sunpower Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -2.3% | 5.2% | 6.8% |

| FCF Margin | ROE | ROA |

| -13.6% | 13.0% | 4.1% |

Analysis

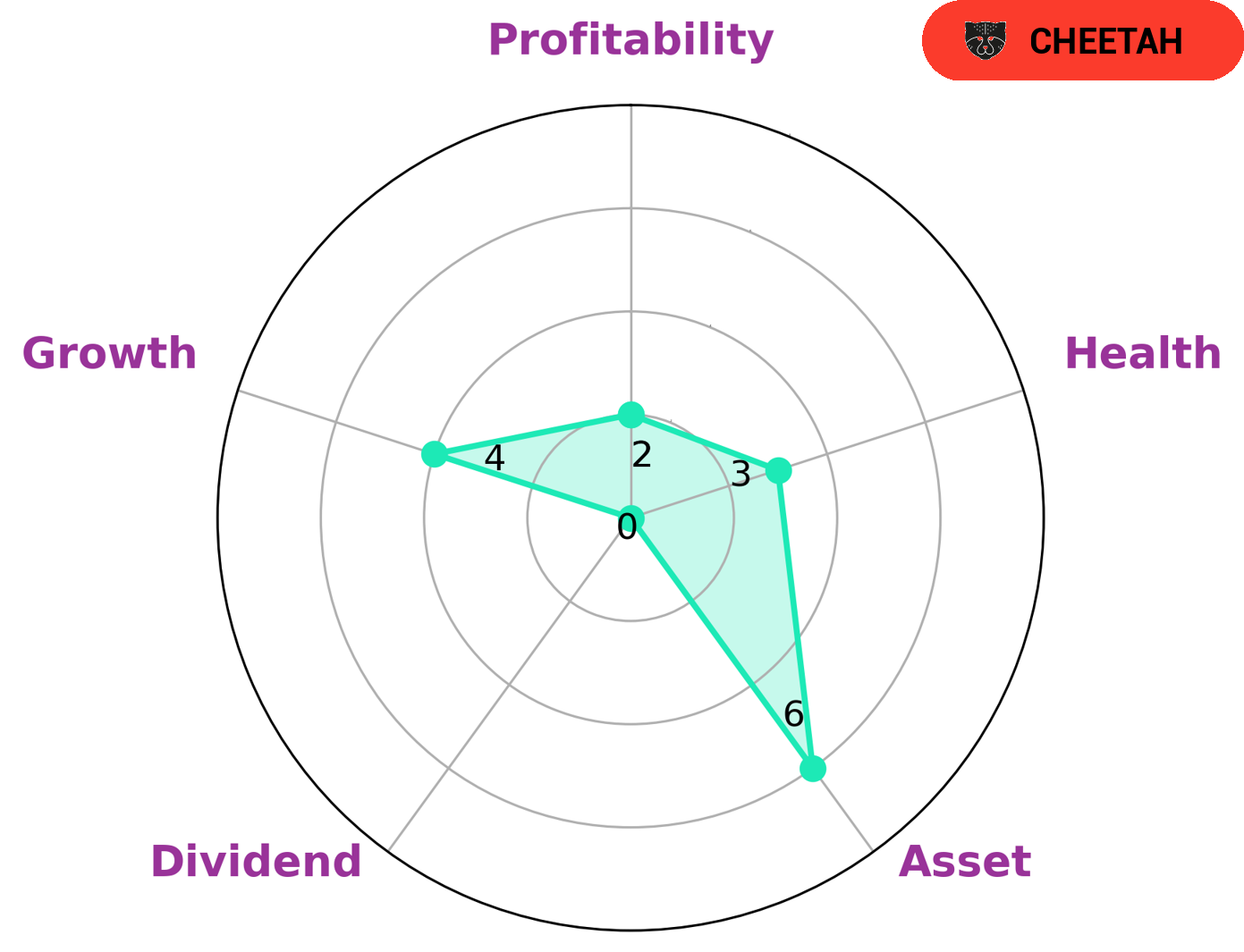

GoodWhale recently conducted an analysis of SUNPOWER CORPORATION‘s fundamentals. Unsurprisingly, the company scored low on our Star Chart health score of 3/10 due to cashflow and debt issues. This score means SUNPOWER CORPORATION is less likely to be able to pay off debt and fund future operations. SUNPOWER CORPORATION is classified as a ‘cheetah’ – a company that achieved high revenue or earnings growth but is considered less stable due to lower profitability. This makes it an attractive prospect for risk-seeking investors who are willing to invest in a company that may not have the most stable future prospects. In terms of its fundamentals, SUNPOWER CORPORATION is strong in growth, medium in asset and weak in dividend and profitability. This suggests that investors will likely see a higher return in terms of revenue growth than they would with dividends or profitability. More…

Peers

Solar panel technology has come a long way in recent years, and SunPower Corp has been at the forefront of this innovation. The company’s unique technology has allowed it to become one of the leading manufacturers of solar panels in the world. However, SunPower Corp is not without competition. Enphase Energy Inc, Central Development Holdings Ltd, and PT Sky Energy Indonesia Tbk are all leading solar panel manufacturers that are vying for market share.

– Enphase Energy Inc ($NASDAQ:ENPH)

Enphase Energy Inc is a publicly traded company that designs, manufactures and sells microinverters for the solar photovoltaic industry. Enphase has a market cap of $32.82B as of 2022 and a Return on Equity of 58.92%. The company was founded in 2006 and is headquartered in Fremont, CA.

– Central Development Holdings Ltd ($SEHK:00475)

Central Development Holdings Ltd is a property development and investment company based in Hong Kong. The company’s market cap as of 2022 was 251.92M and its ROE was -15.66%. Central Development Holdings Ltd’s primary business activity is the development of residential and commercial properties in Hong Kong. The company also has a portfolio of investment properties in Mainland China.

– PT Sky Energy Indonesia Tbk ($IDX:JSKY)

Sky Energy Indonesia Tbk is the largest Indonesian-based integrated energy company with operations in exploration and production, refining, marketing and trading, power generation, and mining. The company has a market capitalization of $105.69 billion as of 2022 and a return on equity of -22.56%.

Sky Energy Indonesia Tbk is a vertically integrated energy company with operations in exploration and production, refining, marketing and trading, power generation, and mining. The company has a strong presence in the Indonesian energy market and is the largest Indonesian-based integrated energy company. The company has a market capitalization of $105.69 billion as of 2022 and a return on equity of -22.56%. Sky Energy Indonesia Tbk is a well-positioned to benefit from the growing demand for energy in Indonesia and the Asia Pacific region.

Summary

SunPower Corporation is a leading solar energy technology and services supplier, primarily providing solutions to residential and commercial customers. BofA recently upgraded SunPower, citing its strong backlog as an underappreciated growth driver. SunPower’s stock price moved up the same day, indicating positive investor sentiment.

SunPower has seen an impressive growth in revenue and profits over the last few years, and the company continues to invest heavily in research and development to remain at the forefront of the solar energy industry. The stock is also bolstered by an attractive dividend yield and its strong balance sheet.

Recent Posts