A&W Revenue Royalties Income Fund Declares 16.0 Cent per Trust Unit Distribution for April 1-30.

May 10, 2023

Trending News ☀️

The A&W ($TSX:AW.UN) Revenue Royalties Income Fund, an open-ended trust that invests primarily in A&W Restaurants Inc., has declared a cash distribution of 16.0 cents per trust unit for the period from April 1 to April 30. A&W Revenue Royalties Income Fund is a passive investment vehicle that enables investors to take advantage of A&W’s royalty income stream. The fund holds a portfolio of A&W Restaurants Inc. franchises, and each trust unit is entitled to receive a portion of the royalty income generated from the sale of products at A&W restaurants. The trust is managed by Active Energy Management LP and trades on the Toronto Stock Exchange under the symbol “AW.UN”. Investors should note that this distribution may be taxable in some jurisdictions and that taxes may be withheld from the distribution at the applicable rate specified by the Canada Revenue Agency.

These distributions are paid out four times per year, with distributions in March, June, September and December. The fund’s objective is to provide investors with consistent quarterly cash flow and modest long-term capital appreciation.

Market Price

The stock opened at CA$37.2 and closed at CA$36.9, a marginal increase of 0.1% from its prior closing price. The Fund invests in high-quality, fixed income investments, such as real estate investment trusts, term deposits and government and corporate bonds, to generate income for investors. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for AW.UN. More…

| Total Revenues | Net Income | Net Margin |

| 52.18 | 33.8 | 57.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for AW.UN. More…

| Operations | Investing | Financing |

| 44.26 | – | -37.22 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for AW.UN. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 411.66 | 85.41 | 15.15 |

Key Ratios Snapshot

Some of the financial key ratios for AW.UN are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.5% | 5.4% | 107.9% |

| FCF Margin | ROE | ROA |

| 84.8% | 15.9% | 8.5% |

Analysis

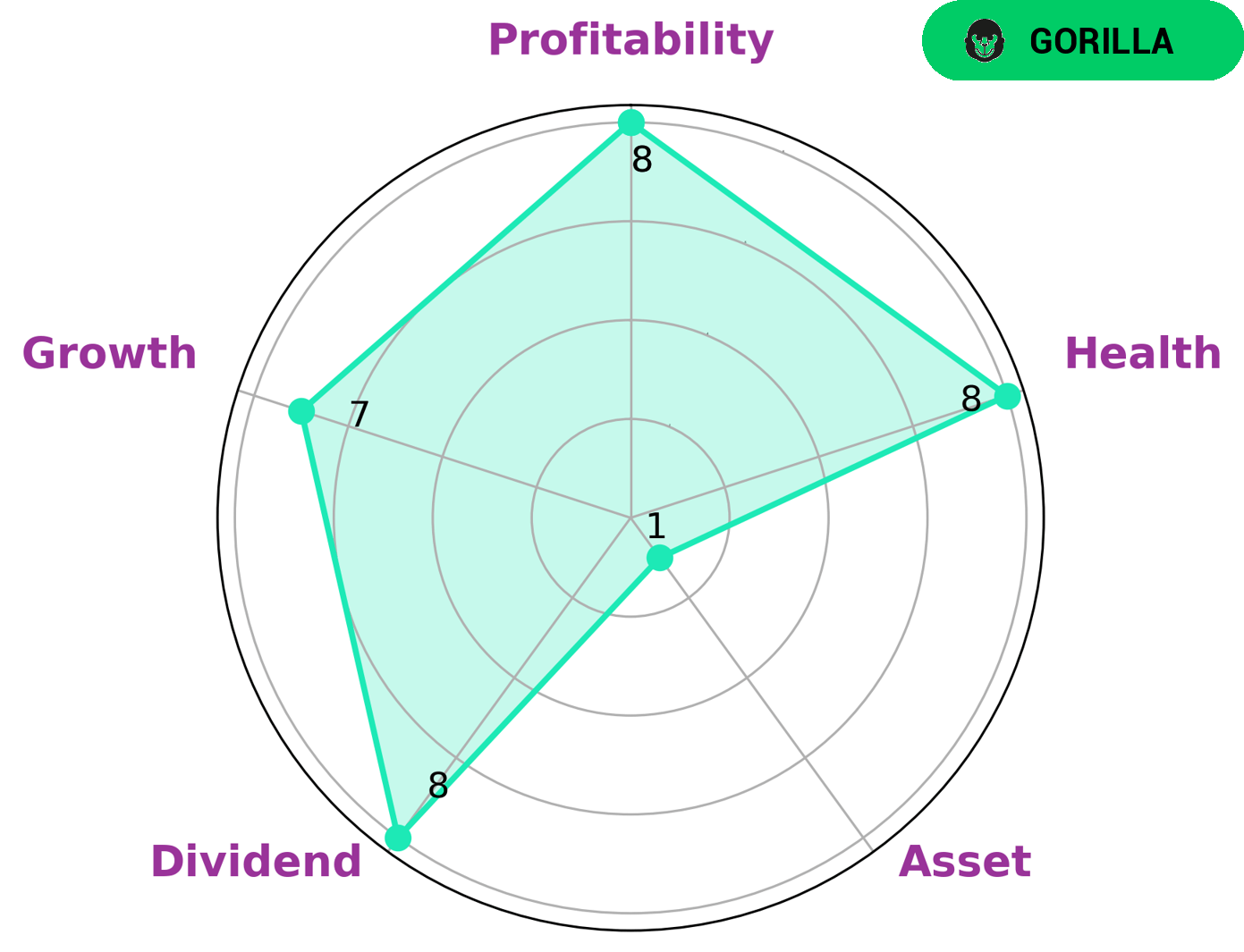

GoodWhale has analyzed A&W REVENUE ROYALTIES’s fundamentals and found that it is classified as a ‘gorilla’, a company that has achieved stable and high revenue or earnings growth due to its strong competitive advantage. With GoodWhale’s Star Chart, we can conclude that A&W REVENUE ROYALTIES may be of interest to investors who are looking for companies with a strong competitive advantage. We also found that A&W REVENUE ROYALTIES has a high health score of 8/10 with regard to its cashflows and debt, indicating that it is capable of safely riding out any crisis without the risk of bankruptcy. Furthermore, A&W REVENUE ROYALTIES is strong in dividend, growth, and profitability, but weak in asset. This information can help investors decide if this is the right company for their portfolio. More…

Peers

It is one of the leading food service royalty income funds in Canada and competes with Priszm Income Fund, MTY Food Group Inc, and Pizza Pizza Royalty Corp. These companies offer investors opportunities to invest in the restaurant industry and earn income through royalty payments made by the franchisors.

– Priszm Income Fund ($OTCPK:PSZMF)

MTY Food Group Inc is a Canadian franchisor and operator of quick-service restaurants. The company operates a wide variety of restaurants, including franchised and corporate-owned locations. In 2023, MTY Food Group Inc had a market cap of None, indicating that the company was not publicly traded. However, its Return on Equity (ROE) was 11.88%, meaning that it was able to generate a return for its shareholders that was more than 11 times the amount invested. This indicates that MTY Food Group Inc was a profitable company in 2023, despite not being publicly traded.

– MTY Food Group Inc ($TSX:MTY)

Pizza Pizza Royalty Corp is a Canadian-based company that owns and operates pizza restaurants in Canada. The company is the master franchisor of the Pizza Pizza chain, which includes both corporate and franchised locations. As of 2023, the company has a market cap of None and a Return on Equity (ROE) of 6.95%. The market cap of Pizza Pizza Royalty Corp indicates that the company has not yet been able to monetize it’s operations and create shareholder value. The ROE of 6.95% suggests that the company is moderately profitable, however it is still far from achieving its full potential.

Summary

Investors interested in A&W Revenue Royalties Income Fund will be pleased to hear that the company recently declared a cash distribution of 16.0 cents per trust unit for the period April 1 to April 30. This is a sign of stability and continued growth for the company, which should be attractive to potential investors. A&W Revenue Royalties is a diversified trust which invests in a variety of income-producing securities and provides exposure to Canadian and global markets through its portfolio of equity, fixed income, and real estate investments. With the recent cash distribution increase, A&W Revenue Royalties remains an attractive investment option for those looking for income-producing investments.

Recent Posts