Gambling.com Group Anticipates Up to $42.5m in 2021 Revenue Growth

May 12, 2023

Trending News ☀️

Gambling.com Group ($NASDAQ:GAMB), a leading online gambling comparison and information provider, is anticipating up to $42.5 million in revenue growth for 2021. This estimate is based on their acquisitions of Casinomeister, PokerScout and Sports Betting Dime, which are digital gambling companies that extend the reach of Gambling.com Group across the global online gambling industry. They provide consumers with comprehensive reviews, comparisons and recommendations for the best online gambling sites, covering sports betting, poker, casinos, bingo, and more. They have grown significantly over the past decade, and their acquisitions of Casinomeister, PokerScout and Sports Betting Dime have further solidified their position as a leader in the online gambling industry. These acquisitions also present Gambling.com Group with an opportunity to expand their growth beyond the traditional online gambling sector.

Their extensive reach in the industry provides them with an extensive database of customers and partners they can leverage to increase their revenues in 2021. Furthermore, Gambling.com Group is well-positioned to capitalize on the increasing demand for gaming content and services, as well as the rising popularity of esports. The expected revenue growth of up to $42.5 million in 2021 further highlights Gambling.com Group’s commitment to growth and expansion in the online gambling industry. With their strategic acquisitions and partnerships, Gambling.com Group is poised to become a major player in the global online gaming market.

Earnings

GAMBLING.COM GROUP recently released their financial report for the fourth quarter of their 2021 fiscal year, ending December 31 2022. The report shows that total revenue increased by a massive 107.5%, from 10.27M USD to a total of 21.35M USD. This pattern suggests that the company is on track to achieve their 2021 revenue growth target of up to $42.5 million. Despite the decrease in net income, the company’s strong revenue growth is indicative of a successful financial year and suggests that GAMBLING.COM GROUP is well-positioned for continued success in the future.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Gambling.com Group. More…

| Total Revenues | Net Income | Net Margin |

| 76.51 | 2.39 | 15.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Gambling.com Group. More…

| Operations | Investing | Financing |

| 18.75 | -32.7 | -7.31 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Gambling.com Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 138.88 | 51.77 | 2.25 |

Key Ratios Snapshot

Some of the financial key ratios for Gambling.com Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 58.4% | 111.6% | 5.1% |

| FCF Margin | ROE | ROA |

| 12.4% | 2.9% | 1.7% |

Stock Price

On Tuesday, GAMBLING.COM GROUP stock opened at $10.0 and closed at the same price, an increase of 0.4% from the previous closing price. The increase in revenue will be driven by the company’s successful expansion of its affiliate network into new markets. GAMBLING.COM GROUP has been able to efficiently grow its portfolio of websites, including casino, poker and sports betting affiliates, which have seen a surge in popularity over the past year. The company’s strength comes from its focus on delivering innovative and effective solutions for the online gaming industry. GAMBLING.COM GROUP has been able to leverage its strong relationships with leading gaming operators to bring cutting-edge technology to the market.

The company’s solutions are designed to enhance the user experience and promote safe and responsible gaming practices. These measures are expected to increase the company’s revenue in 2021 to a maximum of $42.5m, which could potentially provide a boost to shareholders. With such promising numbers, GAMBLING.COM GROUP looks well-positioned to capitalize on the growing demand for online gambling services. Live Quote…

Analysis

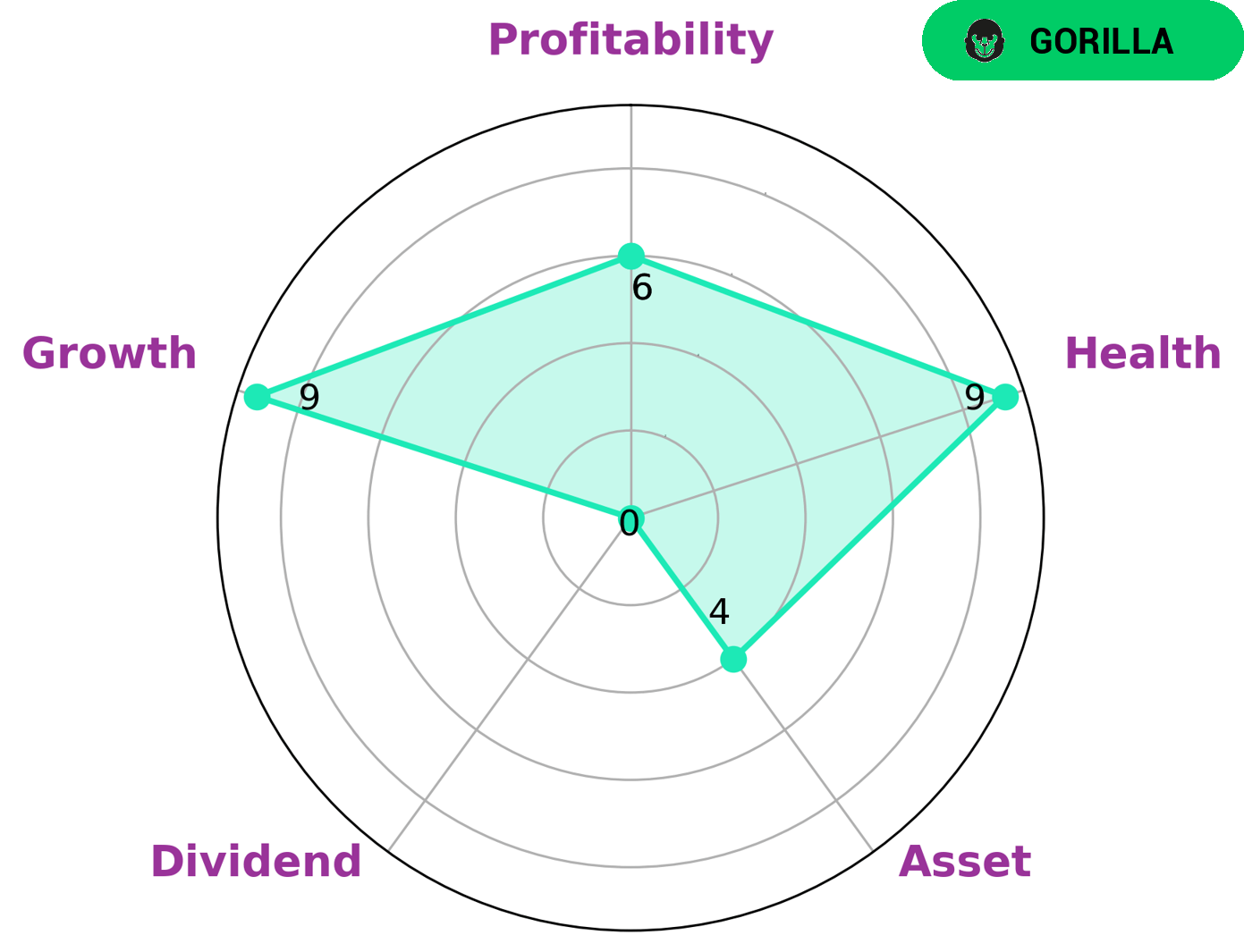

As a part of GoodWhale’s analysis of GAMBLING.COM GROUP‘s finances, we concluded that the company is strong in growth, medium in asset, profitability and weak in dividend. This led us to classify GAMBLING.COM GROUP as a ‘gorilla’ – a type of company that achieves stable and high revenue or earning growth due to its strong competitive advantage. Given the company’s strengths, as well as its high health score of 9/10 (considering its cashflows and debt), GAMBLING.COM GROUP is likely an attractive option for investors looking for a company that is capable to pay off debt and fund future operations. Furthermore, due to the strong competitive advantage that GAMBLING.COM GROUP holds, the company is likely to generate consistent returns for longer-term investors. More…

Peers

The company is engaged in the online gambling and sports betting industry. The company operates a number of websites and brands, including Gambling.com, Bettingexpert.com, and Casinopedia.org. The company’s main competitors are B90 Holdings PLC, Kindred Group PLC, and Super Group (SGHC) Ltd.

– B90 Holdings PLC ($LSE:B90)

SSE plc, commonly known as SSE, is a British energy company headquartered in Perth, Scotland. It is listed on the London Stock Exchange and is a constituent of the FTSE 100 Index. SSE operates in the United Kingdom and Ireland.

The company has a market cap of 10.58M as of 2022 and a Return on Equity of -43.3%. The company operates in the United Kingdom and Ireland. SSE is involved in the generation, transmission, distribution and supply of electricity and in the storage, distribution and supply of gas. The company also provides other energy-related services, including energy efficiency and telecommunication services.

– Kindred Group PLC ($LTS:0RDS)

Kindred Group PLC is a gambling company with operations in Europe and Australia. The company has a market cap of 20.47B as of 2022 and a ROE of 17.97%. The company’s main products are online casino games, sports betting, and poker. The company also offers land-based casino services in some countries.

– Super Group (SGHC) Ltd ($NYSE:SGHC)

The company’s market cap is 1.98B as of 2022 and its ROE is 66.12%. The company is a leading provider of integrated logistics solutions in China. It provides a comprehensive range of services, including express delivery, warehousing, transportation, cross-border e-commerce logistics, and other value-added services. The company has a strong network of over 4,000 service outlets and a fleet of over 30,000 vehicles. It has a strong market presence in China, with a market share of over 20%.

Summary

Investing in Gambling.com Group has become a more attractive option with the company expecting to post up to $42.5m in full-year 2021 revenue. The majority of this growth is being driven by the company’s recent acquisitions across the gambling industry. Gambling.com Group has been able to leverage the power of its brand to acquire businesses and expand its portfolio of services.

This has resulted in a number of new products, including sports betting, online gaming, and online casino. For investors, Gambling.com Group offers the potential for long-term growth and profitability, as well as access to a diverse range of gambling and gaming options.

Recent Posts