C.H. Robinson Worldwide Experiences Divergent Revenue and Net Income in Q1, Causing Investors to Remain Cautious

May 13, 2023

Trending News 🌧️

C.H. ($NASDAQ:CHRW) Robinson Worldwide is a leading global provider of transportation and logistics services. This troubling divergence has caused some concern among investors, especially as C.H. Robinson‘s stock price has been volatile in recent weeks. Despite this, the company remains confident that its long-term growth prospects remain intact. With such divergent results in Q1 and continued economic uncertainty, investors should wait until there is more stability before investing in C.H. Robinson’s stock.

Earnings

This marks a 32.3% decrease in total revenue and a 57.5% decrease in net income, compared to the same period from the previous year. Over the last 3 years, total revenue has dropped from 4803.87M USD to 4611.67M USD.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for CHRW. More…

| Total Revenues | Net Income | Net Margin |

| 22.49k | 785.07 | 3.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for CHRW. More…

| Operations | Investing | Financing |

| 1.92k | -67.89 | -1.85k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for CHRW. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.6k | 4.21k | 11.62 |

Key Ratios Snapshot

Some of the financial key ratios for CHRW are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.5% | 17.1% | 4.8% |

| FCF Margin | ROE | ROA |

| 8.0% | 50.0% | 12.1% |

Price History

The release of these results sent CHRW’s stock opening almost flatly on Friday at $99.7 and closing at $99.2, down by 0.1% from the previous closing price of 99.3. Live Quote…

Analysis

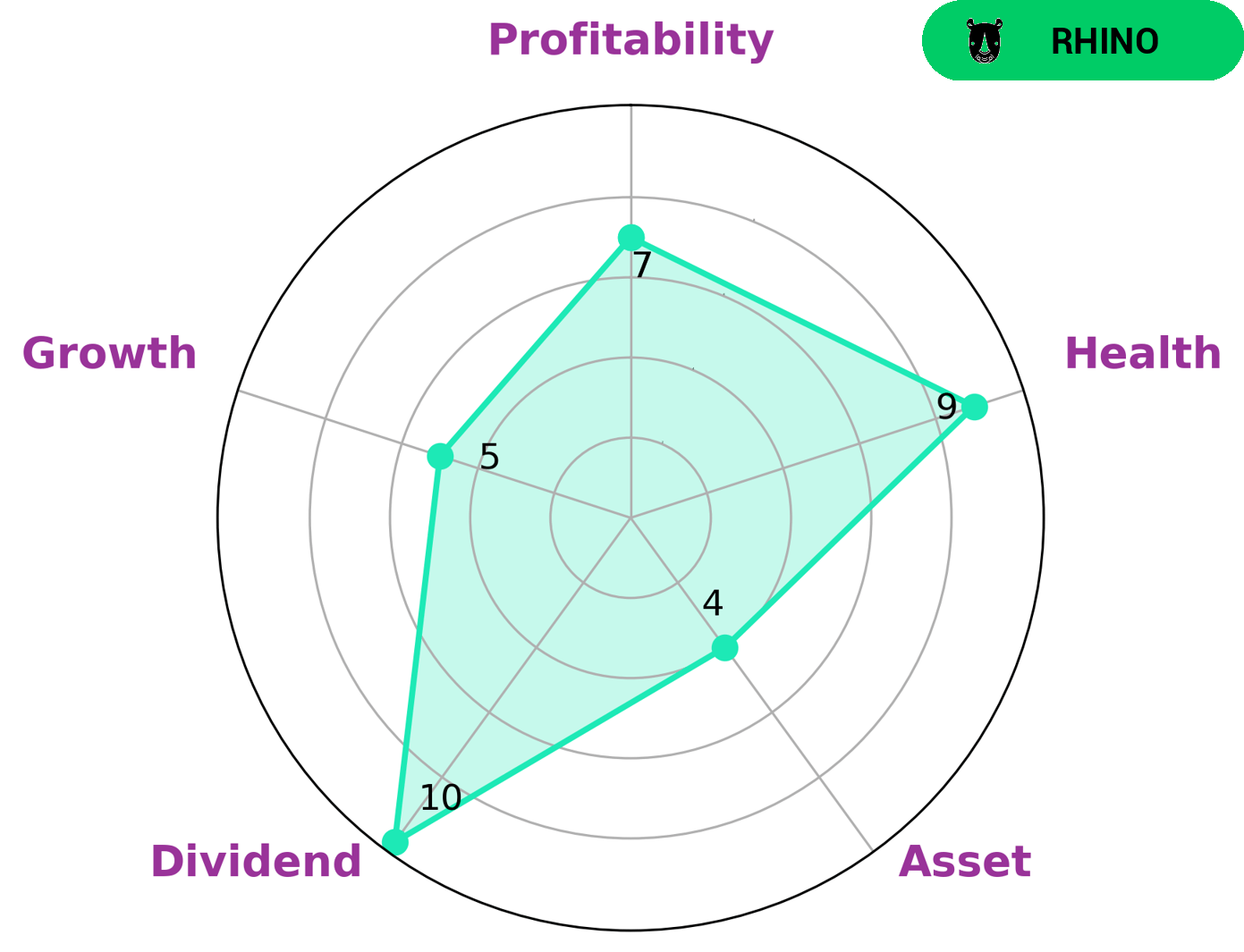

We at GoodWhale have conducted an analysis of C.H. ROBINSON WORLDWIDE’s wellbeing. According to our Star Chart, C.H. ROBINSON WORLDWIDE is classified as ‘rhino’, a type of company we conclude that has achieved moderate revenue or earnings growth. As such, C.H. ROBINSON WORLDWIDE may be of interest for investors looking for companies with a steady history of income growth. In terms of its financial health, C.H. ROBINSON WORLDWIDE has earned an impressive score of 9/10, owing to its cashflows and debt payments. This indicates that C.H. ROBINSON WORLDWIDE is capable of paying off its debt and have funds left over to invest in future operations. This makes it a great option for investors looking for a reliable stock with consistent returns. More…

Peers

The company’s competitors are FedEx Corp, Expeditors International of Washington Inc, and United Parcel Service Inc.

– FedEx Corp ($NYSE:FDX)

FedEx is a transportation and logistics company that delivers packages and freight around the world. The company has a market cap of $41.16 billion and a return on equity of 13.35%. FedEx is a global leader in transportation and logistics, and its services are relied on by businesses and consumers alike. The company has a strong track record of growth and profitability, and its shares are widely held by institutional investors.

– Expeditors International of Washington Inc ($NASDAQ:EXPD)

Expeditors International of Washington, Inc. is a global logistics company headquartered in Seattle, Washington. The company employs over 16,000 people in 375 locations across six continents. Expeditors provides integrated logistics solutions, including air and ocean freight forwarding, customs brokerage, and transportation management.

In terms of market capitalization, Expeditors is one of the largest logistics companies in the world. As of 2021, the company had a market cap of $16.17 billion. Expeditors has a strong return on equity, with a ratio of 35.3% as of 2021. This indicates that the company is efficient in generating profits for shareholders.

Expeditors is a well-established company with a long history of success. Founded in 1979, the company has grown steadily and today is a leader in the global logistics industry. Expeditors is a publicly traded company, listed on the Nasdaq stock exchange under the ticker symbol EXPD.

– United Parcel Service Inc ($NYSE:UPS)

UPS is a publicly traded company with a market capitalization of $142.37 billion as of 2022. The company has a return on equity of 56.44%. UPS is in the business of providing transportation and logistics services worldwide. The company operates in three segments: UPS Air, UPS Ground, and UPS International.

Summary

C.H. Robinson Worldwide, Inc. is one of the largest global third-party logistics companies providing freight transportation, logistics, and supply chain solutions. The company recently reported its first-quarter financial results and revealed that there is a divergence between its revenue and net income. Despite the strong revenue growth, the company’s operating expenses have increased significantly, putting pressure on their net income.

Investors should be aware of the discrepancies between revenue and net income, as this could indicate possible financial instability in the future. It is therefore critical to monitor C.H. Robinson Worldwide’s financials closely before making any decisions to invest in the company.

Recent Posts