State of Alaska Department of Revenue Sells 1202 Shares of Select Medical Holdings Co.

July 5, 2023

☀️Trending News

The State of Alaska Department of Revenue recently sold 1202 shares of Select Medical ($NYSE:SEM) Holdings Co. at Defense World. Select Medical Holdings Co. is a publicly traded company that specializes in providing post-acute healthcare services. It is known for its high-quality care, experienced and dedicated medical staff, and its commitment to providing excellent patient care.

Select Medical’s services include long-term acute care hospitals, rehabilitation hospitals, outpatient rehabilitation clinics, occupational health centers, and physical therapy centers. Its stock is traded on the New York Stock Exchange (NYSE) under the symbol SEM.

Earnings

Compared to previous year, there was a 3.3% decrease in total revenue and a 125.1% increase in net income. Over the last three years, SELECT MEDICAL‘s total revenue has grown from 1546.46M USD to 1664.98M USD. These figures demonstrate an overall positive trend for the company, indicating that SELECT MEDICAL is in a healthy financial state.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Select Medical. More…

| Total Revenues | Net Income | Net Margin |

| 6.4k | 174.14 | 2.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Select Medical. More…

| Operations | Investing | Financing |

| 329.93 | -240.07 | -137.04 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Select Medical. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.7k | 6.25k | 9.2 |

Key Ratios Snapshot

Some of the financial key ratios for Select Medical are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.9% | -2.7% | 7.5% |

| FCF Margin | ROE | ROA |

| 2.0% | 26.2% | 3.9% |

Share Price

At the opening bell, SELECT MEDICAL stock was priced at $31.4, however, following the sale, the stock dipped to close at $31.1 – a 2.3% decrease from its previous closing price of $31.9. This decrease led to a drop in market capitalization for the company as well. Live Quote…

Analysis

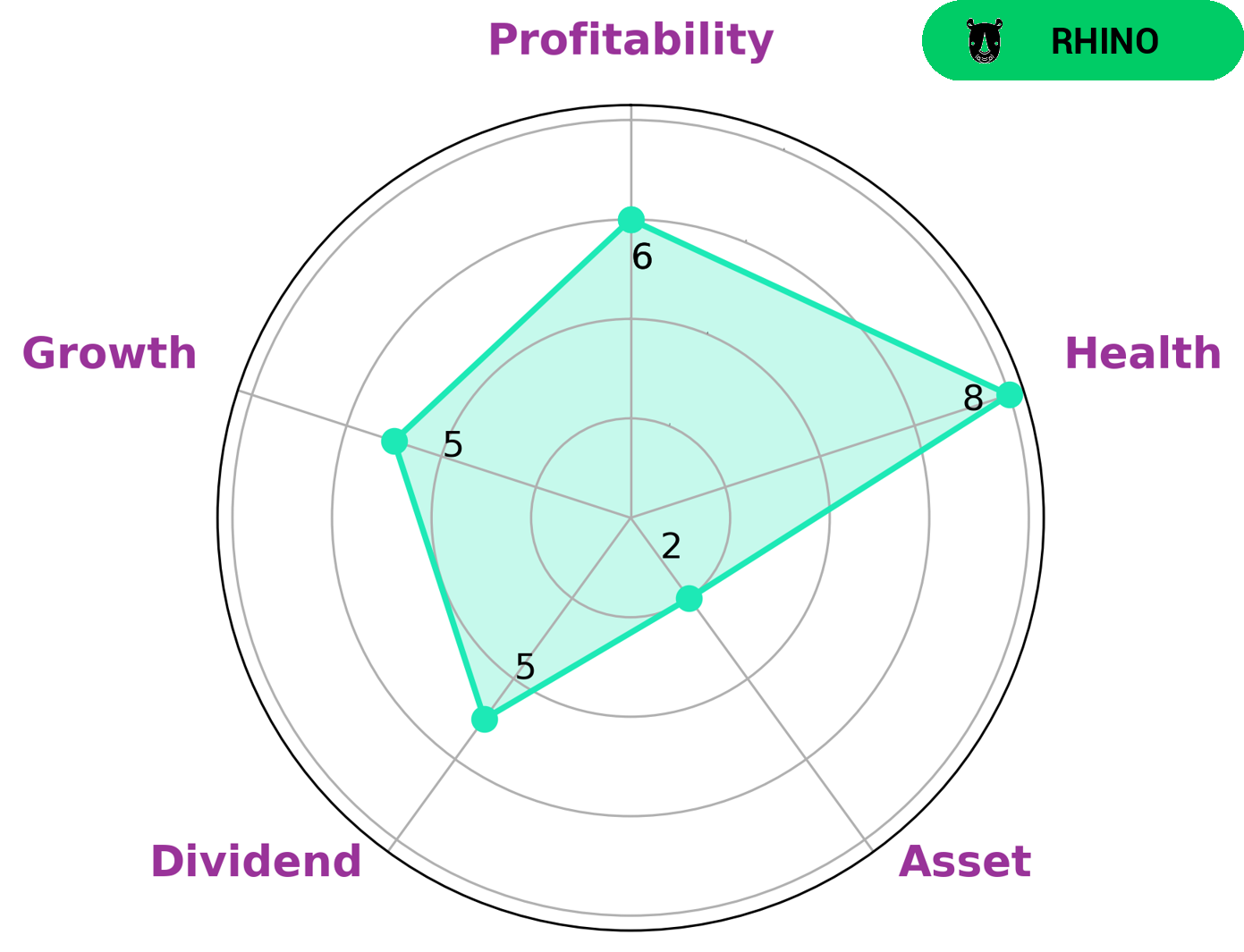

GoodWhale has conducted an analysis of SELECT MEDICAL‘s wellbeing and classified them as a ‘sloth’ company, meaning they have achieved revenue or earnings growth slower than the overall economy. We believe that investors looking for slow and steady returns may be interested in such a company. SELECT MEDICAL is strong in terms of its health score, which is 8/10 considering its cashflows and debt, and is capable to safely ride out any crisis without the risk of bankruptcy. However, it is medium in terms of dividend, profitability and weak in asset and growth. This could indicate a need for further long-term strategy to improve its financial performance. More…

Peers

The company’s competitors include Eukedos SpA, Med Life SA, Athens Medical Centre SA, and other similar companies.

– Eukedos SpA ($LTS:0Q8E)

Eukedos SpA is a pharmaceutical company that focuses on the development and commercialization of drugs for the treatment of rare diseases. The company has a market cap of 28.09M as of 2022 and a Return on Equity of 10.29%. Eukedos SpA is headquartered in Milan, Italy.

– Med Life SA ($LTS:0RO5)

MedLife SA is a publicly traded company with a market capitalization of 2B as of 2022. The company’s return on equity is 22.48%. MedLife SA is a leading provider of medical and healthcare services in South America. The company offers a full range of services including primary care, hospital care, specialty care, and behavioral health services. MedLife SA also has a strong presence in the insurance and managed care markets.

– Athens Medical Centre SA ($LTS:0ONM)

Athens Medical Centre SA is a medical company that operates in Greece. The company has a market cap of 117.53M as of 2022 and a return on equity of 18.02%. The company provides medical services and products to patients in Greece. Athens Medical Centre SA operates in the following segments: Medical Services, Medical Products, and Other. The Medical Services segment provides medical services to patients in Greece. The Medical Products segment provides medical products to patients in Greece. The Other segment includes activities such as real estate and investments.

Summary

Select Medical Holdings Co. is a leading operator of specialty hospitals, outpatient rehabilitation clinics, and occupational medicine centers in the United States. The State of Alaska Department of Revenue recently purchased 1202 shares of Select Medical, indicating that the company may be a strong investing option. Analysts point to strong growth in revenue, profits, and market share as well as a strong balance sheet as reasons for investing in this healthcare giant. The company’s current financial position shows increased liquidity and assets, strong cash flow, and a well-diversified portfolio of investments.

Select Medical also has a long track record of dividend payments and has been consistently rewarding its shareholders. With a strong management team, robust operations, and attractive growth opportunities, Select Medical looks like a great investment for the long term.

Recent Posts