Regal Rexnord Intrinsic Value Calculator – Regal Rexnord: Risky But Undervalued with Secular Growth Potential

May 26, 2023

Trending News ☀️

Regal Rexnord ($NYSE:RRX) is a relatively risky company, but one that is currently undervalued with potential for long-term growth. The company is a leading global industrial manufacturer and distributor of power transmission, motion control, and bearing solutions for a variety of industrial equipment. Regal Rexnord’s guidance suggests that it is well-positioned to benefit from secular growth trends that will drive demand for its products. The company has bolstered its competitive position in the industry through its strong portfolio of products and services, as well as its focus on innovation and R&D. Regal Rexnord is also an active acquirer, having completed five acquisitions over the last two years.

This strategy has helped the company strengthen its presence in key markets and expand its product offerings. Given its guidance and strategic initiatives, the company could be an attractive investment opportunity for those who are willing to take on the risks associated with investing in the industrial sector.

Stock Price

Regal Rexnord (REGX) has been one of the best performing stocks on the market recently, as it opened at $127.8 on Thursday and closed at $130.5, up by 2.7% from its prior closing price of 127.1. This makes REGX one of the most attractive investments of the moment. Despite this, many investors are still wary of investing in REGX due to its risky nature and uncertain future. The company has been faced with a number of challenges, such as increased competition in the market, changing customer preferences, and volatile commodity prices. Despite these issues, REGX is still considered a good investment for those looking for long-term growth potential.

REGX has been gaining traction in recent months due to its efforts to focus on a secular growth strategy. The company has invested heavily in research and development in order to stay ahead of the competition, as well as increased its presence in emerging markets. This has allowed the company to benefit from the increased demand for its products and services in these markets and capitalize on growth opportunities. Its long-term strategy should help to improve its performance over time and make it a more attractive investment option for those looking to diversify their portfolio. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Regal Rexnord. More…

| Total Revenues | Net Income | Net Margin |

| 5.14k | 357.4 | 7.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Regal Rexnord. More…

| Operations | Investing | Financing |

| 548.3 | -4.93k | 4.93k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Regal Rexnord. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 16.55k | 10.09k | 96.91 |

Key Ratios Snapshot

Some of the financial key ratios for Regal Rexnord are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 18.2% | 25.5% | 12.3% |

| FCF Margin | ROE | ROA |

| 8.9% | 6.2% | 2.4% |

Analysis – Regal Rexnord Intrinsic Value Calculator

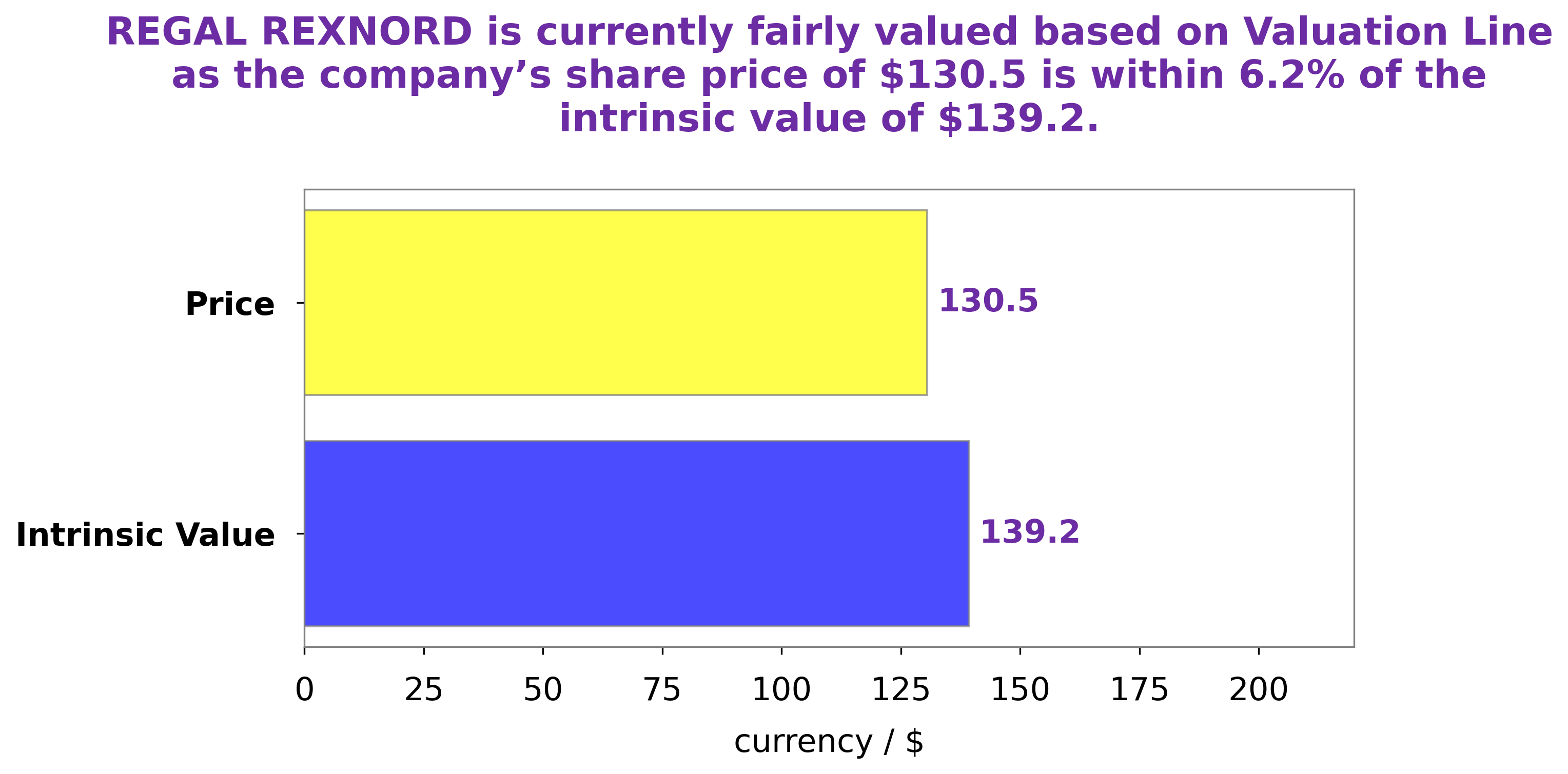

At GoodWhale, we thoroughly analyze and assess the financials of REGAL REXNORD. Through our proprietary Valuation Line, we estimate the intrinsic value of REGAL REXNORD share to be around $139.2. Currently, REGAL REXNORD stock is traded at $130.5, which is slightly undervalued by 6.3%. This means that investors have the opportunity to buy a quality share at a fair price. More…

Peers

The company’s products are used in a variety of industries, including aerospace, defense, transportation, and industrial. Rexnord is a publicly traded company, and its shares are listed on the New York Stock Exchange. The company has a market capitalization of approximately $3 billion. Rexnord’s competitors include Estun Automation Co Ltd, Parker Hannifin Corp, and R Stahl AG.

– Estun Automation Co Ltd ($SZSE:002747)

Estun Automation Co Ltd is a company that manufactures and sells automation equipment. The company has a market cap of 17.8B as of 2022 and a return on equity of 6.3%. The company’s products are used in a variety of industries, including automotive, aerospace, and electronics. Estun Automation Co Ltd is a publicly traded company listed on the Shenzhen Stock Exchange.

– Parker Hannifin Corp ($NYSE:PH)

Parker Hannifin Corp is a manufacturer of motion and control technologies. Its products include hydraulic, pneumatic, and electromechanical systems and components. The company has a market cap of $33.39 billion and a return on equity of 13.12%.

– R Stahl AG ($LTS:0Q9C)

Founded in 1883, thyssenkrupp AG is a German multinational conglomerate with businesses in a wide range of sectors, including automotive, elevators, industrial services, materials, and shipbuilding. The company has a market capitalization of €70.2 billion as of 2022 and a return on equity of -1.36%. thyssenkrupp AG is headquartered in Essen, Germany.

Summary

Investors looking for value investments should take a closer look at Regal Rexnord. Despite its lower-than-average profitability, the company’s guidance, secular growth prospects and conservative balance sheet suggest it may be undervalued. Specifically, the company’s management has indicated that it aims to significantly improve margins and earnings in the near-term, while its strong cash flows and low debt levels point to a well-managed balance sheet. This makes Regal Rexnord an attractive investment opportunity for those willing to accept some additional risk in exchange for potential upside.

Recent Posts