Davita Inc Intrinsic Value Calculation – DaVita HealthCare Partners Reports Record Profit and Revenue

May 10, 2023

Trending News ☀️

DAVITA ($NYSE:DVA): DaVita HealthCare Partners, Inc. is a leading provider of kidney care services in the US, offering dialysis and related products and services to patients with end-stage renal disease (ESRD). Its Non-GAAP EPS of $1.58 exceeded expectations by $0.36, while revenue of $2.87B surpassed estimates by $30M. This strong performance was driven by a number of factors, including strong performance in its core dialysis business, higher volumes of dialysis treatments, and the successful integration of its recent acquisitions. DaVita HealthCare Partners also recorded higher net income as a result of improved operating efficiency and lower costs. The company is also investing in technology and innovation to improve patient outcomes and provide more personalized care.

In addition to its core dialysis services, DaVita HealthCare Partners also offers a range of other health care services such as vascular access management, home dialysis services, and nutrition counseling. It has also expanded into the areas of chronic kidney disease management, value-based care, and artificial intelligence-based solutions. With its investments in technology, innovation, and its focus on providing personalized care, the company is well-positioned for continued growth and success.

Earnings

DaVita HealthCare Partners reported record profit and revenue for FY2022 Q4, ending December 31 2022. The company earned 2916.89M USD in total revenue and 68.1M USD in net income, representing a 0.9% decrease in total revenue and a 63.7% decrease in net income compared to the previous year. However, despite the decrease in profit and revenue compared to the previous year, DAVITA INC‘s total revenue showed a steady increase over the past 3 years, increasing from 2905.32M USD to 2916.89M USD.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Davita Inc. More…

| Total Revenues | Net Income | Net Margin |

| 11.61k | 560.4 | 4.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Davita Inc. More…

| Operations | Investing | Financing |

| 1.56k | -630.35 | -1.12k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Davita Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 16.93k | 14.7k | 5.91 |

Key Ratios Snapshot

Some of the financial key ratios for Davita Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.6% | -9.2% | 11.4% |

| FCF Margin | ROE | ROA |

| 8.3% | 132.9% | 4.9% |

Market Price

As a result, the company’s stock opened on Monday at $88.0 and closed at $89.2, a 0.8% increase from the prior closing price of 88.5. Live Quote…

Analysis – Davita Inc Intrinsic Value Calculation

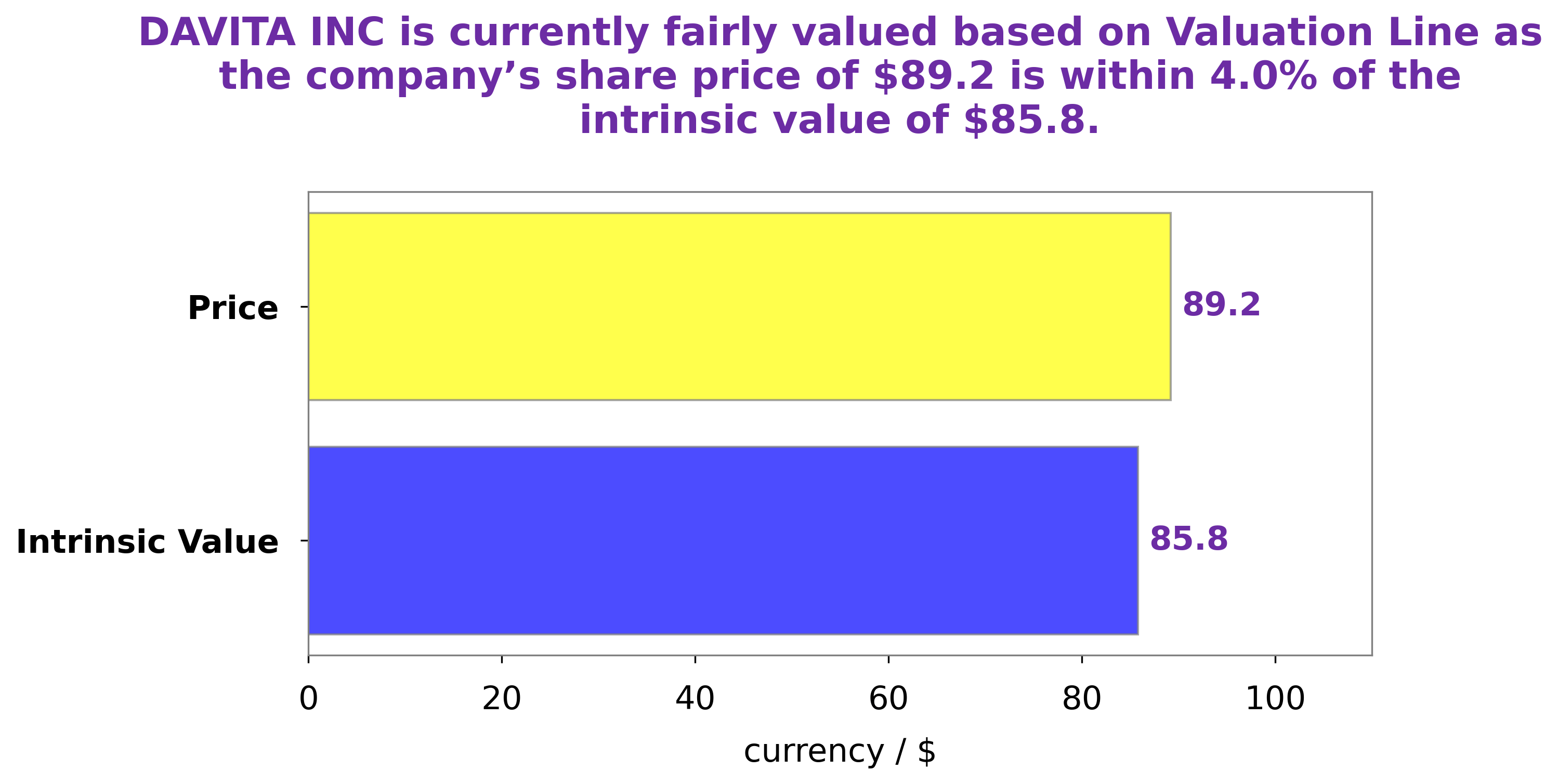

At GoodWhale, we have analyzed DAVITA INC‘s wellbeing and determined its intrinsic value to be around $85.8. This was calculated using our proprietary Valuation Line, which takes into account factors such as earnings, assets, and industry standards. Currently, DAVITA INC stock is being traded at $89.2, which is a fair price but slightly overvalued by 3.9%. We recommend that investors watch the stock closely in the coming weeks and be prepared to act when the time is right. More…

Peers

In the dialysis industry, DaVita Inc. competes with Acadia Healthcare Co Inc, Fresenius Medical Care AG & Co. KGaA, Medical Facilities Corp, and other companies. The company has a network of 2,664 outpatient dialysis centers in the United States that serve approximately 198,000 patients with end-stage renal disease.

– Acadia Healthcare Co Inc ($NASDAQ:ACHC)

Acadia Healthcare Company, Inc. is a provider of behavioral healthcare services. It operates a network of behavioral healthcare facilities in the United States, Puerto Rico, and the United Kingdom. The company offers inpatient psychiatric and substance abuse services, residential treatment, outpatient behavioral health services, and specialty behavioral healthcare services.

– Fresenius Medical Care AG & Co. KGaA ($LTS:0H9X)

Fresenius Medical Care AG & Co. KGaA, a renal care company, provides products and services for patients with renal diseases worldwide. The company’s products and services include dialysis machines, dialyzers, and related disposable products, as well as renal pharmaceuticals. It also offers clinical laboratory testing services. The company was founded in 1912 and is headquartered in Bad Homburg vor der Höhe, Germany.

– Medical Facilities Corp ($TSX:DR)

Medical Facilities Corporation is a leading operator of specialty surgical hospitals and ancillary services in the United States. The company owns and operates seven specialty surgical hospitals, one surgical hospital, and three surgical facilities located in Arkansas, Illinois, Louisiana, Mississippi, Oklahoma, and Texas. Medical Facilities Corporation’s hospitals offer a broad range of services, including general surgery, cardiovascular surgery, orthopedic surgery, pain management, gastroenterology, urology, and otolaryngology. The company’s hospitals are accredited by the Joint Commission on Accreditation of Healthcare Organizations and are licensed by the respective state Departments of Health.

Summary

DAVITA INC is a strong performer in the healthcare industry, reporting impressive financial results in their latest earnings report. According to their Non-GAAP EPS of $1.58, they have beaten the estimated target by $0.36.

Additionally, they have reported revenue of $2.87B which is higher than expected by $30M. These results show that the company is succeeding in their operations and indicates potential for investors to gain returns. With this, investors should consider DAVITA INC for their portfolio as the company continues to grow and provide strong returns.

Recent Posts