LL Flooring Sees Boost as Investor Group Initiates Sales Process, Talks with F9

June 14, 2023

☀️Trending News

LL ($NYSE:LL) Flooring, a publicly traded flooring products and installation company, has reported a recent surge in its stock price as a consortium of investors has encouraged the company to initiate a sales process. Talks are now underway with F9, a leading home décor and renovation firm, to explore potential deals. The consortium of investors believes that the sale of LL Flooring would be mutually beneficial for both parties as well as other stakeholders. F9 has been keen to acquire LL Flooring for some time, and this recent development presents a great opportunity for them to do so. The company has seen a rapid increase in its stock value since the announcement of the potential sale.

Investors are optimistic that the sale will result in substantial profits for LL Flooring and its stakeholders. Furthermore, the company’s management believes that the sale could help them to make investments and expand their operations in the future. This news has been welcomed by shareholders of the company who have been eagerly awaiting a potential sale for some time. With the discussions now underway, it looks like LL Flooring is on track to make significant gains in the near future.

Price History

LL Flooring saw a boost on Tuesday as an investor group initiated a sales process and opened talks with F9. The stock opened at $4.6 and closed at the same price, representing a 0.9% increase from its previous closing price. This marks a significant shift in the company’s share value, driven by the investor group’s discussions and sales process.

Such news has investors interested in what the future holds for the company. LL Flooring is now in an interesting position, one that is sure to draw much attention from industry analysts and investors as the situation develops. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ll Flooring. More…

| Total Revenues | Net Income | Net Margin |

| 1.07k | -26.7 | -2.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ll Flooring. More…

| Operations | Investing | Financing |

| -67.16 | -21.54 | 39.6 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ll Flooring. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 588.28 | 341.96 | 8.55 |

Key Ratios Snapshot

Some of the financial key ratios for Ll Flooring are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.7% | 34.9% | -2.8% |

| FCF Margin | ROE | ROA |

| -8.3% | -7.5% | -3.2% |

Analysis

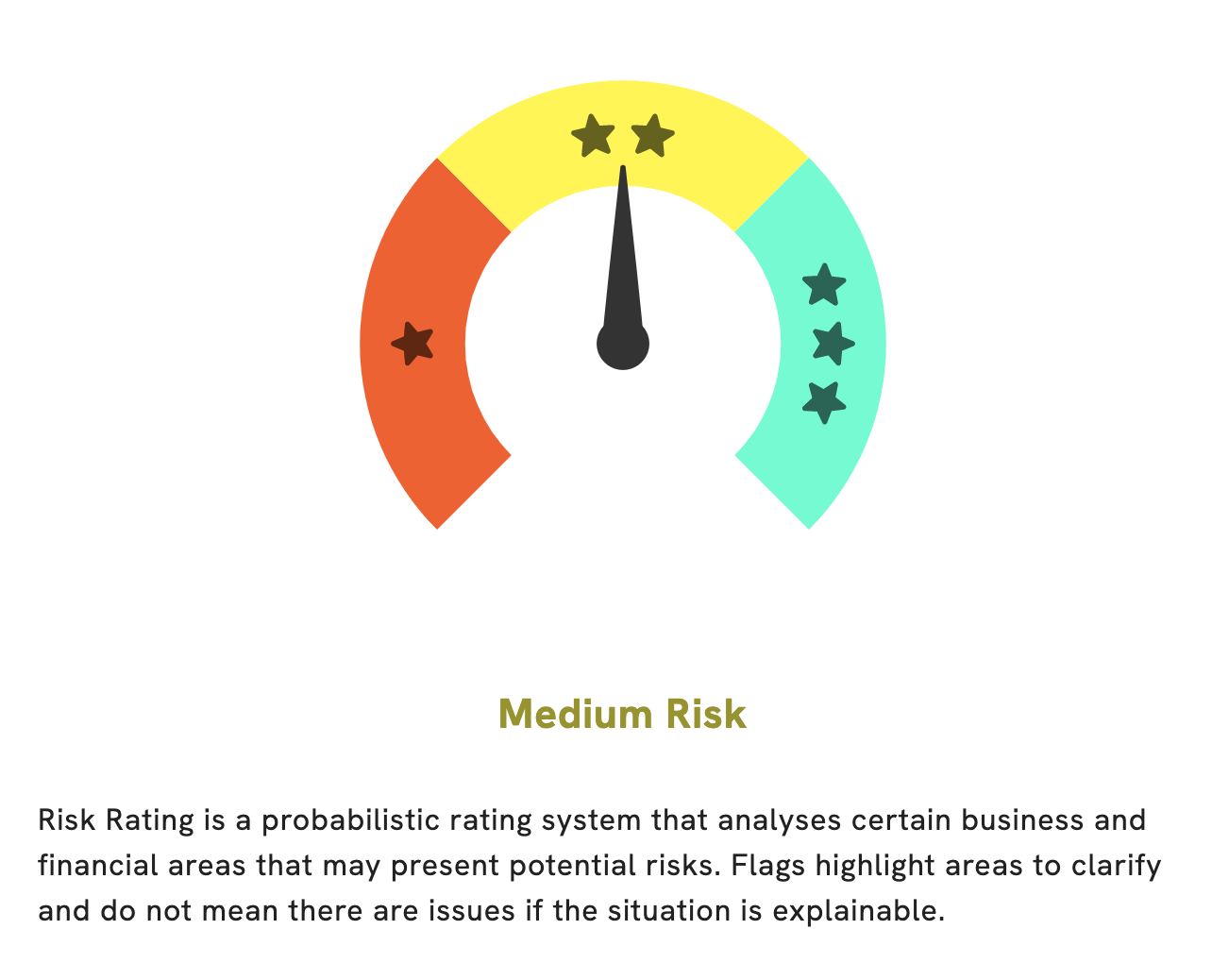

We at GoodWhale have conducted an analysis of LL FLOORING‘s financials. Our Risk Rating has determined that LL FLOORING is a medium risk investment in terms of its financial and business aspects. Further, our research has identified 3 risk warnings in its income sheet, balance sheet, and financial journal. If you would like to know more about these risks, register with us to check it out. We are confident that our insights will help you make an informed decision regarding your investment in this company. More…

Peers

– Lands’ End Inc ($NASDAQ:LE)

Lands’ End is a publicly traded company with a market capitalization of $341.08 million as of 2022. The company has a return on equity of 7.35%. Lands’ End is a retailer that specializes in selling casual clothing, luggage, and home furnishings. The company was founded in 1963 and is headquartered in Dodgeville, Wisconsin.

– Enjoy Technology Inc ($NASDAQ:ENJY)

The Children’s Place, Inc. is a children’s specialty apparel retailer in North America. As of February 3, 2018, the Company operated 1,102 stores in the United States, Canada and Puerto Rico. The Company also operated e-commerce sites at http://www.childrensplace.com and http://www.gymboree.com. In addition, it operated 117 side-by-side stores in the United States under the children’s place and Gymboree brand names as of February 3, 2018. The Company offers apparel, accessories, footwear and home furnishings for children. It designs, contracts to manufacture and sells products under the The Children’s Place, Place and babyPLACE brand names.

Summary

A consortium of investors is driving a sales process for LL Flooring, a flooring and installation product manufacturer. The group is also engaged in talks with F9, a private-equity firm, to potentially acquire the company. The consortium’s decision to push this forward is seen as a positive sign for the future of the company, as it could potentially result in increased growth and profitability. Analysts have found this to be an attractive investment opportunity and are looking forward to the outcome of the negotiations to see what the future holds for LL Flooring.

Recent Posts