Icu Medical Intrinsic Stock Value – Rally in ICU Medical Stock Prompts Revisiting of Investment Thesis, Challenges to Profit Growth Clearly Identifiable

June 24, 2023

☀️Trending News

ICU ($NASDAQ:ICUI) Medical Inc. is a publicly traded medical device company that specializes in developing, manufacturing and distributing intravenous (IV) therapy products and services. Recently, the stock has been rallying, prompting a re-evaluation of the investment thesis. One of the primary challenges to ICU Medical‘s profit growth is the competitive landscape. The market is highly competitive, with several major players vying for market share. In addition, the company has faced pricing pressures due to increased competition from generic manufacturers, leading to decreased revenue and profitability. Another challenge to ICU Medical’s profit growth is their reliance on certain key suppliers. In order to remain competitive, the company must maintain a strong relationship with their suppliers in order to ensure timely delivery of components and materials.

However, a disruption in the supply chain could significantly impact profits. Finally, ICU Medical has come under increasing pressure from government regulations. These regulations can cause delays in product launches and limit the potential market size for certain products. As such, the company must remain vigilant in order to ensure compliance with all applicable regulations. The competitive landscape, supply chain disruptions and government regulations all present significant risks to the company’s profitability. Investors must weigh these risks carefully when making decisions about ICU Medical’s stock.

Market Price

Thursday marked a notable rally in ICU MEDICAL stock, with the stock opening at $185.4 and closing at $188.8, up 1.5% from the prior closing price of 186.0. As ICU MEDICAL conducts its operations, it is subject to a range of market and economic changes that affect its ability to generate profits. In particular, the company faces increasing competition in the medical industry which has hindered its ability to increase profits year over year. Moreover, rising costs of supplies, overhead expenses, and wages have weighed on ICU MEDICAL’s ability to pass on cost savings to its customers.

As such, investors are presented with an opportunity to reevaluate their stance on ICU MEDICAL stock. While the current rally in share prices may be encouraging, investors must take into account the various factors that could impede the company’s ability to generate profits in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Icu Medical. More…

| Total Revenues | Net Income | Net Margin |

| 2.31k | -46.03 | -1.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Icu Medical. More…

| Operations | Investing | Financing |

| -19.54 | -56.9 | -27.72 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Icu Medical. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.47k | 2.37k | 87.29 |

Key Ratios Snapshot

Some of the financial key ratios for Icu Medical are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 22.2% | -43.0% | 0.3% |

| FCF Margin | ROE | ROA |

| -4.8% | 0.2% | 0.1% |

Analysis – Icu Medical Intrinsic Stock Value

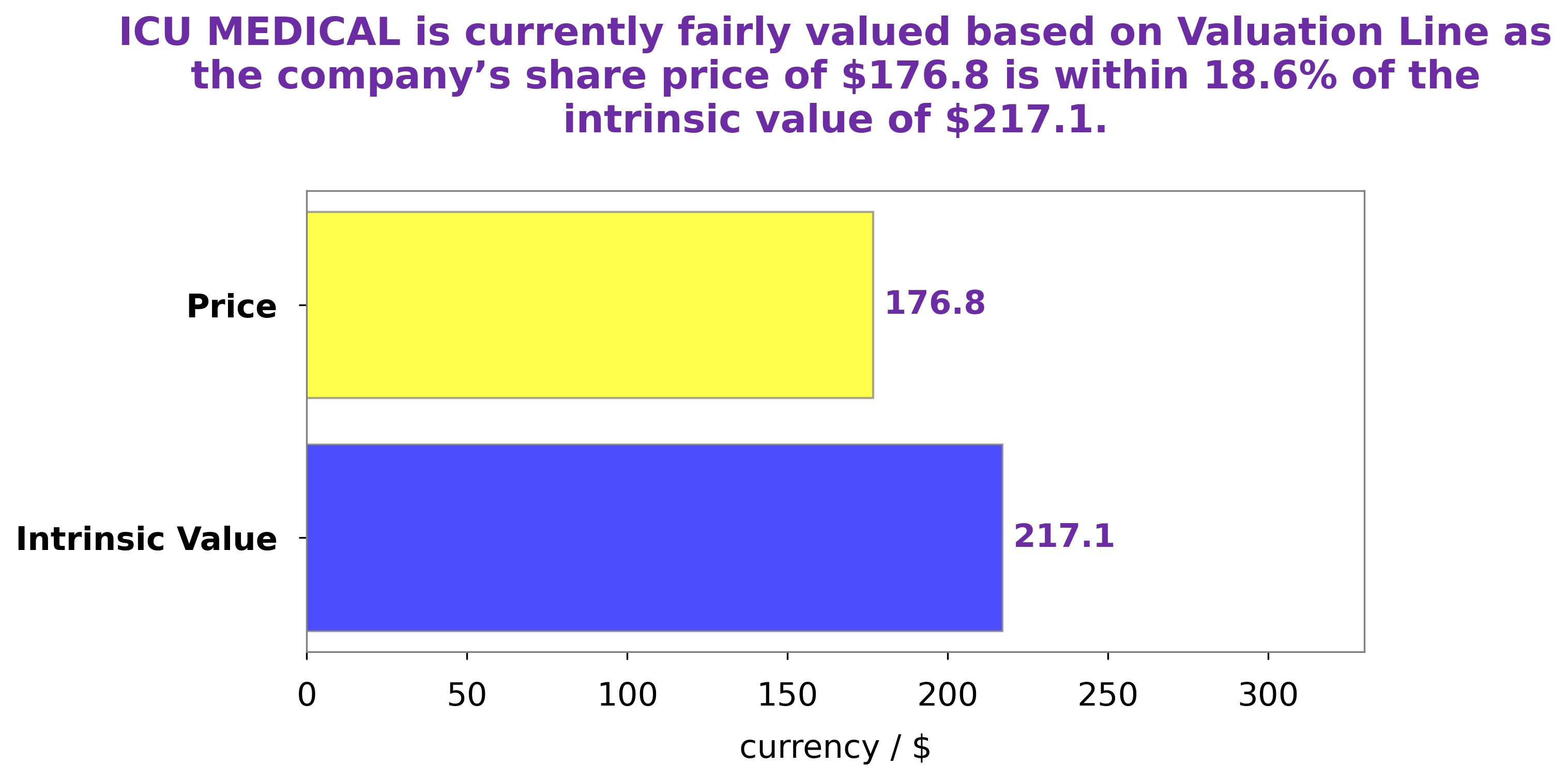

As GoodWhale, we have conducted a financial analysis of ICU MEDICAL. After our proprietary Valuation Line, our fair value of ICU MEDICAL shares is estimated to be around $269.2. This presents an investment opportunity for investors who are looking to diversify their portfolios with reliable financials. It is also an ideal stock for long-term investments as ICU MEDICAL has demonstrated solid financial performance and has a good outlook for the future. More…

Peers

It operates in a highly competitive market that includes major competitors such as Ypsomed Holding AG, Coloplast A/S, and Cardiovascular Systems Inc. These companies all strive to provide the best quality products and services to meet the needs of their customers.

– Ypsomed Holding AG ($LTS:0QLQ)

Ypsomed Holding AG is a leading Swiss medical technology company that designs, develops, and manufactures healthcare products for delivery of drugs and other treatments. The company has a market capitalization of 2.34 billion as of 2022, reflecting the confidence of investors in the company’s potential and its ability to grow in the coming years. Ypsomed Holding AG also has a Return on Equity of 4.93%, which is a measure of the company’s profitability relative to its shareholders’ equity. This indicates that the company is using its resources efficiently and delivering value to its shareholders.

– Coloplast A/S ($LTS:0QBO)

Coloplast A/S is a Danish medical device company that develops, manufactures, and markets medical products and services worldwide. The company has a market cap of 183.14B as of 2022 and a Return on Equity (ROE) of 50.58%. The market cap is an indication of the overall size of the company and its potential to generate profits. A high ROE indicates that the company is able to generate a significant return on the invested capital, making it an attractive investment. Coloplast is known for its products and services in the areas of urology, continence care, ostomy care, and wound and skin care, which have helped to ensure the company’s continued success.

– Cardiovascular Systems Inc ($NASDAQ:CSII)

Cardiovascular Systems Inc is a medical device company that develops, manufactures, and markets innovative interventional treatment systems for peripheral and coronary artery disease. The company has a market cap of 576.3M as of 2022 and a Return on Equity of -9.45%. This indicates that the company is not generating enough profits to cover its costs, which is not a good sign for the investors. Despite this, the company continues to innovate and develop new products in order to improve its financial performance.

Summary

Investors interested in ICU Medical should be aware that the company has seen a significant rally since the last publication of its financials. Despite this, potential profits are not guaranteed and a close analysis of the company’s finances and operations should be undertaken to identify any risks or areas of opportunity. The critical areas to investigate include earnings growth, cost control, and competitive positioning.

An investor should also consider the potential effects of macroeconomic trends on the company’s operations. Ultimately, by taking a close look at the company’s fundamentals, an investor will gain a better understanding of its performance and can make an informed decision about investing in ICU Medical.

Recent Posts