SWK Intrinsic Value Calculator – Stanley Black & Decker Must Make Strategic Shifts to Reinvigorate Margin Growth

June 26, 2023

☀️Trending News

Stanley Black & Decker ($NYSE:SWK) (SWK) is a diversified industrial company that manufactures and markets power tools, security products, and storage solutions. In order to reinvigorate the company’s growth and return to previous performance levels, Stanley Black & Decker must make some strategic shifts in its operations. While the company’s revenue has increased over the past few years, this has not been reflected in their profitability. The company must find ways to reduce its production costs and make more efficient use of their resources in order to return to previous levels of margin growth. With the advent of new technologies and changing customer preferences, Stanley Black & Decker must invest in R&D efforts to develop new products and services that meet the needs of their customers.

This will help the company remain competitive in the market and ensure that they are able to capture new opportunities as they arise. The company must ensure that their products offer superior value compared to those of their competitors, so as to drive customer loyalty and attract new customers. To achieve this, Stanley Black & Decker must review their pricing strategies and ensure that their products are competitively priced while still providing customers with high-quality solutions. With focus on reducing costs, investing in innovation, and strengthening their value proposition, the company can reinvigorate its growth and capture new opportunities.

Share Price

On Tuesday, Stanley Black & Decker’s (SBD) stock opened at $79.2 and closed at $77.5, a decrease of 1.6% from its previous closing price of $78.7. This sharp drop in the stock price has made it increasingly evident that SBD must make strategic shifts in order to reinvigorate its margin growth. In order to successfully address this issue, Stanley Black & Decker will need to devise a comprehensive plan that focuses on cost reduction and efficiency improvement.

They will also need to consider new revenue sources, such as expanding their product portfolio and increasing their focus on international markets. By taking these steps, SBD can improve their margins and create a more profitable future for their company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for SWK. More…

| Total Revenues | Net Income | Net Margin |

| 16.43k | 699.4 | -0.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for SWK. More…

| Operations | Investing | Financing |

| -504.7 | 3.67k | -3.06k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for SWK. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 25.07k | 15.58k | 61.97 |

Key Ratios Snapshot

Some of the financial key ratios for SWK are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.9% | -40.8% | 0.5% |

| FCF Margin | ROE | ROA |

| -5.9% | 0.6% | 0.2% |

Analysis – SWK Intrinsic Value Calculator

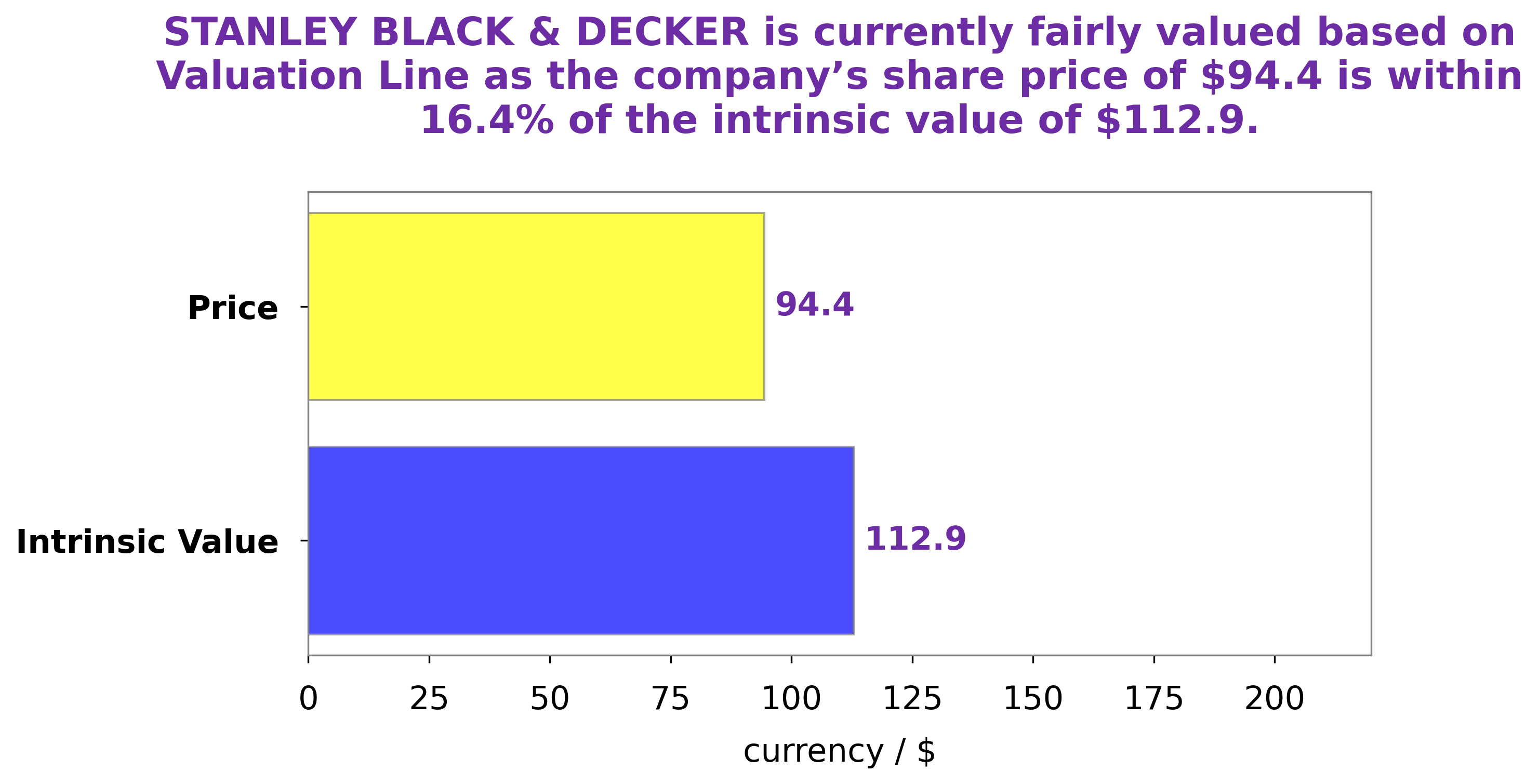

At GoodWhale, we recently analyzed the financials of STANLEY BLACK & DECKER. After our proprietary Valuation Line assessment, we found that the fair value of STANLEY BLACK & DECKER share is around $134.3. Unfortunately, at present, STANLEY BLACK & DECKER stock is traded at $77.5 – a discrepancy of 42.3%. This suggests that currently the stock is undervalued and could be a great investment opportunity. More…

Peers

In the business world, competition is inevitable. Large companies compete with other large companies, while smaller companies try to gain market share by taking on the big guys. Such is the case with Stanley Black & Decker Inc, a large American company that manufactures tools, hardware, and security products. Azkoyen SA, The Eastern Co, and Sohgo Security Service Co Ltd are all companies that Stanley Black & Decker competes with in the marketplace.

– Azkoyen SA ($LTS:0DOG)

Azkoyen SA is a Spanish company that manufactures vending machines and other related products. The company has a market cap of 142.86 million as of 2022 and a return on equity of 11.63%. Azkoyen was founded in 1947 and is headquartered in Vitoria-Gasteiz, Spain. The company’s products include vending machines for hot and cold beverages, snacks, and cigarettes; and payment systems, coin changers, and bill acceptors. Azkoyen also offers maintenance and repair services for its products.

– The Eastern Co ($NASDAQ:EML)

The Eastern Co is a publicly traded company with a market capitalization of 133.23M as of 2022. The company has a return on equity of 9.56%. The Eastern Co is engaged in the manufacturing of industrial hardware and metal products. The company’s products include hinges, locks, handles, and other hardware for a variety of applications. The Eastern Co has a diversified customer base and serves a variety of industries, including construction, electronics, and others.

– Sohgo Security Service Co Ltd ($TSE:2331)

Sohgo Security Service Co Ltd is a Japanese security company that provides security services to businesses and households. The company has a market cap of 366.47B as of 2022 and a return on equity of 9.44%. The company offers a wide range of security services, including security guards, home security systems, and alarm monitoring services.

Summary

Stanley Black & Decker is a leading global tools and storage company. Investment analysts suggest the company needs to focus on improving operating efficiency and cost management in order to revive margin growth. Strategies such as cost-cutting, increasing efficiency, and streamlining operations are being implemented to drive growth and profitability.

Additionally, the company is investing in new products and services to meet the changing demands of its consumers. Stanley Black & Decker is also focused on expanding its presence in emerging markets and investing in digital technologies to remain competitive in the global market. Investment analysts believe this strategy will help the company improve its financial performance in the future.

Recent Posts