Triple Flag Sees Record-Breaking Quarterly Revenues of $50.1M from Sale of 26.6k GEOs

April 14, 2023

Trending News 🌥️

The strong performance was driven by rising gold prices, increased demand from institutional and retail buyers and the company’s ability to bring customers a safe and secure way to purchase physical gold and silver bullion. Triple Flag’s ability to provide a wide range of products, including coins, bars and vaulted bullion, allowed customers to diversify their portfolios and manage their precious metal investments with ease. Triple Flag Precious ($NYSE:TFPM) Metals Corp. is a publicly traded company on the Toronto Stock Exchange with a unique focus on delivering high-quality physical gold and silver bullion products to individual and institutional buyers. With offices in Canada, Switzerland, London, Singapore and New York, the company has a global presence and takes pride in providing customers with the best service and quality products.

Share Price

On Thursday, TRIPLE FLAG PRECIOUS METALS stock opened at $16.8 and closed at $16.8, up by 5.0% from last closing price of 16.0. This impressive result is the result of the successful execution of the company’s business plan and a commitment to finding innovative ways to increase profits. With this strong performance, TRIPLE FLAG PRECIOUS METALS has demonstrated its capabilities and potential for further success in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for TFPM. More…

| Total Revenues | Net Income | Net Margin |

| 151.88 | 55.09 | 39.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for TFPM. More…

| Operations | Investing | Financing |

| 118.38 | -48.92 | -38.75 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for TFPM. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.34k | 18.55 | 6.57 |

Key Ratios Snapshot

Some of the financial key ratios for TFPM are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 36.9% | 300.4% | 40.4% |

| FCF Margin | ROE | ROA |

| 77.9% | 2.9% | 2.9% |

Analysis

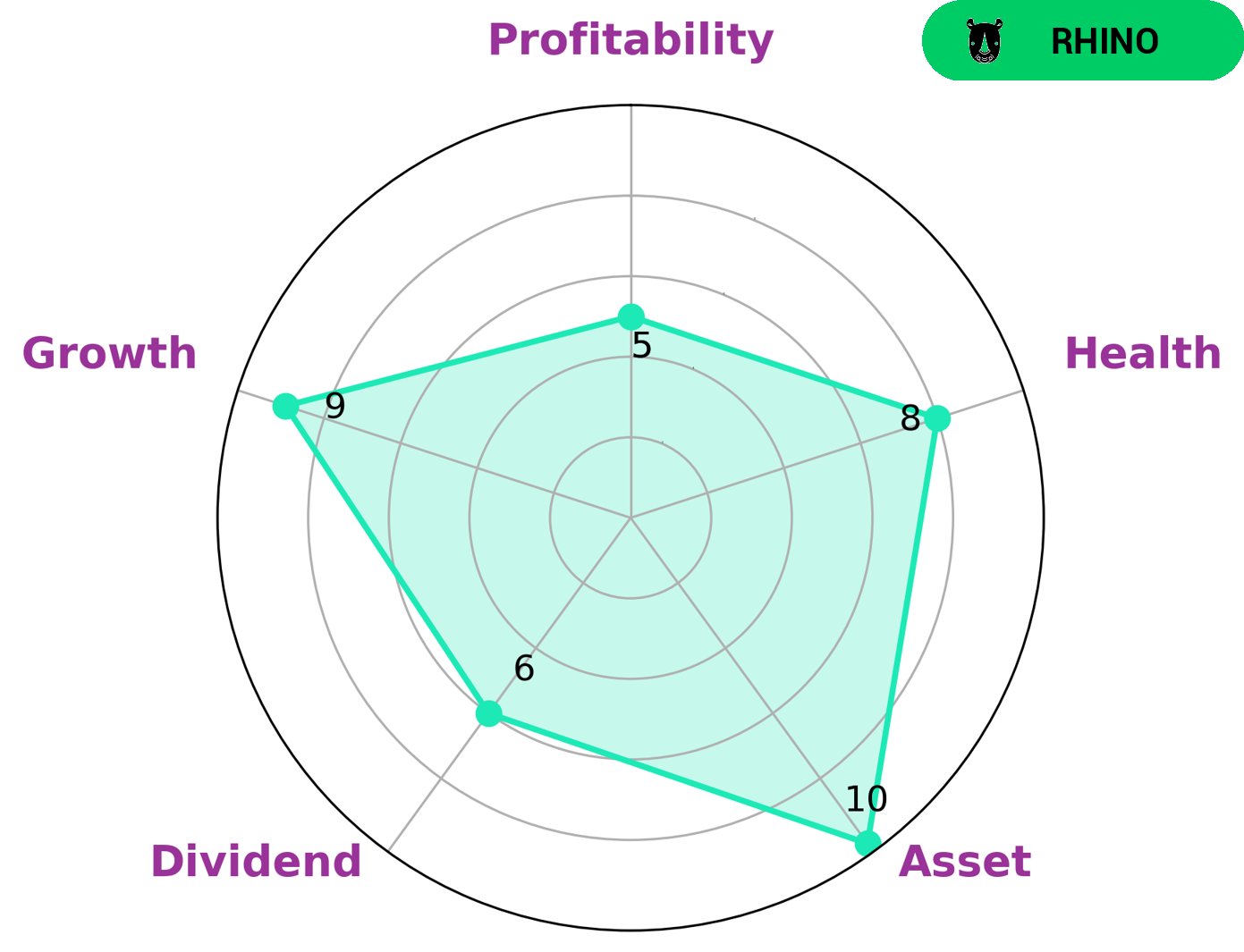

GoodWhale conducted a fundamental analysis of TRIPLE FLAG PRECIOUS METALS, which resulted in a high health score of 8/10. This score indicates that the company is capable of stabilizing its cashflows and debt in times of crisis, making it a reliable long-term investment. The results also show that the company is highly rated in asset, growth and medium in dividend and profitability. Based on this, we have classified TRIPLE FLAG PRECIOUS METALS as a ‘rhino’ company, which are organizations that have achieved moderate revenue or earnings growth. Given the fundamentals of TRIPLE FLAG PRECIOUS METALS, it would be a great fit for value investors looking for a reliable and consistent investment vehicle. The company’s strong asset and growth fundamentals make it an attractive option for long-term investors, while its medium dividend and profitability make it appealing to those looking for more immediate returns. Overall, TRIPLE FLAG PRECIOUS METALS is an excellent pick for those looking for a well-rounded investment. More…

Summary

This resulted in a stock price increase on the same day, a sign of investor confidence. In the near term, investors should be encouraged by the strong revenue and GEO sales numbers, indicating a potential rise in the stock price. It is also important to monitor the long-term prospects of the company, such as its ability to maintain strong sales growth and hit its long-term profit targets. Ultimately, Triple Flag Precious Metals has made a positive start to the quarter and investors should keep an eye on future developments in order to make an informed decision about their investments.

Recent Posts