Alaska Department of Revenue Investing $3.6 Million in Qorvo, Stock

January 8, 2023

Trending News 🌥️

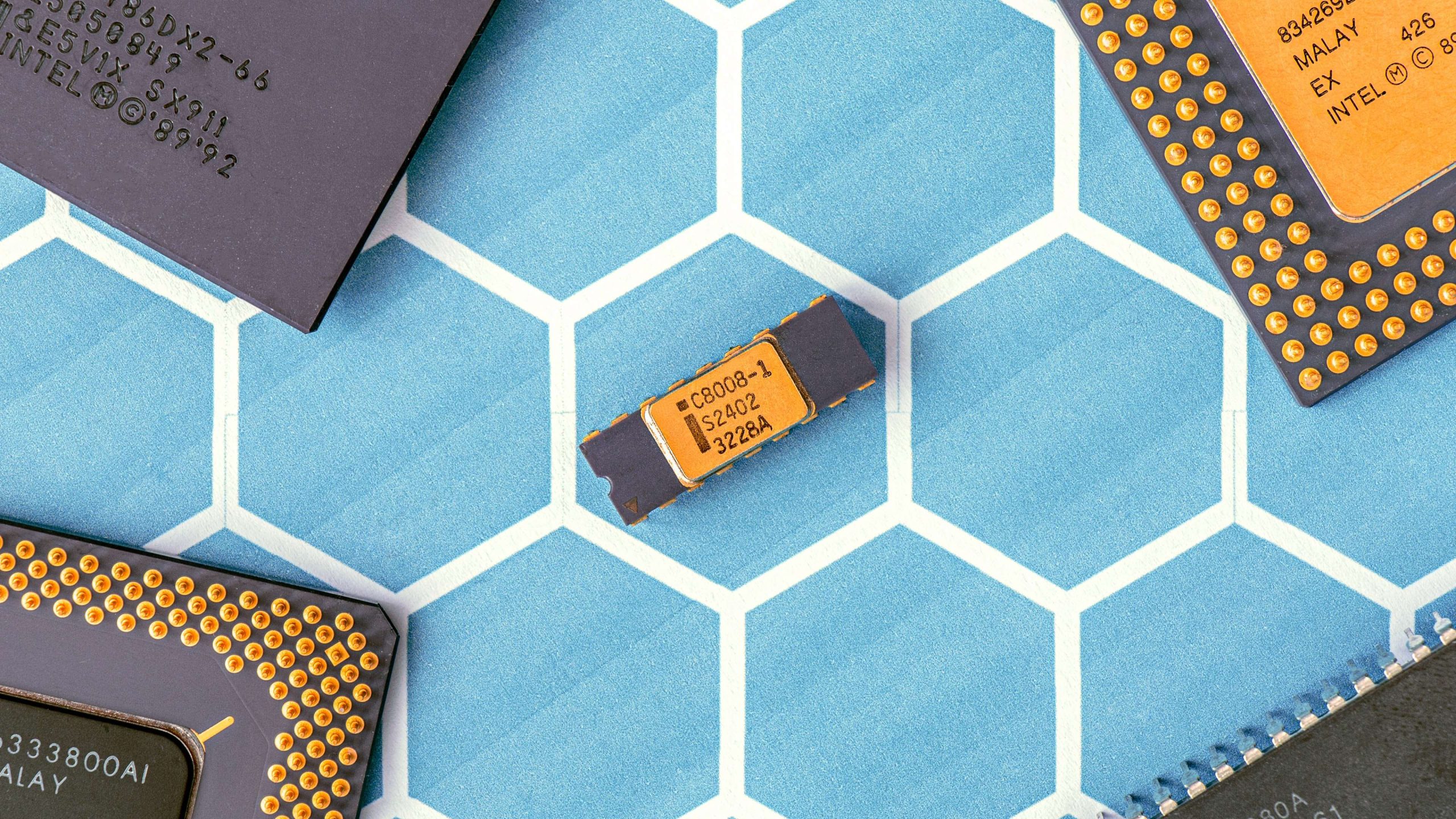

Qorvo Intrinsic Stock Value – Qorvo ($NASDAQ:QRVO), Inc. is a leading provider of advanced semiconductor solutions for mobile, infrastructure, and defense applications. The company designs, manufactures, and markets its innovative semiconductor and system solutions to leading companies in the wireless communications, networking, defense and aerospace, broadband and internet of things (IoT) industries. Recently, the Alaska Department of Revenue announced its decision to invest $3.60 million in Qorvo, Inc. stock. This is part of the state’s investment strategy to diversify its holdings and provide long-term stability and growth for Alaska’s economy.

The Alaska Department of Revenue believes that Qorvo, Inc. is an attractive investment opportunity due to its leadership position in its industry, strong financial performance, and commitment to innovation. The company has a proven track record of delivering innovative products and solutions to its customers and has a long-term strategy for growth. Qorvo’s products are becoming increasingly important as the demand for mobile communications, networking, defense and aerospace, broadband and IoT products continues to grow. With this strategic investment, the state is making a commitment to diversifying its holdings and providing long-term stability and growth for Alaska’s economy.

Price History

This move is part of the ADR’s ongoing effort to diversify its portfolio and invest in promising stocks. This includes a wide variety of products such as mobile devices, infrastructure, automotive and industrial applications. Qorvo also has a strong presence in the Internet of Things (IoT) market, with its cutting-edge solutions providing a secure connection to the digital world. The ADR has also highlighted the company’s commitment to environmental sustainability, with its products being designed to reduce power consumption and carbon emissions. This makes them an ideal choice for environmentally conscious investors.

In addition, Qorvo is known for its advanced research and development capabilities, which have enabled it to continuously develop new technologies and products that drive its growth and profitability. By investing in Qorvo stock, the ADR is taking advantage of the company’s potential for long-term growth and profitability. The ADR’s decision to invest in Qorvo stock demonstrates its optimism about the company’s future and the potential for it to become a major player in the semiconductor market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Qorvo. More…

| Total Revenues | Net Income | Net Margin |

| 4.47k | 686.04 | 15.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Qorvo. More…

| Operations | Investing | Financing |

| 1k | -412.64 | -825.71 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Qorvo. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.37k | 3.05k | 42.63 |

Key Ratios Snapshot

Some of the financial key ratios for Qorvo are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.1% | 43.7% | 20.7% |

| FCF Margin | ROE | ROA |

| 18.1% | 13.4% | 7.8% |

VI Analysis – Qorvo Intrinsic Stock Value

QORVO is an American semiconductor company, and its fundamentals are the key drivers of its long-term potential. An analysis of the company’s value using the VI app reveals that its intrinsic value is around $159.4. This means that the current stock price of $89.1 is undervalued by 44%. This means that investors can take advantage of this gap and purchase QORVO’s stock at a discount. The company’s fundamentals are strong and indicate that the stock could be a great long-term investment. Its cash flow, earnings, and debt all point to the potential for future growth. The dividend yield is also attractive, with the current yield at 1.7%. QORVO’s revenue has grown significantly over the past few years, and its bottom line has improved as well. Despite a challenging market environment, the company has managed to increase its operating income. This suggests that the company is well-positioned to continue to grow in the future. Overall, QORVO is a great investment opportunity for investors looking to take advantage of a 44% discount from the company’s intrinsic value. Its fundamentals indicate that it could be a great long-term play for those who are willing to take on the risk associated with investing in a single stock. More…

VI Peers

In the world of semiconductor companies that provide radio frequency products, Qorvo Inc. has stiff competition. Its main competitors are Skyworks Solutions Inc, Broadcom Inc, and Qualcomm Inc. All of these companies are vying for a share of the market in order to provide their customers with the best products possible.

– Skyworks Solutions Inc ($NASDAQ:SWKS)

Skyworks Solutions Inc is a semiconductor company that designs, manufactures, and markets radio frequency and mixed signal semiconductor solutions for mobile, base station, satellite communications, WiFi, cable television, and other wireless communications applications. The company has a market cap of 13.87B as of 2022 and a return on equity of 17.47%.

– Broadcom Inc ($NASDAQ:AVGO)

Broadcom Inc is a global technology leader that designs, develops and supplies semiconductor and infrastructure software solutions. The company’s products enable the delivery of voice, video, data and multimedia content over fixed and mobile networks to homes, businesses and public places. Broadcom’s product portfolio includes switching, routing, security and storage solutions. The company markets its products to enterprises, service providers and consumers worldwide.

– Qualcomm Inc ($NASDAQ:QCOM)

Qualcomm Inc is a leading telecommunications company with a market cap of 131.76B as of 2022. The company has a strong focus on research and development and has a return on equity of 65.09%. Qualcomm’s products and services include chipsets, modems, and other technology solutions for the wireless industry. The company has a strong presence in the global market and is a major player in the development of 5G technology.

Summary

Qorvo is a global leader in RF solutions, providing essential technologies that enable customers to create innovative solutions for advanced wireless products, networks and defense radar applications. The investment is expected to pay off in the long run as more and more companies rely on Qorvo’s solutions. By investing in Qorvo, the Alaska Department of Revenue is making an important statement that they believe in the company’s potential and are willing to invest in its success.

Recent Posts