Becton Stock Fair Value – FDA Approves Becton, Dickinson AI Imaging App for Bacterial Growth Analysis

May 17, 2023

Trending News ☀️

The U.S. Food and Drug Administration (FDA) recently gave the green light to Becton ($NYSE:BDX), Dickinson’s artificial intelligence (AI) imaging application for analyzing bacterial growth. This approval allows for a new technology to assist medical professionals in identifying bacterial cultures and aiding in the diagnosis of various infections. This marks a major milestone for the company, which is one of the world’s leading medical technology companies, specializing in a range of products and services designed to improve healthcare outcomes.

The company has a wide range of business interests, ranging from medical technologies to diagnostics and laboratory supplies. With the FDA approval of its AI imaging application, Becton, Dickinson is now well-placed to capitalize on this new technology and further its goal of providing healthcare solutions to the global market.

Share Price

On Tuesday, the FDA approved a Becton, Dickinson AI imaging app for bacterial growth analysis. This approval comes after successful trials of the company’s artificial intelligence technology. The stock opened at $250.3 and closed at $250.4, down 0.3% from the previous closing price of 251.1. The approval is an indication of the effectiveness of the AI imaging technology developed by Becton, Dickinson, and is expected to have a positive impact on the company’s stock in the coming days. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Becton. More…

| Total Revenues | Net Income | Net Margin |

| 18.27k | 1.53k | 9.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Becton. More…

| Operations | Investing | Financing |

| 2.1k | -2.77k | -562 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Becton. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 54.39k | 28.7k | 89.72 |

Key Ratios Snapshot

Some of the financial key ratios for Becton are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.6% | 3.3% | 10.7% |

| FCF Margin | ROE | ROA |

| 6.3% | 4.8% | 2.3% |

Analysis – Becton Stock Fair Value

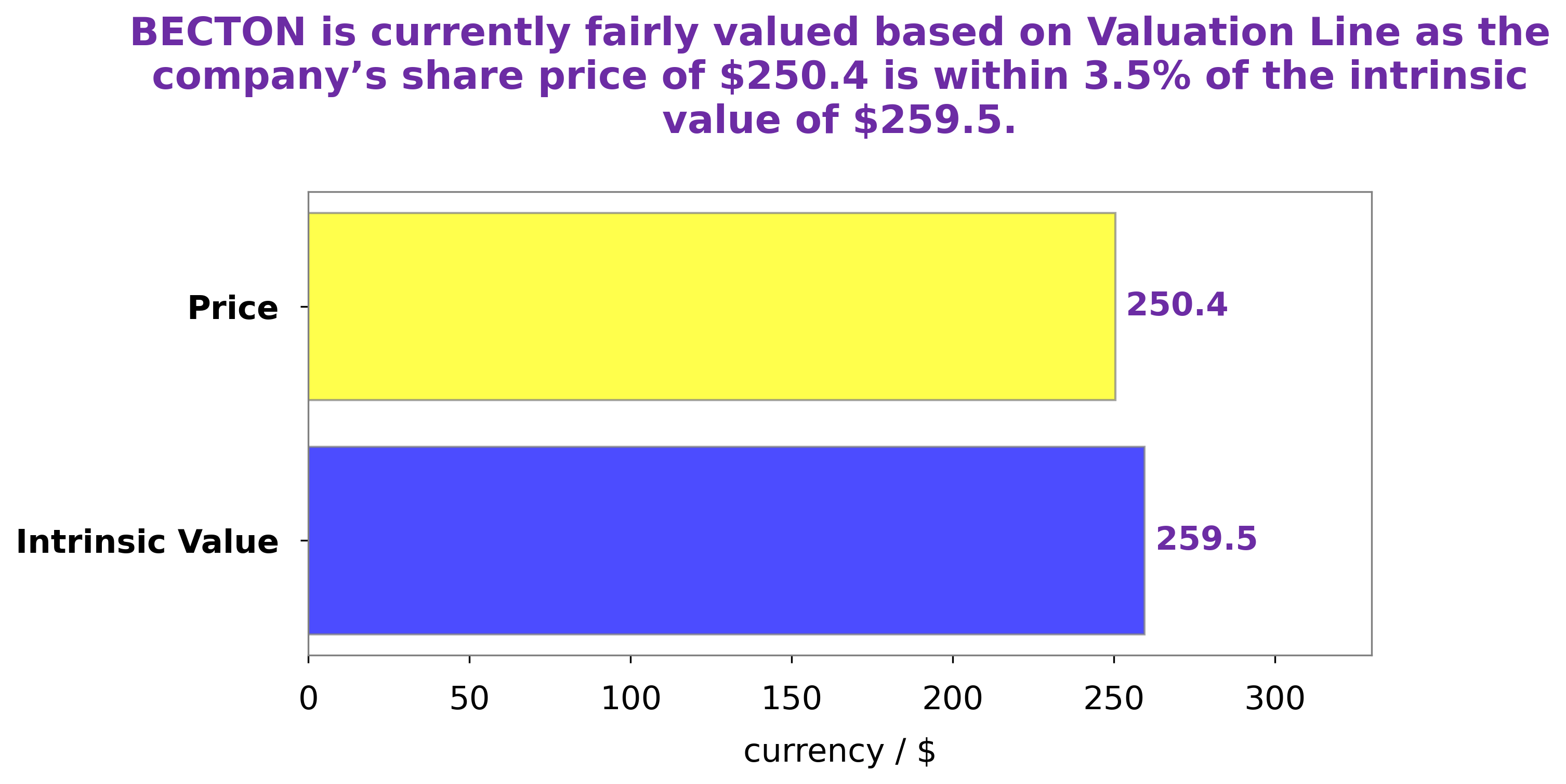

At GoodWhale, we recently conducted an analysis of BECTON‘s wellbeing. Our proprietary Valuation Line determined that the intrinsic value of BECTON share is around $259.5. Presently, BECTON stock is traded at $250.4, which appears to be a fair price that is undervalued by 3.5%. Our analysis indicates that investors may stand to benefit from investing in BECTON at this pricing. More…

Peers

Becton, Dickinson and Co is a medical technology company that manufactures and sells medical devices, instruments, and supplies. The company operates in three segments: BD Medical, BD Biosciences, and BD Diagnostics. It offers a wide range of products, including syringes, needles, catheters, blood collection devices, IV administration and infusion products, safety products, and sharps disposal systems. The company competes with Penumbra Inc, Teleflex Inc, SheerVision Inc, and other medical technology companies.

– Penumbra Inc ($NYSE:PEN)

Founded in 2002, Umbra is a leading global provider of shading and decorative products. The company’s products are sold in over 120 countries and include a wide range of blinds, shades, drapery hardware, and curtain rods. Headquartered in Toronto, Canada, Umbra employs over 1,200 people worldwide.

Umbra’s market cap is 7.01B as of 2022. The company’s Return on Equity is -2.31%.

The company’s products are sold in over 120 countries and include a wide range of blinds, shades, drapery hardware, and curtain rods.

– Teleflex Inc ($NYSE:TFX)

Teleflex Incorporated is a diversified global provider of medical technologies designed to improve the health and quality of people’s lives. The Company provides solutions for critical care, anesthesia, surgical, urology and emergency medicine.

– SheerVision Inc ($OTCPK:SVSO)

SheerVision Inc is a US-based company that manufactures and sells ophthalmic surgical instruments and devices. The company has a market cap of 140.32k as of 2022 and a Return on Equity of -70.28%. SheerVision’s products are used by eye surgeons to correct vision problems such as nearsightedness, farsightedness, and astigmatism. The company’s products are sold through a network of distributors and retailers worldwide.

Summary

Becton, Dickinson has received FDA approval for its AI imaging application, which enables automated bacterial growth analysis. The approval enables Becton, Dickinson to expand its capabilities in the area of automated microbiology and presents an opportunity for investors to capitalize on this growth. It is designed to identify bacterial colonies in various stages of development and provides results in real-time. The application is highly efficient in terms of time and cost savings and is expected to increase its user base significantly, providing a potential source of revenue for the company.

With its AI-powered solution, Becton, Dickinson is well-positioned to capitalize on the growing demand for automated imaging and analytics in the healthcare sector. For investors, this is an attractive opportunity to benefit from the company’s success in this field.

Recent Posts