Gitlab Inc Stock Fair Value Calculator – GitLab’s Valuation and Growth Prospects Take a Hit

April 21, 2023

Trending News ☀️

GITLAB ($NASDAQ:GTLB): GitLab Inc., the software development platform, has seen its valuation and growth prospects take a hit in recent weeks. This drop has caused investors to reassess their expectations for the company and its potential for future growth. GitLab Inc. is an open-source platform for creating, managing, and deploying code. It offers a unified platform for developers to collaborate and work together on projects. In addition to this, GitLab also provides services for continuous integration, testing, and deployment of applications.

It has become a popular choice for many organizations due to its robust features and ease of use. Despite this impressive performance, its stock has been hit hard due to concerns over its ability to maintain its growth trajectory in a post-pandemic world. In order to boost its valuation and growth prospects, GitLab will need to showcase its ability to continue to build upon its current success. While there have been some positive signs of progress in recent months, it will ultimately be up to the company to convince investors that it can remain a leader in the industry going forward.

Stock Price

GitLab Inc, a provider of DevOps solutions, took a hit to its valuation and growth prospects on Thursday as its stock opened at $32.4 and closed at $32.5, down by 1.4% from its previous closing price of 33.0. These developments have not been enough to prevent the stock’s current slump, however, and investors have grown increasingly concerned about GitLab’s ability to continue its growth trajectory in the face of stiff competition from other DevOps providers. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Gitlab Inc. More…

| Total Revenues | Net Income | Net Margin |

| 424.34 | -172.31 | -40.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Gitlab Inc. More…

| Operations | Investing | Financing |

| -77.41 | -605.69 | 97.48 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Gitlab Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.17k | 344.48 | 5.1 |

Key Ratios Snapshot

Some of the financial key ratios for Gitlab Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 73.5% | – | -49.8% |

| FCF Margin | ROE | ROA |

| -19.7% | -17.2% | -11.3% |

Analysis – Gitlab Inc Stock Fair Value Calculator

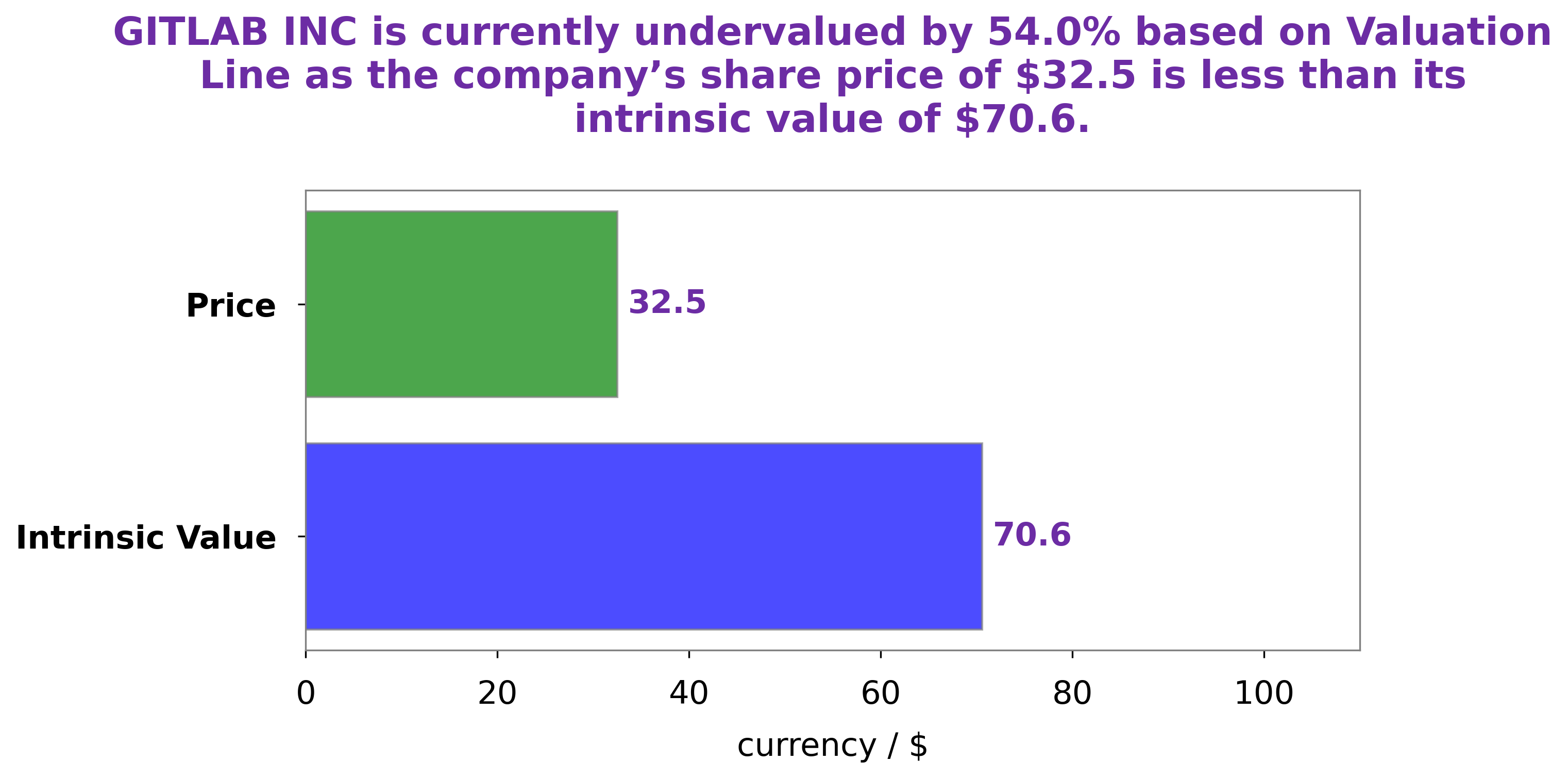

At GoodWhale, we have conducted an in-depth analysis of GITLAB INC‘s fundamentals to better understand the company’s value. After careful consideration, our proprietary Valuation Line indicates that the fair value of GITLAB INC’s share is approximately $70.6. Currently, GITLAB INC is trading for $32.5, which is 54.0% lower than the fair value, making it a very attractive buying opportunity. More…

Peers

Its competitors are ATTRAQT Group PLC, UserTesting Inc, and Tymlez Group Ltd.

– ATTRAQT Group PLC ($LSE:ATQT)

FATRAQT Group PLC is a publicly traded company with a market capitalization of 60.47 million as of 2022. The company has a return on equity of -7.65%. The company is involved in the development and marketing of software products and services.

– UserTesting Inc ($NYSE:USER)

UserTesting Inc is a publicly traded company with a market capitalization of 1.07 billion as of 2022. The company has a return on equity of -27.62%. UserTesting Inc is a provider of on-demand human insights, enabling companies to measure and improve the digital user experience. The company was founded in 2007 and is headquartered in San Francisco, California.

– Tymlez Group Ltd ($ASX:TYM)

Tymlez Group Ltd is a technology company that provides enterprise software solutions. The company has a market cap of 19.79M and a Return on Equity of -82.23%. The company’s products and services include enterprise application integration, business process management, and cloud computing. Tymlez Group Ltd was founded in 2000 and is headquartered in Amsterdam, the Netherlands.

Summary

Investing in GitLab Inc. comes with lower expectations than in the past. Growth projections are much lower than what was previously anticipated due to the competitive landscape and a shift in the company’s focus. Financial analysts are recommending that investors should be conservative when evaluating the stock, as there is significant risk involved. The stock is presently trading at a favorable price-to-earnings ratio and offers a good dividend yield.

However, any potential capital gains may be limited due to the company’s limited growth prospects. Investors should also consider their options carefully, as the stock may not perform as expected and could ultimately lead to losses.

Recent Posts