Booking Holdings Intrinsic Stock Value – Booking Holdings Reports Impressive Non-GAAP EPS and Revenue Growth

May 5, 2023

Trending News ☀️

BOOKING ($NASDAQ:BKNG): On Wednesday, the company reported a strong quarter in terms of Non-GAAP earnings per share (EPS) and revenue growth. Its Non-GAAP EPS of $11.60 exceeded expectations by $0.86, while revenue of $3.78 billion was higher than anticipated by $30 million. The company attributed the impressive performance to its core business, which saw an increase in room nights and rental cars booked, as well as improvements in pricing.

Furthermore, it noted that its efforts to increase its presence in alternative accommodations also contributed positively to the results. Going forward, the company expects its positive momentum to continue, as it looks to capitalize on growing demand for travel services around the world.

Earnings

Booking Holdings recently reported its fourth quarter earnings of FY2022 ending December 31 2022, and they have certainly come out with impressive results. The total revenue generated was 4049.0M USD, showing a 35.8% increase compared to the previous year. The net income rose even more drastically with a 99.8% increase to 1235.0M USD. These remarkable results indicate BOOKING HOLDINGS‘s significant growth and success in the online travel space.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Booking Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 17.09k | 3.06k | 21.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Booking Holdings. More…

| Operations | Investing | Financing |

| 6.55k | -518 | -4.9k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Booking Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 25.36k | 22.58k | 73.48 |

Key Ratios Snapshot

Some of the financial key ratios for Booking Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.3% | -2.8% | 25.2% |

| FCF Margin | ROE | ROA |

| 36.2% | 83.6% | 10.6% |

Stock Price

Booking Holdings, the world’s leading online travel company, reported impressive non-GAAP EPS and revenue growth on Thursday. Despite this positive news, its stock opened at $2610.9 and closed at $2603.6, down by 1.6% from its last closing price of 2646.2. This decrease could be attributed to a variety of factors, such as investor caution or a more bearish outlook on the company’s future prospects. Nonetheless, Booking Holdings’ reported growth is certainly noteworthy and indicates that the company is well-positioned to continue its growth going forward. Live Quote…

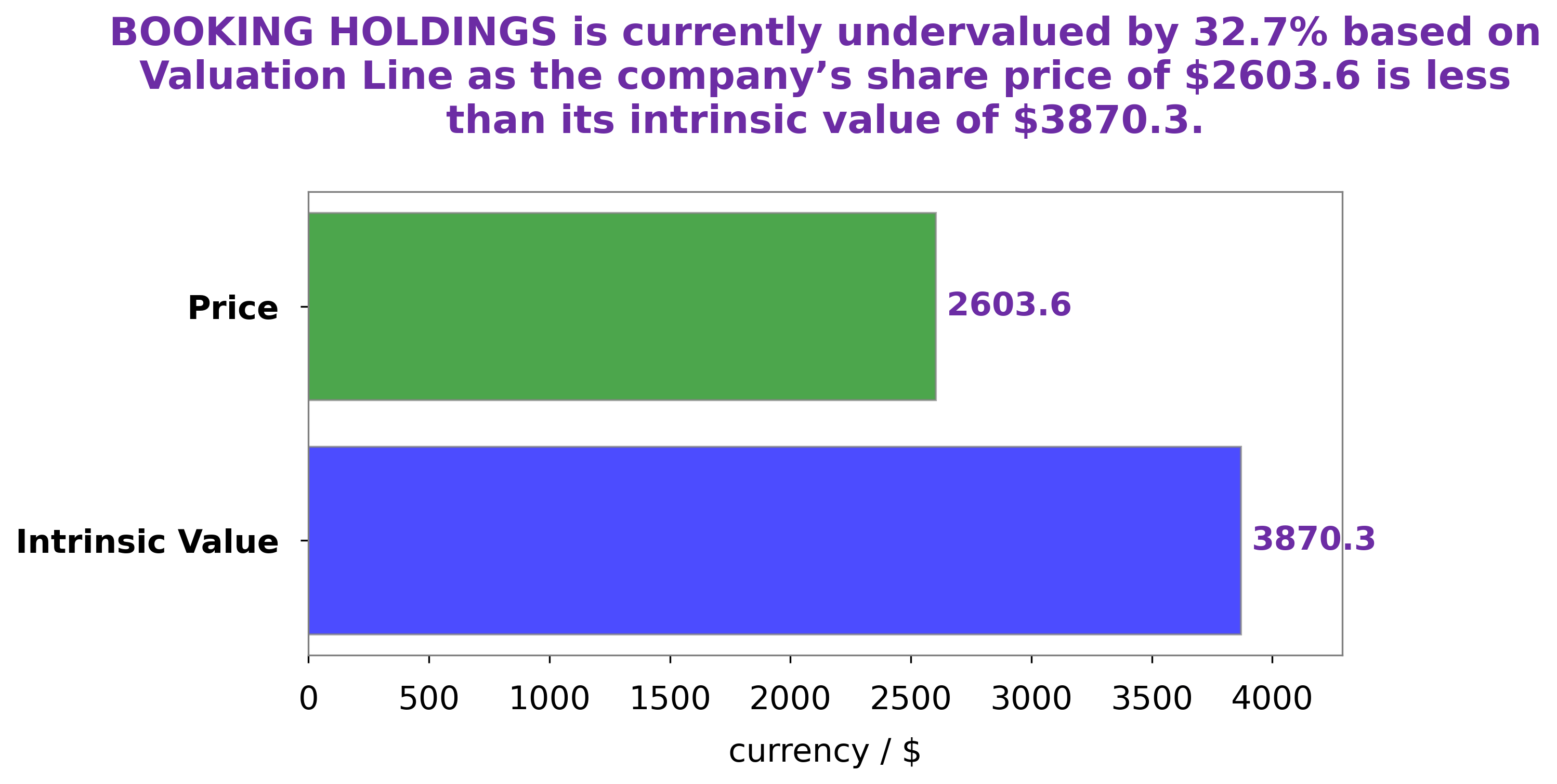

Analysis – Booking Holdings Intrinsic Stock Value

GoodWhale recently conducted an analysis of BOOKING HOLDINGS‘ wellbeing. After meticulous research and analysis, our proprietary Valuation Line concluded that the fair value of BOOKING HOLDINGS’ share is around $3870.3. However, at this moment, BOOKING HOLDINGS’ stock is traded at $2603.6, which is undervalued by 32.7%. This presents a great opportunity for investors to gain a significant return on investment. More…

Peers

Booking Holdings Inc, Expedia Group Inc, Ezfly International Travel Agent Co Ltd, and Adventure Inc are all travel companies that compete for customers. They all offer different services, but they all aim to make booking travel easier and more convenient for customers.

– Expedia Group Inc ($NASDAQ:EXPE)

Expedia Group is an online travel company that owns and operates a portfolio of travel brands. Its brands include Expedia.com, Hotels.com, trivago, HomeAway, Orbitz, Travelocity, Wotif, lastminute.com.au, and eLong. The company offers a one-stop travel booking experience to its customers. It enables customers to compare prices and book travel services from a single platform.

– Ezfly International Travel Agent Co Ltd ($TPEX:2734)

Ezfly International Travel Agent Co Ltd is a travel company based in Taiwan. The company offers a variety of travel services, including flight tickets, hotel reservations, and tour packages. Ezfly International Travel Agent Co Ltd has a market cap of 912.87M as of 2022, a Return on Equity of -19.32%. The company has been negatively impacted by the COVID-19 pandemic, as travel restrictions have prevented customers from using its services. Ezfly International Travel Agent Co Ltd is working to adapt its business model in order to survive the pandemic and continue operating in the future.

– Adventure Inc ($TSE:6030)

Adventure Inc. is a publicly traded company with a market capitalization of $85.43 billion as of 2022. The company’s return on equity is 13.93%. Adventure Inc. operates in the adventure travel industry, providing travelers with unique and immersive experiences. The company has a strong focus on customer service and safety, and has been recognized as a leader in the industry. Adventure Inc. offers a variety of travel products and services, including adventure tours, safaris, and cruise vacations.

Summary

Booking Holdings has outperformed expectations in both its non-GAAP earnings per share and revenue. Analysts believe optimism over the company’s future prospects will continue to drive its share price. The company is continuing to invest in digital marketing and technology in order to grow its business and stay ahead of the competition. Investors should consider investing in this stock for the long term as it continues to show strong performance.

Recent Posts