Alpha DNA Investment Management LLC Invests in NOW to Secure a Profitable Future

April 16, 2023

Trending News ☀️

Alpha DNA Investment Management LLC made an exciting announcement on April 9, 2023 – the acquisition of a strategic stake in NOW ($NYSE:DNOW) Inc., a major player in the oil and gas industry. This latest venture is part of Alpha DNA’s commitment to securing a profitable future for their clients. NOW Inc. is the leading supplier of oil and gas products and services for a wide range of customers. NOW Inc.’s mission is to provide their customers with quality products, timely delivery, and reliable customer service. With the acquisition, Alpha DNA Investment Management LLC has set their sights on the future of NOW Inc., investing in the company’s long-term success.

With this investment, Alpha DNA will help to ensure that NOW Inc. continues to be a leader in the oil and gas industry and will be able to continue to provide their customers with top-notch products and services. With their deep knowledge of the oil and gas industry, Alpha DNA will be able to leverage their expertise to ensure that NOW Inc. continues to thrive in the years to come.

Price History

The move marked a major step for the company towards a more profitable future. Following the announcement, the stock of NOW Inc. opened at $10.4 and closed at $10.7, a 2.4% increase from its previous closing price of $10.4. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Now Inc. More…

| Total Revenues | Net Income | Net Margin |

| 2.14k | 128 | 6.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Now Inc. More…

| Operations | Investing | Financing |

| 0 | -87 | -10 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Now Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.32k | 476 | 7.63 |

Key Ratios Snapshot

Some of the financial key ratios for Now Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -10.2% | 46.3% | 6.6% |

| FCF Margin | ROE | ROA |

| -0.4% | 10.7% | 6.7% |

Analysis

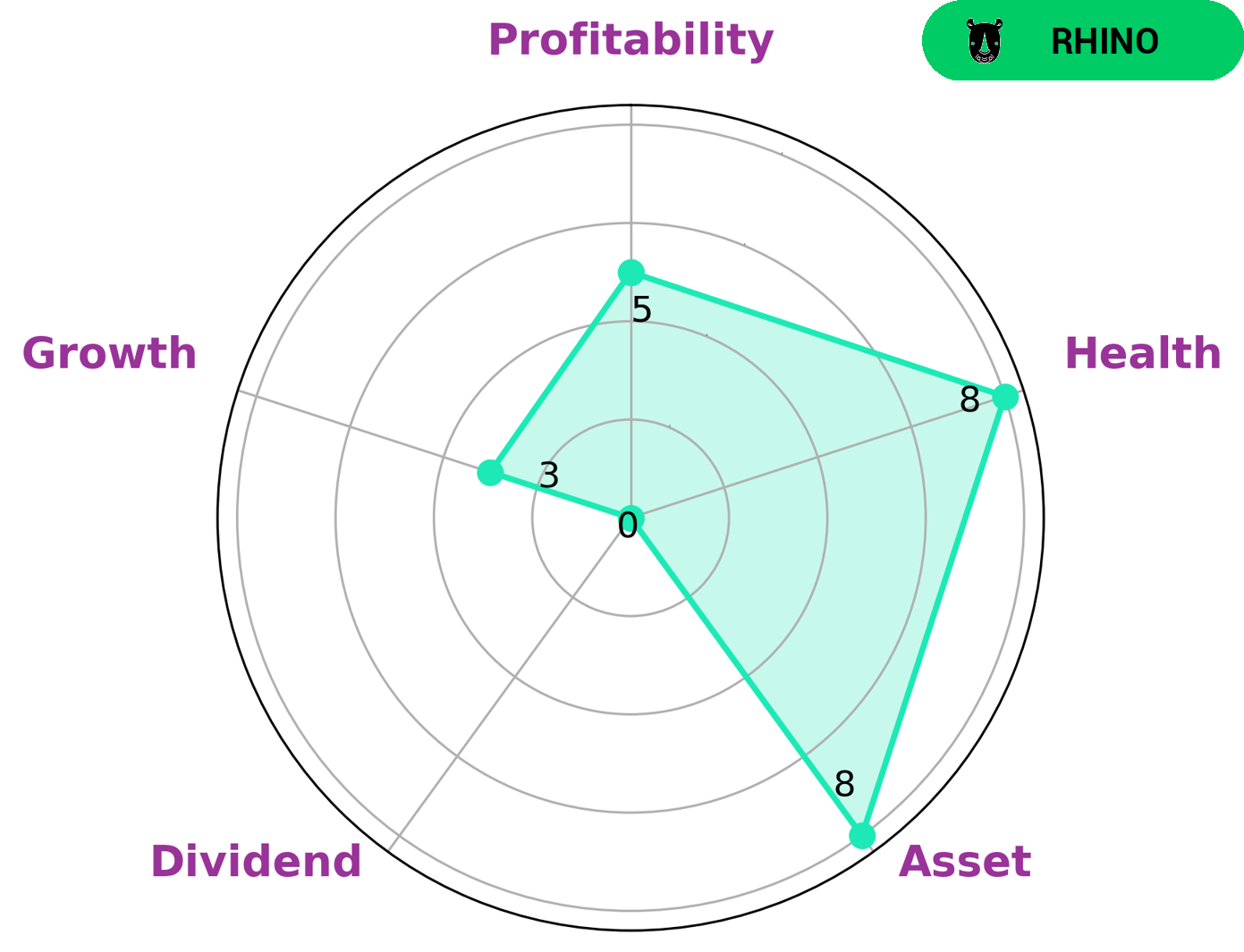

As a GoodWhale analyst, I have done a comprehensive analysis of the fundamentals of NOW INC. According to our Star Chart, NOW INC has a strong health score of 8/10, taking into account its cash flows and debt. This indicates that the company is capable of paying off its debt and can fund its future operations. Furthermore, based on our analysis, we have classified NOW INC as a ‘rhino’ company – a type of company that has achieved moderate revenue or earnings growth. Considering this, I believe that investors who are looking for moderate growth in their investments may be interested in NOW INC. Additionally, the company is strong in terms of asset but has a medium profitability and weak dividend growth. Therefore, investors may need to consider the company’s growth potential when making their investment decisions. More…

Peers

NOW Inc is an American provider of oilfield products and services with operations in the United States, Canada, Latin America, the Middle East, Africa, and Asia Pacific. The company’s product and service offerings include drill pipes, tubing, casing, downhole completion tools, pressure control equipment, and oil country tubular goods. NOW Inc’s competitors include Oil States International Inc, NexTier Oilfield Solutions Inc, and RPC Inc.

– Oil States International Inc ($NYSE:OIS)

The company has a market cap of 460.1M as of 2022 and a Return on Equity of -1.47%. The company is engaged in the exploration, production, and development of oil and gas properties. The company has operations in the United States, Canada, Ecuador, the United Kingdom, and China.

– NexTier Oilfield Solutions Inc ($NYSE:NEX)

NexTier Oilfield Solutions Inc is a leading provider of oilfield services. The company has a market cap of 2.58B and a ROE of 20.02%. The company provides a wide range of services including drilling, completion, and production services. The company has a strong presence in the United States and Canada.

– RPC Inc ($NYSE:RES)

RPC Inc is a publicly traded company with a market capitalization of $2.21 billion as of 2022. The company has a return on equity of 16.65%. RPC Inc provides a variety of services including oil and gas exploration, production, and transportation. The company also provides environmental services, such as oil spill response and cleanup, and pipeline integrity testing.

Summary

Alpha DNA Investment Management LLC’s recent purchase of shares in NOW Inc. signals their confidence in the company. An analysis of NOW Inc. revealed a strong track record of solid financial performance, with increasing revenues and net income in recent years. Furthermore, their robust balance sheet and low debt levels suggest a solid foundation and healthy financial outlook. The company is also well-positioned to benefit from the recent upturn in the oil and gas sector.

Recent Posts