Gambling.com Group Reports Q2 Non-GAAP EPS of $0.20 and Revenue of $26.69M

May 19, 2023

Trending News 🌥️

The company reported Non-GAAP earnings per share of $0.20 and revenue of $26.69 million. Gambling.com Group ($NASDAQ:GAMB) is a leading digital platform connecting consumers with online gambling operators. As a trusted source of gambling information, Gambling.com helps consumers identify the best online gambling sites for their needs and interests. It offers detailed reviews, comparison tools, and advice to ensure that consumers make informed decisions. Through its affiliate network, Gambling.com also helps operators increase their customer base by providing access to an established and growing audience base.

The company’s second-quarter performance was driven by strong organic growth in both revenue and earnings. With this strong financial position, Gambling.com is well positioned to capitalize on opportunities in the digital gambling space going forward.

Earnings

GAMBLING.COM GROUP recently reported its financials for the fourth quarter of the 2022 fiscal year. Compared to the previous year, this translates to a 107.5% increase in total revenue and a 606.9% decrease in net income. This brings GAMBLING.COM GROUP’s total revenue over the last three years to a total of $21.35M. This shows GAMBLING.COM GROUP’s commitment to growing its business and achieving sustainable growth.

Overall, GAMBLING.COM GROUP has succeeded in its fourth quarter earnings report as it has achieved both record revenue and earnings per share. This is a positive sign for the company and investors as it shows the company’s ability to generate growth and sustain it. With a strong financial footing, GAMBLING.COM GROUP is well-positioned for future success.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Gambling.com Group. More…

| Total Revenues | Net Income | Net Margin |

| 76.51 | 2.39 | 15.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Gambling.com Group. More…

| Operations | Investing | Financing |

| 18.75 | -32.7 | -7.31 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Gambling.com Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 138.88 | 51.77 | 2.25 |

Key Ratios Snapshot

Some of the financial key ratios for Gambling.com Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 58.4% | 111.6% | 5.1% |

| FCF Margin | ROE | ROA |

| 12.4% | 2.9% | 1.7% |

Stock Price

On Thursday, the stock opened at $9.9 and closed at $9.8, down by 0.3% from last closing price of 9.8. Analysts have pointed out that GAMBLING.COM GROUP‘s revenue is still largely dependent on advertising spend in the gambling industry, and the current global crisis has forced companies to cut their marketing budgets significantly. Consequently, the company’s revenue and EPS have come under pressure over the past few quarters. Live Quote…

Analysis

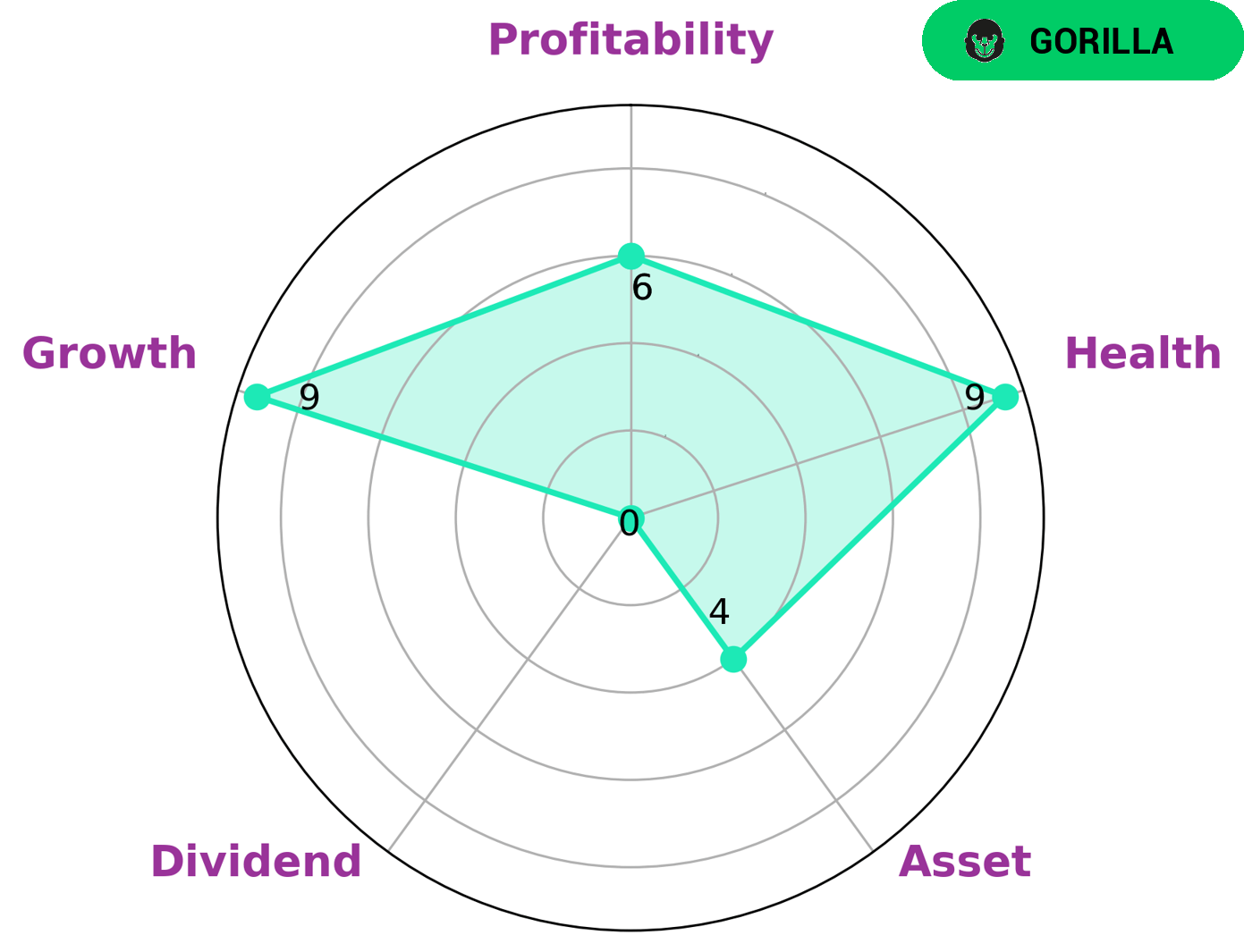

As GoodWhale has analyzed GAMBLING.COM GROUP‘s fundamentals, based on the Star Chart classification of it as a ‘gorilla’, a company that has achieved stable and high revenue or earning growth due to its strong competitive advantage, we have determined what type of investors may be interested in such company. GAMBLING.COM GROUP is strong in growth, medium in asset, profitability and weak in dividend. The company has a healthy score of 9/10 considering its cashflows and debt, showing its capability to sustain future operations in times of crisis. This could be attractive to investors who prioritize long-term investments and stability, as the company has demonstrated a robust growth track record and financial health. More…

Peers

The company is engaged in the online gambling and sports betting industry. The company operates a number of websites and brands, including Gambling.com, Bettingexpert.com, and Casinopedia.org. The company’s main competitors are B90 Holdings PLC, Kindred Group PLC, and Super Group (SGHC) Ltd.

– B90 Holdings PLC ($LSE:B90)

SSE plc, commonly known as SSE, is a British energy company headquartered in Perth, Scotland. It is listed on the London Stock Exchange and is a constituent of the FTSE 100 Index. SSE operates in the United Kingdom and Ireland.

The company has a market cap of 10.58M as of 2022 and a Return on Equity of -43.3%. The company operates in the United Kingdom and Ireland. SSE is involved in the generation, transmission, distribution and supply of electricity and in the storage, distribution and supply of gas. The company also provides other energy-related services, including energy efficiency and telecommunication services.

– Kindred Group PLC ($LTS:0RDS)

Kindred Group PLC is a gambling company with operations in Europe and Australia. The company has a market cap of 20.47B as of 2022 and a ROE of 17.97%. The company’s main products are online casino games, sports betting, and poker. The company also offers land-based casino services in some countries.

– Super Group (SGHC) Ltd ($NYSE:SGHC)

The company’s market cap is 1.98B as of 2022 and its ROE is 66.12%. The company is a leading provider of integrated logistics solutions in China. It provides a comprehensive range of services, including express delivery, warehousing, transportation, cross-border e-commerce logistics, and other value-added services. The company has a strong network of over 4,000 service outlets and a fleet of over 30,000 vehicles. It has a strong market presence in China, with a market share of over 20%.

Summary

GAMBLING.COM GROUP has recently announced a Non-GAAP EPS of $0.20 and revenue of $26.69M for the most recent quarter. Fundamental analysis of the company suggests that this may be a good opportunity for investors as the company has shown strong financial performance in recent years. The company has posted strong revenue growth and increasing profitability, while operating expenses have been consistently low.

Furthermore, GAMBLING.COM GROUP has been able to maintain healthy liquidity levels and has returned significant amounts of cash to shareholders in the form of dividends. Overall, this suggests that GAMBLING.COM GROUP is likely to remain a profitable opportunity for investors in the future.

Recent Posts