Shoucheng Holdings L. 697 Sees 2% Increase in Q1 Profits

May 19, 2023

Trending News ☀️

Shoucheng Holdings ($SEHK:00697) L. 697, a publicly traded company based in Hong Kong, has reported a 2% increase in their profits for the first quarter of this year. Their portfolio includes products such as mobile phones, tablets, laptops, home appliances, and personal care items. The company has also recently begun to explore the development of new technologies and services, such as Internet of Things and smart home solutions. Shoucheng’s success is due in large part to their commitment to innovation and quality control. They strive to provide superior customer service and ensure that all of their products meet the highest standards of safety and performance.

Furthermore, they have an active investor relations program that keeps shareholders up to date on the company’s financial performance. The successful Q1 report from Shoucheng Holdings L. 697 is just the latest example of their continued success in the marketplace. With their impressive growth and innovative products, the company is well-positioned for continued success in the years ahead.

Analysis

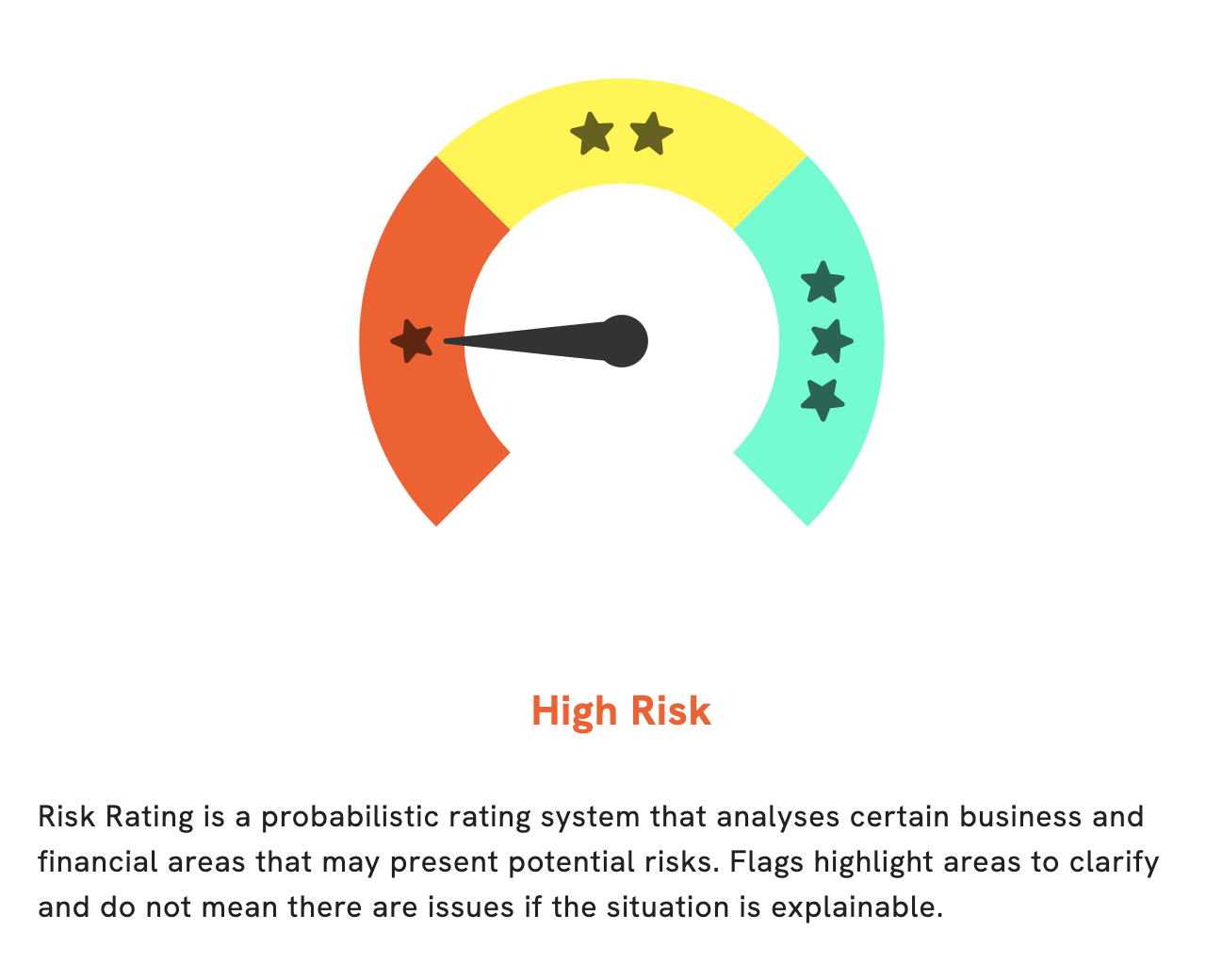

At GoodWhale, we assessed the fundamentals of SHOUCHENG HOLDINGS to create an analysis for our users. After considering all the financial and business factors, our Risk Rating has classified SHOUCHENG HOLDINGS as a high risk investment. We identified four risk warnings in the income sheet, balance sheet, cashflow statement, and financial journal of SHOUCHENG HOLDINGS. For details on our findings, please register on goodwhale.com to view our comprehensive analysis. It is important to remember that high risk investments can be lucrative, but they must be approached with caution. As always, we recommend that investors thoroughly evaluate any investment opportunity before making a financial commitment. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Shoucheng Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 1.6k | 922.01 | 57.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Shoucheng Holdings. More…

| Operations | Investing | Financing |

| 56.48 | 1.81k | -740 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Shoucheng Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 13.66k | 3.63k | 1.46 |

Key Ratios Snapshot

Some of the financial key ratios for Shoucheng Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 59.3% | – | 80.4% |

| FCF Margin | ROE | ROA |

| 3.2% | 7.8% | 5.9% |

Peers

It faces competition from PT Jasa Marga (Persero) Tbk, Jiangsu Expressway Co Ltd, and PT Citra Marga Nusaphala Persada Tbk, all of which have established their own footprints in the same marketplace. With its innovative approach towards the transportation industry, Shoucheng Holdings Ltd has managed to remain relevant as one of the leading players in this domain.

– PT Jasa Marga (Persero) Tbk ($IDX:JSMR)

PT Jasa Marga (Persero) Tbk is a state-owned infrastructure services company that operates toll roads, airports, and other transportation infrastructure in Indonesia. As of 2023, the company has a market capitalization of 25.48T, which reflects its rapid growth over the past few years. Its strong performance is further evidenced by its Return on Equity (ROE) of 20.01%. This indicates that Jasa Marga has managed to generate a significant amount of earnings from its equity base. The company’s success is a reflection of its commitment to providing quality infrastructure services across Indonesia.

– Jiangsu Expressway Co Ltd ($SHSE:600377)

Jiangsu Expressway Co Ltd is a Chinese expressway company based in Jiangsu province. The company is one of the oldest expressway operators in the country, having been established in 1988. With a market cap of 46.34 billion as of 2023, the company has a strong financial position in the market. Additionally, the company’s 11.89% Return on Equity demonstrates its ability to consistently generate profits and create shareholder value. The company operates a network of toll roads and expressways stretching across Jiangsu and connecting various cities and towns.

– PT Citra Marga Nusaphala Persada Tbk ($IDX:CMNP)

PT Citra Marga Nusaphala Persada Tbk is a leading Indonesian infrastructure company engaged in the development, construction, and maintenance of toll roads. As of 2023, the company had a market capitalisation of 9.32T and a Return on Equity of 7.37%, indicating a profitable and well-managed firm. Its market capitalisation makes it one of the largest companies in the country and its strong ROE indicates that it has been able to generate returns for its investors. The company has established a strong presence in the country by successfully completing numerous toll road projects over the years.

Summary

The company’s improved performance can be attributed to its strategic investments and cost-efficiency measures. The company’s strong financial position, coupled with its diversified portfolio of investments, has enabled it to capitalize on opportunities in the market. Shoucheng Holdings has continued to experience steady growth in profits and is poised to benefit even further from its current position in the near future. With increased investor confidence, the company is likely to continue to experience positive gains in both short-term and long-term investments. Investors should pay close attention to SHOUCHENG Holdings and consider investing in this promising stock.

Recent Posts