Ttec Holdings Intrinsic Value Calculator – TTEC HOLDINGS Posts Q1 Revenue of $633.3M, Exceeding Street Estimate of $598.9M.

May 18, 2023

Trending News 🌥️

TTEC HOLDINGS ($NASDAQ:TTEC), INC. is a leading global technology and services provider focused on providing customer experience solutions through its proprietary technology and services platforms. The company posted strong results in the first quarter of 2021, with total revenues of $633.3 million, exceeding expectations of $598.9 million. The company attributed this positive growth primarily to the ongoing success of its Connectivity and Contact Solutions divisions, as well as the successful integration of newly acquired companies.

In addition, the company pointed to the strong customer demand for artificial intelligence, analytics, and customer experience solutions as major drivers of its performance in the quarter. Overall, these results demonstrate the strength of TTEC HOLDINGS’ business model and its ability to continue to deliver strong financial results even during challenging market conditions. With its ongoing investments in new technology and services, TTEC HOLDINGS is well-positioned to capitalize on future growth opportunities and continue to deliver value for its shareholders.

Earnings

TTEC HOLDINGS, INC. recently announced its earnings report for FY2023 Q1 as of March 31 2023, with total revenues of 633.29M USD and net income of 18.65M USD. This is a 7.6% increase in total revenue and a 44.2% decrease in net income compared to the same period last year. The total revenue generated by TTEC HOLDINGS has increased from 539.22M USD in FY2021 Q1 to 633.29M USD in the last 3 years. This exceeds the street estimate of 598.9M USD for this period.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ttec Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 2.49k | 88.48 | 4.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ttec Holdings. More…

| Operations | Investing | Financing |

| 172.42 | -223.16 | 49.24 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ttec Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.15k | 1.52k | 11.85 |

Key Ratios Snapshot

Some of the financial key ratios for Ttec Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.0% | 11.4% | 7.3% |

| FCF Margin | ROE | ROA |

| 3.7% | 20.3% | 5.3% |

Market Price

TTEC HOLDINGS, INC. has recently posted its quarterly revenue results for the first quarter of 2021, exceeding the Street estimate of $598.9M with an impressive amount of $633.3M. Additionally, the company’s share price opened at $33.9 on Friday and closed at $33.0, indicating a 2.2% decrease from the prior closing price of $33.7. This marks the second consecutive quarter of the company’s revenue exceeding the Street estimate, setting a strong precedent for the rest of the year. Live Quote…

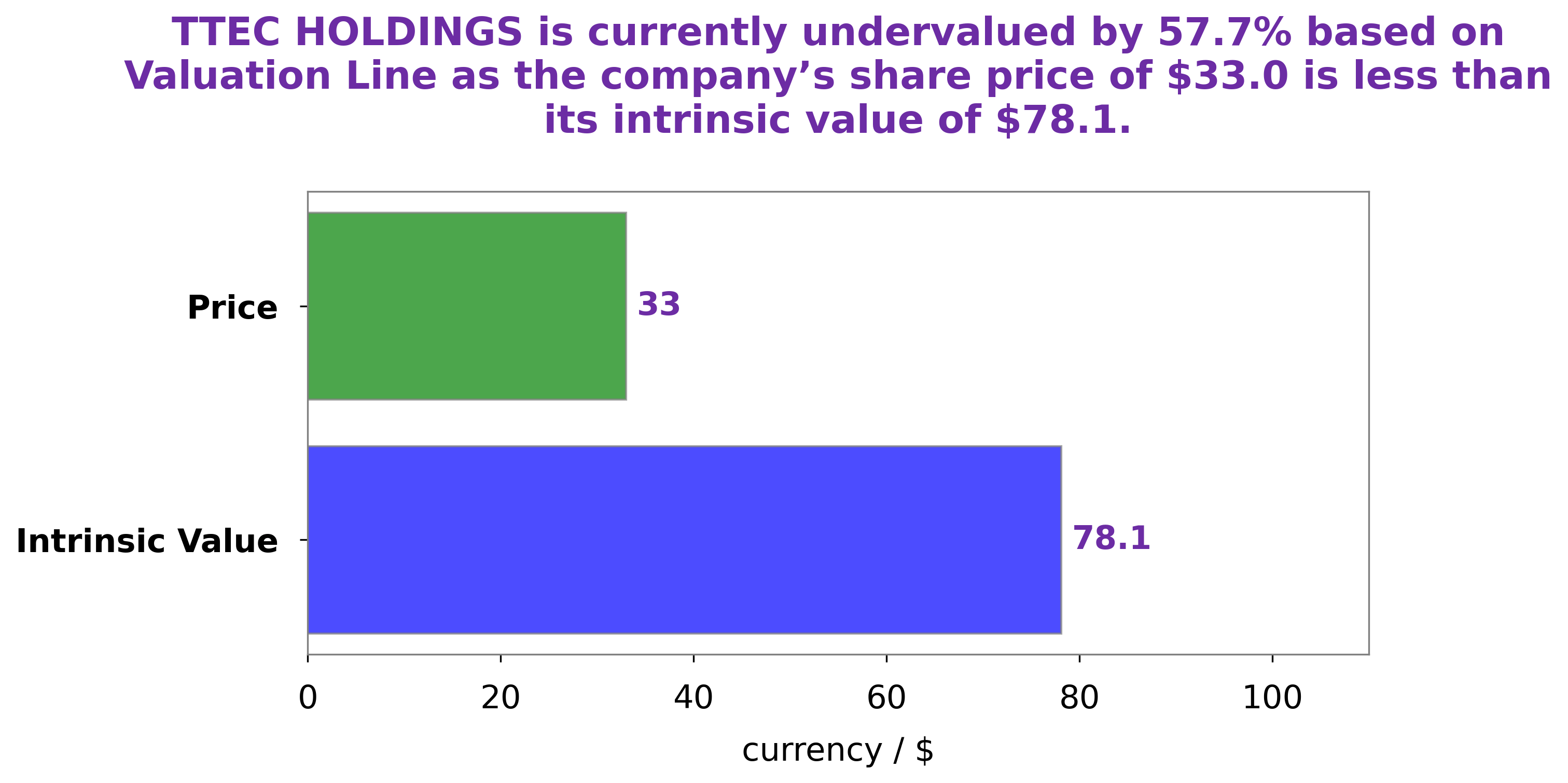

Analysis – Ttec Holdings Intrinsic Value Calculator

At GoodWhale, we conducted an in-depth analysis of TTEC HOLDINGS‘s fundamentals. After careful assessment, we determined that the fair value of TTEC HOLDINGS share is around $78.1. This price was calculated through our proprietary Valuation Line. As such, now may be a great time to invest in TTEC HOLDINGS. More…

Peers

The company offers a suite of digital customer engagement technologies and services that enable clients to manage customer interactions across multiple channels. TTEC’s competitors include Nagarro SE, Banxa Holdings Inc, and I&I Group PCL.

– Nagarro SE ($OTCPK:NGRRF)

Nagarro SE is a global provider of digital transformation solutions. The company has a market cap of 1.3B as of 2022 and a ROE of 37.18%. Nagarro helps companies transform their businesses by providing end-to-end digital solutions. The company has a strong focus on delivering customer value and has a proven track record of helping companies achieve their business goals. Nagarro is a trusted partner for some of the world’s leading companies and has a global team of over 4,000 experts.

– Banxa Holdings Inc ($TSXV:BNXA)

Banxa Holdings Inc is a Canadian company that provides online payment solutions for businesses. Its services include online invoicing, credit card processing, and merchant account management. The company has a market capitalization of 49.19 million as of 2022 and a return on equity of -46.42%. Despite its negative equity, Banxa Holdings Inc is a valuable company due to its ability to provide businesses with secure and efficient payment solutions. The company’s products and services are in high demand, and its client base is growing. Banxa Holdings Inc is a company to watch in the coming years.

– I&I Group PCL ($SET:IIG)

PCL is a leading investment company in Thailand with a market cap of 4.03B as of 2022. It has a strong focus on ROE with a return of 13.91%. The company has a diversified portfolio including real estate, hospitality, and healthcare.

Summary

TTEC HOLDINGS has posted Q1 revenue of $633.3M, exceeding analyst expectations of $598.9M. This is a positive sign for investors in the company, indicating that their growth is continuing to be strong. Moreover, the company’s stock price has been steadily increasing since the start of 2021, making it a potentially appealing investment opportunity.

In addition, TTEC HOLDINGS has been expanding its operations internationally and has seen a consistent pattern of revenue growth in recent years. With this in mind, investors may wish to consider TTEC HOLDINGS as a potential investment option.

Recent Posts