American Water Works Continues to Provide Essential Services Despite Difficult Year, Anticipates EPS Increase in FY22

January 9, 2023

Trending News ☀️

American Water Works ($NYSE:AWK) is the largest publicly-traded water and wastewater utility in the United States, with approximately 3.4 million residential and commercial customers in 14 states. It is a diversified utility provider, offering a range of services such as water supply, wastewater treatment, storage and distribution, and other related services. For the full-year of FY22, American Water Works expects revenues to be slightly lower than the previous year due to a decrease in demand for residential and commercial services. American Water Works is also investing in infrastructure projects to improve current systems and expand service offerings.

The company is also engaging in discussions with state and local governments to provide additional services such as stormwater management and water reuse, as well as providing assistance to customers who need help with their water bills. With its strong balance sheet and a long history of providing essential services, American Water Works is well positioned to weather the difficult times ahead and continue to provide reliable services to its customers.

Stock Price

With the recent media exposure being mostly positive, the company continues to expand its service offerings and support its customers. On Tuesday, American Water Works stock opened at $153.8 and closed at $154.1, up by 1.1% from its prior closing price of 152.4. This indicates that investors are confident in the company’s ability to continue to provide a reliable and essential service to its customers. This increase in EPS is due to the company’s ability to quickly adapt to economic shifts and adjust its services accordingly. With its strong customer base, American Water Works remains focused on providing quality service and expanding its offerings.

With the pandemic still ongoing, it is reassuring to know that American Water Works is committed to ensuring that its customers have access to clean water and other essential services. The company is also taking measures to ensure the safety of its workers, customers, and the environment. As the pandemic continues to affect the economy, American Water Works is well-positioned to remain a reliable provider of essential services. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for AWK. More…

| Total Revenues | Net Income | Net Margin |

| 3.81k | 1.32k | 19.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for AWK. More…

| Operations | Investing | Financing |

| 1.18k | -1.54k | 373 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for AWK. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 27.13k | 19.37k | 42.67 |

Key Ratios Snapshot

Some of the financial key ratios for AWK are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.3% | 1.3% | 56.2% |

| FCF Margin | ROE | ROA |

| -29.0% | 17.5% | 4.9% |

VI Analysis

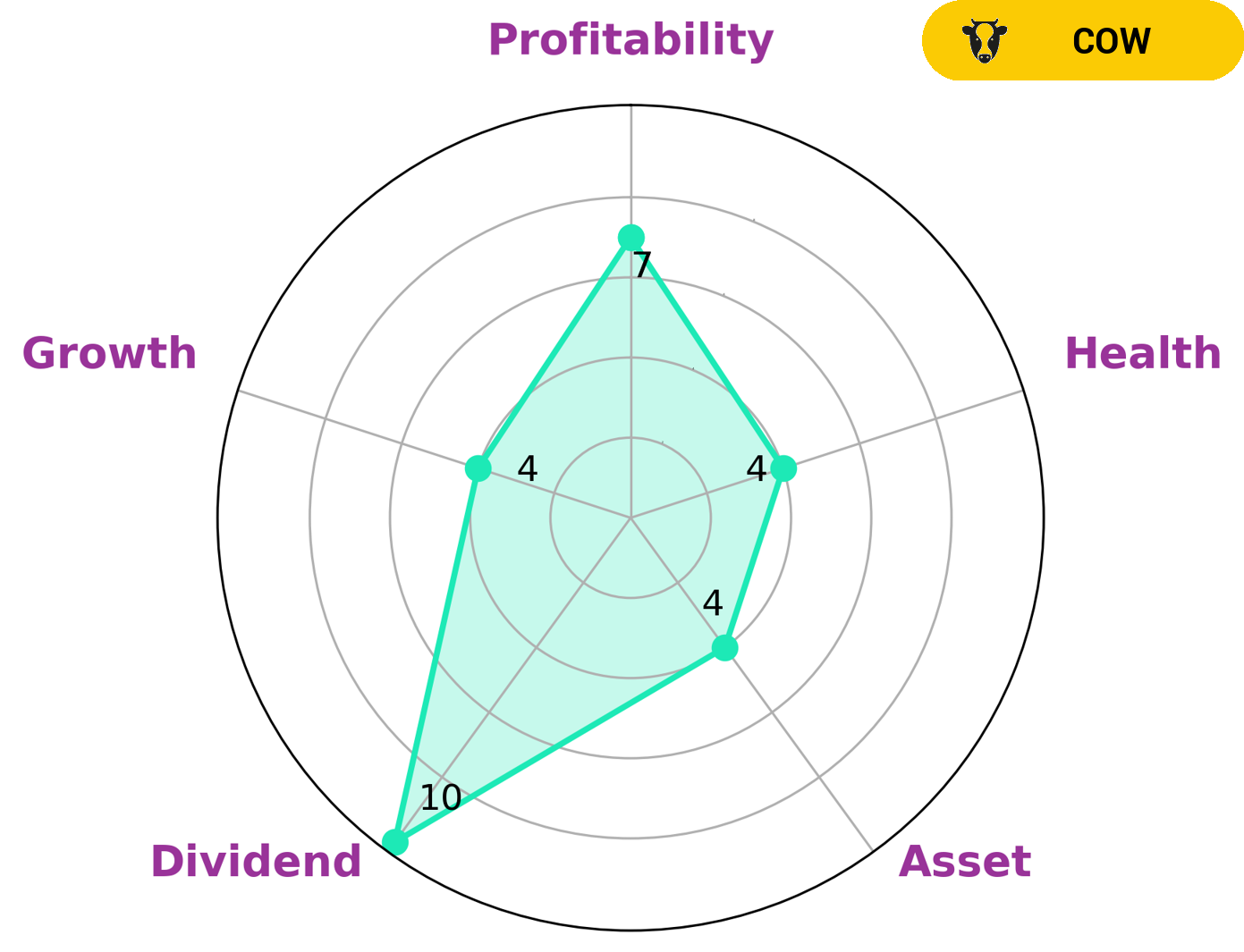

Investors looking for a company with strong fundamentals and a reliable track record of dividend payments may be interested in American Water Works. The VI Star Chart scores the company’s cashflows and debt at 4/10, indicating that it is likely to be able to weather any economic crisis without the risk of bankruptcy. Additionally, the company has earned a strong score for profitability and a medium score for asset and growth, indicating good long-term potential. American Water Works is classified as a “cow”, meaning that it has a history of reliable dividend payments and has exhibited strong fundamentals over time. Investors looking for a steady income stream with minimal risk may find American Water Works to be an attractive option. Furthermore, the company’s moderate scores for asset and growth provide investors with the opportunity to benefit from an appreciation in stock price. In conclusion, American Water Works may be a good choice for investors seeking reliable dividend payments and long-term growth potential. With its strong cashflows and debt score, investors can be confident that their investments are safe in the event of a downturn. More…

VI Peers

American Water Works Co Inc, American States Water Co, Global Water Resources Inc, and Artesian Resources Corp are all water utilities companies. They are all in the business of providing water and wastewater services to residential, commercial, and industrial customers.

– American States Water Co ($NYSE:AWR)

American States Water Co is a water and wastewater utility company that serves nearly million people in the United States. The company has a market cap of 3.22B as of 2022 and a ROE of 12.01%. American States Water Co is the largest water utility company in California and the fourth largest in the United States. The company also provides wastewater services to approximately 700,000 people in Arizona, Illinois, New Mexico, and Texas.

– Global Water Resources Inc ($NASDAQ:GWRS)

Global Water Resources, Inc. is a water resource management company that provides water and wastewater services to residential and commercial customers in the Phoenix metropolitan area. The company has a market cap of $296.66 million and a return on equity of 21.79%. Global Water Resources is headquartered in Scottsdale, Arizona.

– Artesian Resources Corp ($NASDAQ:ARTNA)

Artesian Resources Corp is a water utility company that serves the metropolitan area of Wilmington, Delaware. It is the largest provider of water and wastewater services in the state of Delaware, and is the 8th largest provider of water and wastewater services in the United States. The company has a market cap of 496.24M as of 2022 and a Return on Equity of 10.87%.

Summary

American Water Works has been a reliable provider of essential services throughout the pandemic, which has enabled the company to remain profitable. They anticipate an increase in EPS for FY22 that should be beneficial to investors. Analysts are optimistic about American Water Works’ future, citing the company’s diverse operations, strong financials and resilient customer base.

The stock has been performing well and is expected to continue growing in value, making it a good long-term investment. Investors should keep an eye on the company’s upcoming earnings reports and other developments, as they may have an impact on the stock’s performance.

Recent Posts