Livent Corporation Intrinsic Stock Value – Livent Corporation Reports Record-Breaking Quarter with Non-GAAP EPS and Revenue Growth

May 4, 2023

Trending News ☀️

Livent Corporation ($NYSE:LTHM) is a leading producer of lithium compounds used to manufacture a variety of products. The company’s recent quarter has been a record-breaking one, with Non-GAAP EPS and revenue growth surpassing expectations. Livent reported Non-GAAP EPS of $0.60, which was $0.22 higher than expected and generated a total revenue of $253.5M, $23.56M higher than forecast. The impressive results have been attributed to the growing demand for lithium products in the energy storage and electric vehicle sectors, as well as the company’s expansion into new markets around the world.

Additionally, Livent’s cost-cutting initiatives and innovative technologies have allowed them to remain competitive in the ever-changing marketplace. Livent’s strong results from the past quarter demonstrate their ability to continue to grow and stay ahead of the competition. The company is well-positioned to take advantage of any potential opportunities in the future and continue to deliver strong financial results for its shareholders.

Earnings

LIVENT CORPORATION reported a record-breaking quarter in its earning report of FY2022 Q4 ending December 31 2022. The company earned a total revenue of 219.4M USD, with a net income of 82.7M USD. This is an impressive 78.5% increase in total revenue compared to the previous year. Furthermore, over the last three years, the company’s total revenue has grown from 82.2M USD to 219.4M USD.

This is a testament to the company’s dedication and commitment to providing quality products and services to its customers. It appears that LIVENT CORPORATION is going from strength to strength in terms of both revenue and profits.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Livent Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 813.2 | 273.5 | 34.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Livent Corporation. More…

| Operations | Investing | Financing |

| 454.7 | -364.7 | -12.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Livent Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.07k | 631.2 | 8.04 |

Key Ratios Snapshot

Some of the financial key ratios for Livent Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 27.9% | 67.7% | 41.2% |

| FCF Margin | ROE | ROA |

| 14.5% | 15.0% | 10.1% |

Market Price

The stock opened at $20.6 on Tuesday and closed at $21.0, up 0.6% from its previous closing price of $20.9. This marks the company’s fourth consecutive quarter of revenue and profit growth. The company credited the success to their innovative product lines and strong sales performance in both domestic and international markets. Despite facing a challenging overall macroeconomic environment, the company was able to maintain a strong balance sheet, with positive cash flow from operations. LIVENT CORPORATION also announced plans to invest in marketing and research and development efforts to further drive growth in the near term.

The company’s strategic investments in digital transformation initiatives are also expected to benefit its overall performance in the coming quarters. Overall, the company’s impressive quarter results point to a bright future ahead, and investors have responded positively to the news with a 0.6% increase in stock price. Live Quote…

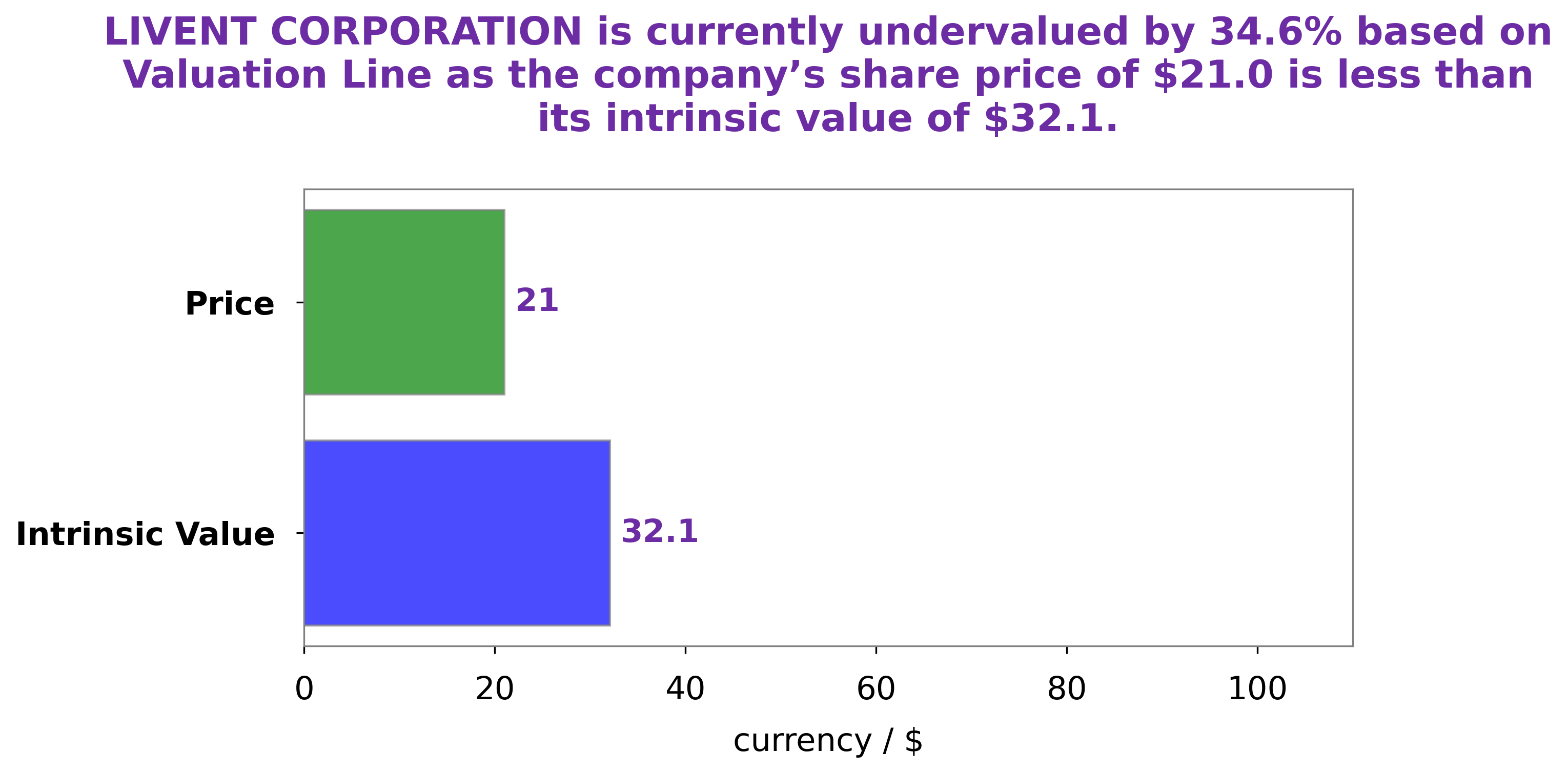

Analysis – Livent Corporation Intrinsic Stock Value

We at GoodWhale have conducted an in-depth analysis of LIVENT CORPORATION‘s fundamentals. Through our proprietary Valuation Line, we estimate the fair value of LIVENT CORPORATION to be around $32.1. Yet, it is currently being traded at $21.0, meaning that the stock is undervalued by 34.5%. As such, investors may have the opportunity to benefit from buying the stock at a discounted price. More…

Peers

The lithium market is currently dominated by four major companies: Livent Corp, Albemarle Corp, Tianqi Lithium Industries Inc, and Ganfeng Lithium Co Ltd. These companies are in a constant state of competition with each other in order to maintain their respective market shares. The competition between these companies is fierce, and it is not likely to abate anytime soon.

– Albemarle Corp ($NYSE:ALB)

Albemarle Corporation is a publicly traded corporation headquartered in Charlotte, North Carolina that produces specialty chemicals. The company was founded in 1994 and has over 5,000 employees. Albemarle is a global leader in the production of lithium, bromine, and catalysts. The company has a market capitalization of over $31 billion and a return on equity of 2.69%. Albemarle is a publicly traded company on the New York Stock Exchange under the ticker symbol ALB.

– Tianqi Lithium Industries Inc ($SZSE:002466)

Tianqi Lithium Industries is a Chinese chemical company that produces lithium compounds. It is the world’s largest producer of lithium chemicals. The company has a market capitalization of $136.76 billion as of 2022 and a return on equity of 61.7%. Tianqi Lithium Industries produces a range of lithium compounds, including lithium carbonate, lithium hydroxide, and lithium chloride. The company is a major supplier of lithium to the electric vehicle industry.

– Ganfeng Lithium Co Ltd ($SZSE:002460)

Ganfeng Lithium Co Ltd is a leading producer of lithium. The company has a market capitalization of 144.54 billion as of 2022 and a return on equity of 28.99%. Ganfeng Lithium is a vertically integrated producer of lithium, with operations spanning mining, refining, and production of lithium chemicals. The company has a strong presence in the global lithium market, with a significant market share in China, the world’s largest lithium market.

Summary

Livent Corporation is a specialty chemical company that focuses on the production and sale of lithium-ion batteries and related products. Livent reported earnings per share (EPS) of $0.60, which was $0.22 higher than expected, and revenue of $253.5 million, which beat estimates by $23.56 million. The strong results were driven by strong performance in all segments of its business as well as increased demand for its products and services.

The company’s stock price rose significantly on the news, indicating investor sentiment for the company is positive. Livent is well-positioned to capitalize on the growing demand for lithium-ion batteries and the company remains optimistic about the future.

Recent Posts