JACK Intrinsic Value – Loop Capital Predicts strong sales Growth for Jack in the Box

April 1, 2023

Trending News ☀️

Loop Capital recently announced their forecast of strong sales growth for Jack ($NASDAQ:JACK) in the Box, subsequently initiating them at Buy. The chain primarily operates as a drive-thru chain, and has recently expanded to offering delivery and curbside pick-up options as well. With the current pandemic forcing more people to turn to delivery options, Jack in the Box is anticipating a surge in sales from their delivery services. Additionally, the company is actively investing in digital marketing and advertising, which analysts believe will lead to increased brand recognition and higher sales.

Stock Price

The firm’s analysis showed that JACK IN THE BOX stock opened at $86.0 and closed at $87.6, up by 3.3% from prior closing price of 84.8. This news caused a surge in optimism among investors, driving the stock prices to new heights. This positive prediction has many analysts believing that JACK IN THE BOX will become a strong competitor in the fast-food industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for JACK. More…

| Total Revenues | Net Income | Net Margin |

| 1.65k | 129.76 | 7.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for JACK. More…

| Operations | Investing | Financing |

| 191.3 | -556.07 | 457.92 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for JACK. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.91k | 3.61k | -34.13 |

Key Ratios Snapshot

Some of the financial key ratios for JACK are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 19.5% | 10.5% | 16.6% |

| FCF Margin | ROE | ROA |

| 7.9% | -23.8% | 5.9% |

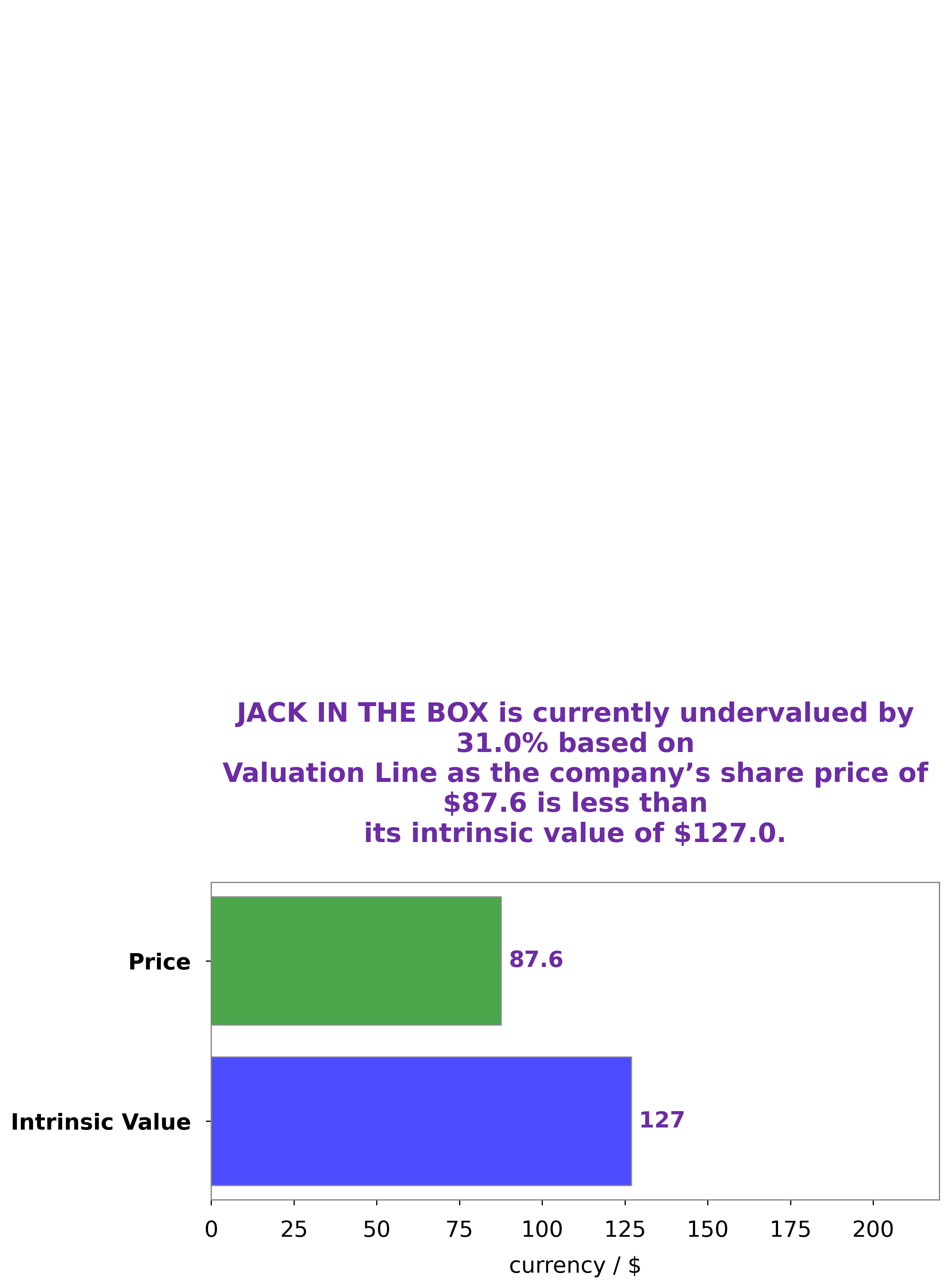

Analysis – JACK Intrinsic Value

At GoodWhale, we recently conducted an analysis of JACK IN THE BOX’s wellbeing. After extensive research and evaluation, our proprietary Valuation Line gave us an intrinsic value of JACK IN THE BOX shares of approximately $127.0. However, the stock is currently being traded at $87.6, creating an undervalued opportunity of 31.0%. This could be an interesting option for investors looking for a potential long-term gain. More…

Peers

In the fast food industry, there is always competition between different companies. Two of the biggest competitors in this industry are Jack in the Box Inc. and Amrest Holdings SE. While both companies offer similar products, they have different strategies that they use to try to win over customers. For example, Jack in the Box Inc. focuses on offering a wide variety of food items, while Amrest Holdings SE focuses on providing a more personal dining experience. Ultimately, it is up to the customer to decide which company they prefer.

– Amrest Holdings SE ($LTS:0OGQ)

Amrest Holdings SE is a holding company that operates in the restaurant industry. It has a market cap of 4.01B as of 2022 and a return on equity of 14.44%. The company operates through two segments: restaurants and other. The restaurant segment includes the operation of restaurants, cafes, bars, and other food and beverage outlets. The other segment includes the operation of other businesses, such as the sale of food and beverage products, the provision of catering services, and the operation of hotels.

– Create Restaurants Holdings Inc ($TSE:3387)

Restaurants Holdings Inc is one of the world’s largest restaurant chains, with over 36,000 locations in over 100 countries. The company has a market cap of 191.66B as of 2022 and a ROE of 12.73%. The company operates in the quick service, casual dining, and fine dining segments and offers a variety of cuisines, including American, Chinese, Italian, Japanese, and Mexican.

– Mos Food Service Inc ($TSE:8153)

In 2022, Sysco’s market cap was $96.21 billion and its ROE was 5.34%. Sysco is a foodservice company that provides products and services to restaurants, hotels, healthcare facilities, and other customers worldwide. Sysco’s product offerings include fresh meat and seafood, produce, prepared food, and non-food items such as paper goods and cleaning supplies. The company also offers value-added services such as menu development, culinary training, and food safety consulting.

Summary

Investors appear to be bullish on Jack in the Box, as Loop Capital recently upgraded their ratings on the stock. This upgrade comes after strong sales results, which have caused the stock price to increase. Analysts are optimistic that Jack in the Box will continue to perform well, due to its strong brand recognition, wide product selection, and competitive pricing.

The company has a strong focus on value, and provides quality products and convenient locations which further boost their competitive edge. Investors should remain cognizant of Jack in the Box’s results and updates from Loop Capital in order to remain informed of any potential changes in their outlook on the stock.

Recent Posts