Alaska Department of Revenue Invests $2.72 Million in MSC Industrial Direct Co.

January 10, 2023

Trending News 🌥️

MSC ($NYSE:MSM) Industrial Direct Co., Inc. is a leading North American distributor of metalworking and maintenance, repair, and operations (MRO) products and services. It operates through its subsidiaries, providing a wide range of products, including cutting tools, abrasives, power tools, and safety products to customers in the manufacturing, construction, fabrication, and other industries. The company serves customers through its branch network, eCommerce platform, and direct sales force. The Alaska Department of Revenue has recently reported that they possess $2.72 million worth of stock in MSC Industrial Direct Co., Inc. This investment is part of the State’s commitment to diversifying its investment portfolio to include investments in publicly-traded companies like MSC. The State views MSC as a reliable long-term investment and is confident that this stock will be a strong contributor to the portfolios of both the State and its citizens. The company’s strong financial performance, including solid revenue growth, profitability and return on investment, makes it a valuable addition to the Alaska Department of Revenue’s portfolio.

With its broad product offering, wide distribution network, and commitment to customer service, MSC Industrial Direct Co., Inc. is a reliable partner for Alaska’s industrial customers. In addition to the investment in MSC Industrial Direct Co., Inc., the Alaska Department of Revenue has also invested in other companies such as Microsoft Corporation and Amazon.com Inc. These investments are part of the State’s ongoing effort to diversify its portfolio and create sustainable long-term value for its citizens. The Alaska Department of Revenue’s decision to invest in MSC Industrial Direct Co., Inc. is a sound move that will benefit both the State and its citizens. MSC Industrial Direct Co., Inc. is a reliable long-term investment that will provide both stability and growth to the State’s portfolio.

Market Price

On Tuesday, the Alaska Department of Revenue announced that it had invested $2.72 million in MSC Industrial Direct Co. MSC Industrial Direct is a leading distributor of industrial supplies, equipment, and tools in North America. The stock opened at $81.8 and closed at $81.7 on Tuesday, reflecting the company’s strong performance over the past year. The funds will be used to help MSC Industrial Direct grow and expand its business, as well as increase its competitive advantage in the industrial supplies, equipment, and tools market. The investment in MSC Industrial Direct Co. is a strategic move for the Alaska Department of Revenue, as it provides the department with access to the company’s impressive portfolio of products and services.

The department is confident that the investment will yield strong returns in the future and help them to better serve their customers. This move demonstrates that the Alaska Department of Revenue is committed to investing in businesses that offer strong returns, as well as provide them with access to high-quality products and services. It is yet another example of their commitment to making strategic investments that will benefit their constituents. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for MSM. More…

| Total Revenues | Net Income | Net Margin |

| 3.8k | 355.03 | 9.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for MSM. More…

| Operations | Investing | Financing |

| 264.4 | -104.82 | -196.3 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for MSM. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.75k | 1.35k | 24.77 |

Key Ratios Snapshot

Some of the financial key ratios for MSM are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.2% | 8.6% | 13.0% |

| FCF Margin | ROE | ROA |

| 5.1% | 22.5% | 11.2% |

VI Analysis

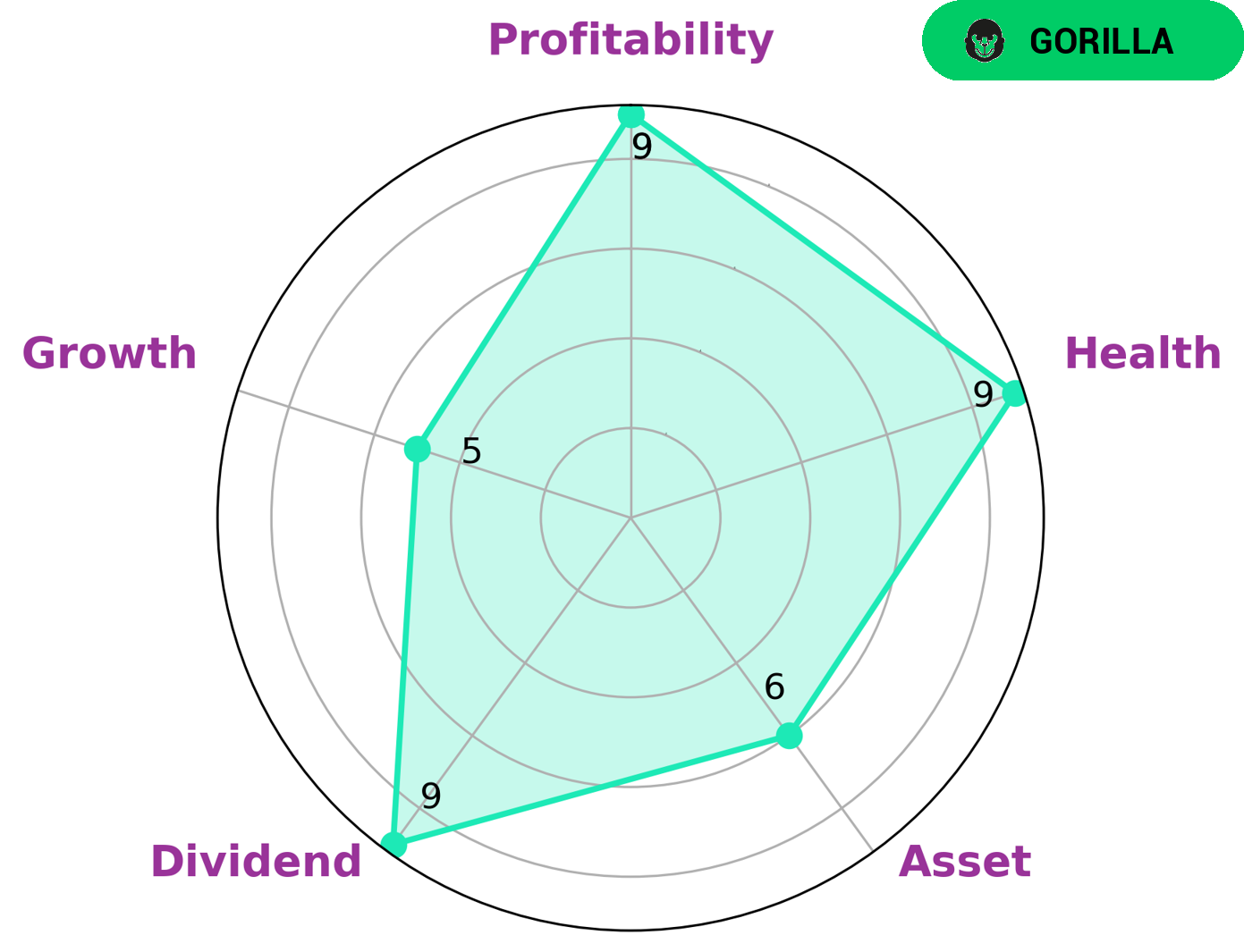

It has high dividend payouts, good profitability and medium assets and growth. It is classified as a ‘rhino’ company, having achieved moderate revenue or earnings growth. Investors interested in such a company may be those looking for a steady stock with good dividends. This type of investor may be comfortable with the moderate growth, as long as it is positive. They may also be looking for a stock that is stable and not too risky, and MSC Industrial Direct’s high health score of 9/10 ensures it is able to ride out any crises without the risk of bankruptcy. Furthermore, the company’s good fundamentals make it an attractive prospect for long-term investments, as they are likely to remain steady and reliable. This could make it an ideal choice for investors looking to build a portfolio over time and reap the benefits of consistent returns. Overall, MSC Industrial Direct is a company with strong fundamentals and a good health score, making it an attractive option for investors looking for a steady and reliable stock. With its moderate growth, good dividend payouts and strong financials, it could be a great addition to any investor’s portfolio. More…

VI Peers

The company has a wide range of products and services that it offers to its clients. The company has a strong presence in the market and is one of the leading companies in this sector. The company has a good reputation in the market and is known for its quality products and services. The company has a strong competition from other companies such as Hardwoods Distribution Inc, Watsco Inc, WESCO International Inc.

– Hardwoods Distribution Inc ($TSX:HDI)

As of 2022, Hardwoods Distribution Inc has a market cap of 534.86M and a ROE of 29.08%. The company is a wholesale distributor of hardwood lumber and related products in North America, with a network of over 60 locations in the United States and Canada. Products include hardwood lumber, softwood lumber, plywood, veneers, decking, flooring, and other millwork products. The company has a long history dating back to 1925, and is a publicly traded company on the Toronto Stock Exchange.

– Watsco Inc ($NYSE:WSO)

Watsco Inc is a provider of air conditioning, heating and refrigeration solutions. It has a market cap of 9.62B as of 2022 and a return on equity of 27.67%. The company serves the residential, commercial and industrial markets in the United States, Canada, Mexico and the Caribbean.

– WESCO International Inc ($NYSE:WCC)

Wesco International Inc is a holding company that, through its subsidiaries, engages in the distribution of electrical, industrial, and communications products and services in the United States, Canada, and Mexico. The company operates through three segments: Electrical, Industrial, and Communications. The Electrical segment offers products and services to customers in the construction, industrial, commercial, and utility end-markets. The Industrial segment provides products and services to customers in the mining, oil and gas, transportation, and infrastructure end-markets. The Communications segment offers products and services to customers in the communications, data center, and enterprise end-markets.

As of 2022, Wesco International Inc had a market cap of 6.45B and a Return on Equity of 16.97%.

Summary

The Alaska Department of Revenue recently invested $2.72 million in MSC Industrial Direct Co., Inc (MSC). MSC is a leading industrial distributor of products and services for businesses in North America. The investment is seen as a positive step for MSC, as it highlights the company’s position as a reliable provider of industrial products and services. The Department of Revenue believes that the investment will provide a solid return on investment for the state.

MSC has a strong track record of delivering exceptional customer service, providing top quality products, and maintaining competitive pricing. This investment should help MSC to continue to grow and expand its customer base.

Recent Posts