Allegion PLC Stock Outperforms Market on Monday Rise.

February 2, 2023

Trending News 🌥️

On Monday, Allegion ($NYSE:ALLE) PLC stock outperformed the market, increasing significantly in value. Allegion PLC is a leading provider of security products and solutions, which are designed to protect people, property, and the world’s most valuable assets. The company offers a comprehensive range of products and services including door hardware, access control products, electronic locks, and safety products.

Additionally, Allegion PLC provides a range of services such as installation, maintenance, and training. It is one of the largest independent manufacturers and distributors of security products and solutions in the world. The company serves a wide range of markets including residential, commercial, institutional, and government customers. With its strong market presence and innovative product designs, Allegion PLC has been able to establish itself as a leader in the industry. The company has been consistently delivering strong financial results over the years. Its sales have grown steadily and profits have increased significantly. The company has also expanded into new markets such as China and India in recent years. In addition to its core business, Allegion PLC has also developed a range of technology-based products such as biometric readers and smart locks. The stock’s strong performance on Monday can be attributed to the company’s strong fundamentals and attractive valuation. Investors were also buoyed by the company’s strong outlook for the future as it continues to expand its operations into new markets. With its robust portfolio of products and services, Allegion PLC is well-positioned to capitalize on future growth opportunities.

Market Price

Allegion PLC, a global provider of security and safety products, saw its stock outperform the market on Monday. At the time of writing, news surrounding Allegion PLC was mostly neutral. On Monday, the stock opened at $113.4 and closed at $114.4, up 0.1% from its last closing price of $114.3. This slight increase was enough to outpace the broader market and put Allegion PLC in a good position going forward. The increase in stock price could be attributed to investors’ confidence in the company’s long-term prospects. Allegion PLC has a proven track record of providing quality products and services to its customers, which has resulted in a loyal customer base and consistent revenue growth over the years.

In addition, Allegion PLC has also been making strategic investments in new products and technologies which have improved its competitive edge in the market. Investors are also likely encouraged by the fact that Allegion PLC’s stock price has been relatively consistent over the past few months, indicating that the company is likely to remain in a good position in the near future. This predictability is attractive to investors, who can be confident that they are making a sound investment when investing in the company’s stock. Overall, Allegion PLC is in a good position after Monday’s rise in stock price, and investors are optimistic about the company’s future performance. The company’s consistent performance and strategic investments have made it an attractive option for investors looking for a reliable and long-term investment. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Allegion Plc. More…

| Total Revenues | Net Income | Net Margin |

| 3.12k | 435.5 | 14.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Allegion Plc. More…

| Operations | Investing | Financing |

| 399.3 | -982.6 | 386.1 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Allegion Plc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.94k | 3.15k | 9.01 |

Key Ratios Snapshot

Some of the financial key ratios for Allegion Plc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.2% | -1.3% | 18.1% |

| FCF Margin | ROE | ROA |

| 10.9% | 45.0% | 8.9% |

Analysis

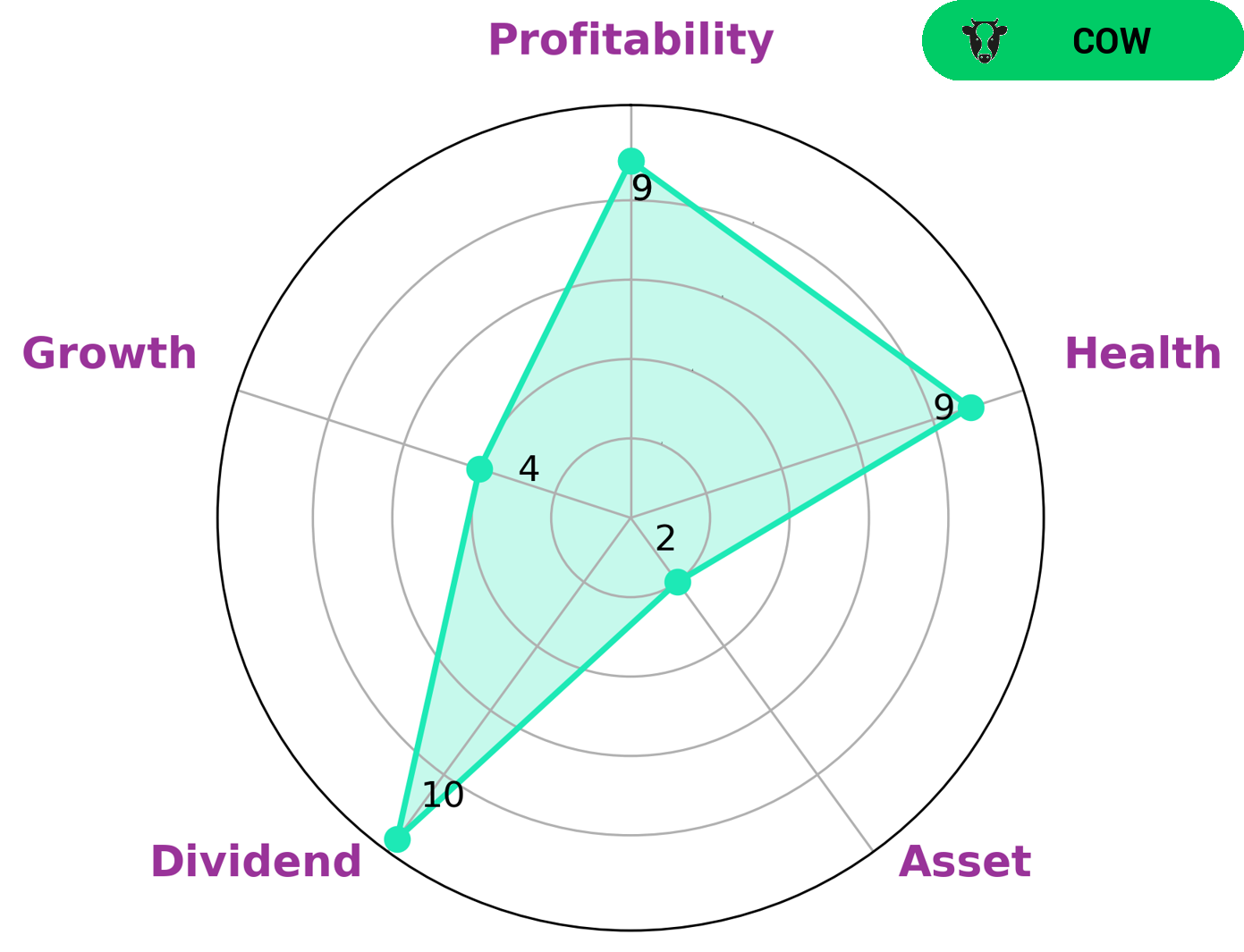

Investors looking to invest in companies with a track record of consistent and sustainable dividends may be interested in ALLEGION PLC. GoodWhale’s Star Chart classifies ALLEGION PLC as a ‘cow’, indicating its potential to generate consistent dividends over time. GoodWhale’s analysis of ALLEGION PLC’s financials reveals a strong dividend score, profitability score, and a high health score of 9/10 with regard to its cashflows and debt. This suggests that ALLEGION PLC is capable of paying off debt and funding future operations. However, the company does have a weak asset score, indicating that it may not have the resources needed for long-term growth. Overall, ALLEGION PLC offers investors a good balance between safety and growth. Its strong dividend and profitability scores make it an attractive option for income seekers, while its medium growth score offers some potential for capital appreciation. Investors should note, however, that ALLEGION PLC’s weak asset score could be a cause for concern in the future. More…

Peers

Its competitors include Perla Group International Inc, Powerlock International Corp, and Drone Guarder Inc. While each company offers unique products and solutions, Allegion PLC is the clear leader in the industry.

– Perla Group International Inc ($OTCPK:PERL)

Drone Guarder Inc. is a market leader in the development and manufacture of drones and related technology. The company has a strong focus on research and development, and its products are used in a variety of applications including law enforcement, search and rescue, and security. Drone Guarder Inc. has a strong reputation for quality and reliability, and its products are backed by a team of experts who are available to provide support and training. The company’s products are sold through a network of authorized dealers and distributors.

Summary

Investing in Allegion PLC (ALLE) can be an attractive option for investors as the company’s stock has seen an upward trend on Monday. Analysts have a largely neutral outlook, but the stock’s performance indicates a promising future ahead. Although the company’s fundamentals and financials should be considered before investing, the stock appears to have potential for growth. Investors should research further to gain a better understanding of the company’s financials and determine if Allegion PLC is a suitable investment for them.

Recent Posts