B. Riley Reduces Q4 2023 EPS Estimates for International Seaways,

November 14, 2023

🌥️Trending News

International Seaways ($NYSE:INSW), Inc. is a leading provider of international seaborne transportation services for crude oil and petroleum products. The company’s fleet consists of owned and time-chartered vessels that are used to transport a variety of refined petroleum products and crude oil. Recently, B. Riley has decreased their Q4 2023 EPS estimates for International Seaways, Inc. This is in response to the current market conditions, which have seen a decrease in demand for the company’s services. The decrease in estimates comes as a result of the weakened outlook for the global shipping industry on the whole, as well as the impact of the pandemic on the company’s operations.

While this is a disappointing development for the company, it is important to remember that the decrease in estimates is only due to short-term market conditions and should not be taken as a reflection of the company’s long-term prospects. International Seaways, Inc. remains a leader in its industry and is likely to be well-positioned to take advantage of any recovery in the global shipping industry.

Earnings

According to the report, International Seaways earned 96.57M USD in total revenue and lost 20.0M USD in net income in the FY2023 Q2 ending June 30 2021. This is a 48.7% decrease in total revenue and a 129.0% decrease in net income compared to the previous year. Over the past three years, International Seaways’ total revenue has grown from 96.57M USD to 292.2M USD. It remains to be seen if the company can recover from these losses and reach new heights of success.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for International Seaways. More…

| Total Revenues | Net Income | Net Margin |

| 1.15k | 658.25 | 55.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for International Seaways. More…

| Operations | Investing | Financing |

| 687.41 | -330.32 | -472.79 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for International Seaways. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.66k | 1.04k | 33.14 |

Key Ratios Snapshot

Some of the financial key ratios for International Seaways are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 35.9% | 61.3% | 63.3% |

| FCF Margin | ROE | ROA |

| 37.8% | 28.8% | 17.2% |

Share Price

On Monday, shares of International Seaways, Inc. (INSW) opened on the New York Stock Exchange (NYSE) at $47.7 and closed at $47.9, up by 0.6% from its prior closing price of 47.6. Despite this news, the stock has remained relatively unchanged in the market as investors largely shrugged off the news. Live Quote…

Analysis

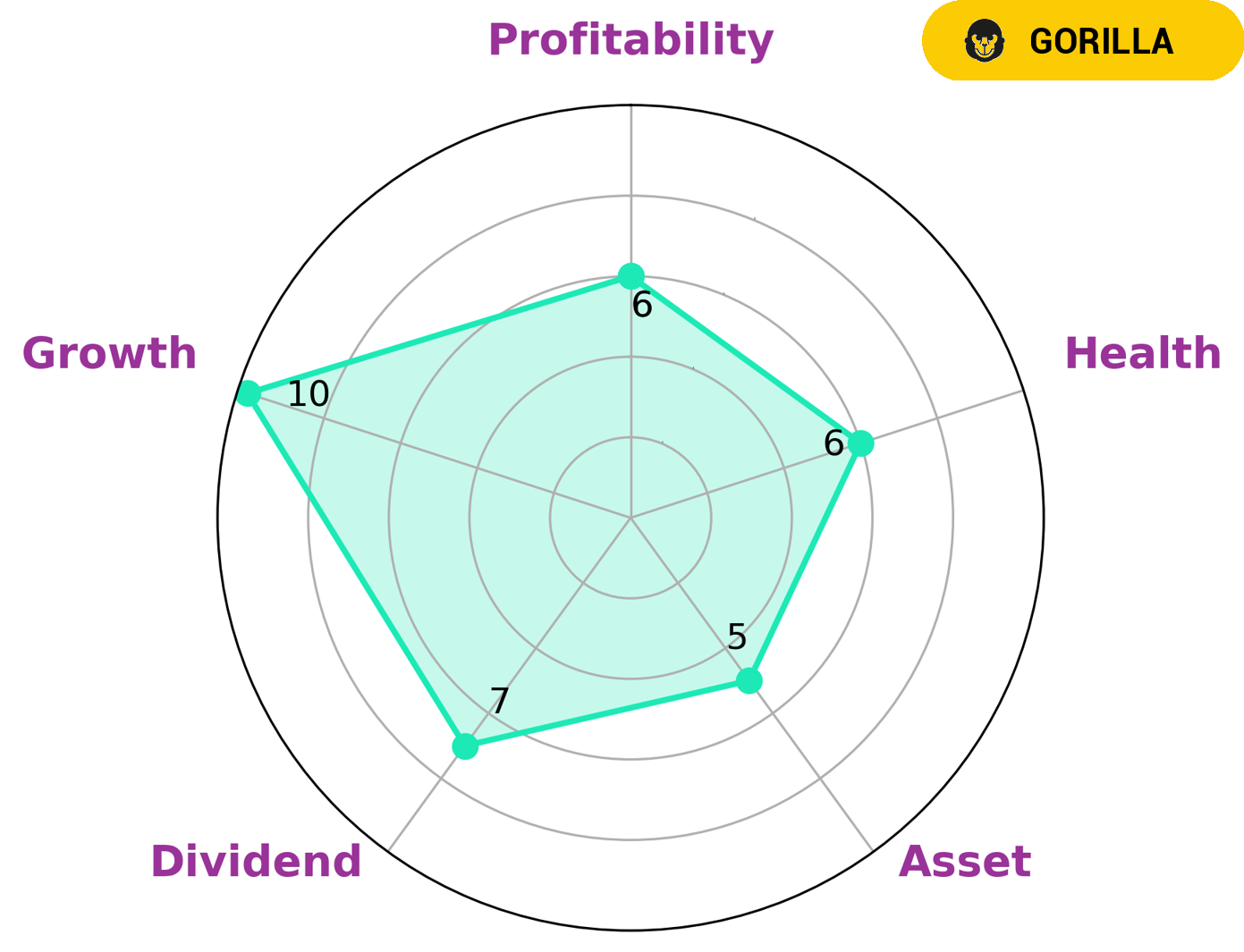

GoodWhale recently conducted an analysis of INTERNATIONAL SEAWAYS‘s wellbeing. Based on our proprietary Star Chart, INTERNATIONAL SEAWAYS is classified as a ‘cheetah’ type of company, which achieved high revenue or earnings growth but is considered less stable due to lower profitability. Given this, the type of investors who may be interested in such a company are those looking for higher risk investments with potential for higher returns. INTERNATIONAL SEAWAYS is strong in dividend and growth, and medium in asset and profitability. Its intermediate health score of 6/10 considering its cashflows and debt, means it is likely to safely ride out any crisis without the risk of bankruptcy. More…

Peers

The shipping industry is highly competitive, with International Seaways Inc competing against TORM PLC, Euronav NV, and Overseas Shipholding Group Inc. All four companies are major players in the industry, with a strong presence in the market. International Seaways Inc has a strong fleet of vessels and a strong financial position, which gives it a competitive advantage in the market.

– TORM PLC ($NASDAQ:TRMD)

SSE PLC is a British energy company headquartered in Perth, Scotland. It is listed on the London Stock Exchange and is a constituent of the FTSE 100 Index. The company has a market capitalisation of £2.45 billion as of May 2021 and a return on equity of 7.59% as of March 2021.

SSE PLC is an integrated energy company with operations in electricity generation, transmission, distribution and supply, as well as gas storage and distribution. The company’s customer base includes domestic and commercial customers, as well as industrial and power generation customers. SSE PLC is one of the “Big Six” energy suppliers in the United Kingdom.

– Euronav NV ($NYSE:EURN)

Euronav NV is a Belgium-based company engaged in the maritime transportation sector. The Company owns and operates a fleet of very large crude carriers (VLCCs), which are used to transport crude oil, as well as a number of product and chemical tankers. As of December 31, 2014, the Company’s VLCC fleet consisted of 32 vessels with a deadweight tonnage (DWT) of 9.7 million each. The Company operates its vessels through time charters, voyage charters and pool arrangements. The Company is also engaged in the crude oil tanker market through its investment in Tanker Investments Ltd. (TiL), which owns a VLCC and an Aframax.

– Overseas Shipholding Group Inc ($NYSE:OSG)

Overseas Shipholding Group, Inc. is one of the world’s leading energy transportation companies. They operate a modern fleet of tankers and product carriers that serve the crude oil and refined petroleum product shipping industries. The company is publicly traded on the New York Stock Exchange and is a member of the S&P 500 Index.

Summary

International Seaways, Inc. is a leading provider of international seaborne crude oil and petroleum product transportation services. The company has recently had its Q4 2023 earnings estimates reduced by B. Riley in its latest investing analysis. Despite the downward revision, International Seaways remains a top-performing stock in the sector and provides investors with a unique opportunity to access the global shipping market. The company has also taken proactive steps to ensure that its financial position remains strong, including reducing operating costs and capital expenditure.

Looking ahead, the company is focused on expanding its fleet and offering premium services to customers. With its strong balance sheet and focus on operational excellence, International Seaways is well positioned to continue providing investors with attractive returns in the long term.

Recent Posts