Xinjiang Communications Construction Group Logs 40.5% Increase in 2022 Profit to 355.2 Million Yuan.

February 24, 2023

Trending News ☀️

XINJIANG ($SZSE:002941): The U.S. Justice Department has recently taken steps to block Adobe’s planned $20 billion acquisition of Figma, a cloud-based web platform developer. This move comes after Adobe announced the agreement between the two companies earlier this year. According to reports, the Justice Department is preparing to file an antitrust lawsuit that could prevent the acquisition from taking place. The acquisition, if successful, would have seen Adobe further solidify its place in the web development market.

But the Justice Department’s lawsuit could prevent the acquisition from taking place, as it could be deemed anticompetitive and a threat to innovation in the market. Adobe has not made any official statement in response to the news, but it is clear that this move from the Justice Department could have a significant impact on the future of both the company and Figma. If the acquisition is blocked, then it could signal a shift in antitrust regulation priorities from the Justice Department.

Stock Price

The U.S. Department of Justice announced Thursday that it would be blocking Adobe Inc.’s planned $20 billion acquisition of Figma. The decision came as a shock to many investors and sent Adobe’s stock down slightly. When the market opened on Thursday, ADOBE INC stock opened at $350.4 and closed at $347.0, down by 0.5% from prior closing price of 348.7. This could be seen as an indication of the uncertainty created by the news.

It is yet unknown what the implications of this decision will have on the future of ADOBE INC, but it is clear that the Justice Department saw the move as anti-competitive and not in the best interest of consumers. The company is currently evaluating its options and a new announcement is expected soon. Until then, investors will be closely monitoring the company’s stock to see how the news affects the company’s share price. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Xinjiang Communications Construction. More…

| Total Revenues | Net Income | Net Margin |

| 9.62k | 301.39 | 4.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Xinjiang Communications Construction. More…

| Operations | Investing | Financing |

| 244.97 | -274.39 | 492.38 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Xinjiang Communications Construction. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 18.73k | 14.41k | 4.51 |

Key Ratios Snapshot

Some of the financial key ratios for Xinjiang Communications Construction are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 21.6% | 53.4% | 7.4% |

| FCF Margin | ROE | ROA |

| 14.4% | 15.6% | 2.4% |

Analysis

At GoodWhale, we have conducted a financial analysis of ADOBE INC’s stock. On our proprietary Valuation Line, we estimate the fair value of ADOBE INC share is around $563.3. However, the stock is currently traded at $347.0, indicating that it is undervalued by 38.4%. This presents a huge buying opportunity for investors looking to gain exposure in this fast-growing sector. More…

Summary

Adobe Inc. has been trading strong in recent months and continues to generate positive investor sentiment. The company is the leader in delivering digital experiences, with its suite of products enabling customers to create, manage and deliver content across multiple channels and devices. Investors are optimistic about Adobe’s successful acquisition of Figma for 20 billion dollars, which will provide the company with added capabilities and a platform for continued growth. Adobe’s sales have risen steadily over the past year, with investors keeping a close eye on the company’s financials and performance in the technology sector.

Expectations are high for Adobe to continue to expand its current product offerings and remain a major player in the digital transformation space. As such, the stock is seen as a solid long-term investment.

Trending News ☀️

AMD has been making consistent strides in the field of GPU technology, aiming to become a leader in the industry. This analysis aims to explore whether the company’s efforts are paying off, by comparing the GPU performance of its products across different desktop and notebook generations with those of Intel and Nvidia. To determine AMD’s competitive edge in this area, benchmark scores were used to measure the performance of its GPUs. Factors such as frame rate, memory bandwidth, power consumption and more were taken into account. Results from this so-called “stress test” analysis revealed that AMD has indeed established itself as a reliable contender in the GPU market, consistently outperforming its rivals in both desktop and laptop categories.

The findings of this analysis not only highlight AMD’s growth in the graphics market but also suggest that the company is encroaching on Intel and Nvidia’s dominance. With its continual advancements, AMD could soon become a major competitor in the GPU sector. As a result, it is worth keeping an eye on their development, as they could potentially disrupt the current market dynamics.

Share Price

Analysis of ADVANCED MICRO DEVICES’ (AMD) performance in Graphics Processing Units (GPUs) across desktop and notebook generations compared to Intel and Nvidia reveals a competitive edge for the company. Media coverage of AMD’s performance has been largely positive, with Thursday seeing the company’s stock open at $80.6 and close at $79.8, up by 4.1% from its prior closing price of 76.6. This demonstrates the increasing level of confidence investors are placing in AMD’s technology. Live Quote…

Analysis

GoodWhale makes analyzing companies’ financial and business performance easier than ever. With our platform, you can easily analyze the fundamentals of ADVANCED MICRO DEVICES and make informed decisions on whether the stock is a good fit for your portfolio. Based on our Risk Rating assessment, ADVANCED MICRO DEVICES is categorized as a high risk investment. In addition, GoodWhale detected two risk warnings in the company’s income sheet and balance sheet. If you want to check out these warnings in detail, register on goodwhale.com and get full access to our extensive analysis tools. More…

Summary

Advanced Micro Devices (AMD) has seen a surge in their stock prices in response to recent analysis of their competitive GPU performance across desktop and notebook generations, compared to Intel and Nvidia. The analysis revealed that AMD has the edge in terms of performance, resulting in a positive spin from the media. Investors should be encouraged by the fact that AMD’s competitive advantage and stock price have both increased in tandem – a sign that AMD is likely to remain competitive in the long run.

Trending News ☀️

Netflix is attempting to boost its subscriber growth by slashing prices in many countries around the world. The reductions range from slight to drastic, with some places seeing decreases of up to 50%. This move comes as companies like Peacock increase prices for direct-to-consumer offerings in order to remain viable. Netflix has reduced prices in the Middle East, sub-Saharan Africa (Kenya included), Europe (Croatia and Slovenia, in particular), Latin America (including Nicaragua, Ecuador, and Venezuela), and parts of Asia (such as Malaysia, Indonesia, Thailand, and the Philippines).

The decision by Netflix to reduce prices shows that it is willing to do whatever it takes to remain competitive in a streaming service market that is becoming increasingly crowded. At the same time, the company may be hoping that the pricing reductions will help increase its subscriber base, especially since many of the countries affected by the discounts have lower incomes than many of its other markets. Only time will tell if this move helps Netflix maintain its position at the top of the streaming game.

Stock Price

Netflix recently made news when it slashed prices around the world in an effort to promote subscriber growth amid growing competition in the streaming industry. The decision was met with mostly neutral news coverage, with some analysts expressing concern that the reduced prices would not be enough to offset competition in the industry. In reaction to the announcement, Netflix’s stock opened on Thursday at $331.2 and closed down at $323.6, a decrease of 3.4% from its previous closing price of $334.9. This prompted concerns about Netflix’s ability to maintain subscriber numbers, as well as its long-term viability in the streaming market. Live Quote…

Analysis

As a GoodWhale analyst, I have carefully studied NETFLIX’s fundamentals and am pleased to share my assessment with you. According to the Star Chart, NETFLIX has earned an intermediate health score of 5 out of 10. This suggests that NETFLIX has the cashflows and debt levels necessary to reasonably weather any economic crisis without the risk of bankruptcy. NETFLIX is classified as ‘rhino’, which implies that it has achieved moderate revenue or earnings growth. This means that NETFLIX may be an attractive choice for investors looking for returns in the mid-term. Furthermore, NETFLIX stands out for its strong growth and profitability, but has weaker asset and dividend performance. More…

Summary

Netflix is a leading entertainment streaming platform widely available across the globe. Recently, the company announced a price cut in order to boost subscriber growth in the face of increasing streaming competition. News coverage of this move has been mostly neutral, though it has had a negative impact on Netflix’s stock price.

For investors, the rising competition could have a long-term impact on Netflix’s profitability and growth prospects. Now is an important time to assess how the price cut affects subscription behavior, how Netflix plans to differentiate itself from other streaming services, and how it plans to improve its financial performance amid the newly intensified competition.

Trending News ☀️

This is a significant miss of the expected earnings and shares of Block fell immediately following the announcement. Analysts had projected that the company would perform strongly due to increasing customer demand, however this was not the case. The miss is perplexing as Block had been projected to grow significantly in the quarter.

Poor cost-cutting measures, underperforming products and other factors could have contributed to the shortfall in earnings. It remains to be seen how this shortfall will affect future earnings reports for Block and its shareholders.

Price History

Despite this, the stock price per share remained relatively stable on Thursday; it opened at $74.3 and closed at $74.2, an increase of 1.7% from its previous closing price of $72.9. This suggests that investors are not overly concerned about the lower-than-expected results for this quarter and remain confident in the potential of the company going forward. Live Quote…

Analysis

GoodWhale has conducted an analysis of BLOCK’s financials and determined that it is classified as a ‘gorilla’, a type of company that has achieved stable and high revenue or earnings growth due to its strong competitive advantage. Such companies may be attractive to investors looking for growth and stability. Our analysis showed that BLOCK is strong in growth and profitability, medium in assets, and weak in dividend, with a high health score of 8/10 when considering its cashflows and debt. This strong health score indicates that BLOCK is likely to be able to sustain future operations in times of crisis. More…

Summary

Investors in BLOCK have been hit with bad news, as the company recently reported non-GAAP EPS of $0.22 for Q4 2023, missing estimates by $0.08. This has dampened investor sentiment on BLOCK shares, and at the time of writing, most analysts have a negative outlook on the future of the company. Going forward, investors should evaluate BLOCK’s financials and assess their potential risk-reward scenario before making any investment decisions.

Trending News ☀️

Grab Holdings is a well-known “Super App” operating in South East Asia, and has the potential to be a highly successful business. In its attempt to gain a significant portion of the market share, Grab made some unwise investments, leading to significant losses. Despite these financial burdens, the company has taken a more strategic approach, focusing more on increasing its profit margins. This has led to a notable improvement in their overall profitability, although the company is still enduring losses at the present time. Grab has made some difficult decisions in order to reduce costs and maximize profits. For example, cutting back on expenditures for marketing and advertising, improving the efficiency of its workforce and resources, and driving greater customer loyalty.

In addition, Grab has expanded its offerings, including food delivery and ride-hailing services, while integrating payment features within its mobile platform. All of these attempts have contributed to a more sustainable level of profitability for the company. Overall, despite enduring losses, Grab Holdings has been able to improve its profit margins by focusing on cost cutting and increasing efficiency. The company has adopted a strategic approach to increase its long-term sustainability and maximize its market share, which is sure to lead to greater success for Grab in the future.

Stock Price

Grab Holdings, a regional leading ride-hailing company, has been making headlines due to its recent profitability. Despite a reported $3.7 billion net loss in the first quarter of 2020, Grab Holdings has managed to improve their net profit margin, allowing the company to increase their market share. This gain in market share is despite the negative media attention they have been receiving since the start of the pandemic.

On Thursday, the stock of GRAB HOLDINGS opened at $3.6 and closed at $3.2, a drop of 8.3% from its prior closing price of 3.5. Despite this drop, the company continues to commence on their pursuit for market share with a positive outlook for their future profitability. Live Quote…

Analysis

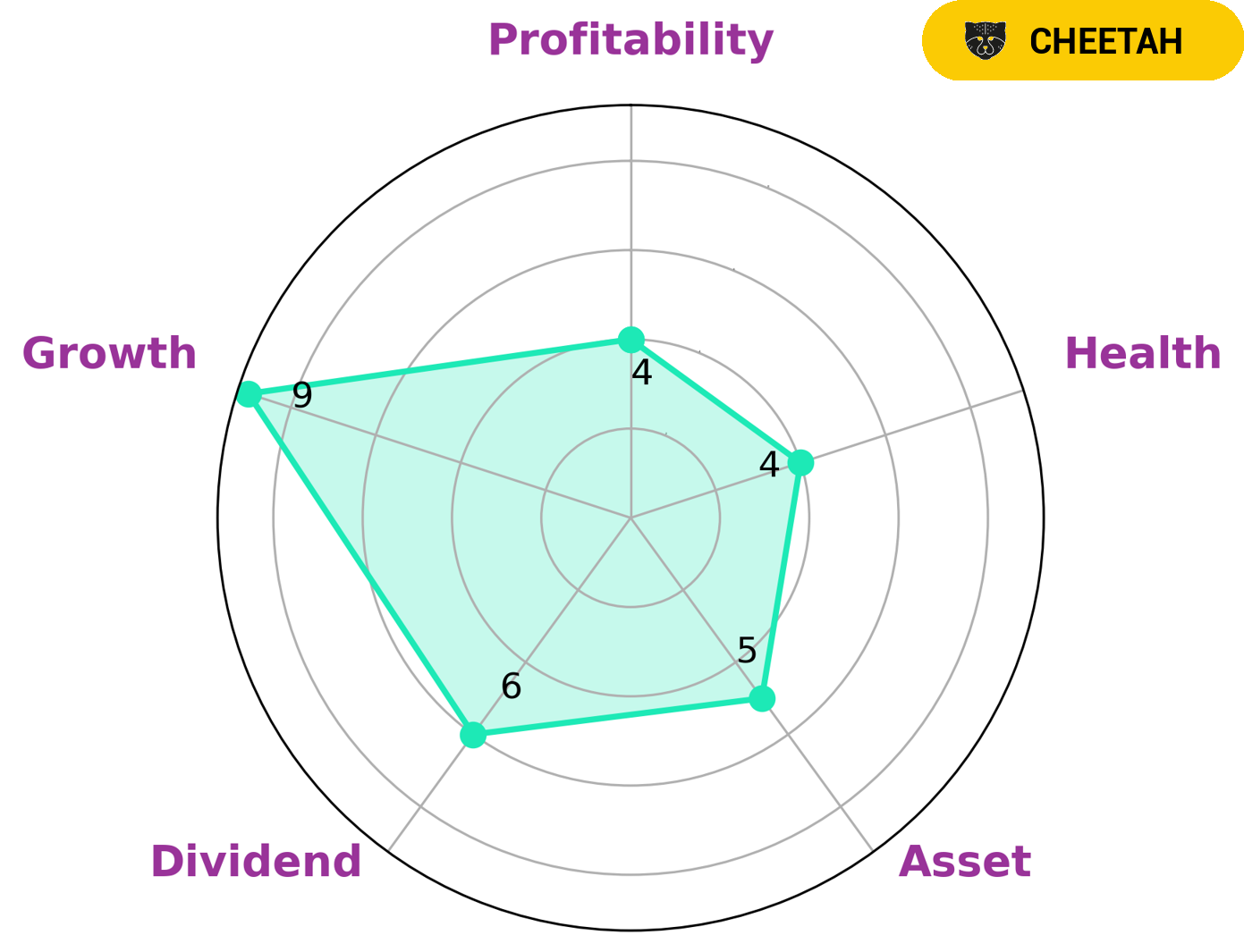

GoodWhale has performed an analysis of GRAB HOLDINGS’s wellbeing. Our star chart indicates that GRAB HOLDINGS is strong in asset and growth, but weak in dividend and profitability. As such, GRAB HOLDINGS has an intermediate health score of 6/10 with regard to its cashflows and debt, and is likely to safely ride out any crisis without the risk of bankruptcy. GRAB HOLDINGS is classified as a ‘cheetah’, a type of company that achieved high revenue or earnings growth but is considered less stable due to lower profitability. Thus, investors who are looking for potential profit opportunities but are also willing to take risks may be interested in investing in GRAB HOLDINGS. More…

Summary

Grab Holdings, a leading mobile technology and transportation platform in Southeast Asia, has recently reported improved profit margins despite the company continuing to face losses amidst its pursuit of growth in market share. This development has been largely positively reflected in the media, however on the same day, the company’s stock price dropped. Investors may be cautiously optimistic at this development while keeping a watchful eye on the company’s future.

It is possible that Grab may be unable to sustain these improvements long-term and that the stock valuation may fall as a result. Therefore, investors should always do their own research and be mindful of any potential risks.

Trending News ☀️

Although Salesforce is currently facing some turbulence with activist investors, Goldman Sachs analyst Kash Rangan is adamant that investors should not be discouraged from investing in the company’s shares. This statement was made in a research report on Thursday, and Rangan even raised his price target for Salesforce shares to $310. He believes that the potential for Salesforce to reach the upper echelons of highly valued tech companies justifies the increase, despite the recent announcement to lay off 10% of its employees. Rangan praised Salesforce’s continually impressive performance and noted that the company’s cloud growth, as well as its plans to invest in artificial intelligence and other emerging technologies, would ensure that the company will remain one of the top players in the tech industry.

Furthermore, he noted that Salesforce is on track to become a trillion-dollar market cap company. This, combined with their diverse customer base and strong customer loyalty, makes Salesforce a business that should not to be underestimated.

Share Price

The recent sentiment towards SALESFORCE.COM has been largely negative, however a Goldman Sachs analyst thinks investors don’t need to be afraid of the turmoil. On Thursday, SALESFORCE.COM opened the day at $165.3 and closed the day at $164.1, which was a slight increase from its previous closing price of 163.4. This indicates that investors are still interested in the company and are not totally deterred by the media sentiment. As such, Goldman Sachs analyst suggest investors should not flee from SALESFORCE.COM despite the current turmoil. Live Quote…

Analysis

At GoodWhale, we have recently conducted an analysis of SALESFORCE.COM’s well-being. Our Risk Rating revealed that SALESFORCE.COM is a high risk investment in terms of financial and business aspects. In particular, there are 4 risk warnings in income sheet, balance sheet, cashflow statement, and non financial areas that could impact the returns of an investment in SALESFORCE.COM. To learn more about what specific risks we discovered and how to protect your investment from them, please register on GoodWhale.com and check it out! More…

Summary

Despite current turmoil surrounding Salesforce.com, Goldman Sachs analysts have suggested that investors should remain in their positions rather than fleeing. With the stock having fallen significantly this month, it may be a good time for investors to consider taking advantage of the low prices. To ensure that investing decisions are made with a full understanding of the implications, investors should analyze and assess the company’s fundamentals, future cash flows, and risk factors such as customer and supplier relationships.

Additionally, investors should explore Salesforce’s competitive advantage and how it plans to expand its marketshare in the future. Ultimately, investors need to determine if investing in Salesforce.com is a sound decision given their individual investment objectives.

Trending News ☀️

Guggenheim recently downgraded stocks of Veeva Systems due to concerns of their too high fiscal 2024 estimates. This downgrade had an immediate effect on markets in premarket trading on Thursday and the stock fell more than 1%. Following the downgrade, other analysts have been quick to point out that the company’s current estimates may be too optimistic, as it is based on an unsustainable growth rate and further suggests that the company’s current valuation is too high. As Veeva Systems has seen stock prices rise steadily since the beginning of this year, the downgrade has caused a major shockwave among investors. Despite the downgrade, some analysts remain confident in the company’s future prospects. They point to the fact that the company has seen steady growth in its cloud-based software, which has helped to drive revenue up significantly over the past year, and is expected to continue to do so in the coming years.

Additionally, they are optimistic that Veeva Systems’s product lineup will continue to remain competitive and effective. At the end of the day, only time will tell if Guggenheim’s downgrade of Veeva Systems is accurate and whether the company’s estimates are too high. Until then, investors must remain vigilant, as any changes in Veeva Systems’s stock could have a dramatic impact on their portfolios.

Price History

On Thursday, Guggenheim downgraded its rating for VEEVA SYSTEMS stock from “buy” to “neutral” due to concerns that the current fiscal 2024 estimates are too high. Consequently, media exposure towards the stock has been mostly negative. Consequently, VEEVA SYSTEMS stock opened at $171.0 and closed at $170.5, down by 0.3% from the previous closing price of 171.0. This indicates that investors are taking the downgrade into consideration and have started to adjust their portfolios accordingly. Live Quote…

Analysis

At GoodWhale, we value VEEVA SYSTEMS. After an extensive analysis of their financials, we determined that their intrinsic value is approximately $292.8, based on our proprietary Valuation Line. While the market value of their shares is currently trading at $170.5, this presents an undervaluation of 41.8%. We believe that there is significant opportunity for investors to benefit from this and purchase VEEVA SYSTEMS stock at this discounted rate. In light of this information, we highly recommend that investors carefully consider VEEVA SYSTEMS and its potential for growth. More…

Summary

Veeva Systems has recently seen negative media exposure due to Guggenheim’s downgrade of the company’s shares. The downgrade was based on concerns about too high fiscal 2024 estimates. Investment analysts have pointed out that the company was already trading at a premium relative to industry peers, and now downgrades are being driven by uncertainty of achieving desired growth when the estimates are too optimistic.

Investors should take the potential downside into account when considering investments in Veeva Systems. It is important to be aware that the stock is subject to volatile swings, as evaluating the long-term potential of the company will require a more analytical approach.

Trending News ☀️

Revolve Group has reported impressive earnings for its fourth quarter of 2023. According to its GAAP earnings per share (EPS), the company managed to exceed expectations by $0.01 from the projected $0.10. This brings the reported Q4 EPS to $0.11, marking a solid result for the end of the fiscal year. The unexpected growth in profitability can be attributed to Revolve Group’s focus on digital growth and cost-effective operations. Thanks to these strategic moves, the company has increased its market share and gained customer loyalty, both of which have drastically boosted their bottom line.

The strong financial performance for Q4 2023 also highlights the strength of Revolve Group’s financial management, which is designed to maximize efficiency and returns. This has helped Revolve Group to remain one of the leading players in the industry and to secure its long-term financial success. All in all, Revolve Group’s Q4 2023 GAAP EPS beating expectations by $0.01 is a testament to the company’s ability to strategically manage its resources and operations in order to maximize profitability. The company’s future looks very promising, and investors should continue to take notice of its impressive growth potential.

Share Price

On Thursday, REVOLVE GROUP reported better than expected Q4 2023 GAAP EPS of $0.01 above analyst expectations. Despite the impressive financial results, REVOLVE GROUP’s stocks opened Thursday at $25.5 and closed at $24.7, down by 2.9%. The better-than-expected earnings came as a surprise to investors and caused the stock to go down.

It is possible that the market was anticipating even better numbers and this resulted in the slight decrease in price. The performance of the stock on Thursday may indicate a short term trend, however, the company’s long-term growth prospects remain strong. Live Quote…

Analysis

As part of GoodWhale’s analysis of REVOLVE GROUP’s financials, we can see that its Star Chart classification is ‘gorilla’, indicative of a strong competitive advantage and stable, high growth. This would make REVOLVE GROUP an attractive target for investors interested in growth companies, particularly those with a strong competitive advantage. We can also see that REVOLVE GROUP has a health score of 10/10, indicating it has adequate cash flows and debt management which allows it to pay off debt and fund future operations. Additionally, REVOLVE GROUP is strong in assets, growth, and profitability, but weak in dividend, suggesting a lower focus on shareholder returns than other growth companies. More…

Summary

Revolve Group Inc. released their Q4 2023 earnings report, revealing a GAAP EPS of $0.01 more than market expectations. This is a positive financial outcome for the company and could be seen as a positive indicator for investors. Analysts expect future earnings to improve due to the company’s expansion into new markets, along with continuing efforts to bring innovative technologies and solutions to the market.

Management is also focusing on increasing their presence in the digital commerce and e-commerce spaces, which may add to overall profitability. Investors may be interested in Revolve Group as their strong performance and potential for future growth may be attractive in the current market environment.

Trending News ☀️

NetEase reported its Q4 2023 earnings on Wednesday, with the company missing its Non-GAAP Earnings Per Average Diluted Share (EPADS) estimate by $0.08. NetEase reported a Non-GAAP EPADS of $1.08, lower than the estimated $1.16. This marks the first time in a while that the Chinese tech giant has missed expectations, and investors were disappointed by the unexpected outcome. NetEase’s non-GAAP net income was $1.15 billion, an increase of 18% year-over-year, but still fell short of analyst expectations.

However, NetEase had warned investors that its goods and services revenue growth would be affected by the Chinese government’s tightening of digital content regulations. The news is seen as a setback for NetEase, although it is still faring better than other tech companies. The company’s stock price took a dip following the news, but has since recovered, indicating investors are not overly worried about the company’s performance. Nevertheless, it is evident that NetEase needs to improve its current model in order to remain competitive in the market going forward.

Stock Price

On Thursday, news of NETEASE missing their Q4 2023 Non-GAAP EPS Estimate by $0.08 made the rounds in the markets. At the time of writing, news coverage of the company largely remain negative, as the stock opened at $88.0 and closed at $82.9, representing a decrease of 3.7% from its prior closing price of 86.0. The lower-than-expected earnings indicate that investors may have to wait a little longer before they can experience the returns they were expecting from NETEASE stock. Live Quote…

Analysis

At GoodWhale, we recently performed an analysis of NETEASE’s wellbeing to give investors a better idea of the intrinsic value of the stock. After using our proprietary Valuation Line, we found that the intrinsic value of NETEASE share is around $102.3. Right now, NETEASE stock is trading at $82.9, which is a fair price that is undervalued by 19.0%. We believe this analysis can provide investors with useful information when considering their next move for this stock. More…

Summary

NetEase Inc. recently released its fourth quarter earnings report for 2023, missing the Non-GAAP EPS estimate of $0.08. At the time of writing, news coverage surrounding the announcement was mostly negative and the stock price experienced a dip in value the same day. For investors considering whether or not to invest in NetEase, it is important to note the company’s financial performance in terms of both non-GAAP and GAAP metrics to gain an understanding of the company’s financial health.

Investors should also take into account the company’s history of earnings reports, its strategic investments and business partnerships, and potential risks associated with investing in the company. Ultimately, investors should research NetEase security thoroughly before committing funds to it.

Trending News ☀️

Autodesk has released its fourth quarter results for 2023, beating market analyst’s expectations. Overall, the impressive performance by Autodesk shows the company is in the midst of a growth period. The company cited its successful acquisitions, strategic partnerships, and investments in research and development as the main drivers of the improved financial performance in Q4 2023. The company’s product portfolio is also expanding, offering more tools and services to corporations and organizations around the world.

The strong Q4 results indicate Autodesk has the potential to continue to deliver solid returns on investments in the future. Analysts have predicted the company’s revenue to grow significantly over the coming years, potentially becoming one of the largest software providers in the world. With its strong focus on innovation and product development, Autodesk is sure to remain a leader in its industry.

Share Price

Thursday ended with a positive outlook for AUTODESK, as their fourth-quarter fiscal 2023 non-GAAP earnings per share (EPS) beat analysts’ estimates by $0.05. The effect of this news was evident in the stock market, as AUTODESK’s stock opened at $218.1 and closed at $221.2, up by 2.1% from its previous closing price of $216.7. This increase highlights how much company performance can be affected by even small improvements in EPS results.

The response to AUTODESK’s performance has been mostly positive from the media, who have praised the company for exceeding expectations. This positive sentiment has helped AUTODESK’s stock rise further, proving that even small improvements in results can build optimism for investors and the public alike. Live Quote…

Analysis

At GoodWhale, we have conducted a thorough analysis of AUTODESK’s financials. Our proprietary Valuation Line has calculated the intrinsic value of AUTODESK’s share to be around $288.5. However, currently the stock is trading at $221.2, constituting a 23.3% undervaluation of its intrinsic value. We recommend that investors purchase shares in AUTODESK now as it presents a great buying opportunity. More…

Summary

Autodesk has seen a largely positive media portrayal since their fourth quarter 2023 earnings announcement, beating expectations on non-GAAP earnings per share by $0.05. Investors have responded positively to this news and the company’s outlook, pushing the stock price up significantly. Analysts view Autodesk as a promising long-term investment opportunity, citing its strong product portfolio and market position.

Autodesk has also made significant investments in technology, research and development, which could position the company well for future growth. Investors should pay attention to the company’s financial performance in the coming quarters and consider whether it is a good fit for their portfolio.

Trending News ☀️

MercadoLibre, the Latin American e-commerce platform, reported record Q4 results that exceeded expectations. The company posted a GAAP EPS of $3.25, beating analyst expectations by $0.93. Revenue for Q4 came in at $3 billion, surpassing previous predictions by $40 million. MercadoLibre experienced astounding growth in their payment service during the fourth quarter, with Total Payment Volume increasing by 80.0% from the previous year, on an FX neutral basis.

In addition, Gross Merchandise Volume saw a 34.7% year-over-year increase on an FX neutral basis, further demonstrating the company’s success. The Q4 results are a testament to MercadoLibre’s dedication to providing the best services and products to customers. The company looks forward to continuing to grow and meet customer needs in the coming quarters.

Price History

MERCADOLIBRE, the Latin American e-commerce giant, has released their record 4th quarter results. The company reported a total payments volume increase by 80%, and a Gross Merchandise Volume increase by 34.7%. On Thursday, MERCADOLIBRE stock opened at 1134.9 and closed at 1136.3; that’s a 1.6% increase from the closing price of 1118.3 the same day. The record 4th quarter results come as a surprise to many, considering the pandemic circumstances of 2020.

The high volume of payments and number of goods sold demonstrate the strength of the e-commerce platform, as well as its ability to cater to the intensified demand during a time of crisis. MERCADOLIBRE is looking forward to continuing their momentum in 2021. The company is optimistic that their investments in key initiatives are well-positioned for the long run, and will ensure their success in the upcoming years. Live Quote…

Analysis

GoodWhale conducted an analysis of MERCADOLIBRE’s wellbeing and calculated the fair value of MERCADOLIBRE share to be around $2076.6 using our proprietary Valuation Line. We have found that the current price of MERCADOLIBRE stock is $1136.3, which means that the stock is currently undervalued by 45.3%. Our analysis shows that investors could potentially benefit from buying the stock at its current price, as it is expected to reach its fair value in the near future. More…

Summary

MercadoLibre (MERCADOLIBRE) reported impressive fourth quarter results, boasting an 80% increase in total payment volume and a 34.7% growth in gross merchandise volume. These figures demonstrate strong organic growth and are likely to be a positive indicator for investors. This follows a period of considerable investment in new product offerings and operational infrastructure, with an emphasis on digital payments and financial services.

The company’s investments have already started to pay off, with the results suggesting MERCADOLIBRE is well placed to take advantage of continued growth opportunities in the Latin American markets in which it operates. Analysts are likely to revise their forecasts upward in light of these results and investors should remain optimistic.

Trending News ☀️

American Express, the multinational credit card provider, has reached new heights in 2023 with record total revenues of $55.62bn and EBITDA of $14.63bn. This milestone is a significant accomplishment for the company after a difficult 2020 due to the global pandemic. While many sectors of business fell due to the pandemic, American Express continued to thrive and make strides in their industry. The increase in total revenues can be attributed to the company’s robust customer base and strong focus on innovation. Their dedication to providing customers best-in-class services has resulted in a steady increase in spending power, sales and revenues.

American Express also invested heavily in new technologies, launching a suite of digital products such as online payments, mobile wallets and an AI-powered virtual assistant. The strong performance of the company is also reflected in their EBITDA of $14.63bn which has further solidified the company’s position as a global leader in the credit card industry. Going forward, American Express is well positioned to capitalize on any future opportunities that may arise and continue to grow their business.

Share Price

American Express continues to reach unprecedented heights, as their third-quarter revenue in 2023 set a record of $55.62 billion, while their earnings before interest, taxes, depreciation and amortization (EBITDA) was calculated at $14.63 billion. This news has been met with largely positive coverage by the media, and the stock market has reacted accordingly. On Thursday, AMERICAN EXPRESS opened at $175.2, and closed at $175.1, showing a 0.3% increase from the 174.7 closing price on the previous day. Live Quote…

Analysis

GoodWhale recently conducted an analysis of AMERICAN EXPRESS’s financials, and based on our proprietary Valuation Line, we determined that the intrinsic value of AMERICAN EXPRESS share is around $183.3. Currently, AMERICAN EXPRESS stock is traded at $175.1, making it a fair price, but undervalued by 4.5%. This creates a buying opportunity for those looking to invest in AMERICAN EXPRESS stock and could yield good returns in the near future. More…

Summary

American Express (AXP) has seen tremendous growth in its financials over the last few years and has achieved a new peak in 2023. The company reported Total Transaction Revenues (TTM) of $55.62 billion and Earnings Before Interest, Tax, Depreciation and Amortization (EBITDA) of $14.63 billion, both of which are all-time highs. The news coverage for the company has been mostly positive, with many investors being attracted to its impressive financials and long history of success.

AXP is well-positioned for further growth, as it continues to expand its product offerings, services, and customer base. It is well worth considering for any investor’s portfolio.

Trending News ☀️

Synopsys, Inc., a provider of electronic design automation (EDA) software and intellectual property (IP) products, recently announced a share repurchase agreement with Bank of America N. A. to buy back up to $300 million worth of its own shares. The rapid repurchase program was designed to enable the company to purchase its own stock on the open market, in order to reduce the amount of outstanding shares and potentially increase the value of those remaining. The repurchase program is subject to certain conditions and will be funded by Synopsys’ available cash resources. Synopsys has also referred to the agreement as part of a larger plan to return value to its shareholders, demonstrating their commitment to the interests of those that have invested in the company.

As a way of reinforcing investor confidence, this agreement reflects how seriously Synopsys takes its responsibility to maximize shareholder value. The company’s commitment to shareholders hasput them in a good position for continued financial success and solidifies their position as leaders in the EDA software market.

Market Price

Synopsys Inc., a leading provider of software for integrated circuit development, recently announced that it has entered into a $300M share repurchase agreement with Bank of America N. A. Reaction to the news has been largely positive and on Thursday, SYNOPSYS’ stock opened at $360.0 and closed at $365.5, up by 2.9% from its last closing price of 355.1. The share repurchase agreement represents a strong vote of confidence in the company’s future by Bank of America and is sure to provide boost to Synopsys Inc.’s stock price. Live Quote…

Analysis

As GoodWhale, I have conducted an analysis of Synopsys’ financials. According to the Star Chart, Synopsys is classified as a ‘gorilla’, a type of company that has achieved stable and high revenue or earnings growth due to its strong competitive advantage. Such companies may be of interest to investors who want to get involved in steady and long-term growth opportunities. The financial health of Synopsys is very good, with a score of 10/10 in terms of cashflows and debt. This indicates that the company is capable of sustaining future operations even during times of crisis. Additionally, Synopsys is strong in terms of growth and profitability, medium in terms of asset, and weak in terms of dividend, making it a viable option for those who want long-term returns on their investments. More…

Summary

Synopsys, Inc., a leading provider of software and IP used in the design, verification, and manufacturing of electronic components and systems, recently announced a $300 million share repurchase agreement with Bank of America N.A. This buyback program will offer Synopsys shareholders the opportunity to reduce the number of its outstanding common stock, thereby increasing its earnings per share and enabling it to invest more in innovation and research and development. Investment analysts are generally positive on the news, as the share repurchase program will likely lead to an increase in Synopsys’ stock value over time. Short-term traders may also benefit from this agreement as well. As such, investors should consider putting their money into Synopsys’ stock, as it is likely to experience a significant bump in price due to this announcement.

Trending News ☀️

Link Administration is currently in negotiations with the Waystone Group with regards to the potential sale of its UK unit. The two groups are currently discussing matters such as the details of the sale, pricing, and exchange of assets. This move is set to be a major milestone for Link Administration, as it would signify the company’s foray into international markets.

Additionally, this could potentially be beneficial for the Waystone Group, as the purchase would give them access to Link Administration’s highly respected infrastructure and services. By owning Link Administration’s UK unit, Waystone Group would be able to expand their reach and strengthen their presence in Europe. Furthermore, the sale of the UK unit would give Link Administration greater resources to explore other areas of operation, such as the Asia-Pacific market. This move could potentially open up new opportunities for the company, allowing them to diversify and increase their overall profitability. Overall, the negotiations between Link Administration and Waystone Group could have a major impact on both companies. As such, it is essential that both sides come up with an agreement that is mutually beneficial and ultimately results in a successful sale of Link Administration’s UK unit.

Share Price

On Monday, LINK ADMINISTRATION, a leading international provider of administration services, announced that it is in advanced negotiations with the Waystone Group, a UK-based investment firm, to sell its UK unit. This news has been well received by the market as LINK ADMINISTRATION stock opened at AU$2.1 and closed at AU$2.1, up by 2.4% from the previous closing price of 2.1. It is currently the largest provider of administration services in the UK and a market leader in the administration sector.

The negotiations between LINK ADMINISTRATION and Waystone Group are expected to be concluded soon, with Waystone Group likely to pay a premium for the UK unit. This could potentially represent a win-win situation for both companies, as Waystone Group is expected to benefit from the increased presence in the administration sector, and LINK ADMINISTRATION will be able to focus on its more profitable core activities. Live Quote…

Analysis

At GoodWhale, we recently conducted an analysis of LINK ADMINISTRATION’s fundamentals. After considering the financial and business aspects of their company, our Risk Rating algorithm identified it as a medium risk investment. We detected three risk warnings in LINK ADMINISTRATION’s income sheet, balance sheet, and cashflow statement. If you’re interested in learning more about the specific risks we uncovered, become a registered user with GoodWhale and access our full report. More…

Summary

Link Administration has recently negotiated a unit sale with Waystone Group, a move that could have strong implications for investors. Link Administration is one of the largest providers of outsourced administrative services in Australia, covering the areas of superannuation, workplace relations, funds administration, and financial reporting. The unit sale with Waystone Group is expected to improve the company’s financials and increase its market share.

Further, the deal could provide investors with significant returns, as it may lead to higher profit margins and improved overall financial health. Overall, the unit sale between Link Administration and Waystone Group is likely to be a positive move for investors, as it will likely bring lucrative returns with long-term advantages.

Trending News ☀️

MaxLinear and Airgain have joined forces to develop a revolutionary massive MIMO reference design that promises to revolutionize radio performance. By combining their respective high performance technologies, Airgain’s 64T64R antenna array and MaxLinear’s MXL1550 8T8R transceiver, the two companies have developed an innovative AI/ML-powered beamforming algorithm to improve spectrum reuse and greater radio performance. With this powerful combination of technology, the design is expected to allow wireless service providers to maximize the use of the spectrum, enabling better coverage and more robust connection for their customers. The massive MIMO reference design provided by MaxLinear and Airgain will allow carriers to deliver better user experience in their 5G networks. Their advanced beamforming algorithms will help to reduce interference and optimize the usage of spectrum, resulting in improved network performance and capacity.

Furthermore, the enhanced radio performance will benefit customers in terms of increased reliability, faster data speeds and better quality of service. In conclusion, MaxLinear and Airgain’s revolutionary massive MIMO reference design is set to revolutionize radio performance. With their advanced AI/ML-powered beamforming algorithm, an improved spectrum reuse and greater radio performance can be achieved allowing carriers to deliver a better user experience and improved network performance.

Price History

On Thursday, MAXLINEAR and Airgain combined forces to develop a revolutionary Massive MIMO Reference Design, an innovative radio performance improvement solution. The news has been welcomed with positive media attention, and the MAXLINEAR stock opened at $35.0 and closed at $34.8, up by 2.6% from its last closing price of 33.9. This collaboration between MAXLINEAR and Airgain is expected to strongly benefit both companies, as well as their customers, who will now have access to this cutting-edge technology. Live Quote…

Analysis

As GoodWhale, I have conducted an analysis of MAXLINEAR’s fundamentals and have classified it as a ‘gorilla’ using the Star Chart. These are companies that have achieved stable and high revenue or earning growth due to their strong competitive advantage. Investors who are interested in such companies will likely be intrigued by MAXLINEAR. Its high health score of 10/10 with regard to its cashflows and debt means that it is capable of safely riding out any crisis without the risk of bankruptcy. Moreover, MAXLINEAR is strong in growth and profitability, medium in asset, and weak in dividend, making it an attractive option for investors. More…

Summary

MaxLinear, a publicly traded semiconductor company, recently partnered with Airgain, a wireless technology developer, to develop a revolutionary Massive MIMO Reference Design. This design is expected to significantly improve radio performance for both companies, making them an exciting investment opportunity. Analysts have predicted that this collaboration could increase MaxLinear’s share price with strong growth potential.

Airgain is likely to benefit from increased demand for its products within the connected home market. Overall, MaxLinear appears to be a good mid-term investment opportunity with growing potential as the company looks to continue to expand its reach in the semiconductor industry.

Trending News ☀️

MaxLinear and Airgain have collaborated to create a new reference design for enhanced spectrum reuse with massive MIMO radio units. By combining their respective high performance technologies, the design aims to improve spectrum reuse while reducing costs. The new design integrates Airgain’s 64T64R antenna array, the MaxLinear MXL1550 8T8R transceiver, and AI/ML-powered beamforming algorithms. With this setup, operators can drastically reduce their power consumption and increase the reliability of their communications networks. The MXL1550 transceiver incorporates the latest RF technologies such as frequency-selective scheduling and advanced beamforming for improved system performance, while the Airgain antenna array is capable of MIMO operation at both 2.4GHz and 5GHz frequency bands. Combined together, the reference design offers an ideal solution for operators looking to maximize spectrum reuse without compromising on system performance.

Additionally, the AI/ML-powered beamforming algorithms enable operators to control and adjust their beamforming strategy according to their specific needs. This will effectively reduce their capital expenditures while improving the overall efficiency of their existing networks. By combining their flagship technologies, MaxLinear and Airgain have created an innovative reference design which is expected to drive further innovation in the industry. Through this design, operators have an ideal solution to boost spectrum reuse while reducing power consumption. This new reference design will also allow operators to leverage AI/ML-based technologies to quickly adjust their beamforming strategies according to changing environment conditions, thus further improving their system performance.

Stock Price

MAXLINEAR and Airgain recently announced a partnership to create a reference design for enhanced spectrum reuse with Massive MIMO radio units. The news has been well-received so far, with MAXLINEAR’s stock positively reacting to the news on Thursday. The company saw its stock open at $35.0 and close at $34.8, up by 2.6% from prior closing price of 33.9. This is a clear sign that investors are optimistic about the new initiative and are bullish towards the future of MAXLINEAR and Airgain. Live Quote…

Analysis

At GoodWhale, we recently performed an analysis of MAXLINEAR’s wellbeing. After considering various factors, our proprietary Valuation Line came to a fair value of approximately $56.3 per share. However, MAXLINEAR stock is currently traded at $34.8, which presents a great opportunity to invest in it – as it is undervalued by 38.2%. We believe that, with the present market conditions, investing in MAXLINEAR’s stock would be a wise financial decision. More…

Summary

MaxLinear Inc. (MXL) is an attractive investment opportunity owing to its strong market performance and partnership with Airgain, a leader in antenna technology. The collaboration has resulted in the creation of a reference design enabling enhanced spectrum reuse with massive MIMO radio units, driving improved returns on investments in 5G networks. On the financial front, MXL has bolstered its balance sheet with dividend distributions and regular cash flow generation.

Additionally, the company has also seen growth in terms of total revenues and net income over the past five years, which has been consistent and impressive. MXL has also been actively engaging in strategic acquisitions, which have further strengthened their market presence and enabled them to expand their product portfolio. All in all, the fundamentals of the company and long-term prospects are favorable for investors.

Trending News ☀️

China BlueChemical has seen a remarkable increase in its shareholding returns over the last three years, far outpacing its earnings growth. This has led to a significant increase in the total value of shareholders’ investments, resulting in a higher return on their investment. This impressive performance can be attributed to a number of factors, including strong market demand, effective cost management and improved organizational efficiency. Since the implementation of strong cost management policies and organizational efficiency measures, China BlueChemical has seen a sharp increase in its profitability. As a result, the company has been able to generate higher cash flows which in turn have enabled it to payoff its debts, resulting in reduced financial burden. Furthermore, the company’s stock price has also benefited from the investor confidence stemming from its solid performance over the past few years.

The strong returns from China BlueChemical have been further bolstered by the increasing demand for its products and services in the global market. This has created additional opportunities for the company to expand its operations and increase its leverage in the global market. With a number of strategic acquisitions and partnerships, China BlueChemical has continued to strengthen its position as a leading player in the global chemical market. Overall, China BlueChemical’s impressive performance has resulted in its shareholding returns outstripping its earnings growth over the last three years. This is an encouraging sign that points to the company’s dynamic and forward-thinking approach to business, which has enabled it to remain one of the most profitable players in the chemical market.

Share Price

China BlueChemical has had an impressive year, with its shareholder returns far outpacing its earnings growth. At the time of writing, media sentiment towards the company is largely positive. On Tuesday, China BlueChemical opened at HK$1.9 and closed the day at the same price, down by 0.5% from its closing price of 1.9 the previous day. Despite the slight dip in share price, China BlueChemical’s earnings growth has significantly outpaced that of its peers and shareholders are enjoying strong returns as a result. Live Quote…

Analysis

At GoodWhale, we have analyzed the financials of CHINA BLUECHEMICAL, and our proprietary Valuation Line suggests that the fair value of its share is around HK$2.2. However, CHINA BLUECHEMICAL stock is currently being traded at HK$1.9, which represents a fair price that is undervalued by 12.6%. This may suggest that it could be a good time to invest in CHINA BLUECHEMICAL stock for potential returns. More…

Summary

China BlueChemical has seen exceptional returns for its shareholders in recent times, far surpassing the growth in earnings. The company has been met with mostly positive sentiment from the media, both domestically and globally. As such, investors are advised to take a closer look at China BlueChemical’s strong fundamentals and potential for further growth. These include their market share in the industry, ongoing new product development and continual investment in technology and innovation.

With a diverse portfolio of products and the ability to operate across multiple industries, it appears that China BlueChemical is well-positioned to capitalize on the emerging economic opportunities. Given the current economic climate, investors should make sure to do their due diligence when investing in this company.

Trending News ☀️

QuantumScape Corporation (QSC) is an American company that designs, develops, and manufactures solid-state battery cell technology for use in electric vehicles. QSC has seen its stock price pull back recently, despite strong performance from some of its peers in the sector. This drop in stock prices has led to the company being rated with a “Hold” investment rating, meaning that while the stock has potential, investors should be cautious before investing. Despite the current pullback in its stock price, QuantumScape Corporation offers plenty of long-term potential. The company has seen a steady rise in its revenue and profits over the last year due to the increased demand for its revolutionary solid-state battery technology. Additionally, the company has significant research and development resources and is well-positioned to capitalize on future opportunities in the electric vehicle segment.

However, QuantumScape Corporation also faces some risks in the long run. Its technology is still new and unproven, and there is a lack of patent protection for this type of battery cell.

Additionally, the company may face difficulty scaling up production and marketing its products in order to compete with more established players in the industry. As such, investors should be aware of these risks before investing in the company. All things considered, QuantumScape Corporation’s stock price pullback reflects both the benefits and risks associated with its long-term prospects. Investors should take these into account before investing and should remain aware of any changes in the company’s fortunes when making their decisions. Overall, the company currently holds a Hold investment rating, meaning it is a relatively safe option for those looking to add some diversity to their portfolios.

Share Price

QuantumScape Corporation’s stock price experienced a pullback on Thursday, opening at $10.1 before closing at $9.6, a decrease of 2.4% from its previous closing price of $9.9. This downturn reflects a mixed long-term outlook of the company, which has up to now received mostly positive news coverage. Despite this short-term dip, analysts still hold a “Hold” rating on QuantumScape stock due to its long-term potential. Live Quote…

Analysis

At GoodWhale, we have been closely analyzing the financials of QUANTUMSCAPE CORPORATION. Through the use of our proprietary Valuation Line methodology, we have determined that the intrinsic value of QUANTUMSCAPE CORPORATION shares is around $23.3. Although this value may fluctuate over time, it is currently well above the current market price of $9.6, making it a highly attractive investment opportunity. This means that investors are currently receiving a discount of roughly 58.8% on their investment. As QUANTUMSCAPE CORPORATION continues to unlock new market opportunities and improve its financials, we believe that this stock will be a great addition to any portfolio. More…

Summary

QuantumScape Corporation is a high-growth company currently experiencing a pullback in its stock price. Despite this, the long-term outlook for the company remains largely positive and attractive for potential investors. Reports from news coverage have been generally favorable, citing the company’s innovative battery storage technology and potential for long-term growth and profitability.

Analysts have suggested holding the stock, suggesting there may be further volatility in the near-term, but with the potential for long-term gains as well. Investors should therefore consider their individual risk appetite and assess the potential upside of investing in QuantumScape.

Trending News ☀️

QuantumScape Corporation has recently had a pullback in its stock price, which has resulted in its shares being assigned a Hold investment rating. The reason behind this is that while QuantumScape’s profits timeline is not as attractive as its competitors, the risks associated with investing in the company have been taken into account. This mixed outlook for QuantumScape means that investors may want to consider holding off on investing in the company until the outlook changes. Though the current outlook on QuantumScape is not ideal, there are still some opportunities to be found. The company is still a leader in the field of solid-state battery technology and has begun to make advances in the automotive sector. This could be a lucrative area for investors if QuantumScape is able to capitalize on the opportunities and successes it has seen in the past.

Additionally, the current share price of QuantumScape provides a good entry point for those looking to invest for the long-term. In conclusion, QuantumScape Corporation’s stock price pullback has reflected the assessed risks and opportunities present with the company. As such, the company has been assigned a Hold rating from investors. Those interested in potentially investing in QuantumScape should take into account these risks and opportunities before making any decisions.

Price History

QuantumScape Corporation has been receiving a lot of media exposure of late, and the majority of it has been positive.

However, on Thursday, the company’s stock opened at $10.1 and closed at $9.6, down by 2.4% from its previous closing price of 9.9. This pullback in stock price reflects investors’ assessment of the risks and opportunities associated with investing in QuantumScape Corporation. The pullback in the stock price does not necessarily mean that investors are shying away from the company, but could be due to them assessing the facts and assessing the risks associated with investing in the company. It could also be driven by investors wanting to take profits off the table due to fears of a potential market downturn. All-in-all, this pullback in stock price could be a sign that investors are assessing the risks and opportunities that come with investing in QuantumScape Corporation. Though this is one factor to consider when investing in stocks, it should not be the only factor. Analyzing the company’s performance, its growth prospects, and any other potential risks should also be considered. Live Quote…

Analysis

At GoodWhale, we conducted an in-depth analysis of QUANTUMSCAPE CORPORATION’s wellbeing. Based on our Risk Rating, QUANTUMSCAPE CORPORATION is a high risk investment in terms of financial and business aspects. We have uncovered 3 risk warnings in the cashflow statement, non-financial and financial journals. Our analysis of their financials has found that QUANTUMSCAPE CORPORATION is operating at a high risk of default. We recommend that potential investors become registered GoodWhale users to gain full insight into our findings. Only then will you be able to assess the risk associated with investing in QUANTUMSCAPE CORPORATION and make an informed decision about your future investments. More…

Summary

QuantumScape Corporation is a leading innovator in energy storage technology with a focus on developing and commercializing all-solid-state lithium-ion batteries for electric vehicles. The company’s stock price has recently seen a pullback, which reflects the assessed risks and opportunities that accompany investing in the company. Generally, media coverage so far has been positive, with analysts citing the company’s technology and advanced manufacturing capabilities as major drivers of potential growth.

QuantumScape has several deals pending with automakers in the electric vehicle space and has entered a strategic partnership with Volkswagen. Moving forward, investors are closely watching the progress of QuantumScape’s technology as the company grows and expands, as well as the development of a competitive battery market in the coming years.

Trending News ☀️

Freshpet Inc. stock had a tumultuous day yesterday, closing at $62.45, down -7.22% from its previous closing price of $67.31. This sharp decline in Freshpet Inc.’s stock price is significant and signals that the company may be in a downward trend. Investors may be wary of investing in Freshpet Inc. due to its current state, as the stock’s value has decreased more than 7% in a single day. Overall, this left a bleaker outlook for Freshpet Inc. as a whole.

Investors may be skeptical of investing in the company, as its current stock price is indicative of a downward trend. The 7.22% drop in value highlights the uncertainty in the company’s future and may cause some investors to steer clear of Freshpet Inc.’s stock. In the coming days, it will be important to keep an eye on the company’s performance to see if its stock price will rebound or continue to decline.

Market Price

At the time of writing, news surrounding Freshpet Inc (FRESHPET) seemed to be mostly positive.

However, on Thursday, the company’s stock price took a dip. FRESHPET opened at $63.4 and closed at $62.45, down -7.22% from the previous closing price of 63.2. This dip in stock price may be attributed to overall market sentiment or other external factors. Investors should keep a close eye on FRESHPET in the near-term as the market dynamics could potentially change soon. Live Quote…

Analysis

As GoodWhale, we recently completed an analysis of the wellbeing of FRESHPET. Our Star Chart evaluation found that FRESHPET is classified as a ‘cheetah’, a type of company that is able to achieve high revenue or earnings growth but has lower profitability, making it less stable. We believe that the type of investor interested in FRESHPET would be those who are willing to take on this risk in order to potentially gain higher returns. In terms of the company’s health score, FRESHPET scored 7/10, with our analysis showing that its cashflows and debt levels put it in a position to ride out any economic crisis without the risk of bankruptcy. The company is strong in assets and growth, medium in profitability and weak in dividends. More…

Summary

Investing in Freshpet Inc. (FRPT) can be considered a risky but potentially rewarding venture. The company’s stock recently experienced a 7.22% drop in price and closed at $62.45. Despite this, analyst opinions are largely positive, and some believe the company has promising potential for future returns. Investors should be aware of the risks involved before committing funds to this volatile stock.

Analysts are also watching to see how the company’s initiatives and new products perform in the market in the coming months. With careful research and due diligence, those with a higher risk tolerance may find success investing in Freshpet Inc.

Trending News ☀️

McLean has been a driving force for Medical Properties Trust for over 20 years, and has made an indelible impact on the company’s success. During his tenure he held various leadership roles, including EVP, COO, and Secretary, as well as serving on the board of directors. As one of the three founders of the REIT, McLean helped develop and launch the strategic vision for the company which has been instrumental to its success. McLean was responsible for the management of Medical Properties Trust’s asset portfolio, and was responsible for the underwriting, human resources, and IT departments.

Through his leadership and guidance, he has helped the REIT become one of the leading healthcare real estate investment trusts in the United States. The Board of Directors and senior management team at Medical Properties Trust would like to thank Emmett McLean for his hard work and dedication to the organization over the years. His experience and insight were integral to the success of Medical Properties Trust, and he will be greatly missed.

Share Price

Medical Properties Trust announced on Thursday that founding member Emmett McLean was retiring after over twenty years of service. The news was met with mostly positive media coverage, although the stock fell 8.7% on the same day, opening at $12.1 and closing at $11.1. It was a significant decrease from its previous closing price of 12.2. The retirement of McLean, a long-time leader in the industry, comes with mixed feelings of loss and celebration. McLean has been an integral part of Medical Properties Trust’s success and growth over the years, and his presence will surely be missed.

Despite this, the company is able to celebrate his accomplishments and thank him for his service with the hopes that he can enjoy a well-deserved rest. Medical Properties Trust is in an optimistic position to move forward despite the stressful task of replacing its founding member. As the company looks ahead to a future without McLean, it’s clear that his contributions and legacy will remain a driving force in the organization. Live Quote…

Analysis

GoodWhale provides thorough financial analysis of MEDICAL PROPERTIES TRUST. Using our comprehensive data and advanced analytics, we determined the Risk Rating for this investment to be medium. This means there is an average level of risk associated with this financial and business decision. We also identified 2 risk warnings within the balance sheet and cash flow statement of MEDICAL PROPERTIES TRUST. If you are interested in understanding what these risks are, simply register on our website GoodWhale.com and you will have access to all of our useful insights. More…

Summary

Medical Properties Trust (MED) experienced a drop in its stock price on the day that the company announced the retirement of its founding member, Emmett McLean, after more than 20 years of service. While the news coverage has overall been positive due to McLean’s impact and contributions, investors are concerned about the long-term implications of the retirement. Analysts anticipate that MED may face challenges in the areas of leadership and strategic direction as it transitions to a new team. Investors should continue to closely monitor the company’s progress as it navigates this major personnel change.

Trending News ☀️

Chorus Limited has rewarded its shareholders with an increased dividend payout compared to the previous year. The company recently announced that its shareholders will receive a higher dividend payout than the one distributed in the prior year. This comes as good news for investors looking for steady returns on their investment. The increased dividend will not only be beneficial to existing shareholders, but it could also attract new investors who are interested in the company’s short-term and long-term growth prospects. This could potentially result in an increase in share price in the near-term. The improved dividend payout from Chorus Limited is a sign that the company is performing well and that it is financially stable.

It could also be seen as an indication of the company’s good management and ability to generate profits for its shareholders. This could have a positive impact on investor sentiment in the long-term, further supporting the stock price. Overall, this announcement of an increased dividend payout for Chorus Limited is a welcome development for investors. The improved performance of the company could lead to greater returns for shareholders and increased interest from potential new investors. It could also be a sign that the company is on a path of sustained growth, which could be beneficial to its long-term prospects.

Dividends

CHORUS LIMITED has been rewarding its shareholders with increased dividend payout over the last 3 years. From 2021 to 2022, CHORUS LIMITED has issued an annual dividend per share of 0.28 NZD each year, totaling a dividend yield of 4.02% for 2021 to 2022. This average dividend yield makes CHORUS LIMITED an attractive stock option for investors looking for dividend-focused stocks. With its steady and consistent dividend payment, CHORUS LIMITED is well-positioned to offer reliable returns to its shareholders in the near future.

Price History

Recent media coverage for Chorus Limited has been overwhelmingly positive; and this week, the telecommunications and infrastructure provider rewarded shareholders with a significant increase in dividend payout. On Thursday, CHORUS LIMITED stock opened at NZ$8.0 and closed at NZ$8.1, up by 1.4% from its previous closing price of 8.0. This reflected investors’ confidence in the company’s future prospects and the tangible benefits of maintaining stock in the company. Analysts have suggested that the company is well placed to capitalize on new opportunities in telecommunications and infrastructure in the future, making it an attractive stock on the market. Live Quote…

Analysis

At GoodWhale, we have been taking a close look at the financials of CHORUS LIMITED and have discovered that the intrinsic value of its shares is around NZ$7.6. This calculation was made using our proprietary Valuation Line. Currently, CHORUS LIMITED stock is being traded at NZ$8.1 which is a fair price, although it’s slightly overvalued by 6.1%. More…

Summary

Chorus Limited is a publicly traded company that recently announced a dividend increase to reward their shareholders. This has been met with positive media coverage, as it indicates strong financial performance and investor confidence. For investors considering Chorus Limited, key metrics to consider include current dividend yield, payout ratio, and debt to equity ratios to ascertain the risk and reward potential of investing in the company. Furthermore, reviewing historical performance of the company’s share price in comparison to the industry and general market, as well as its peers can be helpful in assessing the potential of investing in Chorus Limited.

Trending News ☀️

Regeneron Pharmaceuticals has recently been granted priority review status by the US FDA for their high-dose version of their best-selling Eylea treatment. This 8 mg version of the treatment is intended to be used for macular degeneration and diabetic macular edema. This approval was facilitated by their partnership with Bayer AG and the application of a priority review voucher. As a result, the action date set for approval of the treatment is June 27, 2020. This approval is significant for a number of reasons.

First, it is expected that the availability of this high-dose version of Eylea will significantly reduce the number of injections received by patients suffering from either macular degeneration or diabetic macular edema. This will likely result in improved patient outcomes and reduced healthcare costs. Furthermore, the availability of such a treatment in the US will provide more options to those who are seeking to improve their vision. The priority review status granted by the US FDA to Regeneron Pharmaceuticals marks a major milestone in their efforts to increase access to treatments for macular degeneration and diabetic macular edema. If approved, it would be the first high-dose injectable medication for these conditions to be made available in the US. This would be a major step forward for those suffering from these conditions, as well as for Regeneron Pharmaceuticals and the pharmaceutical industry at large. With the action date quickly approaching, all eyes are on Regeneron Pharmaceuticals to see whether this promising treatment will be approved.

Share Price

On December 5th, the US Food and Drug Administration (FDA) accepted Regeneron Pharmaceuticals’ Priority Review of their High-Dose Eylea Treatment for Macular Degeneration and Diabetic Macular Edema. This news has been widely covered in the media, with most reports showcasing a positive outlook. In response to the announcement, Regeneron stock opened at $744.8 on Thursday and closed at $759.7, marking a 1.5% increase from the previous closing price of $748.1. This signifies the investors’ interest in the drug and their belief that it will be successful in its review process.

The High-Dose Eylea Treatment from the pharmaceutical giant is set to revolutionize treatment for the abovementioned conditions with its more effective and quicker results. If successful in its review process, the drug is expected to provide relief to hundreds of thousands of patients across the US. Live Quote…

Analysis

At GoodWhale, we recently conducted an extensive analysis of REGENERON PHARMACEUTICALS’s wellbeing. After extensive research and consideration, we believe that REGENERON PHARMACEUTICALS is a medium risk investment when reviewing the financial and business aspects. We have detected two risk warnings in the balance sheet and cashflow statement, but to gain more insight into these warning signs, register with us today. The more information you have, the better decisions you will be able to make. Don’t let yourself be caught off guard and make sure that you have all the facts before making any big decisions. More…

Summary

Regeneron Pharmaceuticals is an American biopharmaceutical company that has recently had its high-dose Eylea treatment for macular degeneration and diabetic macular edema accepted by the US FDA for priority review. Due to the positive media coverage, investing in Regeneron Pharmaceuticals may be a lucrative opportunity. With potential approvals of their treatments and continued success in research and development, now may be an opportune time to invest in Regeneron.

Trending News ☀️

Analysts at Mizuho have recently reiterated their outperform rating for Harmony Biosciences Holdings, while adjusting the price target range to $60 from $70. Harmony Biosciences Holdings are a biopharmaceutical company focusing on developing and commercializing treatments for rare and orphan diseases such as narcolepsy. The outperformance rating reflects analyst’s expectations of the company’s near-term growth prospects, driven by its recently-approved treatments. The new $60 price target range is still significantly higher than the current trading price of the company’s shares which is around $43. Analysts are expecting the Harmony Biosciences Holdings to benefit from its current portfolio of treatments and upcoming launches in the near future.

While some analysts have cautioned that the current valuation of Harmony Biosciences Holdings may be slightly overvalued, most analysts agree that currently there is ample upside potential in the share price. Overall, analysts maintain a positive outlook on Harmony Biosciences Holdings and believe that investors should consider it to be a good long-term investment. Although the new price target range has been lowered slightly, it is still significantly higher than the current trading price, indicating the potential for significant gains in the company’s share price in the future.

Price History

Harmony Biosciences Holdings recently reiterated its Outperform rating and adjusted its price target from $70 to $60. The news has generally been positive, with analysts optimistic on its performance. On Thursday, HARMONY BIOSCIENCES opened at $46.3 and closed at $46.1, a 0.4% decrease from the previous closing price of 46.3. Despite the slight drop, analysts remain bullish on the future of Harmony Biosciences Holdings and believe that the revised price target of $60 is achievable. Live Quote…

Analysis

At GoodWhale, we believe in creating an even playing field for everyone to make well-informed investment decisions. That’s why we’ve taken a deep dive into the fundamentals of HARMONY BIOSCIENCES. After analyzing their balance sheet, cash flow, and income statement, we believe that the fair value of their stock is around $57.3, which we have determined through our proprietary Valuation Line. This is higher than the current stock price of $46.1, meaning that the stock is currently undervalued by 19.5%. As such, we believe that now is a great time to invest in HARMONY BIOSCIENCES. More…

Summary

Analysts at Harmony Biosciences Holdings have recently reiterated their Outperform rating of the company, adjusting their price target from $70 to $60. Currently, news sentiment around the company remains mostly positive. Investors may consider researching the organization’s competitive landscape, financials and long-term strategy, as well as the efficacy of its products.

Additionally, keeping an eye on stock performance and industry trends can aid in making informed investment decisions. Along with understanding the performance of the company’s stock, investors should closely track market volatility, news and analyst sentiment to assess the risk associated with investing in Harmony Biosciences Holdings.

Trending News ☀️