Targa Resources Intrinsic Value Calculation – State of Alaska Department of Revenue Boosts Investment in Targa Resources Corp. (NYSE:TRGP)

April 2, 2023

Trending News ☀️

The State of Alaska Department of Revenue has recently indicated an increased investment in Targa Resources ($NYSE:TRGP) Corp. (NYSE:TRGP). This move signals a solid endorsement of the company and its prospects. Targa Resources is a leading midstream energy company that provides transportation, storage and other services to customers in the U.S. natural gas industry. The company also possesses a comprehensive gas gathering system, which spans across five states in the United States.

The company is also well diversified, with operations in multiple markets and an experienced management team. It is this kind of performance that has attracted the attention of the State of Alaska Department of Revenue, and is likely to continue to draw investors in the future.

Price History

The news sent Targa’s stock soaring, with shares opening at $68.8 and closing at $69.8, up 3.4% from their previous closing price of $67.5. This is the latest sign of positive investor sentiment in Targa’s performance, as the company continues to benefit from increased demand for natural gas and its related infrastructure. The injection of capital from the State of Alaska Department of Revenue will further strengthen Targa’s balance sheet and provide additional funds for sustaining operational growth and creating new jobs in the region. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Targa Resources. More…

| Total Revenues | Net Income | Net Margin |

| 20.93k | 896.8 | 3.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Targa Resources. More…

| Operations | Investing | Financing |

| 2.38k | -4.15k | 1.83k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Targa Resources. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 19.56k | 14.58k | 11.79 |

Key Ratios Snapshot

Some of the financial key ratios for Targa Resources are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 34.1% | 58.3% | 10.1% |

| FCF Margin | ROE | ROA |

| 5.0% | 52.2% | 6.7% |

Analysis – Targa Resources Intrinsic Value Calculation

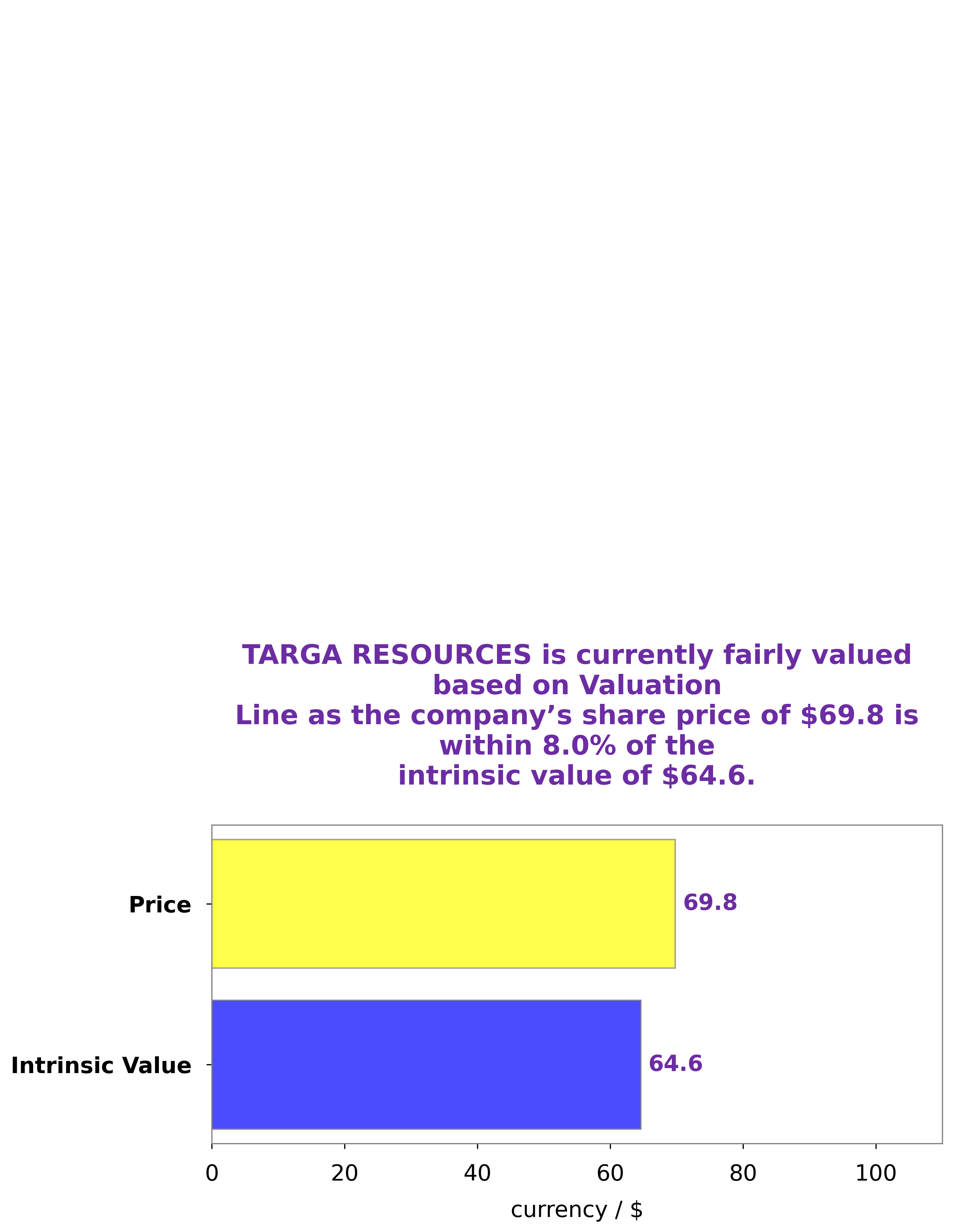

At GoodWhale, we have analyzed TARGA RESOURCES‘ wellbeing to determine its intrinsic value. Our proprietary Valuation Line has provided us with an estimated intrinsic value of TARGA RESOURCES’ share of approximately $64.6. Currently, the stock is trading at $69.8, which is a fair price that is slightly overvalued by 8.1%. Therefore, investors should be aware of this discrepancy and be mindful of the risk associated with investing in TARGA RESOURCES. More…

Peers

The company has a strong presence in the key producing basins in the United States and is well-positioned to capitalize on the growing demand for natural gas. Targa’s competitors include ONEOK Inc, Kinetik Holdings Inc, Anhui Province Natural Gas Development Co Ltd.

– ONEOK Inc ($NYSE:OKE)

ONEOK Inc is a leading midstream service provider in the United States. It has a market cap of 24.61B as of 2022 and a Return on Equity of 28.78%. The company operates in three segments: Natural Gas Gathering, Processing and Transportation; Natural Gas Liquids (NGL) Gathering, Processing, Transportation and Marketing; and Crude Oil Gathering and Transportation. ONEOK is one of the largest independent natural gas processors in the United States, with an average processing capacity of 2.6 billion cubic feet per day in 2020. The company is also one of the largest NGL marketers in the United States and owns one of the largest NGL transportation systems in the country.

– Kinetik Holdings Inc ($NASDAQ:KNTK)

Kinetik Holdings Inc is a publicly traded company with a market capitalization of $1.49 billion as of 2022. The company has a return on equity of 5.46%. Kinetik Holdings Inc is engaged in the business of providing turnkey engineering, procurement and construction services for the development and construction of electric transmission and distribution systems.

– Anhui Province Natural Gas Development Co Ltd ($SHSE:603689)

Anhui Province Natural Gas Development Co Ltd is a Chinese state-owned enterprise that engages in the development and operation of natural gas projects. The company has a market cap of 3.45 billion as of 2022 and a return on equity of 7.42%. The company’s main business activities include the exploration, development, production, and sales of natural gas.

Summary

Targa Resources Corp (NYSE:TRGP) saw a significant increase in its stock price on the same day that the State of Alaska Department of Revenue revealed a boost in its holdings. Analysts regard this as a positive development for the company, as it could indicate a renewed interest in the stock by institutional investors. Furthermore, the company’s strong balance sheet, robust cash flow, and attractive dividend yield may be further reasons for increased interest. All in all, Targa Resources seems to be a solid investment for those seeking both growth and income.

Recent Posts