Kirkland’s Reports Q2 Loss of $0.95 Per Share, Revenue of $96.88 Million

June 9, 2023

🌥️Trending News

Kirkland’s ($NASDAQ:KIRK) Inc. recently reported its second quarter earnings, showing a loss of $0.95 per share under Generally Accepted Accounting Principles (GAAP) and revenue of $96.88 million. The company also offers credit services and loyalty programs to its customers. Despite the decrease in overall sales, Kirkland’s was able to reduce its losses through a decrease in operating expenses. These financial results demonstrate Kirkland’s ability to respond to the changing retail landscape during difficult times.

The company is focused on adjusting to the new normal by continuing to invest in its ecommerce business while also strengthening its financial position through cost savings and operational discipline. Despite the losses, Kirkland’s is well positioned to emerge from the pandemic stronger than before.

Earnings

KIRKLAND’S recently released their earnings report for the second quarter of Fiscal Year 2024, ending April 30th 2021. The report shows KIRKLAND’S had total revenue of $123.57 million USD, with a net income of $1.72 million USD. This is a 19.6% increase in total revenue from the previous year, however there was a 121.9% decrease in net income. In the last three years, total revenue has decreased from $123.57 million USD to $96.88 million USD.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Kirkland’s. More…

| Total Revenues | Net Income | Net Margin |

| 492.42 | -48.95 | -9.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Kirkland’s. More…

| Operations | Investing | Financing |

| 10.7 | -6.47 | -2.54 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Kirkland’s. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 269.88 | 251.8 | 1.41 |

Key Ratios Snapshot

Some of the financial key ratios for Kirkland’s are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -3.7% | 74.9% | -8.5% |

| FCF Margin | ROE | ROA |

| 0.8% | -108.8% | -9.6% |

Share Price

Revenue for the period was reported to be $96.88 million. On Thursday, KIRKLAND stock opened at $3.1 and closed at $3.0, a decrease of 3.8% from it’s previous closing price of $3.2. Going forward, they will continue to focus on cost control and improving their bottom line in order to drive improved future financial results. Live Quote…

Analysis

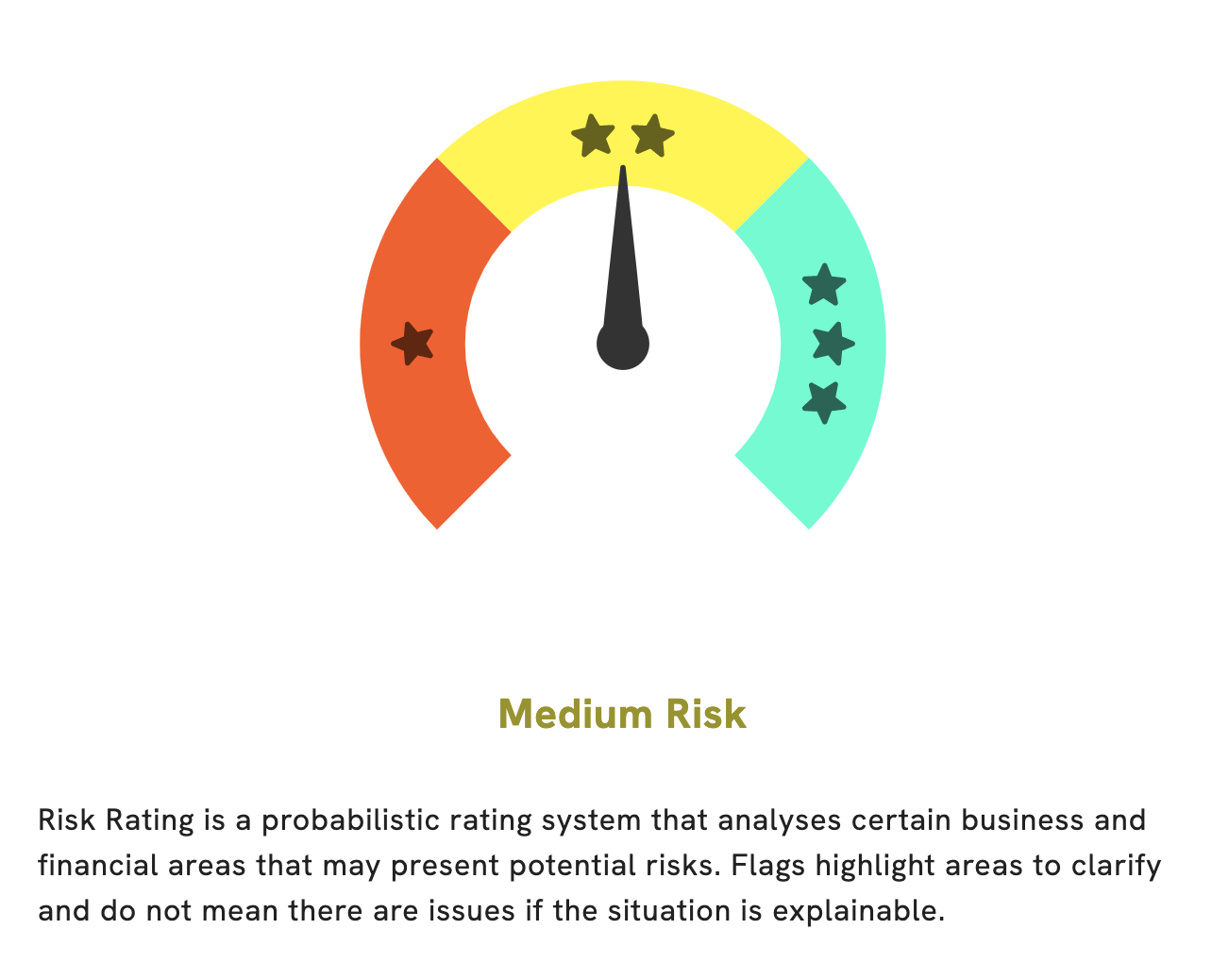

At GoodWhale, we provide investors with the ability to analyze and assess company financials with confidence. Using our platform, investors can easily evaluate KIRKLAND’S financials in detail. Our analysis has determined that KIRKLAND’S is a medium risk investment in terms of financial and business aspects. Although KIRKLAND’S has a solid balance sheet, GoodWhale has detected 1 risk warning. If you would like to explore this further, be sure to register with us. With our comprehensive financial analysis, you’ll be able to make the best decisions when it comes to investing. More…

Peers

The company operates over 350 stores in 37 states and offers its products through its e-commerce website. Kirkland’s main competitors are Max Stock Ltd, bebe stores Inc, and Bed Bath & Beyond Inc. These companies are all leaders in the retail industry and offer similar products to Kirkland’s.

– Max Stock Ltd ($OTCPK:MAXFF)

Max Stock Ltd is a company that has a market cap of 226.6M as of 2022. The company has a ROE of 33.56%. The company does business in the stock market.

– bebe stores Inc ($OTCPK:BEBE)

L Brands, Inc. operates as a specialty retailer of women’s intimate and other apparel, beauty and personal care products, home fragrance products, and accessories under the Victoria’s Secret, Bath & Body Works, Pink, La Senza, Henri Bendel, and Mast General Store brands. The company operates in three segments: Victoria’s Secret Stores, Bath & Body Works, and Victoria’s Secret Direct. It has a market cap of $67.46M and a Return on Equity of -2.11%.

– Bed Bath & Beyond Inc ($NASDAQ:BBBY)

Bed Bath & Beyond Inc. is an American multinational chain of domestic merchandise retail stores. Bed Bath & Beyond operates through 1,507 stores in the United States, Puerto Rico, Canada, and Mexico. The company’s market capitalization is $422.28 million and its return on equity is 146.77%. Bed Bath & Beyond was founded in 1971 and is headquartered in Union, New Jersey. The company sells a variety of home goods, including bedding, bath products, kitchen items, home decor, and small appliances.

Summary

Investors appeared to be concerned with Kirkland’s recent earnings report, as the company reported a GAAP EPS of -$0.95 and revenue of $96.88M. This led to a decline in the stock price on the same day. Investors should still analyze the underlying fundamentals of Kirkland’s before making any decisions, as the company may be able to rebound from its current position. Analysts should examine Kirkland’s financial statements to determine the health of the company’s balance sheet and profitability, as well as its ability to generate cash flow and pay back its debts.

They should also consider the company’s management team, business strategy, competitive landscape, and any industry trends that may affect its performance. Ultimately, investors should carefully weigh all factors before making an investment decision.

Recent Posts