Wolfspeed Stock Fair Value Calculator – Wolfspeed Rides the Trend to Protect Profits

February 13, 2023

Trending News ☀️

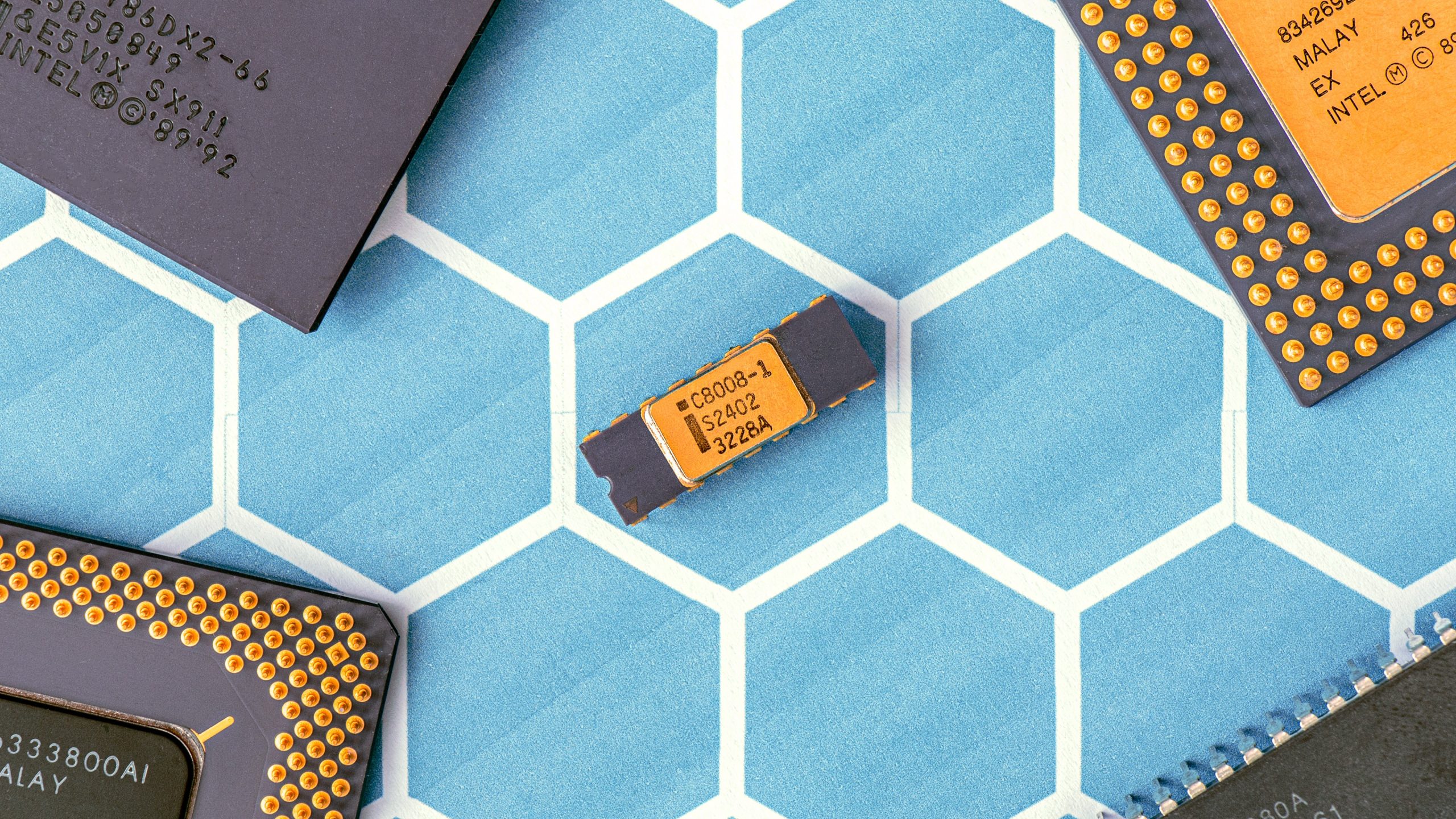

Wolfspeed Stock Fair Value Calculator – Wolfspeed ($NYSE:WOLF) Inc. is a leading provider of silicon carbide and gallium nitride semiconductor materials. They are at the forefront of chip technology, and are dedicated to providing powerful, efficient, and cost-effective solutions to their customers. As the demand for cutting-edge technology increases, Wolfspeed Inc. is looking to capitalize on the trend while also protecting their profits. Wolfspeed Inc.’s success is largely attributed to their ability to keep up with the ever-changing market and quickly adjust their strategy. They are constantly innovating and taking advantage of new opportunities in order to stay ahead of the competition. Wolfspeed Inc. has been successful in riding the wave of the current trend, remaining focused on the tasks at hand and developing innovative products and services in order to stay competitive. In order to protect their profits, Wolfspeed Inc. has also implemented strategies such as diversification and risk management. They have diversified their portfolio by investing in multiple sectors and actively managing their investments to minimize risks.

Additionally, they have established a strong financial foundation by creating a budget that factors in their current market position, expenses, and capital allocation plans. Furthermore, they have put in place a rigorous risk management system to ensure that they are continually monitoring their performance and making timely adjustments to their strategies. Overall, Wolfspeed Inc. has successfully managed to ride the wave of the current trend while also protecting their profits. Through creative strategies, diversification plans, and rigorous risk management practices, they have positioned themselves for success and are continuing to capitalize on the ever-changing market.

Share Price

Wolfspeed Inc. is riding the trend to protect profits, and at the time of writing, media coverage on the company appears to be overwhelmingly positive. On Thursday, Wolfspeed opened at $82.1 and closed at $81.9, a 1.6% increase from its previous close of $80.6. This is a good indication that the company is taking steps to ensure profits remain steady. Wolfspeed has been investing heavily in research and development in order to stay ahead of the competition in their industry. Their commitment to innovation has been paying off, as their products continue to be in high demand. The company has also been expanding its international presence, with more and more countries recognizing their products as superior to the competition. Wolfspeed’s success is also due to a savvy financial management strategy. The company has been able to capitalize on market trends, as well as its own strengths, in order to build a strong portfolio of investments that is consistently generating profits.

By investing in a variety of industries, Wolfspeed has been able to remain insulated against any potential downturns in the market. In addition to their financial management strategy, Wolfspeed has also been focusing on customer satisfaction. The company is constantly striving to provide the best possible products and services, in order to meet the needs of their customers. They have also been focusing on providing customers with accurate and reliable information, which has helped keep customer satisfaction levels high. Overall, Wolfspeed Inc. appears to be doing everything it can to protect its profits by staying ahead of the competition and taking advantage of market trends. Their strong financial management strategy and focus on customer satisfaction have allowed them to remain profitable and successful in an ever-changing market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Wolfspeed. More…

| Total Revenues | Net Income | Net Margin |

| 873.9 | -151.2 | -21.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Wolfspeed. More…

| Operations | Investing | Financing |

| -138.9 | -1.03k | 2.07k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Wolfspeed. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.34k | 3.56k | 14.31 |

Key Ratios Snapshot

Some of the financial key ratios for Wolfspeed are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -4.6% | -59.9% | -25.0% |

| FCF Margin | ROE | ROA |

| -71.6% | -7.0% | -2.6% |

Analysis – Wolfspeed Stock Fair Value Calculator

GoodWhale has conducted an analysis of WOLFSPEED‘s fundamentals, and have determined that its intrinsic value is around $97.1. This was calculated using GoodWhale’s proprietary Valuation Line. Currently, WOLFSPEED shares are traded at a price of $81.9, which is a 15.6% undervaluation. This suggests that there is potential for investors to generate returns if they purchase WOLFSPEED shares at their current price. Furthermore, if the company is successful in executing its current strategy, then there could be additional upside potential for investors as the share price trends closer to its intrinsic value. Ultimately, GoodWhale’s analysis suggests that WOLFSPEED’s stock may be an attractive investment opportunity given the current price. More…

Peers

The company’s products are used in a variety of applications, including cell phones, wireless infrastructure, and military and aerospace. Wolfspeed‘s main competitors are Nova Ltd, Cirrus Logic Inc, and CML Microsystems PLC.

– Nova Ltd ($NASDAQ:NVMI)

Nova Ltd is a large company with a market cap of 2.09B. It has a strong ROE of 25.44%. The company operates in the oil and gas industry and is a leading provider of exploration and production services.

– Cirrus Logic Inc ($NASDAQ:CRUS)

Cirrus Logic, Inc. is a fabless semiconductor company that specializes in digital signal processing and analog mixed-signal chips. It has a market cap of $3.79B and a ROE of 21.86%. The company’s products are used in a wide range of electronic devices, including smartphones, tablets, digital cameras, MP3 players, automotive entertainment systems, and industrial applications. Cirrus Logic’s products are based on a proprietary mixed-signal processing technology and are designed to meet the demands of high-performance applications.

– CML Microsystems PLC ($LSE:CML)

CML Microsystems PLC is a market leader in the design, development and manufacture of high performance analog and mixed-signal semiconductors. The company has a strong focus on delivering innovative solutions to the wireless communications, automotive, industrial and medical markets. CML Microsystems has a long history of profitability and has a strong balance sheet with no debt. The company’s shares are listed on the London Stock Exchange.

Summary

Wolfspeed Inc. is a great investment opportunity for those looking to benefit from the current trend. The company produces semiconductors for electric vehicles and other related electronics, making it well-positioned to take advantage of the growing demand for these products. At the time of writing, nearly all media coverage has been favorable and supportive of the company’s success, indicating that its current trajectory may continue. This makes it an ideal stock for investors looking to ride the trend and protect their profits.

Recent Posts