Newell Brands Intrinsic Value Calculator – Newell Brands Reports Unexpected Loss Despite Higher-Than-Expected Revenue

April 29, 2023

Trending News 🌧️

Newell Brands ($NASDAQ:NWL), a leading global consumer goods company, recently reported unexpected losses despite higher-than-expected revenue. The company reported a Non-GAAP EPS of -$0.06, which was lower than the expected figure by $0.03. The revenue of $1.8B, however, was higher than the forecasted figure by $10M. It operates through a portfolio of well-known brands including Rubbermaid, Sharpie, Yankee Candle, and Graco, among others.

The company’s lower-than-expected earnings can be attributed to higher costs of raw materials and unfavorable product mix. Despite its lower earnings report, the company has seen a steady rise in its share price over the past year. This is likely due to the company’s focus on expanding its presence in international markets and its commitment to innovation and growth.

Stock Price

On Friday, Newell Brands reported an unexpected loss despite higher-than-expected revenue. The stock opened at $12.0 and closed at $12.2, up by 2.3% from prior closing price of 11.9. This indicates that investors remain optimistic about its future prospects despite the unexpected loss. Newell Brands’ performance was a disappointment to investors and analysts alike, as the company’s revenue was higher-than-expected but still failed to offset the losses. This is due mainly to higher costs associated with recent acquisitions and restructuring plans, which have hurt the company’s bottom line.

Moving forward, analysts are expecting Newell Brands to benefit from its portfolio of well-known brands such as Rubbermaid, Paper Mate, and Calphalon. The company is also focused on expanding in international markets such as China and India, which should help boost revenue and profits in the future. Overall, Newell Brands remains an attractive investment despite the unexpected loss, with investors optimistic about its future prospects. With a well-known portfolio of products and plans to expand in international markets, the company should soon be able to turn things around and generate stronger profits in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Newell Brands. More…

| Total Revenues | Net Income | Net Margin |

| 9.46k | 197 | 4.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Newell Brands. More…

| Operations | Investing | Financing |

| -272 | 343 | -232 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Newell Brands. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 13.26k | 9.74k | 8.51 |

Key Ratios Snapshot

Some of the financial key ratios for Newell Brands are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.9% | 1.4% | 4.1% |

| FCF Margin | ROE | ROA |

| -6.2% | 6.7% | 1.8% |

Analysis – Newell Brands Intrinsic Value Calculator

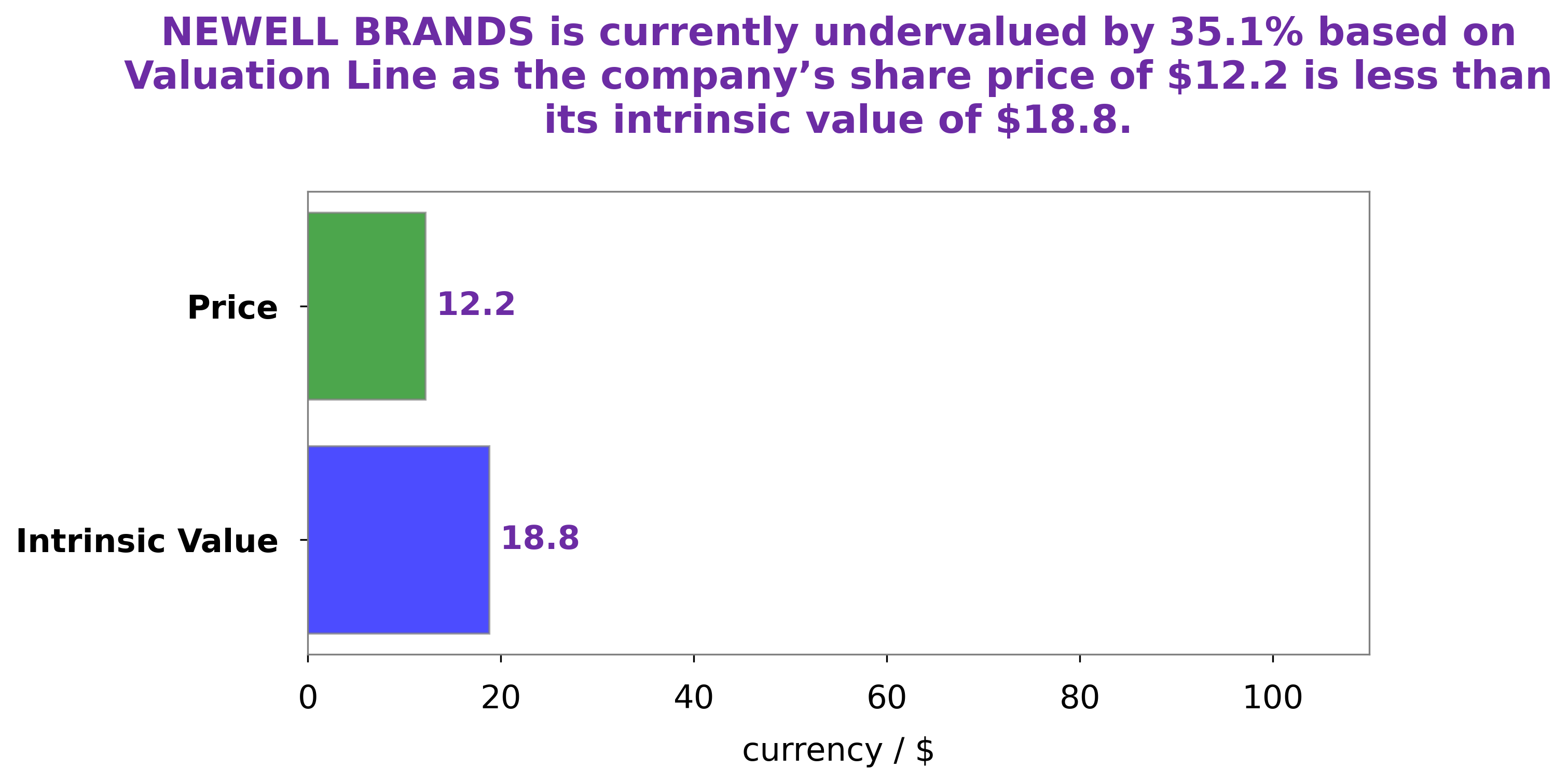

At GoodWhale, we have conducted an analysis of NEWELL BRANDS financials, and our proprietary Valuation Line has revealed that its intrinsic value per share is around $18.8. Currently, NEWELL BRANDS stock is trading at $12.2, which puts it at a 35.3% discount against its intrinsic value. This makes NEWELL BRANDS an attractive investment opportunity, as investors could potentially benefit from capital appreciation in the future. More…

Peers

Newell Brands Inc. competes in the consumer goods market against Beiersdorf AG, Spectrum Brands Holdings Inc, and Winning Brands Corp. Newell Brands Inc. has a diversified portfolio of products that span many categories including housewares, hardware, and office products. The company has a long history dating back to 1898, when it was founded as the Newell Rubbermaid Company.

– Beiersdorf AG ($OTCPK:BDRFY)

Beiersdorf AG is a German skin care company that owns several popular brands, including Nivea, La Prairie, and Eucerin. The company has a market cap of 21.82 billion as of 2022 and a return on equity of 9.31%. Beiersdorf AG is a publicly traded company listed on the Frankfurt Stock Exchange. The company has its headquarters in Hamburg, Germany.

– Spectrum Brands Holdings Inc ($NYSE:SPB)

Spectrum Brands Holdings Inc. is a diversified consumer products company that manufactures, markets, and distributes a wide variety of branded consumer products. The company operates in three segments: Home & Garden, Pet, and Hardware & Home Improvement. The Home & Garden segment produces and markets a variety of consumer products for the home, including small appliances, home fragrance products, and pest control products. The Pet segment produces and markets a variety of pet food, pet supplies, and pet care products. The Hardware & Home Improvement segment produces and markets a variety of hardware and home improvement products, including power tools, hand tools, and plumbing and electrical supplies.

Summary

Newell Brands had a weak fourth quarter earnings report, with a Non-GAAP EPS of -$0.06, which missed expectations by $0.03. Revenue for the quarter came in at $1.8B, beating estimates by $10M. Investors may be wary of investing in the company due to its poor performance this quarter, as well as the fact that it has been struggling to regain profitability over the past few quarters.

The company has taken steps to improve its financials, such as cost cutting initiatives and restructuring, but has yet to see results. Investors should consider the company’s long-term prospects and weigh them against the short-term risks before committing any money to Newell Brands.

Recent Posts