A&W Revenue Royalties Income Fund Distributes Cash to Shareholders for March

April 15, 2023

Trending News 🌥️

A&W ($TSX:AW.UN) Revenue Royalties Income Fund (TSX:AW.UN) recently announced their cash distribution for March. It offers investors a unique and innovative way to participate in the financial success of the iconic A&W restaurants in Canada. The fund is structured to receive royalties derived from sales at A&W restaurants, which it distributes to unitholders on a quarterly basis.

The A&W Revenue Royalties Income Fund provides investors with an attractive and reliable source of income that is backed by the success of one of Canada’s most beloved restaurant chains. The fund is well-positioned to continue paying quarterly distributions to unitholders for the foreseeable future.

Stock Price

On Monday, A&W REVENUE ROYALTIES Income Fund, one of Canada’s top restaurant franchisors and a leader in the quick-service restaurant industry, announced that it will be distributing cash to its shareholders for March. The stock opened at CA$36.5 and closed at CA$37.3, up by 2.8% from previous closing price of 36.2. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for AW.UN. More…

| Total Revenues | Net Income | Net Margin |

| 52.18 | 33.8 | 57.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for AW.UN. More…

| Operations | Investing | Financing |

| 44.26 | – | -37.22 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for AW.UN. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 411.66 | 85.41 | 15.15 |

Key Ratios Snapshot

Some of the financial key ratios for AW.UN are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.5% | 5.4% | 107.9% |

| FCF Margin | ROE | ROA |

| 84.8% | 15.9% | 8.5% |

Analysis

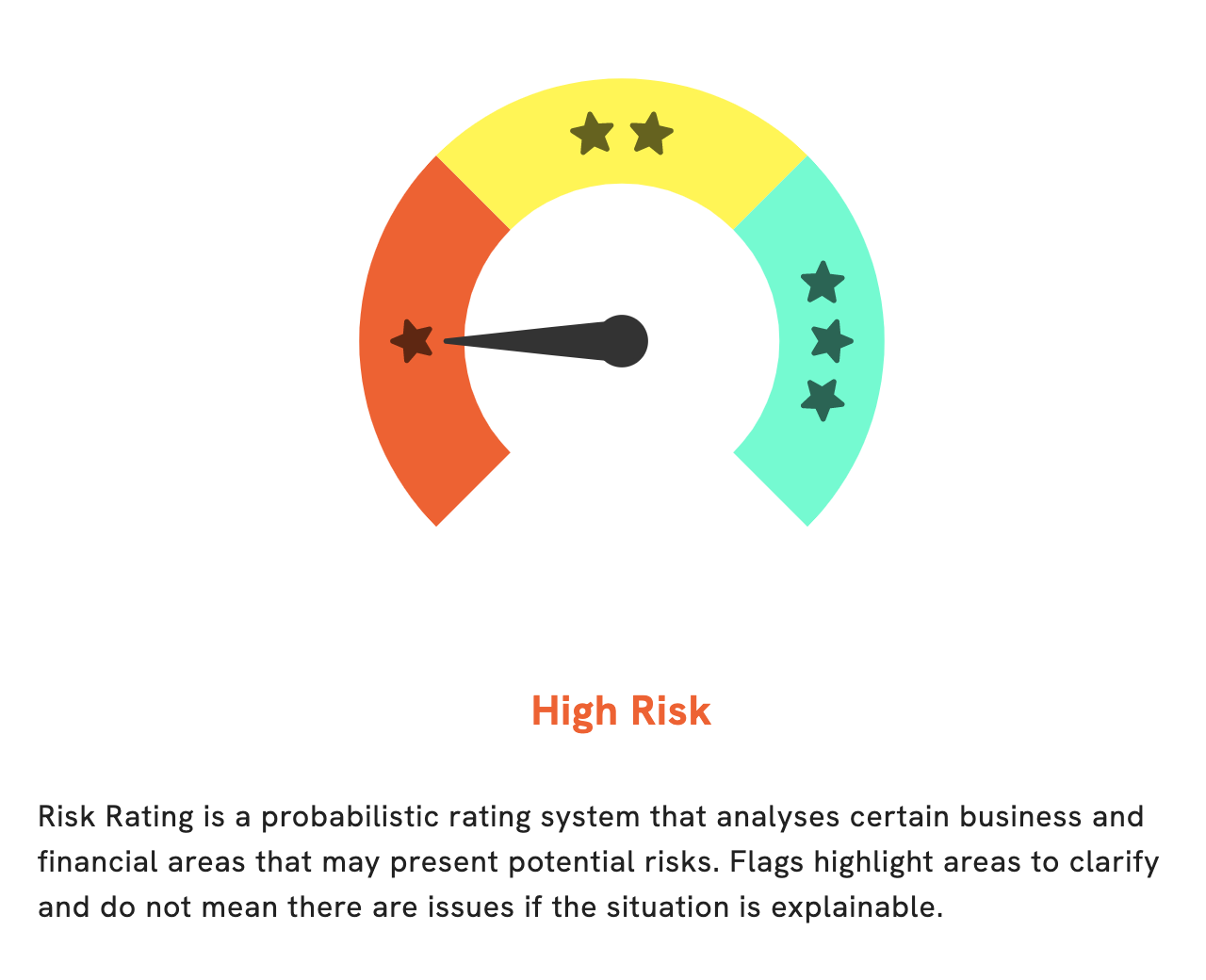

At GoodWhale, we analyzed the fundamentals of A&W REVENUE ROYALTIES and gave it a Risk Rating of high. This is based on the potential financial and business risks associated with the investment. Upon further inspection, we detected two warning signs in the company’s income sheet and balance sheet. If you’re interested to find out more, sign up as a registered user and you’ll get access to more detailed information. More…

Peers

It is one of the leading food service royalty income funds in Canada and competes with Priszm Income Fund, MTY Food Group Inc, and Pizza Pizza Royalty Corp. These companies offer investors opportunities to invest in the restaurant industry and earn income through royalty payments made by the franchisors.

– Priszm Income Fund ($OTCPK:PSZMF)

MTY Food Group Inc is a Canadian franchisor and operator of quick-service restaurants. The company operates a wide variety of restaurants, including franchised and corporate-owned locations. In 2023, MTY Food Group Inc had a market cap of None, indicating that the company was not publicly traded. However, its Return on Equity (ROE) was 11.88%, meaning that it was able to generate a return for its shareholders that was more than 11 times the amount invested. This indicates that MTY Food Group Inc was a profitable company in 2023, despite not being publicly traded.

– MTY Food Group Inc ($TSX:MTY)

Pizza Pizza Royalty Corp is a Canadian-based company that owns and operates pizza restaurants in Canada. The company is the master franchisor of the Pizza Pizza chain, which includes both corporate and franchised locations. As of 2023, the company has a market cap of None and a Return on Equity (ROE) of 6.95%. The market cap of Pizza Pizza Royalty Corp indicates that the company has not yet been able to monetize it’s operations and create shareholder value. The ROE of 6.95% suggests that the company is moderately profitable, however it is still far from achieving its full potential.

Summary

Investing in A&W Revenue Royalties (AW.UN) can be highly rewarding for investors. The fund recently declared a cash distribution for March, showcasing the strength of its revenue streams. A&W Revenue Royalties is an income fund that invests predominantly in A&W Food Services of Canada Inc. and its affiliated entities. The fund has a proven track record of providing strong and stable returns and boasts an impressive dividend yield.

This investment option is ideal for income investors seeking to build a diversified portfolio with a reliable income stream. It is also a good option for those looking to hedge against market volatility and reduce risks associated with stock market fluctuations.

Recent Posts