Imperial Petroleum Reports Record Profits – But Who Benefits?

April 4, 2023

Trending News ☀️

Imperial Petroleum ($NASDAQ:IMPP) is an energy company with a wide range of interests in oil and gas exploration, refining and marketing. Recently, Imperial Petroleum reported record profits of over $3 billion – but the big question remains, who is benefiting from this substantial income? On paper, it appears that all shareholders should benefit from the sizable profits generated by Imperial Petroleum. After all, increased profits should lead to higher stock prices and dividends.

However, this is often not the case. While some of the larger shareholders may enjoy higher dividend payments, the impact on ordinary shareholders may be minimal. This is because larger investors often receive preferential treatment when it comes to dividends and other benefits. As a result, it is important for shareholders to keep a close eye on Imperial Petroleum’s financial performance and the structure of their dividends. While the company’s record profits can be seen as a cause for celebration, it is important to ensure that all shareholders – regardless of size – are able to benefit from the success.

Price History

On Monday, IMPERIAL PETROLEUM reported record profits for the quarter, with its stock opening at $0.2 and closing at $0.2, a rise of 6.7% from its last closing price of 0.2.

However, despite these seemingly positive results, it is yet to be seen who will benefit from this increase in profits. Analysts point to the fact that while shareholders will likely benefit from this increase, there is still a question mark over how much of the profits will be reinvested in the company or benefit the communities in which Imperial Petroleum operates. This raises the issue of corporate responsibility and raises questions on how much of the profits can be attributed to sustainable practices and investments. While Imperial Petroleum’s reported profits are good news for their shareholders, the question remains as to who will actually benefit from the record profits reported by Imperial Petroleum. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Imperial Petroleum. More…

| Total Revenues | Net Income | Net Margin |

| 97.02 | 29.51 | 30.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Imperial Petroleum. More…

| Operations | Investing | Financing |

| 40.9 | -186.68 | 196.95 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Imperial Petroleum. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 366.58 | 84.17 | 1.41 |

Key Ratios Snapshot

Some of the financial key ratios for Imperial Petroleum are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 93.8% | – | 32.1% |

| FCF Margin | ROE | ROA |

| -80.2% | 7.1% | 5.3% |

Analysis

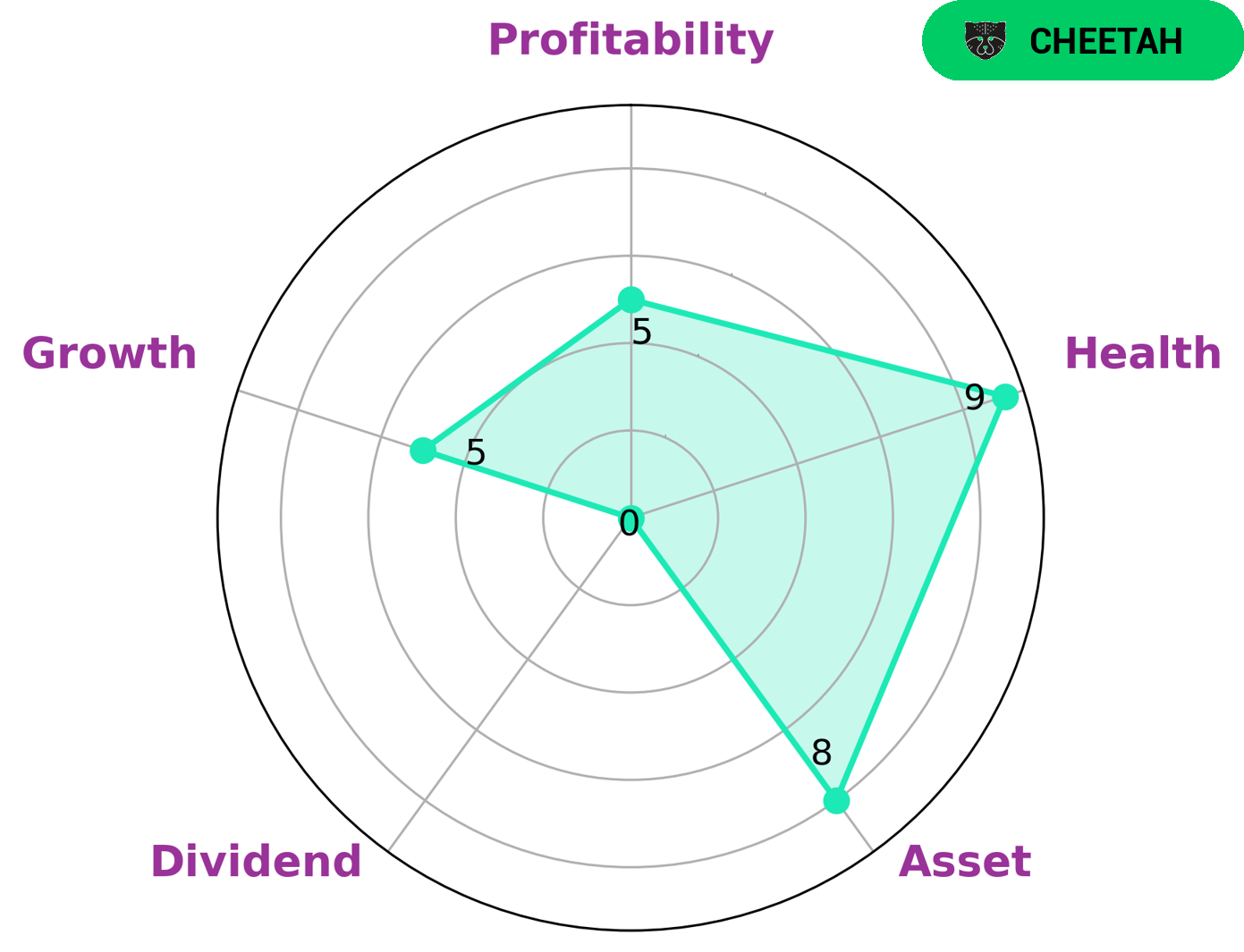

GoodWhale has conducted an analysis of IMPERIAL PETROLEUM‘s wellbeing and our star chart shows that they have a high health score of 9/10. This is mainly due to their strong cashflows and debt, which are indicative of their ability to sustain future operations in times of crisis. We have classified IMPERIAL PETROLEUM as a ‘cheetah’, a type of company that achieved high revenue or earnings growth but is considered less stable due to lower profitability. For investors interested in IMPERIAL PETROLEUM, we have found that they are strong in asset, medium in growth, profitability and weak in dividend. This suggests that investors need to be aware of the risks associated with investing in a company with such characteristics. Nevertheless, IMPERIAL PETROLEUM’s overall financial health score is still high, making it a viable option for investors looking to diversify their portfolio. More…

Peers

The company has a strong market presence and offers a wide range of products and services. CW Petroleum Corp, TORM PLC, Oil Terminal SA are some of the leading competitors of Imperial Petroleum Inc.

– CW Petroleum Corp ($OTCPK:CWPE)

The company’s market cap is 2.27B as of 2022 and its ROE is 17.86%. The company is engaged in the provision of electrical power and gas to businesses and households in the United Kingdom. The company also provides water and wastewater services to businesses and households in Scotland.

– TORM PLC ($NASDAQ:TRMD)

VTTI BV is an international energy storage company. It owns and operates a network of oil terminals and depots in Europe, North America, Asia, the Middle East, and Africa. The company has a market capitalization of 96.68 million as of 2022 and a return on equity of 2.73%. VTTI BV is a subsidiary of Vitol Group.

Summary

Imperial Petroleum has been making impressive profits since its IPO. This news has been driving the stock price up, as investors recognize the value in the company’s strong performance.

However, it is important to look beyond the headline figures to ensure that all shareholders are reaping the benefits. Analysts recommend researching dividend levels, share buyback announcements and capital expenditure plans to ascertain whether the company’s strategy is geared towards long-term growth or short-term returns.

Additionally, investors should pay attention to earnings per share and research the estimated future cash flow for Imperial Petroleum to assess whether the current stock price is supported by the fundamentals.

Recent Posts