Fiverr International Stock Intrinsic Value – Fiverr Downgraded as Room for Growth Shrinks in AI Era

December 19, 2023

☀️Trending News

Fiverr International ($NYSE:FVRR) Ltd (FVRR) has recently been downgraded due to a decrease in room for growth in the age of artificial intelligence. Fiverr is an online platform that connects freelance professionals, entrepreneurs, and businesses with services such as graphic design, copywriting, video editing, web development, and more. The services provided by Fiverr are highly sought after, but the potential for Fiverr’s expansion is restricted due to the prevalence of Artificial Intelligence (AI). As AI-driven services are becoming more prevalent, it has become increasingly difficult for Fiverr to compete in the marketplace. AI-driven services are often more efficient than services provided by humans and tend to be cheaper. As AI continues to rise in popularity, it is becoming increasingly difficult for Fiverr to compete and attract customers. This has caused the company’s stock to be downgraded, as investors are becoming more concerned about its future prospects.

In addition, the devaluation of Fiverr’s services has made it difficult for the company to attract new freelance professionals and entrepreneurs. Despite the downgrade, Fiverr remains committed to providing quality services and continuing to expand. The company is exploring new avenues for growth such as creating partnerships with other AI-driven companies and developing new features for their website.

Additionally, they are focusing on gaining new customers and expanding their customer base through innovative marketing strategies. With these initiatives in place, Fiverr is confident that it can continue to grow despite the current challenges.

Price History

On Monday, FIVERR INTERNATIONAL stock opened at $28.2 and closed at $28.0, down by 0.8% from last closing price of 28.2. This decline was a result of analysts’ lowered outlook for the company’s growth potential as the artificial intelligence (AI) era continues to evolve rapidly. With AI becoming more entrenched in the world of work, the room for growth for Fiverr is seen to be shrinking as the competition intensifies.

This means that, while Fiverr has been a major player in the gig economy for some time now, it may have to find new ways to stay competitive or risk losing market share. As such, Fiverr may be facing an uphill battle in order to remain relevant in the ever-changing world of work. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Fiverr International. More…

| Total Revenues | Net Income | Net Margin |

| 353 | -2.32 | -0.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Fiverr International. More…

| Operations | Investing | Financing |

| 65.24 | -92.23 | 4.04 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Fiverr International. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1k | 678.07 | 8.4 |

Key Ratios Snapshot

Some of the financial key ratios for Fiverr International are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 29.3% | – | -10.5% |

| FCF Margin | ROE | ROA |

| 18.2% | -7.4% | -2.3% |

Analysis – Fiverr International Stock Intrinsic Value

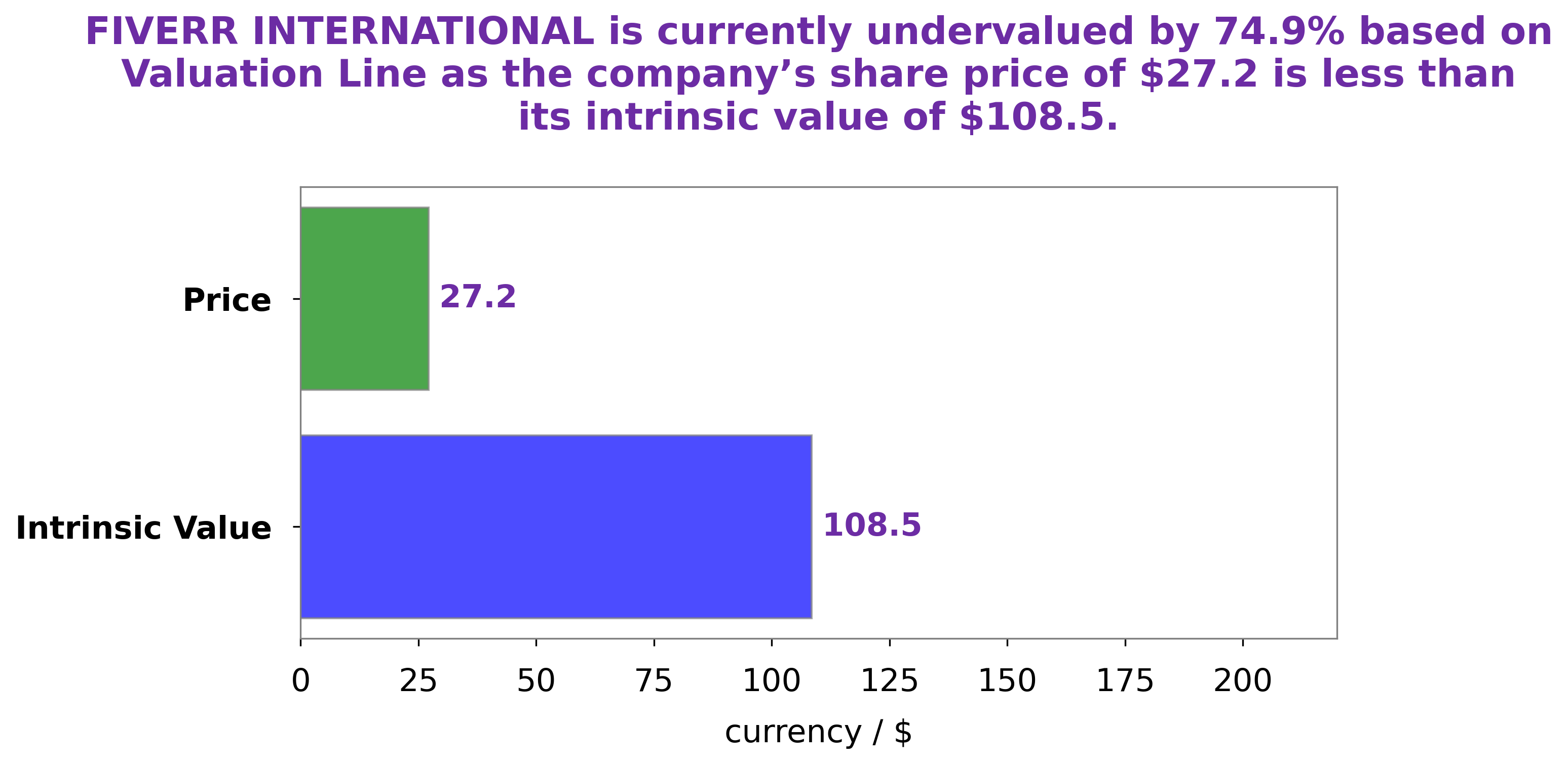

At GoodWhale, we have conducted an extensive analysis of FIVERR INTERNATIONAL’s wellbeing. After our investigation, our proprietary Valuation Line has calculated the fair value of FIVERR INTERNATIONAL shares to be around $111.9. However, right now the stock is trading at $28.0, which is a considerable 75.0% undervalued. This suggests that FIVERR INTERNATIONAL has immense potential to grow in value and could be a great investment opportunity for any prospective investor. More…

Peers

In the online marketplace, there is intense competition between Fiverr International Ltd and its competitors Newretail Co Ltd, Similarweb Ltd, and PT NFC Indonesia Tbk. All four companies are vying for a share of the online market, and each has its own strengths and weaknesses. Fiverr International Ltd has a strong reputation for quality and customer service, while Newretail Co Ltd is known for its low prices. Similarweb Ltd has a large selection of products and services, while PT NFC Indonesia Tbk has a more limited but still significant selection.

– Newretail Co Ltd ($TPEX:3085)

Newretail Co Ltd is a company that operates in the retail industry. It has a market cap of 603.61M as of 2022 and a Return on Equity of 5.63%. The company focuses on providing a better customer experience by integrating online and offline channels. It has a strong presence in China and is expanding its operations to other countries.

– Similarweb Ltd ($NYSE:SMWB)

As of 2022, Similarweb Ltd has a market cap of 488.21M. The company has a Return on Equity of -103.2%. Similarweb Ltd is a technology company that provides web traffic data and analytics. The company was founded in 2007 and is headquartered in Tel Aviv, Israel.

– PT NFC Indonesia Tbk ($IDX:NFCX)

PT NFC Indonesia Tbk is a leading provider of mobile payment and financial services in Indonesia. The company has a market cap of 7.95T as of 2022 and a Return on Equity of 21.4%. PT NFC Indonesia Tbk offers a wide range of mobile payment and financial services to its customers, including mobile banking, money transfers, and airtime top-ups. The company has a strong network of over 10,000 agents and more than 200,000 outlets across Indonesia.

Summary

Fiverr International is a digital marketplace for freelancers, with a majority of services offered in the creative sector. While the platform offers significant opportunity for freelance workers, investors should be aware that there is limited room for growth as automation and artificial intelligence become increasingly commonplace. This may lead to a potential downgrade in ratings, as more and more services can be automated, ultimately reducing the number of available gigs. Investors should factor this into their assessment of Fiverr International and consider the long-term implications of these developments on the platform’s future growth potential.

Recent Posts