Mueller Industries Reports Q4 GAAP EPS of $2.46 and Revenue of $877.6M, Shares Up 1.04% PM.

February 9, 2023

Trending News ☀️

Mueller Industries ($NYSE:MLI), Inc. is a leading manufacturer of copper, brass, aluminum, and plastic products for commercial and industrial applications. Mueller Industries’ products are used in a wide range of industries including HVAC, plumbing, construction, manufacturing, and more. Mueller Industries recently announced its fourth quarter GAAP earnings per share (EPS) of $2.46 and revenue of $877.6 million, with shares climbing 1.04% in after-market trading. The company’s performance in the fourth quarter was driven by the continued demand for their products and services in the plumbing, HVAC, and retail markets.

Additionally, Mueller Industries saw an increase in net sales due to higher sales prices across all three segments. Operating income also increased as a result of higher production volumes and lower costs which were partially offset by increased raw material costs. Moving forward, Mueller Industries continues to focus on improving their operational efficiency and cost structure in order to optimize their financial performance. The company is also looking to capitalize on new growth opportunities in the industrial, construction, and retail markets. With the company’s strong financial position and expanding product portfolio, investors should remain optimistic about the future of Mueller Industries’ stock.

Market Price

Shares of the company rose 1.04% in after-hours trading on Tuesday, closing at $75.7, up from $69.2 at the previous close. This marks a 9.4% increase from the opening price of $70.3. The company benefited from strong demand for its products across several end markets, such as automotive, heating and air conditioning, plumbing, and oil and gas. Furthermore, Mueller Industries‘ product portfolio is well-positioned to meet a variety of customer needs, ranging from OEMs to plumbing and HVAC distributors. This has enabled the company to capitalize on new opportunities in both domestic and international markets.

In addition, Mueller Industries’ cost-cutting measures have been successful, allowing the company to improve gross margins and operating income. Overall, Mueller Industries’ strong fourth-quarter results demonstrate the company’s resilience and ability to capitalize on market opportunities. As the demand for its products continues to grow, investors can expect further upside in the stock price. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Mueller Industries. More…

| Total Revenues | Net Income | Net Margin |

| 3.98k | 658.32 | 16.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Mueller Industries. More…

| Operations | Investing | Financing |

| 723.94 | -242 | -102.66 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Mueller Industries. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.24k | 428.44 | 28.58 |

Key Ratios Snapshot

Some of the financial key ratios for Mueller Industries are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.9% | 66.4% | 22.0% |

| FCF Margin | ROE | ROA |

| 17.2% | 32.1% | 24.4% |

Analysis

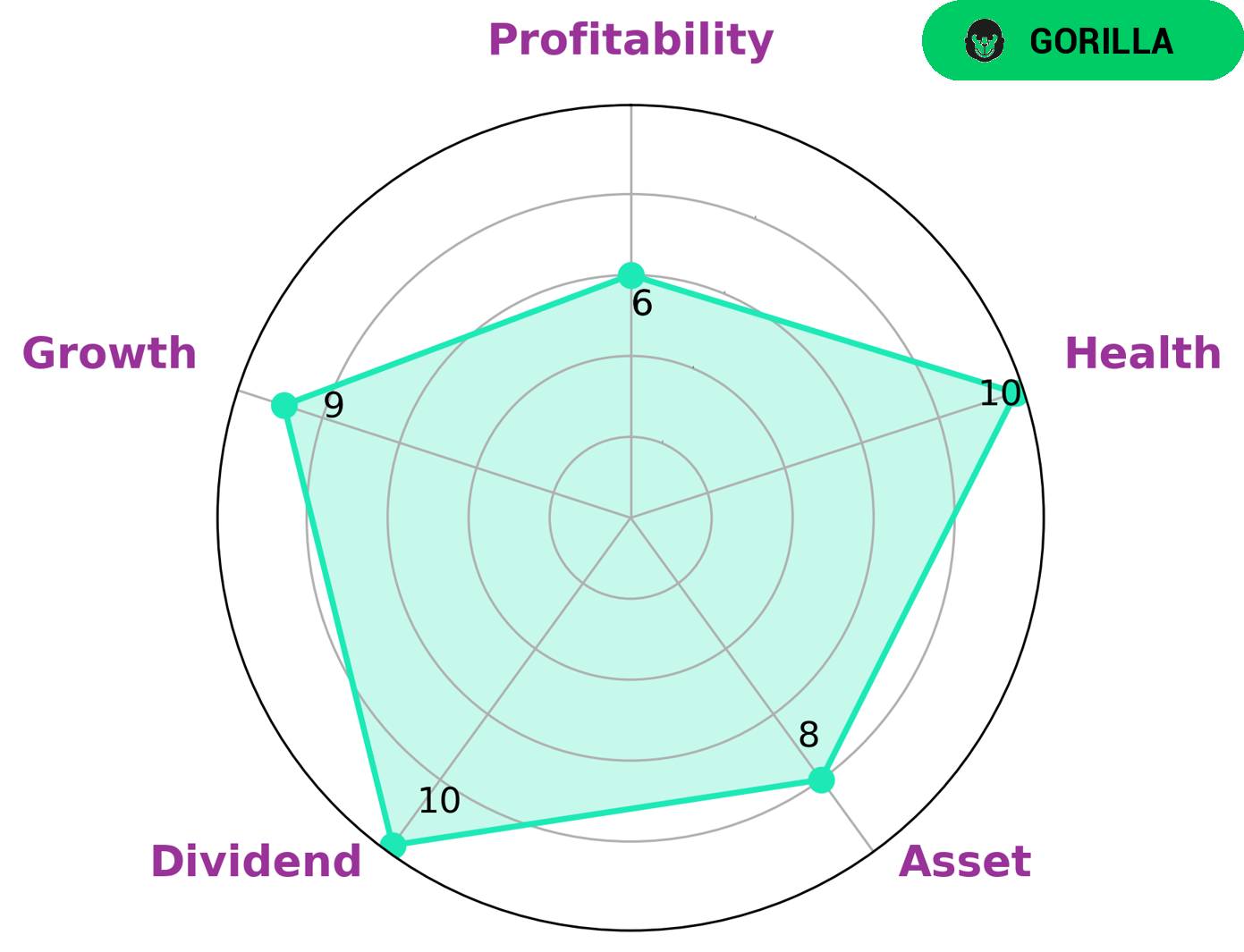

GoodWhale’s analysis of MUELLER INDUSTRIES reveals that it has a high health score of 10/10 according to its Star Chart, indicating it is capable of paying off debt and funding future operations. MUELLER INDUSTRIES also has strong performance in the areas of asset, dividend, and growth, as well as medium performance in profitability. This performance classifies MUELLER INDUSTRIES as a ‘gorilla’ company, meaning that it has achieved stable and high revenue or earnings growth due to its strong competitive advantage. Due to its high health score and strong performance in key areas, investors interested in a steady, reliable investment may be interested in investing in MUELLER INDUSTRIES. These could include dividend investors due to the company’s strong dividend history, and value investors who are looking for undervalued companies with competitive advantages. Additionally, due to the company’s strong assets, growth-oriented investors may also be interested in investing in MUELLER INDUSTRIES, as they may believe that the company has significant potential for capital appreciation. This makes it an attractive option for investors looking for steady and reliable investments, as well as those looking for potential capital appreciation. More…

Peers

Its competitors include Franklin Electric Co Inc, Furukawa Electric Co Ltd, PT Tembaga Mulia Semanan Tbk.

– Franklin Electric Co Inc ($NASDAQ:FELE)

Franklin Electric Co Inc is a manufacturer of submersible motors, pumps, and related parts and equipment. The company has a market capitalization of $3.95 billion as of 2022 and a return on equity of 18.79%. The company’s products are used in a variety of applications including residential, agricultural, commercial, and industrial water pumping.

– Furukawa Electric Co Ltd ($TSE:5801)

Furukawa Electric Co., Ltd. engages in the manufacture and sale of electric and electronic materials, products, and systems. It operates through the following segments: Electronic Devices, Optics, and Communication; Materials; Automotive; and Energy. The Electronic Devices, Optics, and Communication segment offers copper clad laminates, printed wiring boards, lead frames, optical fibers, optical fiber cables, and optical connectors. The Materials segment provides aluminum wire rods, aluminum alloys, aluminum foils, rare metals, and chemical products. The Automotive segment supplies automotive parts such as electric wires and cables, connectors, and battery terminals. The Energy segment offers power cables and power distribution equipment. The company was founded by Masaru Furukawa on June 8, 1949 and is headquartered in Tokyo, Japan.

– PT Tembaga Mulia Semanan Tbk ($IDX:TBMS)

PT Tembaga Mulia Semanan Tbk is one of the largest mining companies in Indonesia with a market cap of 593.25B as of 2022. The company is engaged in the exploration, mining, and smelting of copper and gold.

Summary

Mueller Industries Inc. reported its fourth quarter financial results, with total revenue of $877.6 million and GAAP EPS of $2.46. The firm’s stock price reacted positively to the news, rising 1.04%. This indicates that investors are optimistic about the company’s financial performance. Looking forward, analysts are encouraged by Mueller’s focus on cost containment and profitability, as well as their expansion into new markets and products.

The company has also been actively pursuing strategic partnerships that could provide additional opportunities for growth. In conclusion, Mueller Industries appears to be well-positioned for continued success in the future.

Recent Posts