Paragon 28 Raises Revenue Outlooks for Q4 and Full-Year 2022

January 17, 2023

Trending News 🌥️

On Tuesday, Paragon 28 ($NYSE:FNA) issued a press release announcing its revised revenue outlooks for the fourth quarter and full-year 2022. The company, which produces specialty chemicals and other related products, now forecasts fourth quarter net revenue to be between $51.2 million and $51.5 million, up from its previous prediction of $50.5 million to $51 million. Similarly, full-year 2022 revenue is now expected to come in at $164 million to $165 million, an improvement from the previous outlook of $163 million to $164 million. This news comes as a welcome relief for Paragon 28 investors. With the company’s previous guidance, there had been some concern that the company could miss its targets as the year came to a close.

However, the revised outlook signals that Paragon 28 is on track to meet or exceed its goals for the fourth quarter and full year. The company’s strong performance this year has been driven largely by its successful expansion into new markets, particularly in the Asia-Pacific region. Paragon 28 has also made significant investments in research and development, resulting in a number of new products and services being released over the course of the year. This improved product offering has enabled the company to capitalize on new opportunities and increase its market share. The company’s revised revenue outlook also indicates that its cost-cutting measures have been successful in reducing expenses and improving profitability. Paragon 28 has implemented a number of initiatives to streamline operations, including outsourcing certain production activities, consolidating warehouses, and deploying digital technologies to improve efficiency. These efforts have enabled the company to maximize its revenue potential without sacrificing quality or service. Overall, it appears that Paragon 28 is well-positioned for continued success in the coming quarters and years. The company’s revised Q4 and full-year 2022 revenue outlooks are a testament to its ability to capitalize on market opportunities and adapt to an ever-changing business landscape. Investors can feel confident that Paragon 28 will continue to deliver strong financial performance in the years ahead.

Stock Price

The company’s stock opened at $19.0 and closed at $18.9, a decrease of 0.1% from the prior closing price of $18.9. PARAGON 28‘s management team also noted that they anticipate strong growth in their key products, such as medical devices, artificial intelligence, and cloud-based services, which will contribute to their increased revenue and earnings outlooks. The company is confident that their investments in research and development, as well as their expansion into new markets, will further drive their growth and performance over the coming quarters and years. Overall, PARAGON 28’s announcement on Wednesday reveals their optimistic outlook for the fourth quarter and full-year 2022, with their revenue and earnings estimates being raised significantly from prior estimates. This news has likely been welcomed by shareholders, who are likely looking forward to strong returns from the company in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Paragon 28. More…

| Total Revenues | Net Income | Net Margin |

| 172.65 | -33.22 | -20.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Paragon 28. More…

| Operations | Investing | Financing |

| -38.07 | -63.12 | 150.24 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Paragon 28. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 256.96 | 85.59 | 2.22 |

Key Ratios Snapshot

Some of the financial key ratios for Paragon 28 are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | -17.8% |

| FCF Margin | ROE | ROA |

| -48.4% | -11.0% | -7.5% |

VI Analysis

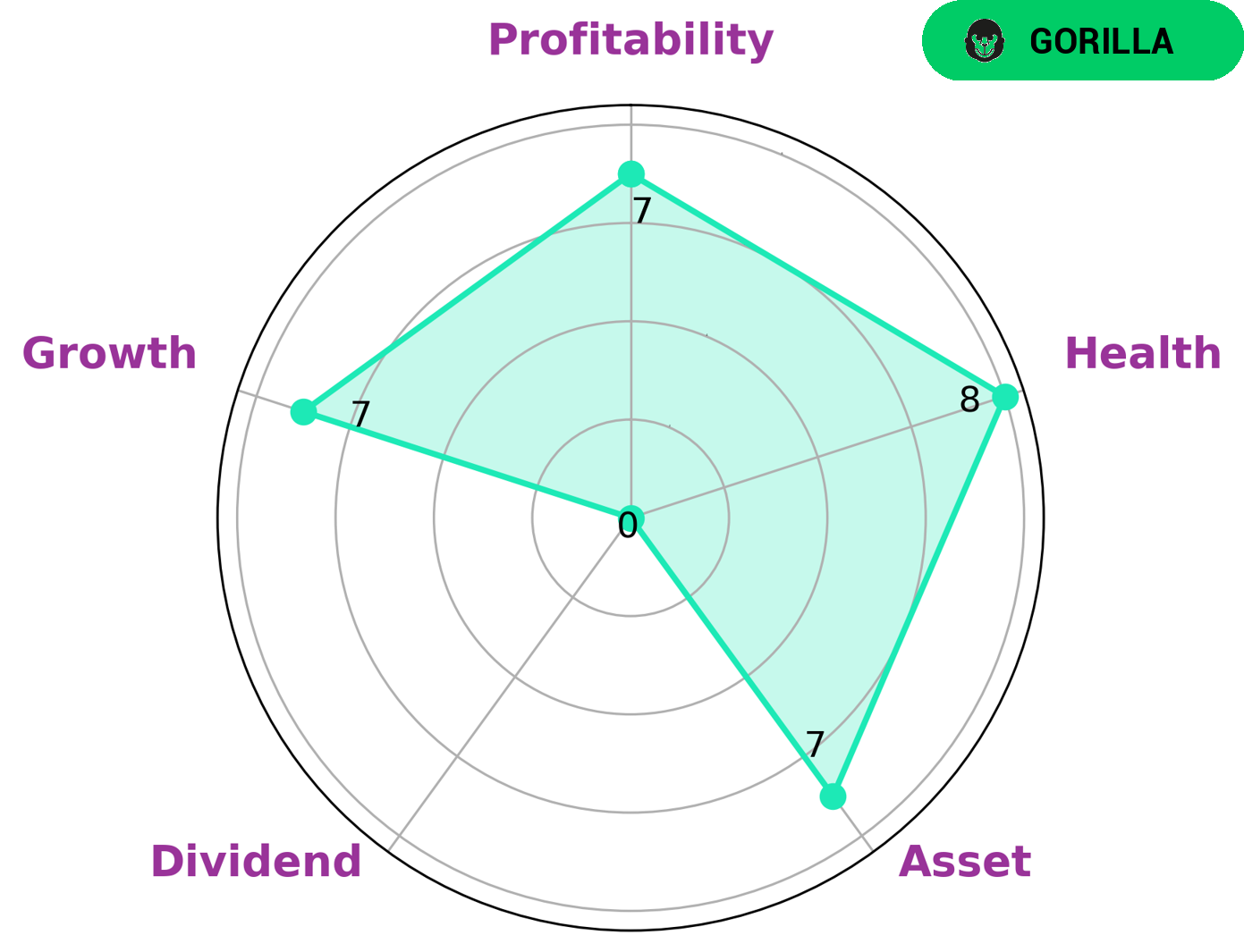

Company fundamentals are an important indicator of its long-term potential, and the VI app makes it easier to analyze the performance of a company. According to the VI Star Chart, PARAGON 28 has a high health score of 8 out of 10 in terms of cashflows and debt, suggesting that it is well-positioned to face any future economic crisis. Furthermore, the company is strong in terms of asset, growth, and profitability, but weak in dividends. PARAGON 28 is classified as a ‘gorilla’ company, meaning it has achieved a stable and high rate of revenue or earnings growth due to its competitive advantage. This type of company is likely to attract investors who value stability and long-term potential over short-term gains. These investors are usually looking for companies that show resilience in the face of market fluctuations and have a strong track record of delivering returns. Overall, PARAGON 28 appears to be a strong investment opportunity with excellent fundamentals and a competitive edge. The company’s health score and classification as a ‘gorilla’ indicate that it is well-positioned to provide long-term returns and stability to investors. More…

VI Peers

The company was founded in 2013 and is headquartered in San Diego, California. Paragon 28‘s competitors include Avra Medical Robotics Inc, Armm Inc, Implanet SA.

– Avra Medical Robotics Inc ($OTCPK:AVMR)

Avra Medical Robotics Inc is a medical technology company that focuses on the development and commercialization of robot-assisted surgery systems. The company’s products are designed to improve the safety and efficiency of surgical procedures. Avra Medical Robotics Inc has a market cap of 317.5k as of 2022, a Return on Equity of 231.87%. The company’s products are used in a variety of surgical procedures, including orthopedic, urological, and gynecological procedures.

– Armm Inc ($OTCPK:ARMM)

Implanet SA is a French company that designs, manufactures, and markets medical devices for orthopedic surgery. The company was founded in 2001 and has a market capitalization of 5.51 million as of 2022. The company’s return on equity is -114.56%.

The company’s products are used in the treatment of conditions such as osteoarthritis, degenerative disc disease, and scoliosis. The company’s products are sold in over 50 countries worldwide.

Summary

Paragon 28 has raised its revenue outlook for the fourth quarter and full year of 2022. This is likely due to the company’s successful investment strategies and growth potential. The company has also implemented several strategies to improve their operations and expand their reach, resulting in increased profits and revenue growth. As a result, Paragon 28 expects to see strong earnings in the coming quarters and years.

Recent Posts